Fertilizer International 530 Jan-Feb 2026

23 January 2026

Kpler – tracking global fertilizer markets in real time

MARKET INTELLIGENCE

Kpler – tracking global fertilizer markets in real time

Kpler monitors global fertilizer markets in real-time using comprehensive vessel tracking and cargo data. The company’s commodity intelligence provides actionable insights on fertilizer supply chains, enabling market participants to optimise operations, mitigate risks, and capitalise on emerging opportunities.

Real-time monitoring increasingly critical

Last summer, as tensions in the Middle East escalated, the Suez Canal, the Bab el-Mandeb Strait, and the Strait of Hormuz gained global attention as major maritime chokepoints for international trade.

Due to these vulnerabilities, geopolitical shocks in the Middle East can destabilise the global fertilizer supply chain and associated agricultural markets – a consequence of the natural centralisation of fertilizer production in the region. The fact that alternative fertilizer supply sources and trade routes are also limited currently adds to this already significant risk, intensifying market volatility and further complicating the situation.

The upshot is that, from physical traders to agricultural merchandisers to national governments and more, the need to monitor real-time fertilizer trade flows is becoming increasingly critical.

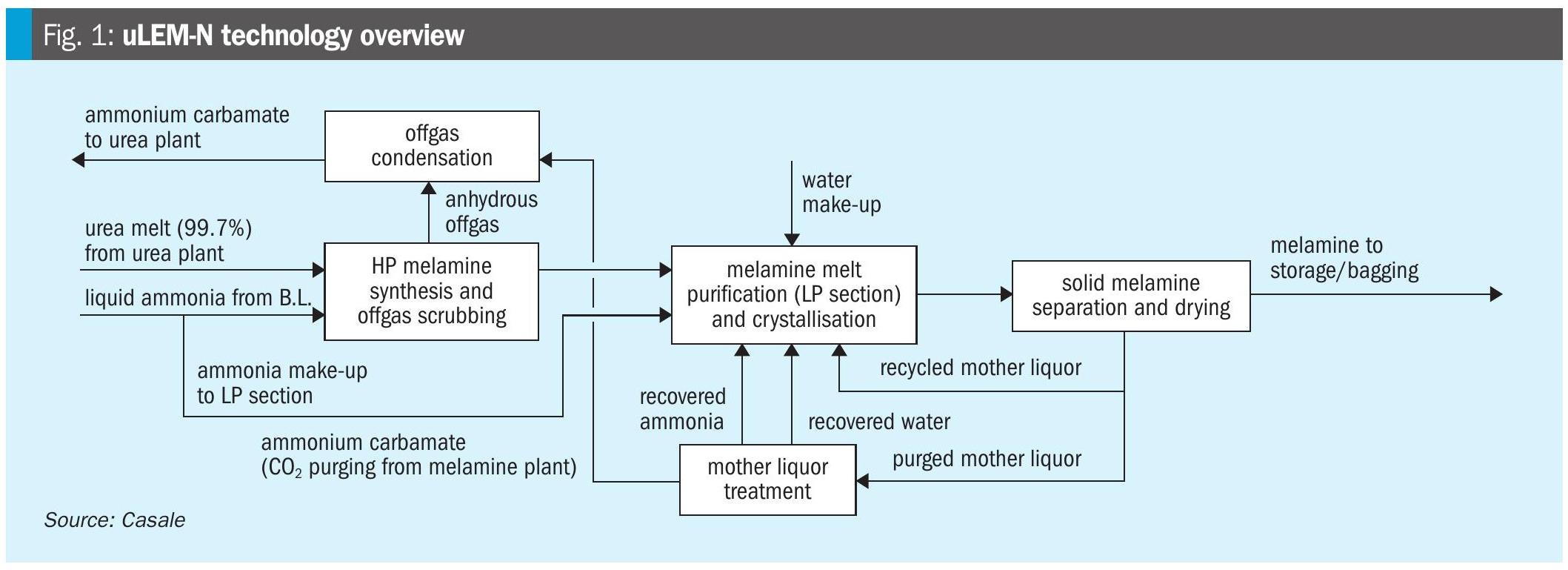

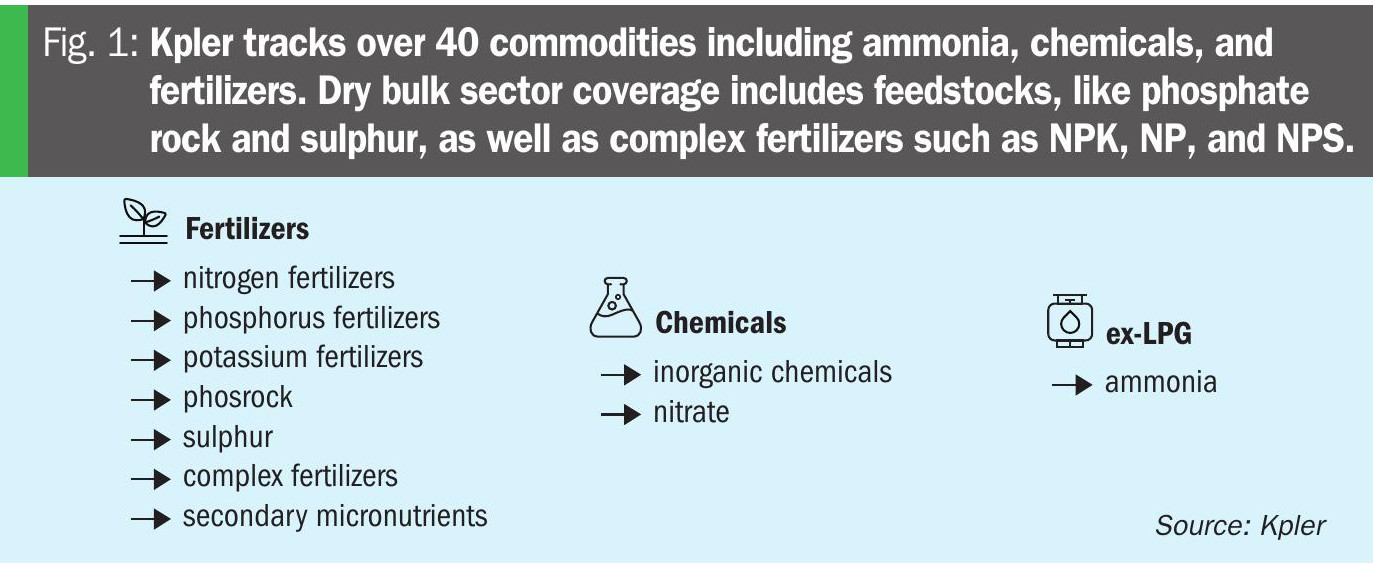

Founded in 2014, Kpler is a leading data and analytics firm that delivers real-time intelligence across global commodity flows. The company leverages the world’s largest proprietary network of vessel tracking, port-call monitoring, and cargo information. Kpler provides data on interconnected commodity markets by tracking the entire seaborne fertilizer supply chain, from upstream feedstocks, through intermediate chemicals, to downstream finished products (Figure 1).

Turning raw data into actionable intelligence

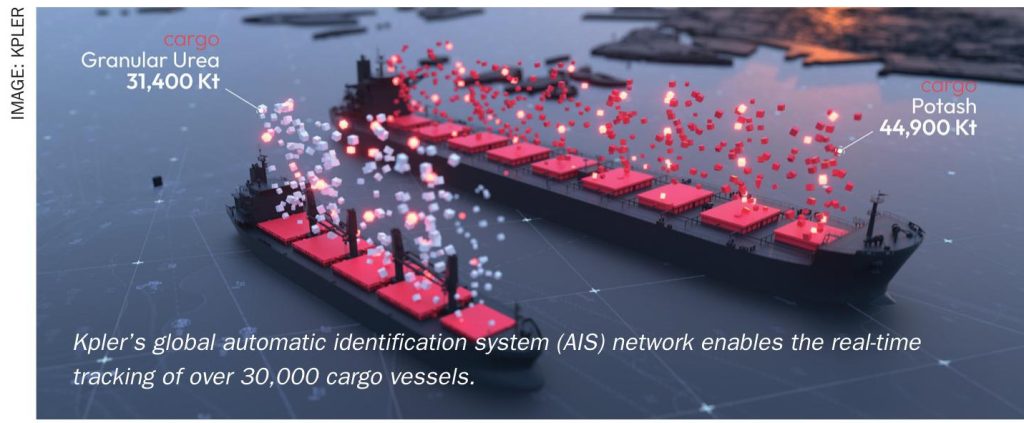

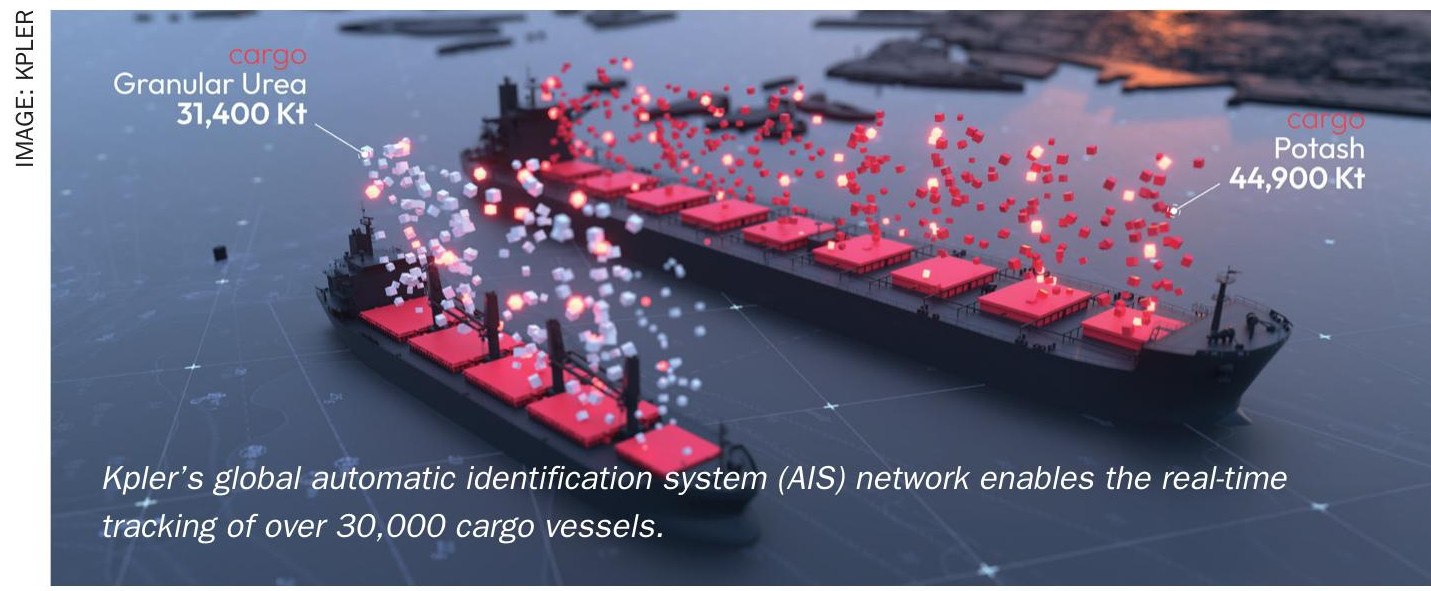

The monitoring of cargo requires tracking the individual vessels that carry these. Kpler’s global automatic identification system (AIS) network for shipping combines satellite, terrestrial, and roaming coverage to provide continuous visibility from coastal waters to the deep ocean, enabling real-time tracking of over 30,000 cargo vessels, including tankers, dry bulk carriers, and general cargo ships. The quality and granularity of Kpler’s AIS data allow real-time tracking of commodity flows down to specific ports, terminals, and berths.

Capturing precise vessel movements helps users monitor exact loading and discharge operations, analyse port congestion patterns, and identify supply chain bottlenecks. AIS data also capture crew-reported updates on vessels’ future destinations and estimated arrival times.

With this real-time intelligence, users can quickly identify potential diversions, from route alterations to complete destination changes. High-quality data standards also make it significantly easier to detect irregularities like AIS gaps or spoofing (the deliberate alteration of vessel location data), which often signal illicit activities such as sanctions evasion or illegal cargo transfers.

Consequently, Kpler’s comprehensive vessel tracking infrastructure transforms raw maritime data into actionable intelligence, providing users with unparalleled visibility into global shipping operations and supply chain dynamics.

More transparency for opaque markets

Kpler tracks global imports and exports by identifying individual vessel shipments and aggregating their specific volumes and cargo details. Historically, market professionals rely on country-level trade statistics that are published weeks or months after the fact. There is no visibility into the exact loading and discharge dates, nor a breakdown by specific ports or installations.

Vessel lineups typically contain little information on real-time operations and the overall voyage. Was there port congestion? Did the vessel change its final destination? Kpler revolutionises this data collection and analysis process by layering cargo and commercial data onto its vessel tracking foundation, creating an integrated view that reveals vessel movements and much more.

Kpler’s fertilizer coverage includes ammonia, liquid chemicals, and the primary NPK fertilizers, to complex and secondary micronutrients and inorganic feed phosphates. This includes, for example, detailed data from triple superphosphate (TSP) and diammonium phosphate (DAP) co-loading operations at Moroccan ports like Jorf Lasfar to the buyers, sellers, and charterers facilitating each shipment.

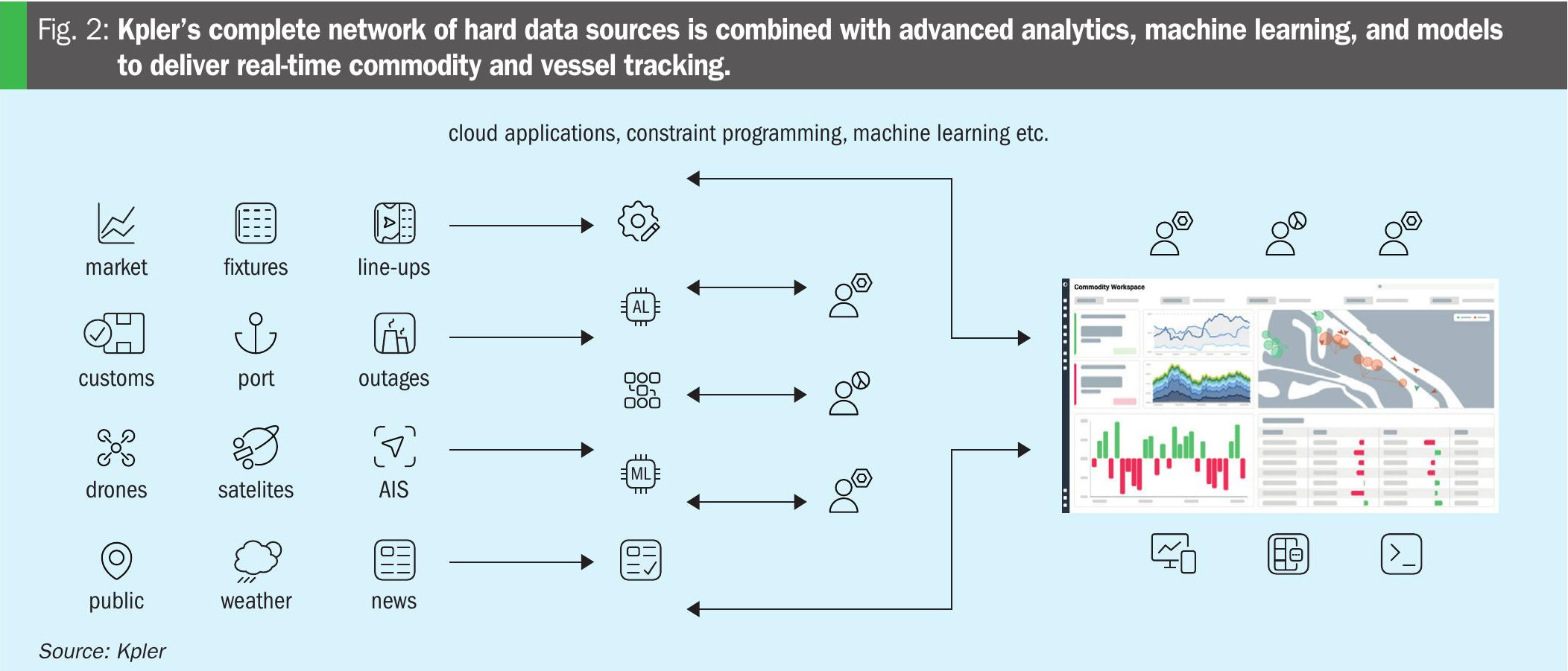

This level of granularity is achieved through an extensive network of more than 600 hard sources, including customs records, US Bills of Lading, fixture data, port line-ups, and market information, that deliver highly accurate data on fertilizer grades and the key commercial players involved (Figure 2).

Kpler’s commodity intelligence also provides visibility into markets with limited or non-existent official statistical reporting. Its methodology relies on proprietary geospatial mapping that identifies berths dedicated to fertilizer operations. This allows vessels to be algorithmically matched with cargo in the absence of hard market data or sources with limited product granularity.

For instance, vessels loading at urea-only berths are most likely to load urea. This helps capture trades in opaque markets and establish reliable baselines for trade activity where none existed before. Kpler’s real-time cargo tracking data enables market professionals to anticipate market movements with unprecedented precision, surpassing the limitations of traditional supply and demand analysis based on historical trade statistics and incomplete vessel schedules.

Identifying potential Iranian urea loadings

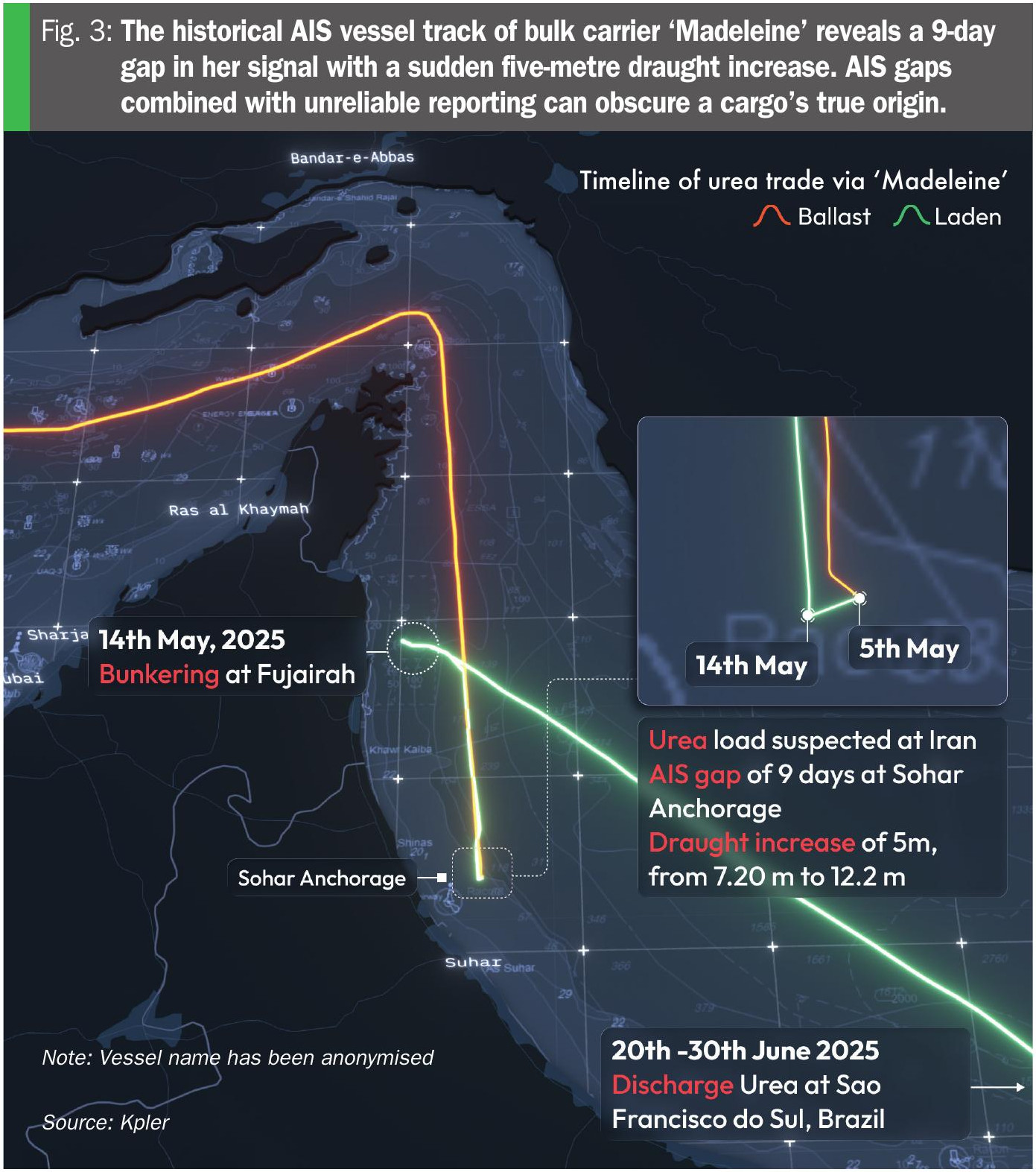

Unreliable reporting and strategic AIS manipulation can hide the true origins of shipments, which is typical of Iranian fertilizer exports, and create significant challenges in tracking potential urea loadings. Cargo data for imports to destination countries can be used to identify loading origins. This data becomes essential when the load operation occurs in a region with limited reporting. In the case of urea shipments from Iran to Brazil, the market typically uses Brazilian vessel lineups to identify product-specific imports. However, such lineups frequently misreport cargo sources, reporting Oman rather than Iran as the origin country. This is often because the bill of lading itself is modified to show Omani origin. In the example case of bulk carrier ‘Madeleine’ (vessel name anonymised for this article), an analysis of misreporting and historical vessel tracks can reveal patterns that distinguish legitimate operations from potential sanction evasions (Figure 3).

Working backwards, Madeleine’s AIS signal clearly shows her discharging at a berth in São Francisco do Sul in Brazil from June 20th to 30th. Hard market data confirmed urea as the product on board. Following her AIS tracks back to the Gulf of Oman, a nine-day AIS gap from May 5th to May 14th is visible.

While the vessel lineups for Madeleine reported Oman as the origin, vessels genuinely loading in Oman maintain a clear and continuous AIS signal throughout their journey, showing precise positioning at loading berths. In contrast, vessels potentially loading Iranian urea will typically signal for Sohar and position around the Sohar Anchorage before intentionally disabling vessel tracking systems to conceal their actual location during cargo operations.

Madeleine’s lengthy AIS gap and significant draught change of five metres, from 7.20 to 12.2 metres, suggests loading activities occurred when the vessel’s transponder was offline. Despite sophisticated efforts to conceal operations, the combination of vessel tracking data with cargo information provides greater transparency into trade flows that conventional methods struggle to detect.

Tracking the UAE to Morocco sulphur shipping route

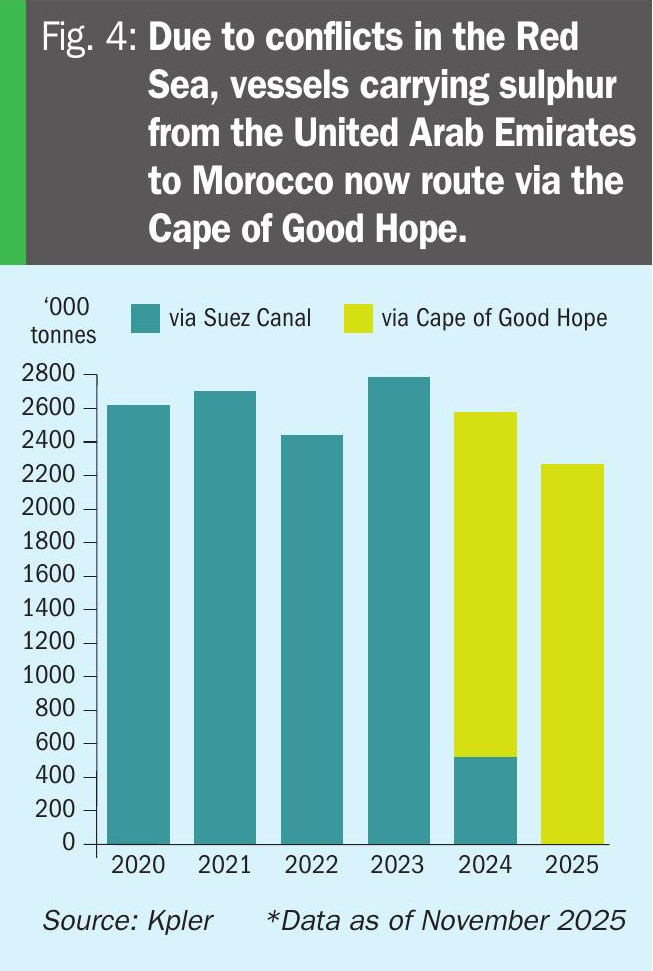

As a leading global phosphate producer, Morocco depends heavily on imported sulphur for its fertilizer production operations, with the United Arab Emirates (UAE) serving as one of its primary suppliers. Sulphur-carrying vessels depart from Ruwais Port in the Western UAE, not too far from the border with Saudi Arabia.

Traditionally, the vessels would then navigate through the four critical maritime chokepoints of the Strait of Hormuz, Bab el-Mandeb Strait, Suez Canal, and Strait of Gibraltar before reaching Moroccan ports. However, the surge in Houthi attacks on commercial shipping vessels in the Red Sea, beginning in the latter months of 2023, disrupted this established trade route for UAE sulphur exports and other Middle Eastern commodities.

The bulk carrier Magic Seas was attacked in early July 2025. She was loaded with steel and fertilizer from Ulsan, South Korea and Zhuhai, China, respectively. After suffering from a strike led by the Houthis, Magic Seas sank off the western coast of Yemen. The following day, the Houthis attacked another bulk carrier, Eternity C, shortly after she discharged American sorghum at Berbera in Somalia. Faced with escalating security risks in the Red Sea, many vessels have abandoned the Suez Canal for a longer but safer route around Africa’s Cape of Good Hope (Figure 4).

Indeed, rerouting via the Cape of Good Hope has become the new standard for shipping. Since January 2024, all UAE sulphur exports to Morocco have travelled via the Cape of Good Hope, significantly extending both the voyage distance and transit time. A journey that was once approximately 5,300 nautical miles and 32 days is now, on average, about 9,800 nautical miles and 49 days.

Stakeholders across the spectrum suffer from the consequences of these longer travel times. Extended voyage times substantially increase shipping costs due to longer vessel charter periods, higher fuel consumption, and elevated insurance costs, these typically being based on voyage duration.

Overall, this maritime security crisis in the Red Sea has fundamentally reshaped global supply chains, with real-time commodity tracking now serving as a critical tool for anticipating and adapting to emerging route disruptions.

Navigating market volatility with Kpler intelligence

Kpler provides a comprehensive picture of global fertilizer markets through its unparalleled vessel tracking and cargo intelligence data, enabling market professionals to navigate an increasingly complex and volatile trade environment. In an era where geopolitical tensions in the Middle East threaten critical maritime chokepoints, real-time visibility into fertilizer supply chains is essential for anticipating supply-demand imbalances amid rapidly changing market conditions.

Ultimately, as global fertilizer trade faces growing challenges, from security risks to supply chain disruptions, Kpler’s intelligence solutions offer the transparency and actionable insights necessary to maintain a competitive advantage in this critical commodity market.