Fertilizer International 530 Jan-Feb 2026

23 January 2026

CRU-Veeries Brazil market report

COUNTRY REPORT

CRU-Veeries Brazil market report

Fertilizer sales to Brazilian farmers are currently in line with the average of the past three years, despite variations by crop and state. CRU’s Anthony Rizzo and Bruno Fardim Christo of Veeries provide an update on the status of fertilizers and crops in the Brazilian market.

CRU and Veeries – new strategic partners

CRU launched a new strategic partnership with Brazilian research house Veeries in September 2025 with the publication of the inaugural Brazil Fertilizers and Crops monthly report. These joint reports deliver a comprehensive view of the Brazilian agricultural market – highlighting both developing trends in prices and supply/demand fundamentals.

Carrying content from both CRU and Veeries, the reports provide deep insights into key N, P and K fertilizers, along with major crops such as soybean and corn. They aim to bring clarity and transparency to the fast growing and strategically important Brazilian market. They also highlight the impacts Brazil faces from price trends in international markets.

This summary article is based on the in-depth December Brazil Fertilizers and Crops report from CRU-Veeries published on 4th December 2025.

Market snapshot – December 2025

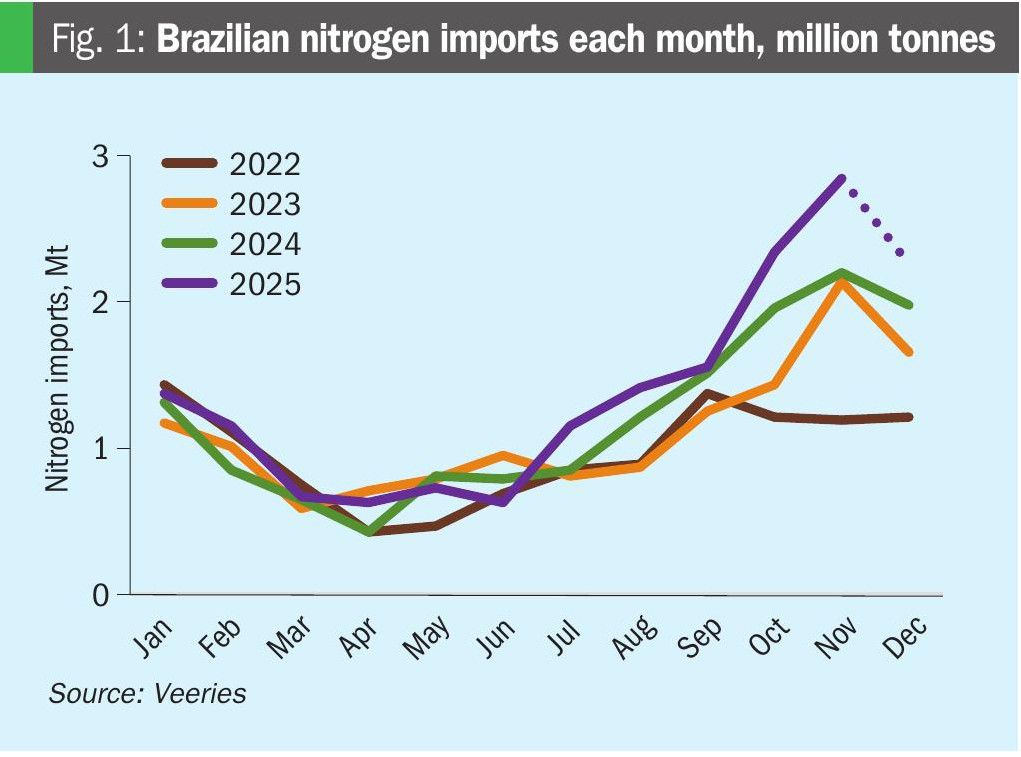

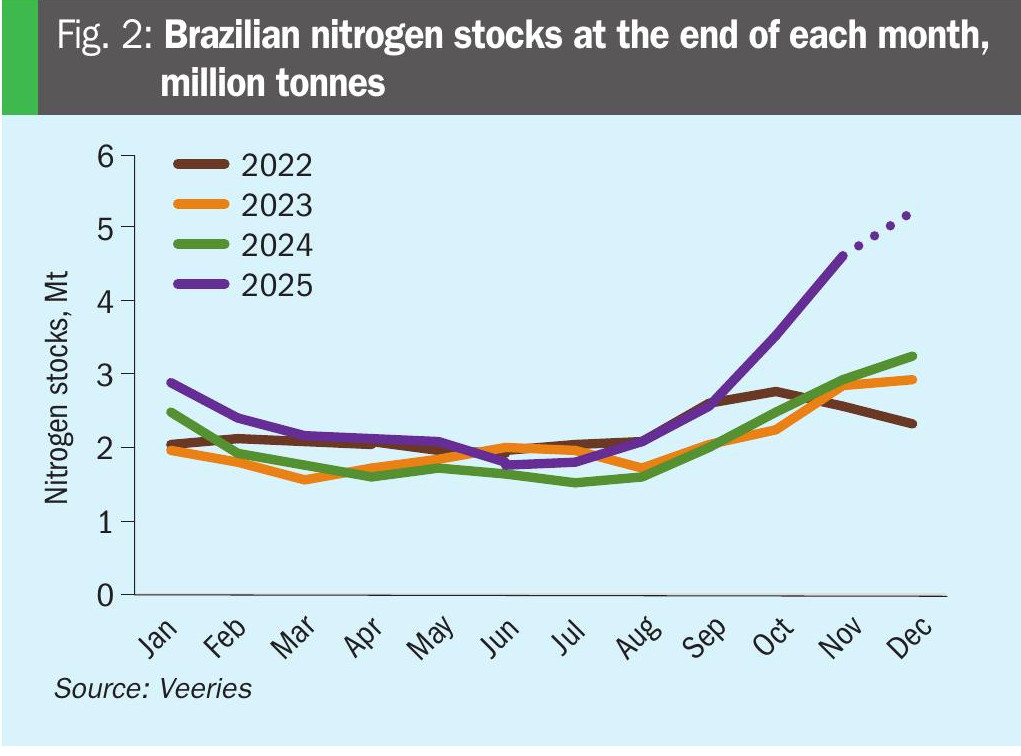

Nitrogen: Imports of nitrogen fertilizers remained high in November 2025, with strong lineups already in place for December (Figure 1). This trend has led to an early buildup of stocks ahead of the second corn crop (safrinha), allowing for advance deliveries (Figure 2).

Despite the large import volumes and solid inventories, a significant portion of this growth has been driven by less concentrated products, such as ammonium sulphate. Total nitrogen fertilizer consumption is increasing by around 8%, but nutrient consumption is rising by only about 2%, reflecting the shift in product mix. The same pattern is evident in inventories: while total stock levels have increased by about 60% year-on-year, the nutrient increase is closer to 40%.

Looking ahead, the safrinha corn area is expected to expand by over 800 thousand hectares. This, together with strong fertilizer demand from the coffee crop, should help absorb currently elevated stock levels over the coming months.

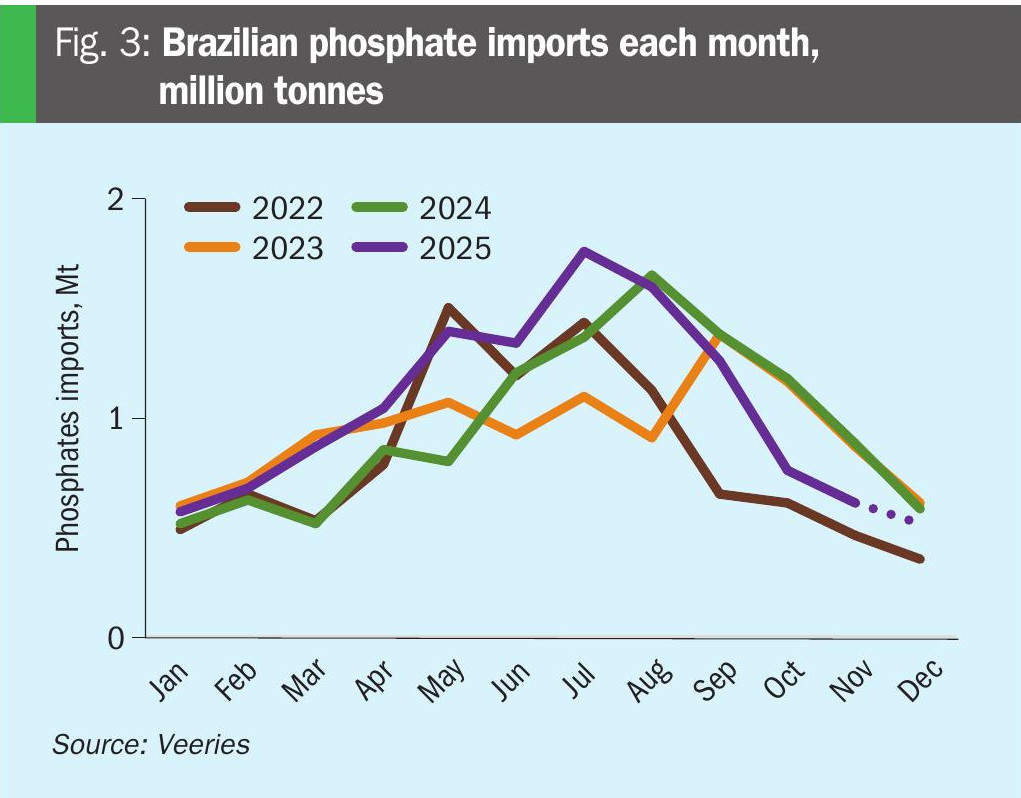

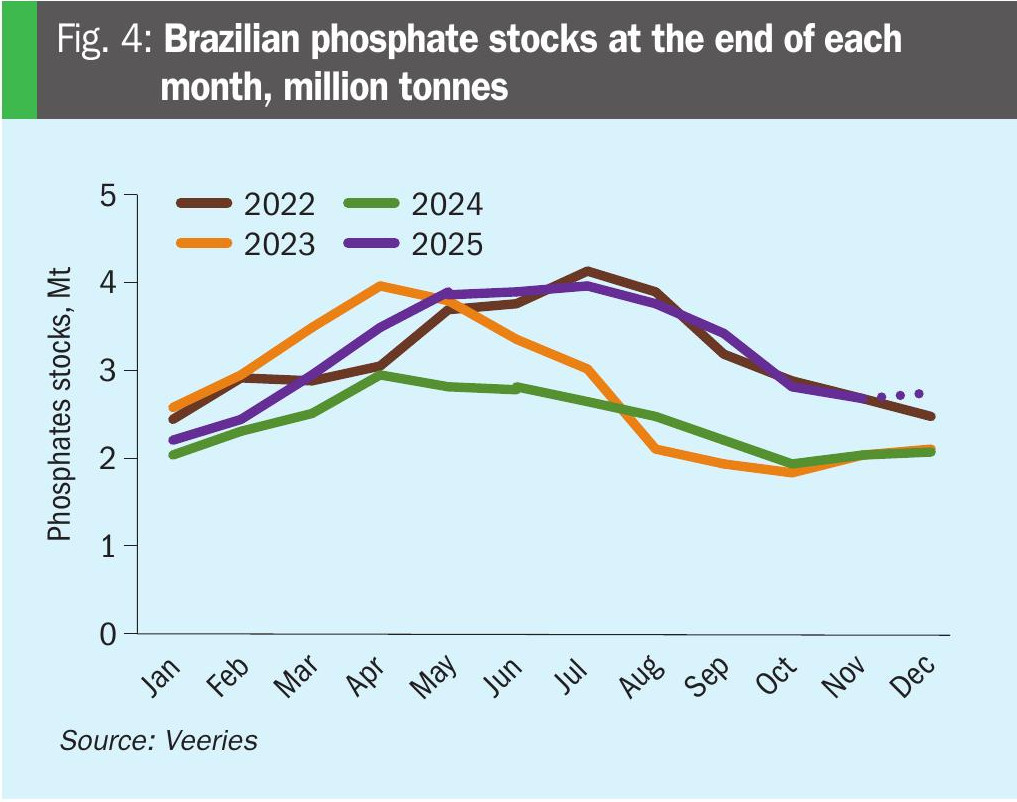

Phosphates: As anticipated, phosphate imports continued their decline in November, and look set to decline again in December, as part of efforts to reduce the high inventories accumulated earlier in the year (Figure 3 & 4).

Similar to the nitrogen segment, while phosphate fertilizer consumption is projected to increase by approximately 7% in 2025, nutrient consumption is expected to grow by only 4%, due to the increased use of single superphosphate (SSP), a lower-concentration phosphate source. Similarly, phosphate inventories are likely to increase by about 30% compared to last year on a product basis, yet only increase by around 15% when measured as nutrients.

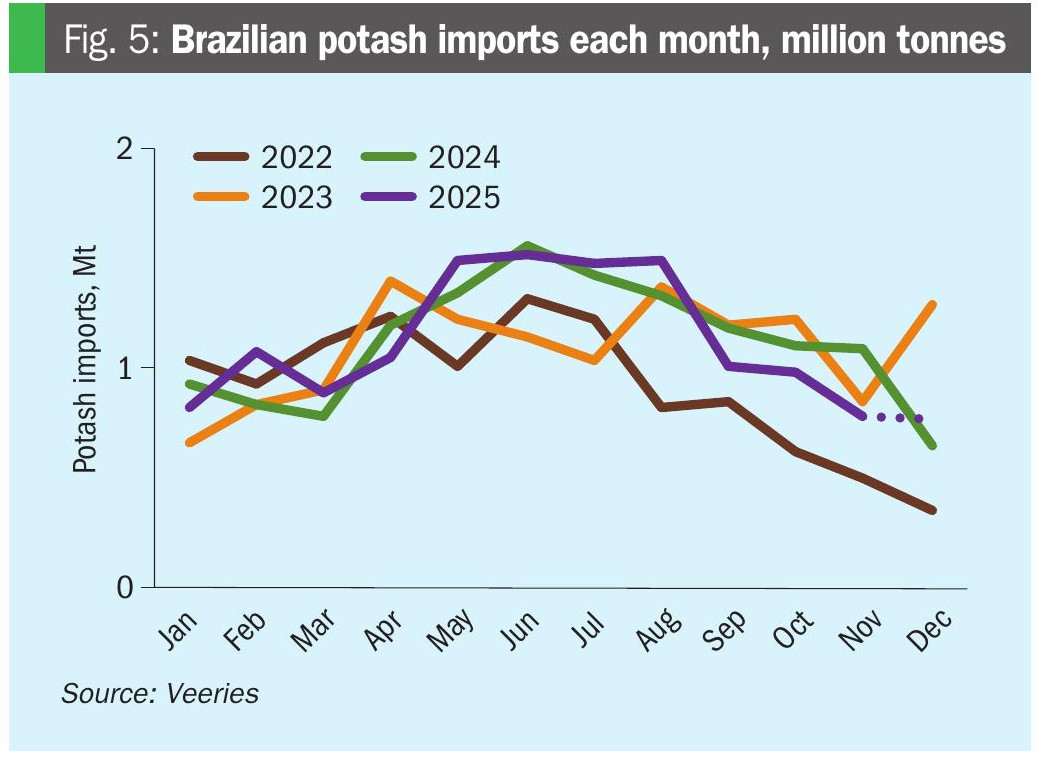

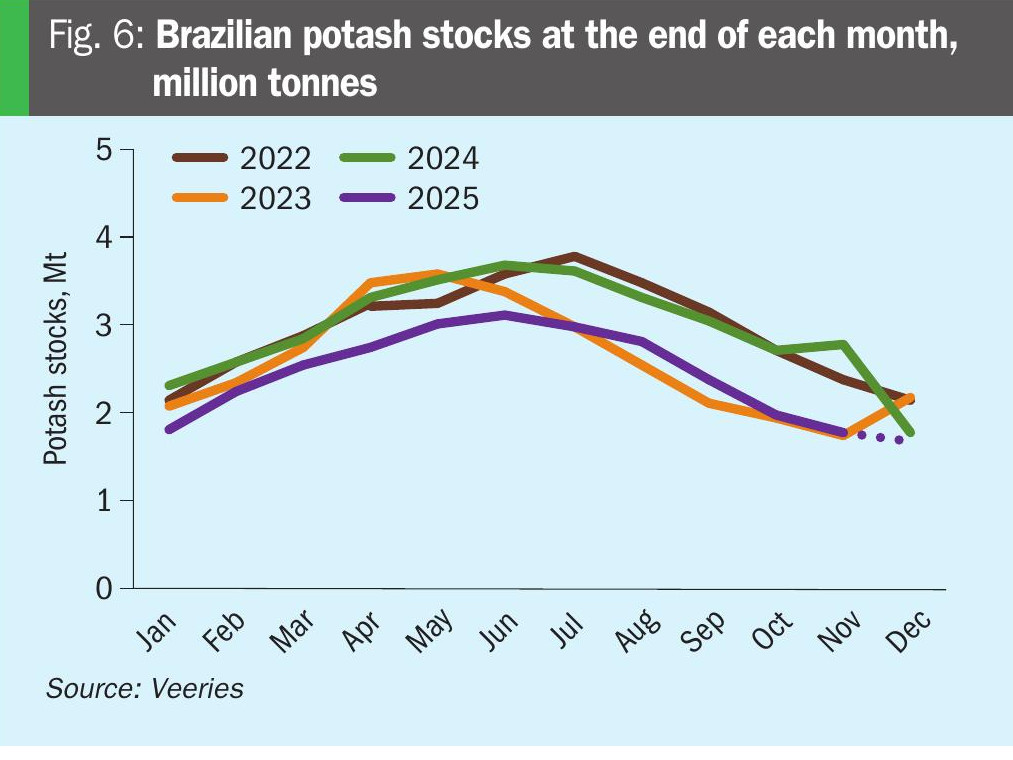

Potash: Modest potassium chloride (KCl) imports in recent months have helped maintain balanced stock levels through 2025 and prevented oversupply (Figures 5 & 6). This has supported firmer domestic prices, with slight upward adjustments, which is an unusual seasonal pattern for this time of year.

Potash imports are expected to increase in the coming months, to ensure an ample supply for the second corn crop (safrinha).

Barter ratios stable

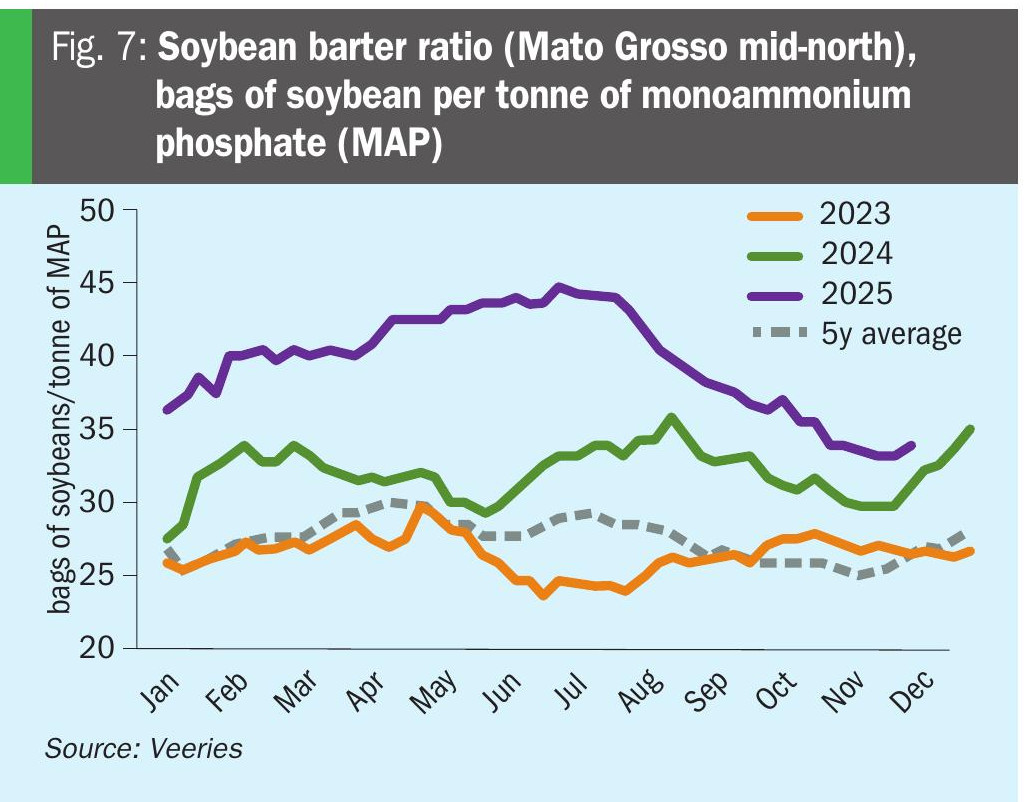

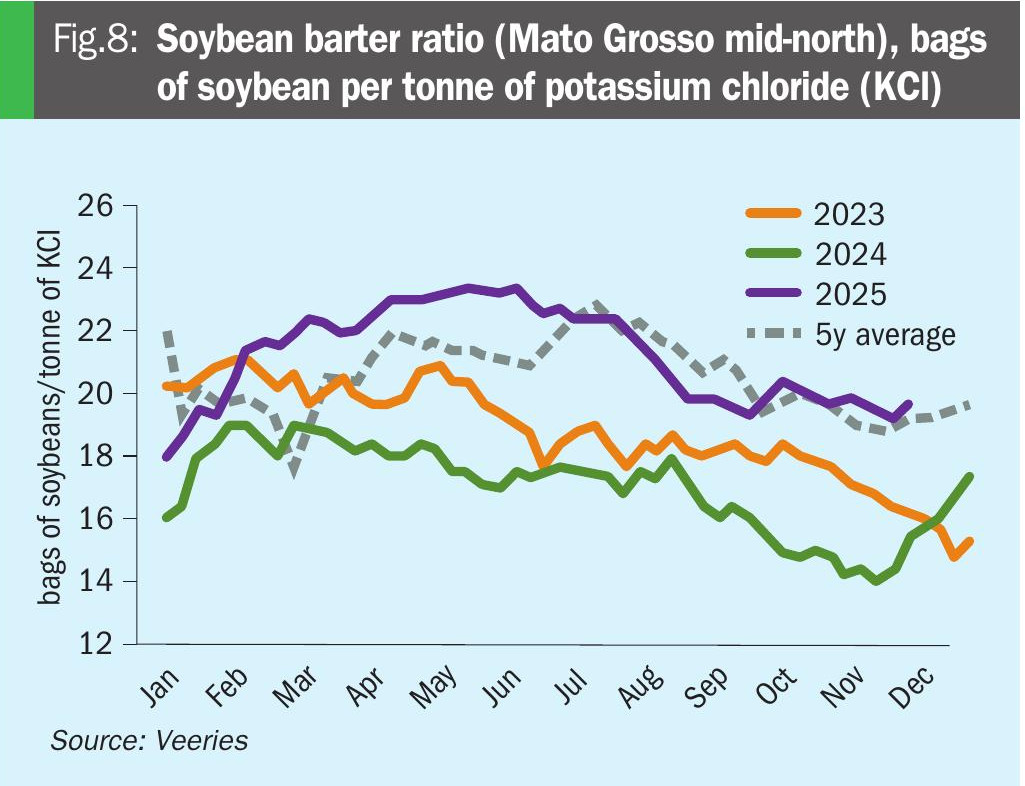

Soybeans: While soybean barter ratios deteriorated slightly at the end of November (Figures 7 & 8), there are currently no remaining volumes to be negotiated for the 2025/26 season (except in Rio Grande do Sul). Consequently, the market focus is now shifting to forward barter ratios and early purchasing activity.

Corn: Barter ratios weakened slightly but remain close to historical averages. This has slowed the pace of fertilizer purchases for the 2025/26 second crop (safrinha). Purchases could increase significantly in December and January, however, if nitrogen fertilizer prices fall slightly and corn prices rise.

Cotton: Barter ratios remain unfavourable for farmers, and fertilizer purchases for the cotton area have been delayed due to low lint prices. There are few signs of improvement on the horizon, and a decline in Brazil’s planted area is expected for the 2025/26 cycle – something not seen since 2020/21.

Coffee: Favourable barter ratios across Brazil are encouraging early fertilizer purchases. High coffee prices continue to encourage investments in new plantings and sustain solid demand, especially in the differentiated and premium segments.

Sugarcane: Barter ratios for sugarcane have remained stable, from mid-September to end-November, but are still at a higher level than in the past two years. The situation has been exacerbated by the narrow margins in the sugar-energy sector, resulting in less intensive fertilization of the crop in 2025 and 2026.

Veeries Fertilizers Sales Index

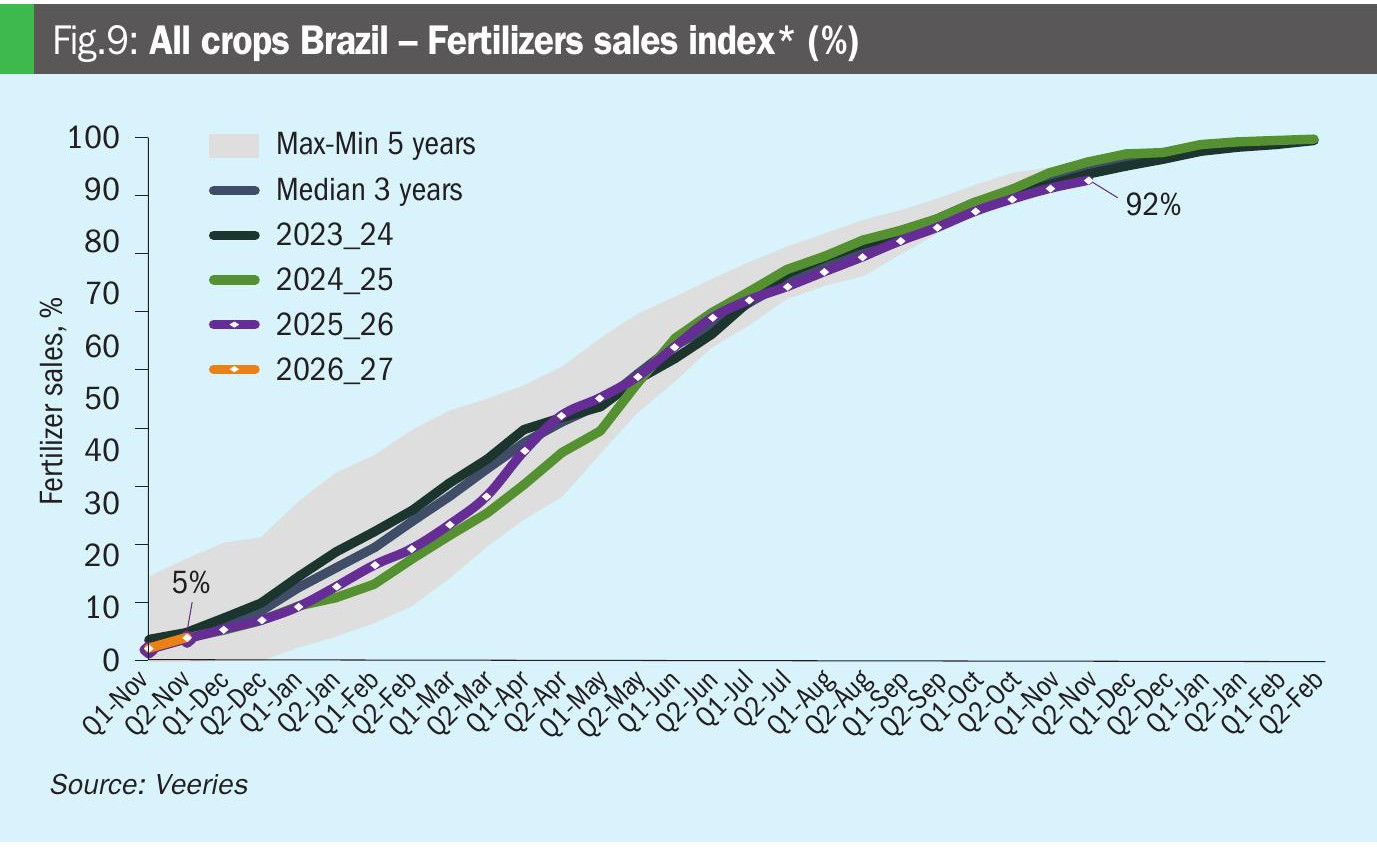

The Veeries Fertilizer Sales Index consolidates the percentage of fertilizer sales for the main crops (soybeans, summer corn, safrinha corn, cotton, sugarcane, wheat, and coffee) across their respective producing states.

The index shows that fertilizer sales to Brazilian farmers are currently in line with the average of the past three years (Figure 9) – signalling a buying pattern within the normal range – despite variations by crop and state. For the 2026/27 season, the index is already at 5%, driven by early soybeans and safrinha corn purchases in Mato Grosso.

Individual fertilizer sales patterns for safrinha corn and soybean are highlighted in more detail below.

Safrinha corn 2025/26

Fertilizer sales evolution for the 2025/26 Safrinha corn season was tracking at 66% at the end of November (based on average annual sales for the last three seasons), above last year’s level (2024/25 season) but 12 percentage points below the three-season average.

Fertilizer sales are maintaining a slower-than-average pace, with agricultural producers waiting for corn prices to rise or for fertilizer prices to fall. There is room for a nitrogen fertilizer price drop of about $10/t from December to January, in our view, and for corn prices to increase (due to second crop risk).

Fertilizer sales have advanced more in Parana and Mato Grosso do Sul states – due to the good calendar for the second crop – and some farm cooperatives there have already reached 80-85% of their sales targets.

Phosphates demand is notably above average. This is linked to the fact that agricultural producers did not apply fertilizers systematically before soybean planting due to the high cost of monoammonium phosphate (MAP) at the time.

Soybean 2026/27

Fertilizer trading for the 2026/27 soybean season was tracking at 9% (based on average annual sales for the last three seasons) at the end of November, with fertilizer sales above the level at this time last year (2025/26 season) but one percentage point below the three-season average.

Advance fertilizer sales are being limited by prices and freight costs. Fertilizer prices have risen since late October and minimum freight rates are making fertilizers even more expensive. Discounts are generally small, although Russian fertilizer companies have the more aggressive offers.

There were more fertilizer price quotes than actual deals at the end of November. Concluded deals were mostly with large producers/groups in Mato Grosso, Goias, Parana and MAPITOBA (Maranhao, Tocantins, Piaui, Bahia) states.

Many agricultural producers are waiting for fertilizer prices to fall by around 5%. On that basis, the end-November MOP (muriate of potash) price of $355/t cfr Paranagua and $492/t cif Sorrisio would need to fall to around $340/t cfr and $475/t cif, respectively, for farmers to close deals, in our view.

Continuing the farmer buying behaviour reported in the November monthly update, 2026/27 fertilizer sales negotiations are being driven by phosphates (lower-concentration SSP). This contrasts with the same period in 2024 when deals were driven by potash (MOP).

About the authors and contact information

Bruno Fardim Christo is Lead Fertilizer Analyst at Veeries. Anthony Rizzo is CRU’s Senior Analyst – Fertilizer Demand and US Markets.

Please contact Anthony Rizzo (anthony.rizzo@crugroup.com) or Anuradha Ramanathan (anu-radha.ramanathan@crugroup.com) at CRU and comercial@veeries.com.br at Veeries for further information about the latest January 2026 Brazil Fertilizers and Crops report.