Sulphur 420 Sep-Oct 2025

19 September 2025

Acid from base metal smelting

BASE METALS

Acid from base metal smelting

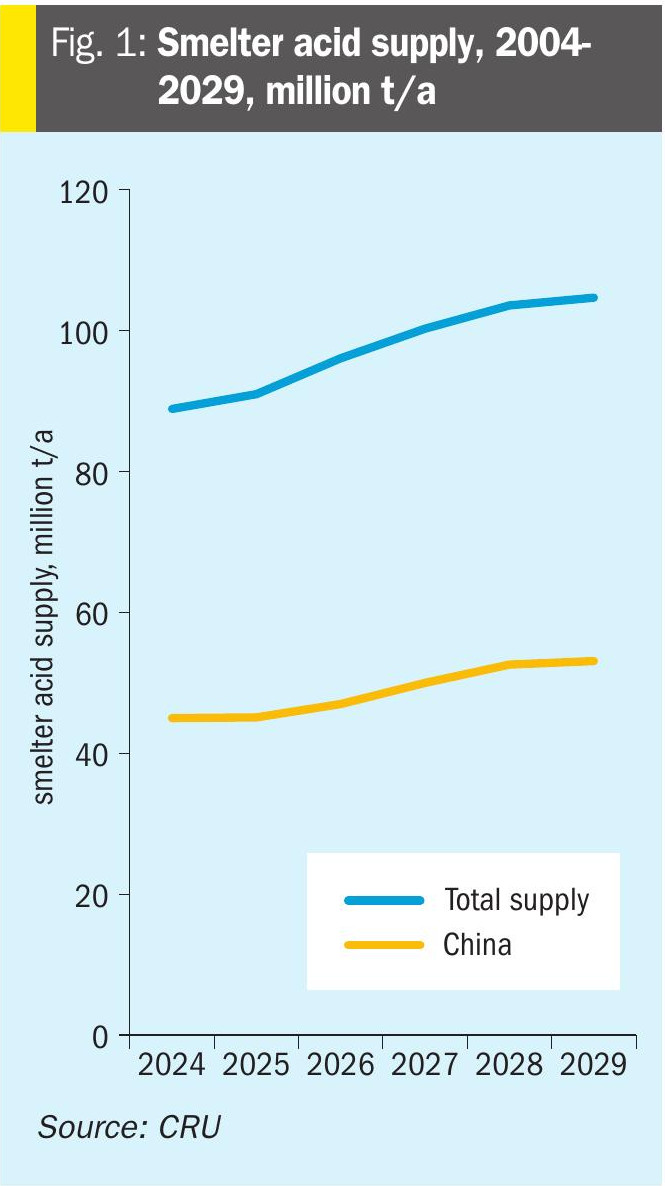

Almost one third of sulphuric acid production, and a much greater share of globally traded acid, comes from smelting of base metal sulphides and the recovery of SO2 from flue gases. Smelter acid production continues to increase, particularly from copper, creating an imbalance in the sulphuric acid market.

Base metal smelting makes up about 30% of the world’s production of sulphuric acid – 89 million t/a of acid in 2024 out of a global total of 304 million t/a. Because it is involuntary production to avoid emissions of harmful sulphur dioxide, production of smelter acid is driven primarily by the economics of metals markets rather than sulphuric acid prices, and hence it is often produced regardless of prevailing acid market conditions. And while sulphur-burning acid capacity is usually integrated into local downstream uses, especially phosphate fertilizer production, but also copper and nickel leaching etc, this is far less frequently the case for smelter acid production. Domestically and internationally traded acid thus tends to come mainly from smelter acid.

Acid from metal smelting is predominantly (about 70%) generated by the copper industry, with zinc and lead smelting representing approximately another 20% of production and the rest mainly from the nickel industry. These base metal industries are destined primarily for construction and industrial end uses and their consumption is closely tied into general economic and industrial growth.

Copper

Copper demand is mostly for electrical wiring, industrial machinery, electronic products, transportation and similar fields, and so is closely correlated with industrial production. It has also increasingly become linked with the green energy transition, with requirements for electrical transmission wires to connect new wind and solar power to grid, battery storage, electric vehicles etc. For the first two decades of the 21st century, incremental demand came mainly from China’s industrialisation, and now from China’s switch to renewable power and electric vehicles. China represented 58% of world copper demand in 2024, and incremental demand for refined copper is coming mainly from China, helping copper demand grow by approximately 3% year on year for several years running. The green energy transition (GET) is supporting copper use, offsetting weakness in traditional sectors, which are more sensitive to the broader economic cycle. Outside of China, refined copper consumption is expected to grow at 1.4% in 2025, accelerating to 3.5% per annum in the medium term. China’s economic growth momentum has moderated, due to the effects of the trade war, but GDP should grow at 4.6% this year. The slump in residential and commercial property has continued; but energy infrastructure, including the electricity grid, has seen strength. This, together with growth in other copper-intensive sectors (even those with some exposure to export markets) means that CRU anticipates that Chinese total copper demand will rise by 3.5% in 2025.

Copper supply comes mainly from smelting of copper concentrate, accounting for around 66% of all copper production according to International Copper Study Group (ICSG) figures. Copper leaching via solvent extraction/electrowinning accounts for another 14% and secondary refining (recycling of scrap copper) about 20%. The latter figure has been pushed up in recent years by a shortage of copper concentrate to feed smelters, leading to higher recycling rates, especially in China. Over the past two decades the smelting industry has moved decisively to Asia, especially China, which now operates 50% of all copper smelter capacity. Japan represents 7%, Chile 5% and Russia 4%, according to the ICSG. Overall, China’s share of global refined copper production of 27.5 million t/a in 2025 is expected to surpass 2023’s record of 47.3%, coming in at 47.4%.

Copper smelters have faced shortages of copper concentrates from mines as China’s rapid expansion of smelter capacity has run ahead of the ability of copper mines to supply them. Copper treatment charges – fees paid by copper miners to smelters for processing copper concentrate into refined metal – are currently at record-low levels due to a tight concentrate market, with benchmark charges below $20-$30/t, well below the $80/t benchmark for 2024. Lower treatment charges reduce the profitability for smelters and are a strong indicator of the concentrate market’s tightness. This is leading to restrictions on output for Chinese smelters and possibly forcing some shutdowns. Overall, Chinese smelter acid production is expected to remain stagnant in 2025, as the copper concentrate shortage will still weigh on the market with further production cuts. Additional smelter capacity in 2025 is actually mainly coming from outside of China, with the startup of the Amman Minerals and Freeport copper smelters in Indonesia, and the huge Adani copper smelter in India in 2H 2025. However, a rebound in smelter production in China is expected next year as new mine start ups ease the tightness in the copper concentrates market.

Nickel

Nickel is, like copper, closely tied to industrial growth. About two thirds of all nickel (67%) is used in the manufacture of stainless steel, and the rest goes into other alloys (11%), nickel plating (5%), and battery uses (14%). As with copper, China has come to dominate the market, consuming 62% of all nickel in 2024, according to CRU figures. Nickel demand has been boosted by its use in electric vehicle batteries, although nickel demand for batteries has been largely stagnant since 2022 due to the rise of alternative technologies such as lithium iron phosphate, and growth is being driven mainly by stainless steel consumption at present. Nickel demand is expected to grow by 30% over the five years from 2024-2029, split roughly 50-50 between new battery demand and growth in demand for stainless steel.

The nickel smelting sector is a relatively smaller part of the supply chain than for copper, with much of the focus now on cheaper, lower grade laterite (oxide) ores, which are processed either via pyrometallurgical routes to generate ferronickel or so-called nickel pig iron (NPI), or via acid leaching routes, particularly high pressure acid leaching, or HPAL.

Zinc and lead

Zinc and lead production produce the remainder of the world’s smelter acid. Global lead demand was 13.2 million t/a in 2024, while zinc consumption was 13.3 million t/a last year. China represented 40% of lead demand and 51% of zinc demand in 2024.

Lead has a much higher rate of recycling than other metals, especially from old lead-acid car batteries, and actual lead mine production for smelting was only about 4.4 million t/a in 2024, or only around one third of supply, although as electric vehicle power trains become more common, so the supply of scrap lead acid batteries is likely to fall. The lead market – almost 90% of it represented by demand for lead acid batteries – has been in deficit for some years, with demand outstripping supply, but is projected to move into surplus in 2025. Production has been downgraded due to the weaker Chinese market, while demand has also been revised lower on fading GDP forecasts, as well as the influence of a lower outlook for vehicle production and sales, but production is nevertheless expected to be ahead of demand. Looking further forward, the lead market is likely to continue to suffer from competition with other battery metals such as lithium. China and India together will account for two thirds of the rise in Asian demand and over 40% of the global rise out to 2029. On the supply side, most new supply is expected to come from recycling, but reducing availability of scrap lead acid batteries will necessitate more smelter production, especially outside of China, with CRU anticipating additional production from Korea Zinc’s Onsan smelter in South Korea, Vedanta’s two Indian plants and Glencore’s Ust Ust-Kamenogorsk smelter in Kazakhstan.

Zinc is mainly used in galvanising of steel (50%), and the manufacture of brass and bronze alloys and die casting. Global zinc demand has been virtually flat since 2017 due to declining growth in key zinc-consuming industries. Zinc has the lowest recycling rates of most primary metals at only 13%, as most zinc end uses are not in easily recyclable applications like batteries, packaging or wire. In spite of the relatively stagnant market, a surge in new smelter expansions over the period 2024-2029 will increase capacity by more than 1.5 million t/a over the forecast period, with the majority of the expansion coming from China. While this will not affect the zinc price directly, it will keep pressure on treatment charges and is likely to keep them low. It is also likely to mean declining utilisation rates at existing producers and possibly some closures, and may not necessarily lead to much of an increase in acid output.

Smelter acid output

There have been some smelter acid outages this year. In Chile, Glencore’s Alto Norte smelter was suspended during April and May 2025 due to a furnace issue. In Peru, Southern Copper’s Ilo smelter shut down operations in April due to shortages of copper concentrate feed. The PASAR smelter in the Philippines was put on care and maintenance in May due to challenging market conditions, removing 900,000 t/a of smelter acid supply. The deteriorating zinc market has also forced Nyrstar to reduce output at its Hobart zinc smelter in Australia by 25% from March this year.

Set against this, there will be start-ups for Freeport’s smelter in Gresik, delayed due to a fire in the sulphuric acid unit in September 2024. Also in Indonesia, Amman Mineral’s Sumbawa smelter is expected to commence operations in 2025 H2, with a capacity of 900,000 t/a of sulphuric acid. India’s Adani Group is also commissioning its smelter, with a sulphuric acid production capacity of 1.5 million t/a. In China, the global copper concentrate shortage is still weighing on acid production. Smelter acid output there is expected to remain stagnant in 2025, and balancing the market for copper concentrates will require market-related smelter cuts for demand to meet supply. Overall smelter output is expected to increase by only 0.9% year on year in 2025 due to this and delays in smelter starts in Indonesia, India, and the DRC.

Looking to the longer term, smelter acid supply is expected to increase by just under 15 million t/a from 2024-2029 (see Figure 1). China will represent 8 million t/a of this increase, with another 1.6 million t/a in India, and 2.5 million t/a in Indonesia, most of the latter in 2025-26. Other smaller increases will occur in Zambia and the DRC and Chile, and 1.1 million t/a in Europe, mainly Germany and Spain. The new capacity in India will help reduce import demand in the short term, though in the longer term more acid will be needed for phosphate production. In China smelter acid is taking over from sulphur-burnt acid on the export market, which may mean that Chinese exports continue in spite of a surplus in the traded acid market.