Fertilizer International 529 Nov-Dec 2025

21 November 2025

Market Insight

Market Insight

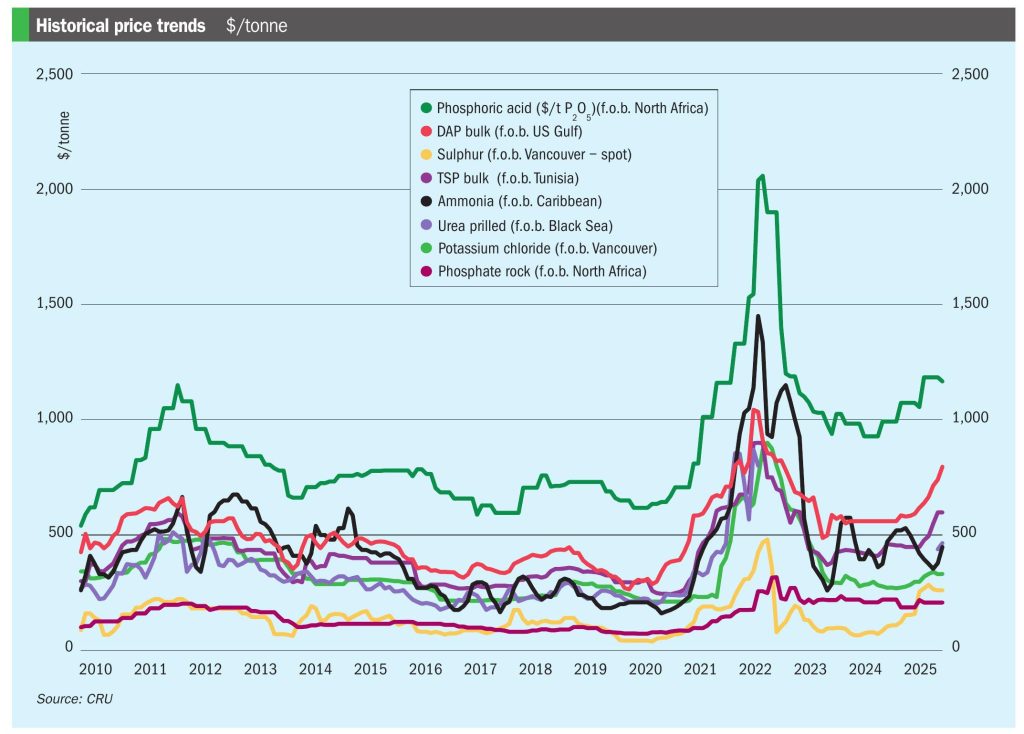

PRICE TRENDS

Market snapshot, 23rd October 2025

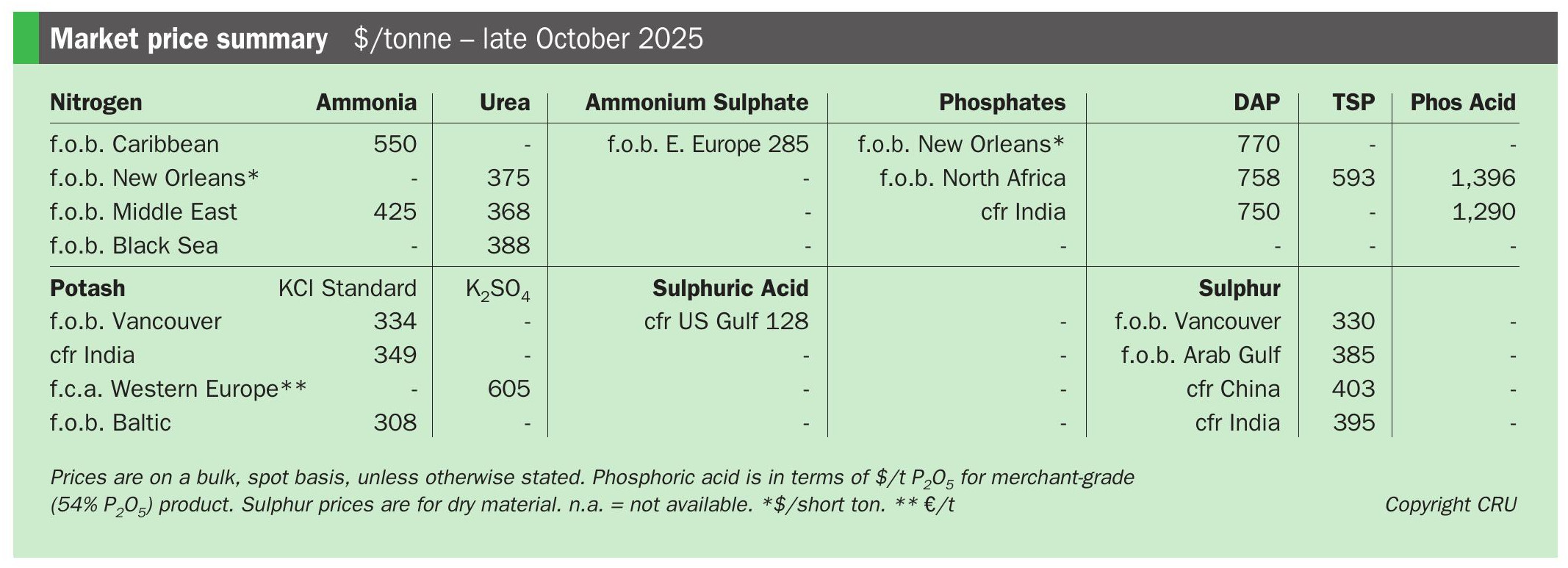

Urea market springs to life. Eyes have been fixed on India and the fulfilment of RCF’s two million tonne urea tender issued on 15th October. RCF had issued counteroffers to all participants at $395/t cfr East Cost India (ECI) and $402/t cfr West Coast India (WCI). But it became clear that suppliers west of Suez were unwilling to commit tonnes at these prices.

Early reports suggest RCF is likely to receive offers for only one million tonnes of the requested volume initially. The bulk of acceptances are now expected to emerge out of the Middle East, almost exclusively destined for India’s west coast. Clarity is still awaited on the extent of Chinese participation in the tender. Unconfirmed reports suggest up to 200,000 tonnes is ready for shipment, while others have indicated quantities below this level.

In the Middle East, Sabic sold a November cargo at $395/t f.o.b. That was later eclipsed by Oman’s SIUCI, which placed a November consignment at $399-400/t f.o.b. In the UAE, meanwhile, Fertiglobe sold 150,000 tonnes at $407/t f.o.b. for November shipment to Ethiopia.

In Egypt, a raft of buying activity took place at $425-440/t f.o.b. Along the coast in Algeria, Sorfert sold November material at $435/t f.o.b., with reports of further business concluded by the producer AOA at $440/t f.o.b.

Across the Atlantic in Brazil, bids slipped into the $390s/t cfr with offers also falling as low as $405/t cfr in some ports. In Europe, buying activity remains subdued on poor affordability and increasingly weak farmer economics. Looking west, activity at NOLA was similarly muted.

Ammonia market pushes higher as supply falters. The ammonia market tightened further, with Nutrien’s shutdown in Trinidad being the latest blow to buyers seeking relief from relentless price rises. Ammonia is tight globally, linked to a significant extended outage in Saudi Arabia, and there is increasing talk of demand destruction.

Algeria’s export price ($625/t f.o.b.) is now at its highest level since CRU began the assessment in January 2024. This benchmark is around 60% up from its low of $390/t f.o.b. seen in June. The delivered price in northwest Europe is also its highest in approaching two years.

In the Middle East, Ma’aden’s MPC outage continues with speculation that the curtailment may now continue into 2026. The 1.1 million t/a capacity ammonia unit went down unexpectedly at the end August and is likely to be down until the end of the year, with the loss of at least 300,000 tonnes of production. Contract prices in the Far East continue to firm on restricted supply, with those in Taiwan and China up around $70/t in a month. China is emerging as one of the few sources of spot cargoes in the region. Prices in India are also climbing.

Phosphate prices under pressure while activity limited. DAP and MAP prices remain under pressure, although overall global spot market activity was limited. Spot prices for MAP sales to Brazil were assessed lower at $650-670/t. While DAP markets were quieter, assessments still inched down.

The key India DAP spot benchmark declined further to $747-752/t cfr amid limited market activity. This price assessment, although down from the $810/t cfr level seen two months ago, is still well up on $632-634/t cfr at the end of February and $690-700/t cfr at the start of May.

China’s total January-September DAP and MAP exports were around 3.8 million tonnes, leaving limited remaining export quota allocations. Meanwhile, another week passed with a lack of DAP, MAP or TSP barge deals at New Orleans, leaving price assessments unchanged.

Potash stability prevails with all eyes on China. Potash prices remained mostly steady, with only slight fluctuations seen in Europe and parts of the US. Market attention continues to centre on the upcoming China contract and how it might influence the market. Despite expectations of potential price declines, if contract negotiations are delayed, formal talks have yet to begin.

In India, focus is now on the Fertiliser Association of India (FAI) Annual Seminar in December, where both producers and importers expect negotiations to take place. For now, the market is adopting a wait-and-see approach ahead of the government’s upcoming announcement of nutrient-based subsidy (NBS) rates for the next quarter.

The Southeast Asian MOP market continues to show price stability, serving as a key reference point regionally. In Europe, standard potash prices edged down slightly, with most offers now around €340/t cif. The Brazilian MOP market remained largely unchanged, with limited deals as buyers shift focus to SSP for the upcoming season. New offers at $365/t cfr emerged, but market participants generally viewed these as inflated.

Sulphur prices rise globally. Sulphur prices advanced further in the third week of October. The bullish sentiment is present even in markets where activity has been limited.

Transactions into both Indonesia and southern China are understood to have taken place at $400/t cfr, with Indonesian demand expected to continue through November. Offers of Middle East material into both China and Indonesia are understood to now be around the $340/t cfr price. This price level is supported by the latest QatarEnergy tender (35,000 tonnes) which, reportedly, was awarded above $400/t f.o.b. for November shipment.

OUTLOOK

Urea prices to find floor in near term before advancing. While the urea market has bottomed out with India back in the import market, and interest in Brazil and Europe picking up, prices have been revised lower in CRU’s latest forecast. Looking ahead, key downside risks include possible demand destruction in Europe in the first quarter of next year, due to a lack of clarity over the carbon border adjustment mechanism (CBAM). Demand in Brazil could also be lower than expected, if ammonium sulphate (AS) consumption were to increase. Prices could also come under increased pressure if India steps back from the market at the end of the year.

Ammonia buoyed in immediate term following Tampa price hike. Prices should continue to retain support in the short term amid ongoing supply constraints both east and west of Suez, although prices should begin to correct downwards as 2026 nears. The market looks very tight through to the end of the year, although some expect supply to improve in the fourth quarter. The commissioning of new capacity in the US Gulf, Baltic Sea and Middle East is likely to apply significant downward pressure on the market, as and when this emerges.

Phosphates prices to fall further but remain elevated. Prices are expected to decline further through the fourth quarter as buyer resistance to high prices grows across the globe. Despite this, prices are still likely to remain historically high, given the limited overall global availability resulting from China exiting the export market until at least the second quarter of 2026.

Potash prices expected to drift lower as demand softens. Prices are expected to remain stable to soft in the short term. Market focus will remain on upcoming contract negotiations, particularly in China, due to their influence on future price trends. Larger-than-expected price declines could occur, however, if falling crop prices negatively affect affordability and potash demand.

Sulphur prices to peak in fourth quarter. Global sulphur prices were adjusted upwards in CRU’s latest forecast, after the market moved to a higher price environment during September. Globally, sulphur price sentiment is likely to remain bullish in the coming weeks. Although sulphur demand in China is likely to decrease, now that the phosphate export window has closed, demand in Indonesia is expected to persist until the end of year. Short-term constraints on FSU-sourced sulphur are also likely to add to market tightness.