Nitrogen+Syngas 398 Nov-Dec 2025

19 November 2025

Price Trends

Price Trends

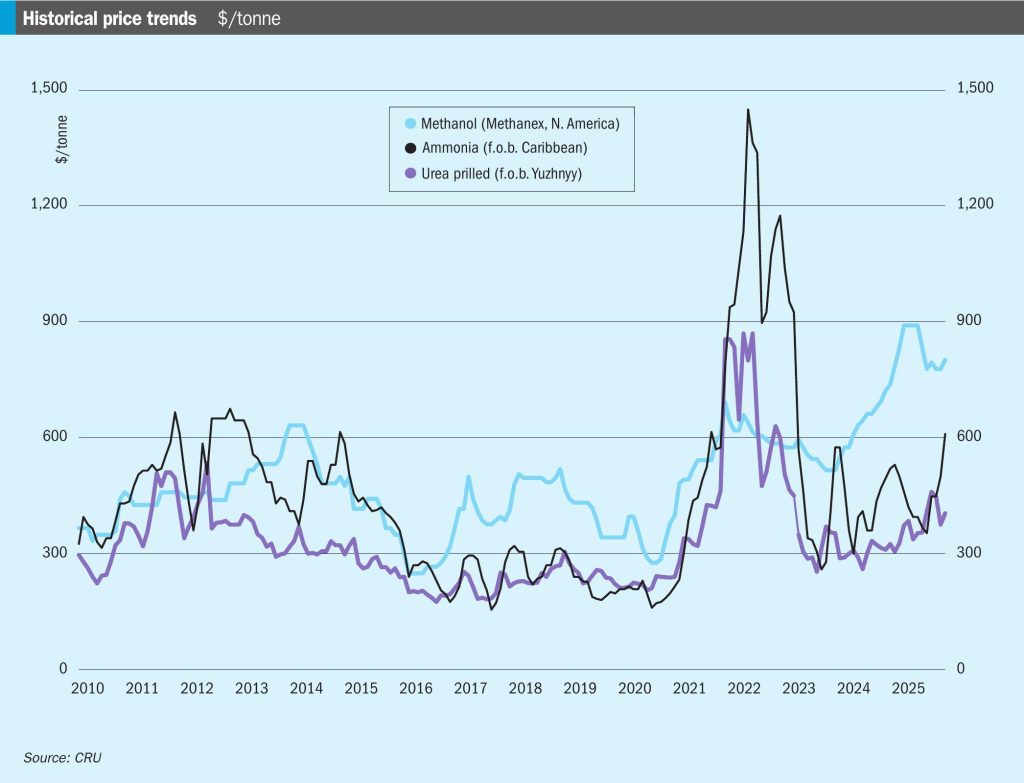

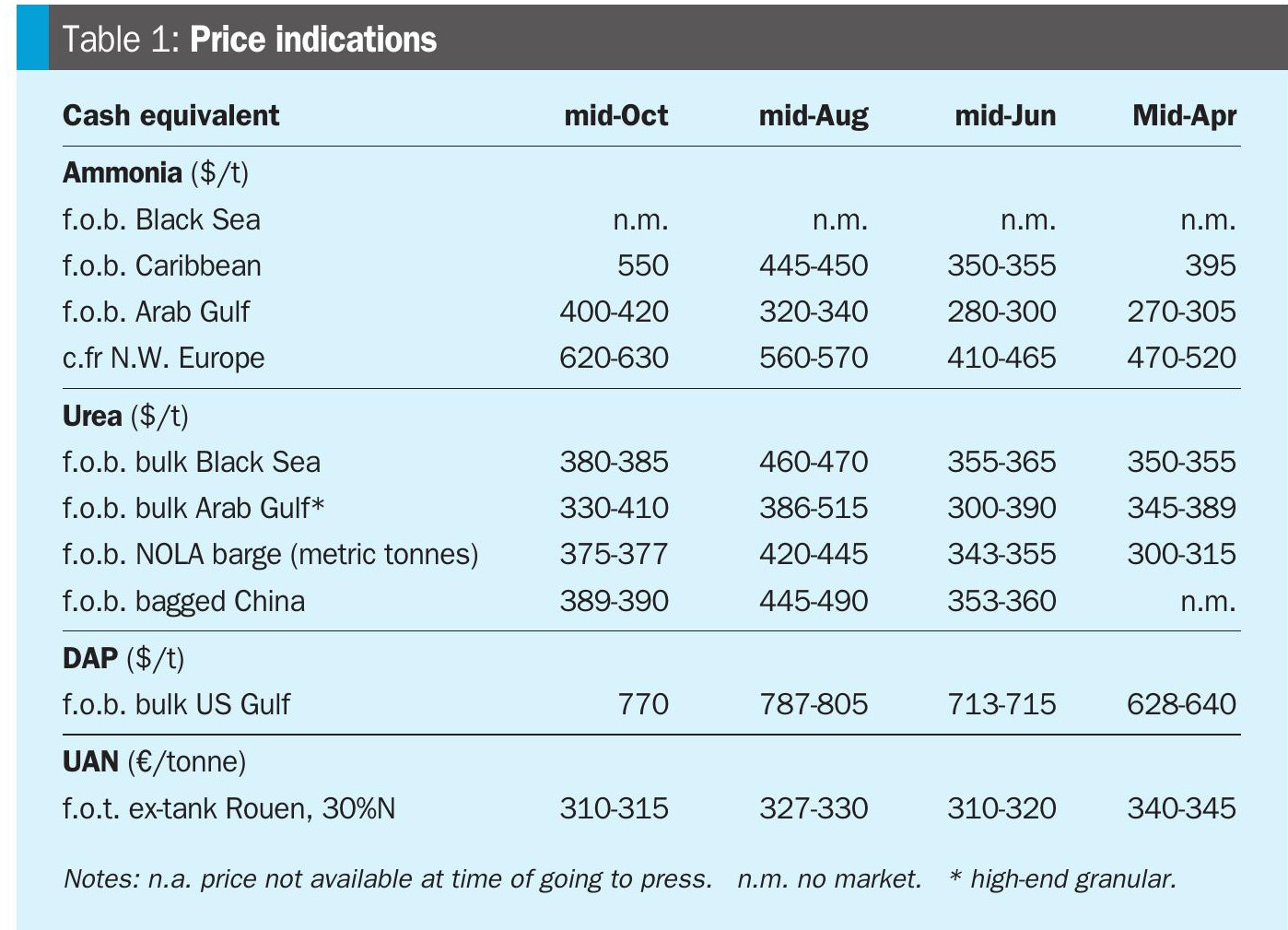

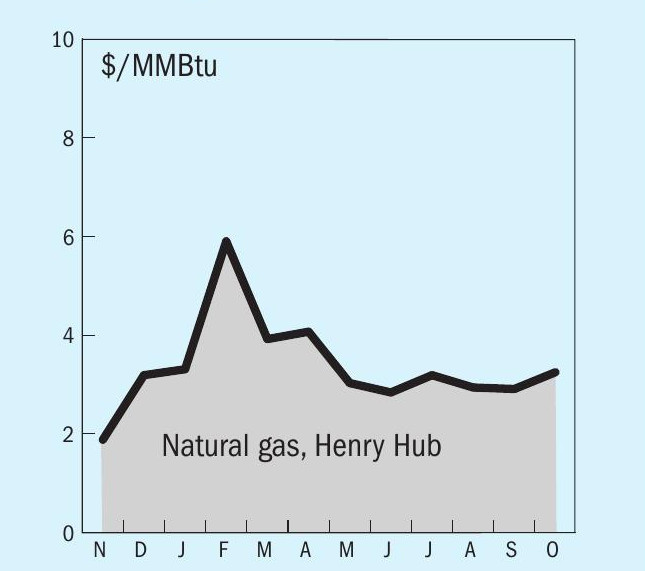

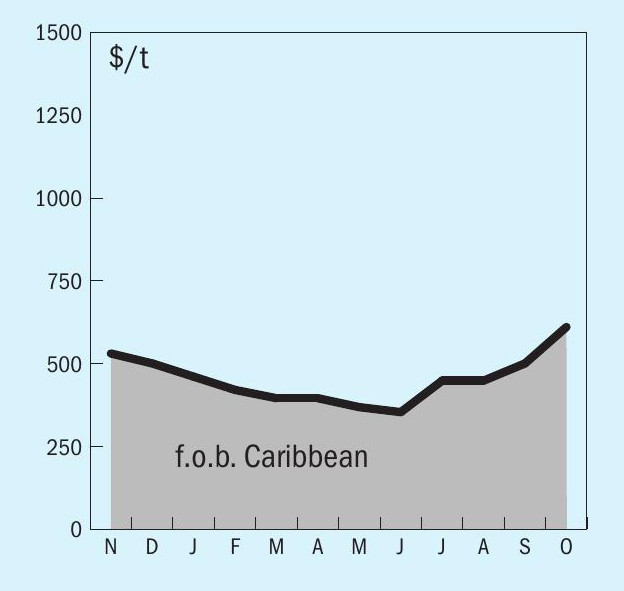

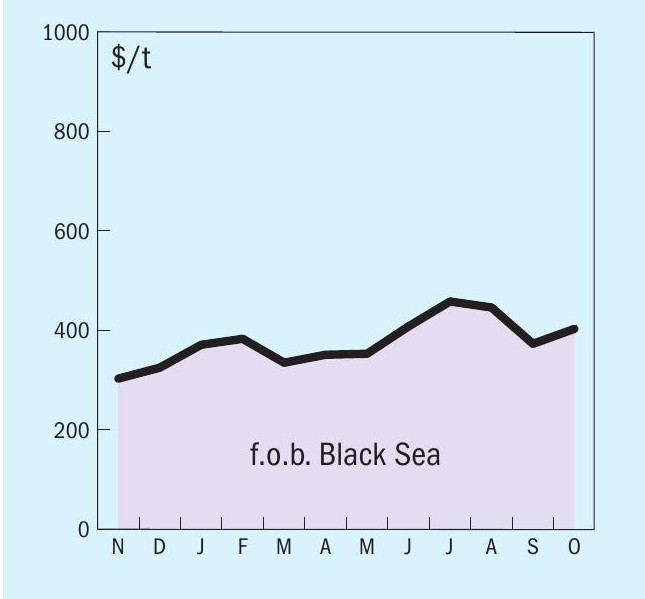

By the end of October the ammonia market was facing an acute shortage of spot tonnage, reflected in a $60/t jump in the Tampa price for November. The benchmark Tampa price increased for the sixth straight month to its highest since February 2023 as the global ammonia supply crunch deepened. The surge at Tampa was said to be driven by good demand in the US for direct application combined with a lack of supply. Contributing factors included Nutrien shutting down its nitrogen production in Trinidad, potentially removing around 85,000 tonnes/month from the market. So far, there is no suggestion that other producers in Trinidad will follow suit, and they may even benefit from a boost natural gas supply given the Nutrien outage, although it is unclear whether the spare gas will be directed to ammonia as opposed to other demand sources.

An outage at Ma’aden’s MPC unit in Saudi Arabia is expected to last at least until the end of the year, with lost production of at least 300,000 tonnes, and potentially more if the outage persists into the New Year. Ma’aden is not currently offering spot tonnes and is maintaining its estimate of a return to MPC’s ammonia production in December. Elsewhere, Mosaic’s standalone ammonia plant at Faustina is still down for planned maintenance but on track to return mid-November.

A large purchase by Yara of 60,000 tonnes from Sorfert in Algeria for November/December loading is considered by some to be spurred by the introduction of CBAM in Europe on 1 January next year; imports after that date will attract additional costs of around $50/t. The delivered duty paid price to northwest Europe was assessed higher again this week, based on Algerian sales at $625/t f.o.b. There remains little relief in sight for ammonia buyers before the end of the year, and concern is mounting over demand destruction at these levels.

The global urea market underwent a rebound in late October as bullish sentiment ahead of yet another anticipated India tender announcement saw prices on both sides of the Suez gain ground. India’s Rashtriya Chemicals and Fertilizers (RCF) issued letters of intent for less than a quarter of the 2 million tonnes of urea it initially sought in its 15 October tender, so the market now expects India Potash Limited (IPL) to return with a fresh tender in 1H November in an attempt to fulfil Indian import requirements.

In the Middle East, values advanced again, with Oman’s SIUCI understood to have sold December tonnes at $410/t f.o.b. Further east, markets in Southeast Asia were largely dormant, with both buyers and sellers alike awaiting future price direction from India. In Indonesia, Pupuk Indonesia was reported to have awarded two PIM cargoes to Aditya Birla at $364/t f.o.b., almost $20/t down on last prilled sales out of the region.

European buyers have been active in securing tonnes for delivery prior to the Christmas off-season in 2H December and subsequent imposition of the European Union’s Carbon Border Adjustment Mechanism. In Brazil, both bids and offers also gained momentum, with the latter now heard in the $420-430/t c.fr range.

END OF MONTH SPOT PRICES

natural gas

ammonia

urea

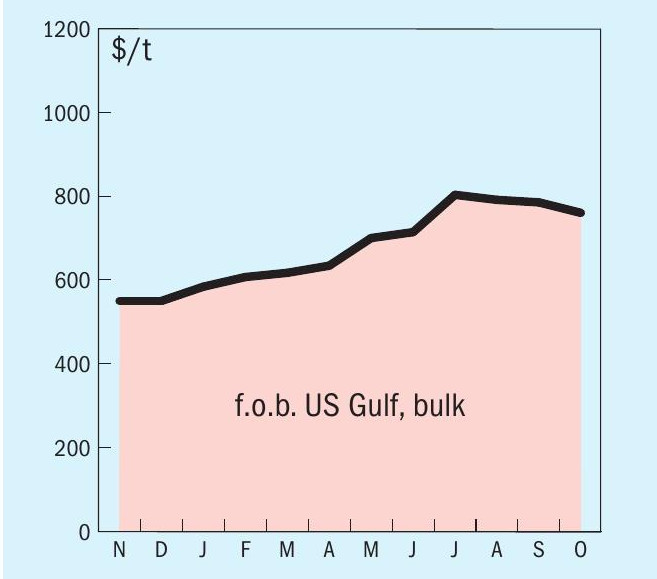

diammonium phosphate