Fertilizer International 530 Jan-Feb 2026

23 January 2026

Specialty potash briefing

SOP MARKET REPORT

Specialty potash briefing

Price premia for specialty potash have hit record highs in recent times, with potassium sulphate (SOP) supply constrained by the return of Chinese export restrictions, as well as new projects over promising yet under delivering. In this CRU Insight, Humphrey Knight assesses the key market factors driving high SOP pricing – including China’s export policy, US import reliance, and the failure to commercially develop and deliver new project capacity.

Demand remains niche

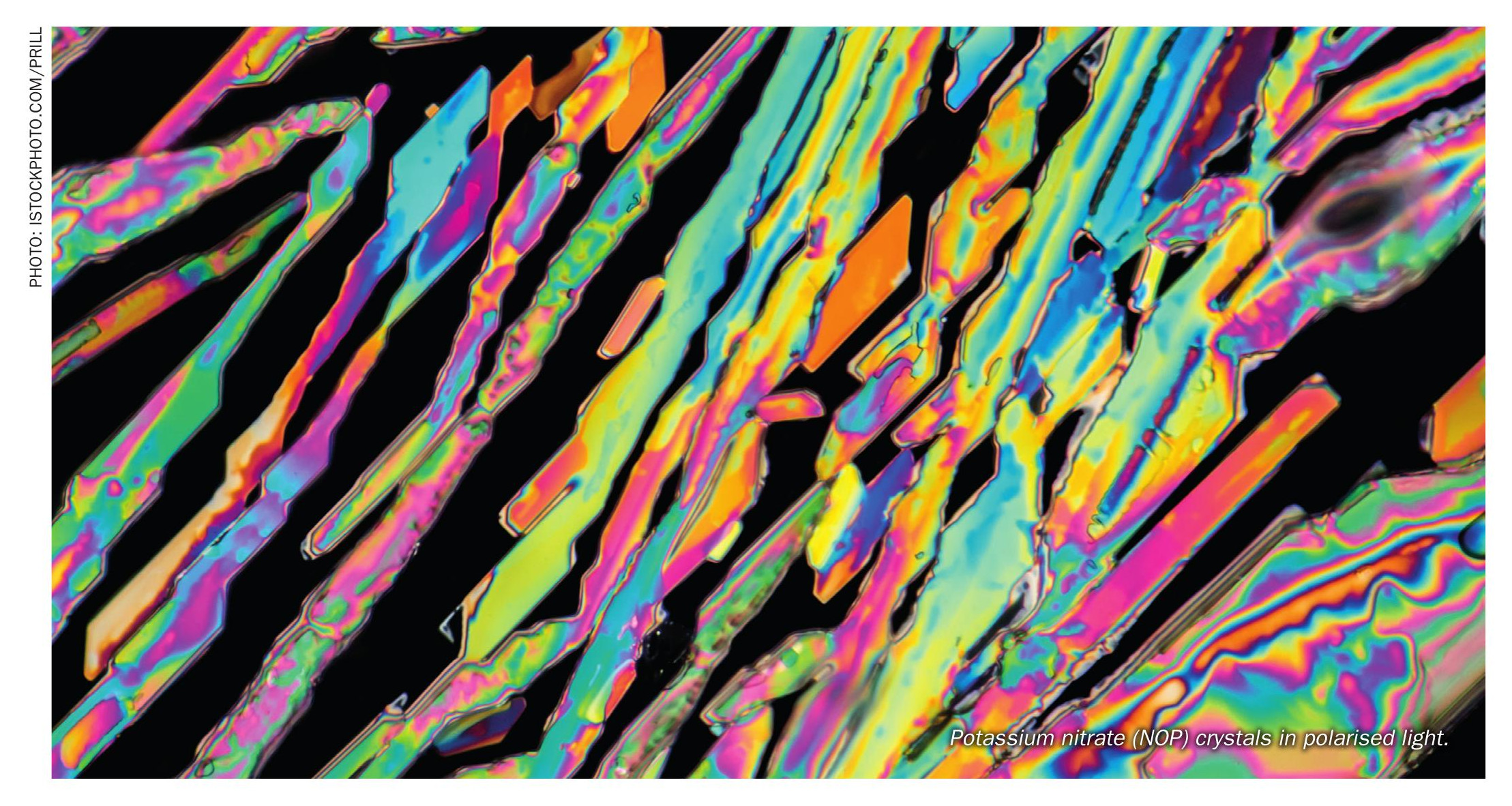

The global potash market is dominated by potassium chloride (MOP), a high analysis (60-62% K2 O) product that accounts for 92% and 84% of global potash production and consumption, respectively (Figure 1).

Specialty potash products, meanwhile, are a lower volume and more expensive option, in comparison to MOP, with limited market penetration. Despite this, niche demand exists in high-value agriculture – particularly for fruits, vegetables, tree nuts and tobacco – where they command substantial price premia over commodity MOP. Growers of these cash crops prize specialty potash products for their agronomically valuable qualities. These vary from product to product and include low chloride content, the supply of additional nutrients (sulphur, nitrogen, magnesium etc.) and applicability as water-soluble fertilizers in drip irrigation (fertigation).

The three main types of specialty potash are:

• Potassium sulphate (SOP). Contains 50-52% K2O (low chloride, some forms water soluble) and accounts for 5% of global K2O production and 10% of consumption

• Potassium nitrate (NOP). Contains c. 46% K2O (low chloride, water soluble) and accounts for 3% of global K2O consumption

• K-Mg fertilizers (mainly SOPM, langbeinite). Contain 11-48% K2O (some forms low chloride) and accounts for 4% of global K2O production and 4% of consumption.

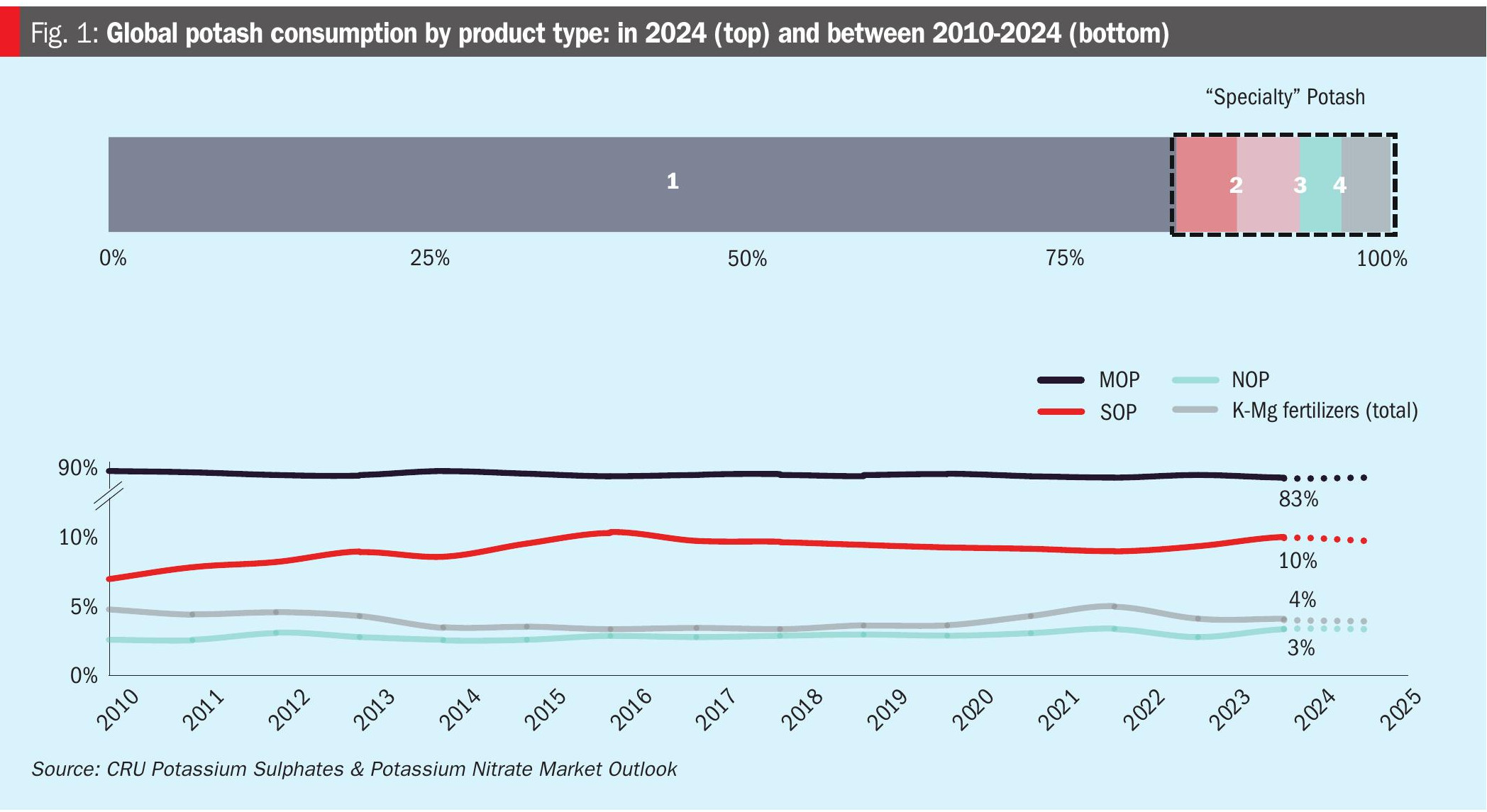

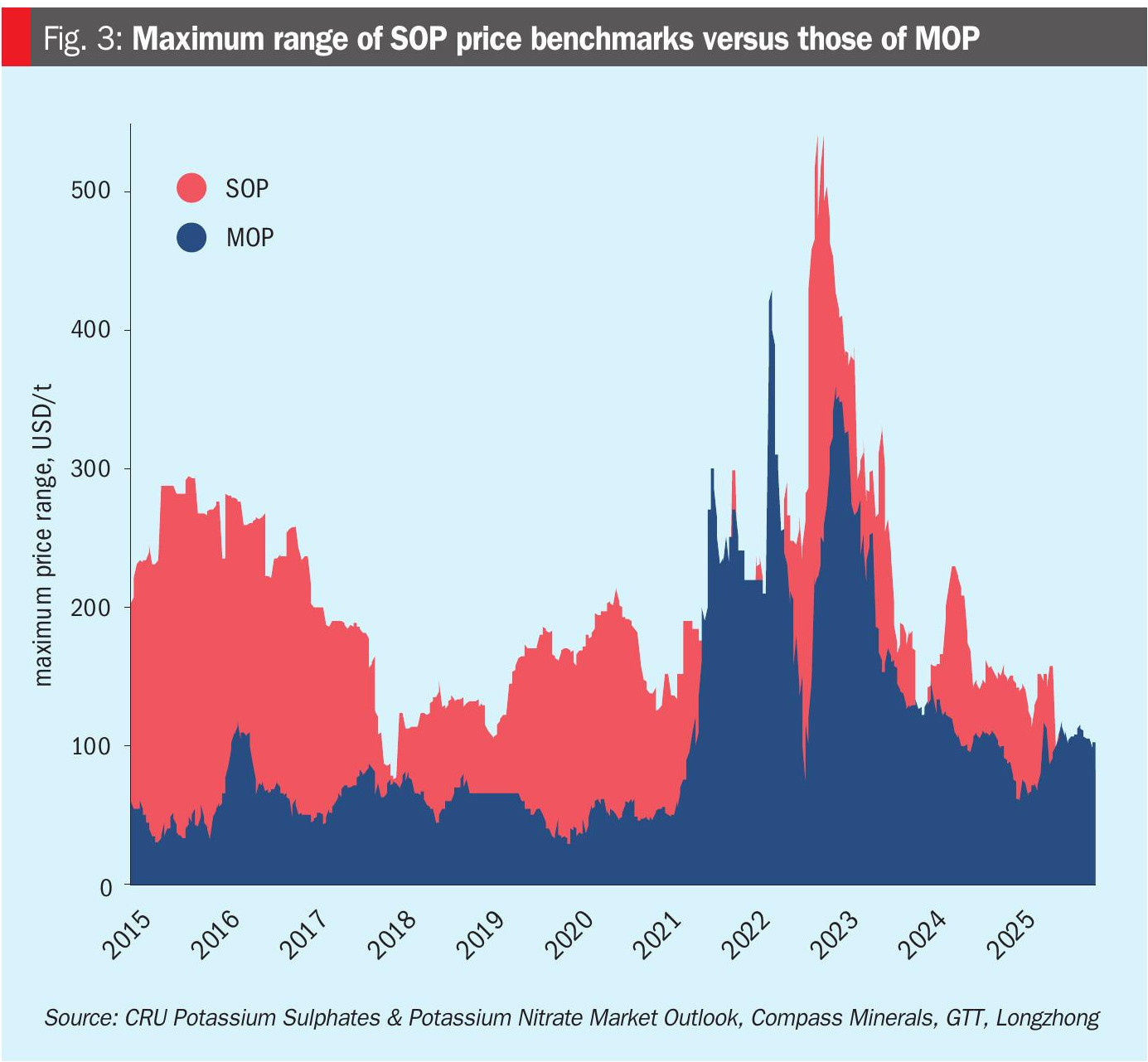

Record price premia and a wide price range

Both SOP and NOP can command large price premia over MOP. The delta between SOP and MOP (both NW Europe), for example, having been on a rally since 2022, reached a new high of $283/t in 2025, while the delta between NOP (Chile) and MOP (NW Europe) is around $418/t currently (Figure 2). In general, attractive SOP premia have been a market fixture of the last decade, dating back to the MOP price slump in 2013.

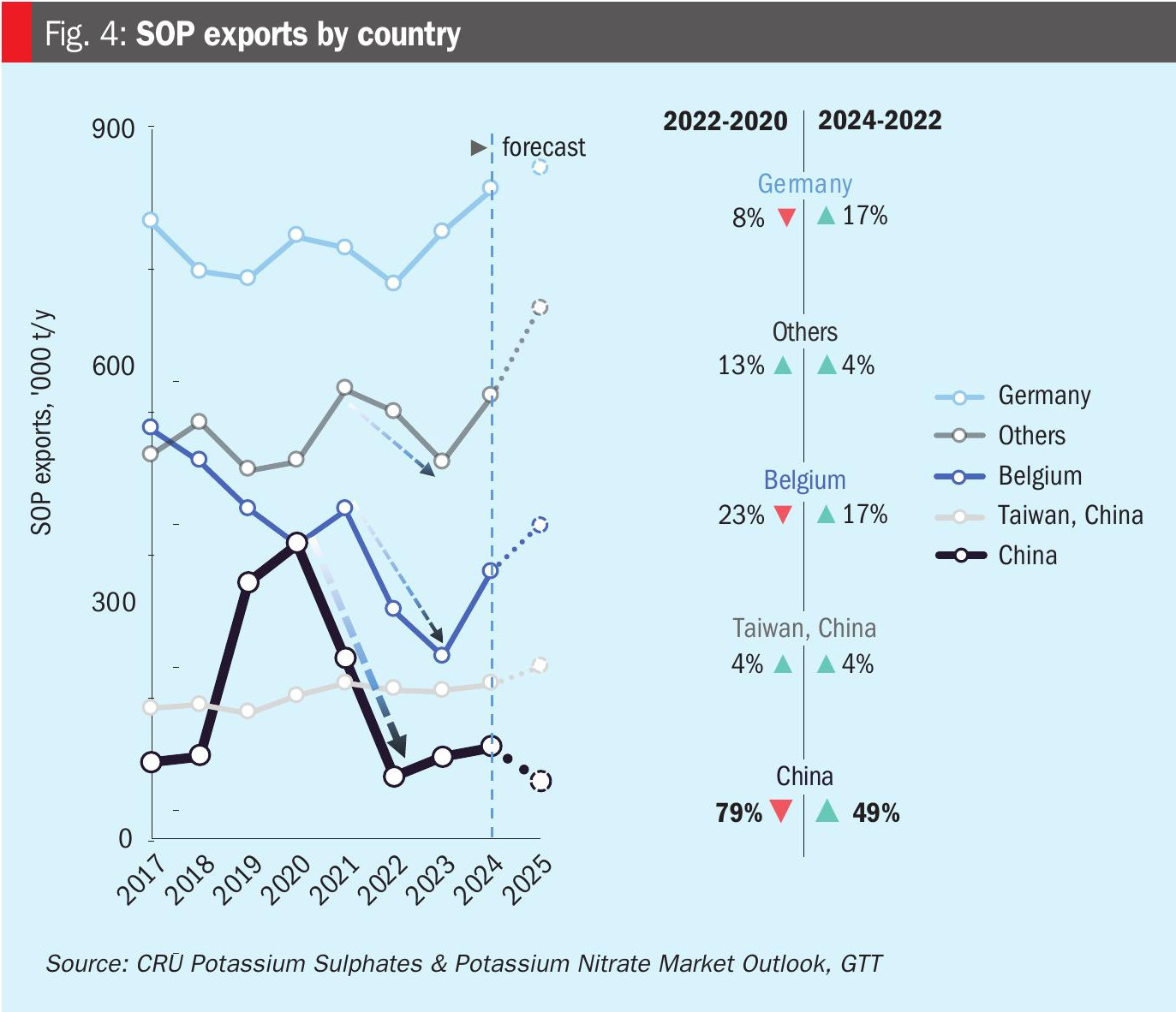

The price paid for SOP does, however, vary widely across the globe. This divergence in pricing – with SOP showing a much greater price range than MOP (Figure 3) – reflects different patterns of production, trade and consumption within countries and regions. Nations such as Belgium, Germany and Taiwan are major SOP exporters, for example (Figure 4), whereas the US is import-reliant for SOP, while the Chinese SOP market is largely self contained. These disparate market conditions are reflected in the wide price range shown by the following SOP benchmarks (2024 averages):

• FCA NW Europe (standard grade) $633/t

• FOB Utah (all grades) $610/t

• FOB Taiwan (all grades) $582/t

• ExW Eastern China (standard grade) $477/t.

Self-contained China

While SOP price premia reached record highs in 2025, as already highlighted, the wide price spread for individual SOP price benchmarks is an equally notable market characteristic – being a function of the limited opportunities for arbitrage. Indeed, global SOP trade remains fragmented, with little volume moving between markets east and west of Suez.

International SOP supply also tightened in the early 2020s (Figure 4) as a consequence of:

• China’s reintroduction of export restrictions

• MOP sourcing problems faced by Europe’s Mannheim producers

• The exit of other exporters like Chile.

As the dominant SOP producing and consuming country – with domestic output and demand both above five million tonnes in 2024 – China’s market behaviour is highly influential. While the country briefly became a major SOP exporter in 2019, having lifted export tariffs, export restrictions were re-introduced in October 2021 to safeguard against a decline in China’s primary SOP production.

China’s SOP exports are unlikely to return to 2019/20 levels, in CRU’s view, this being linked to a shift from primary to secondary SOP production domestically (Fertilizer International 529, p40). In particular, looking ahead:

• While SOP is oversupplied within China, the country remains reliant on MOP imports for its secondary SOP output.

• Primary SOP production is also facing depletion, further increasing China’s reliance on secondary SOP production.

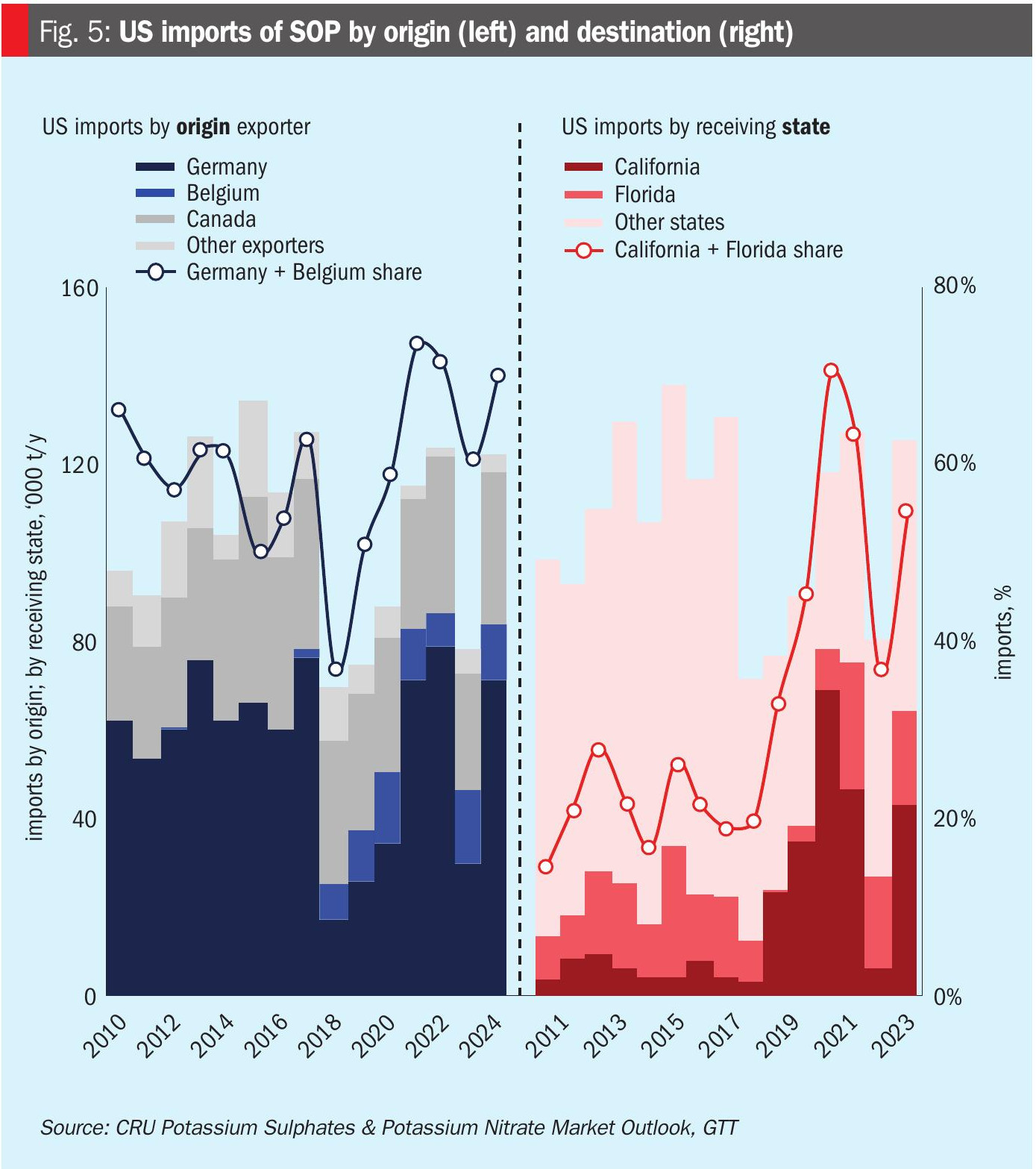

US reliant on SOP imports

The US, the second largest consumer of SOP after China, is an import dependent market, with key offshore supplier Western Europe meeting demand from the country’s main consuming regions, California, the Midwest and Florida. The domestic production of primary SOP in Utah, meanwhile, has faced limitations.

Consequently, SOP imports are taking a growing share of US supply, with long-haul imports common from countries such as Belgium and Germany (Figure 5). California, in particular, has limited its reliance on domestic production in recent years by importing more SOP.

US consumers have the choice to substitute SOP with SOPM, a domestically-produced potassium magnesium sulphate fertilizer commonly known as langbeinite. Historically, on a K2 O-equivalent basis, SOPM (22% K2O) has offered US growers a more affordable specialty potash option at times when SOP (50% K2O) prices are high.

SOPM was last favoured in this way during the four year period 2017-2020 when SOP was at a premium over langbeinite. There are signs, however, that this price-based substitution of SOPM for SOP may no longer hold, with a lack of SOP availability instead becoming a more fundamental and limiting choice factor in the US specialty potash market.

Projects fail to deliver new supply

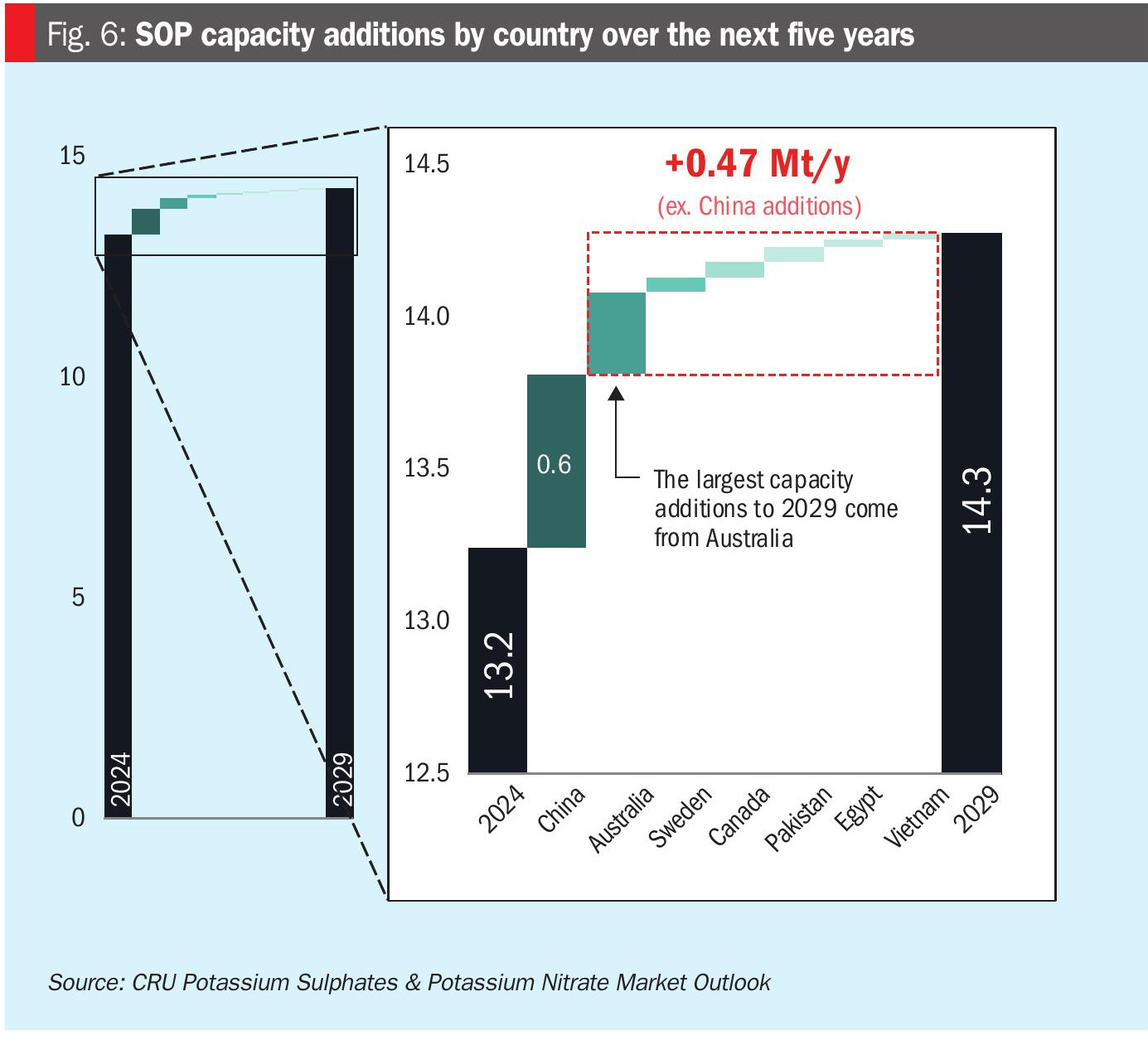

SOP demand outside China is likely to grow in the medium term, with CRU forecasting an increase in global demand from 7.87 million tonnes to 7.98 million tonnes between 2024 and 2029. Balancing this higher demand with extra supply requires new projects. It is therefore significant that, in recent years, a large number of announced SOP projects have failed to enter commercial production.

The high failure rate for SOP projects in countries as diverse as Australia, Eritrea, Ethiopia and the US – which promised much yet delivered little – has dashed hopes of a significant increase in global supply (Fertilizer International 523, p41). This lack of supply growth, in turn, has sustained SOP market tightness and the attendant high-price environment.

In the medium term, CRU expects SOP demand outside China to grow by 0.52 million t/a between 2024-2029 while SOP capacity will grow by 0.47 million t/a (Figure 6). Sev.en Global Investments’ Lake Way project in Western Australia recently entered CRU’s base case. It represents a large 200,000 t/a primary capacity addition in an otherwise thin SOP project pipeline, as rising MOP and sulphur prices squeeze secondary producers’ costs.

Polyhalite – the future of specialty potash?

Unsurprisingly, given the faltering SOP project pipeline, the potential of polyhalite, a naturally–occurring potassium, magnesium and calcium sulphate fertilizer, has received a lot of attention over the last decade. ICL is the only global polyhalite producer currently, having started production at its Boulby potash mine in the UK in 2012. The company sells around one million tonnes of polyhalite annually, having completely switched Boulby from MOP to polyhalite mining in 2018, partly due to geological difficulties.

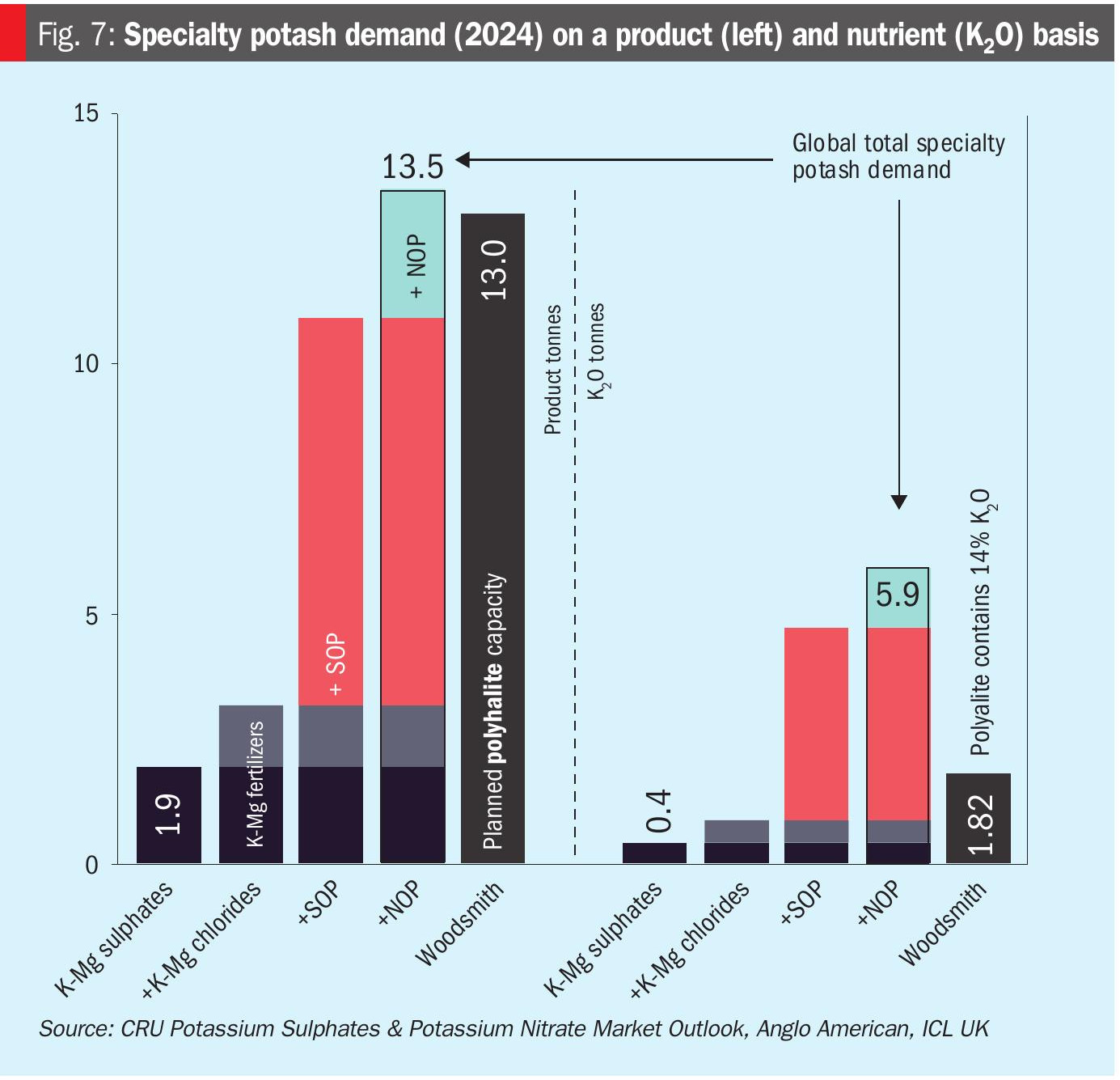

Also in the UK, Anglo American is slowing capital investment in its large-scale, under-development Woodsmith polyhalite mine – as it deleverages its balance sheet, looks for a project investor and decides whether to proceed to a final investment decision (Fertilizer International 528, p10). The company’s ambitions for this multi-nutrient fertilizer are on a different level – with the polyhalite output from the Woodsmith mine potentially matching, on a product basis, total global specialty potash demand (Figure 7).

Key takeaways

The depreciation of the US dollar and tight supply in 2025 has led to higher SOP and SOPM prices outside China. These higher prices, however, have not deterred overall growth in specialty potash consumption. NOP prices, meanwhile, have remained largely flat since the end of 2024, although slight increases in feedstock costs in recent months, particularly for MOP, have placed an upwards pressure on production costs.

In summary:

• Specialty potash prices remain high and disparate. China’s export restrictions are a key driver as the world’s largest SOP supplier turns inwards once again.

• Tight supply in the US SOP market is set to continue. Long-haul imports of SOP remain vital, even with the option for significant substitution with domestically produced SOPM.

• Little new capacity on the horizon. SOP demand growth has outpaced extra supply capacity with a large number of SOP projects failing to enter commercial production.

• Uncertain future for polyhalite. With only one operative mine globally, this multi-nutrient fertilizer has yet to deliver promised large-scale production.

References

About the author

Humphrey Knight,

Principal Consultant, CRU

Tel: +44 207 903 2191