Nitrogen+Syngas 397 Sep-Oct 2025

16 September 2025

Market Outlook

Market Outlook

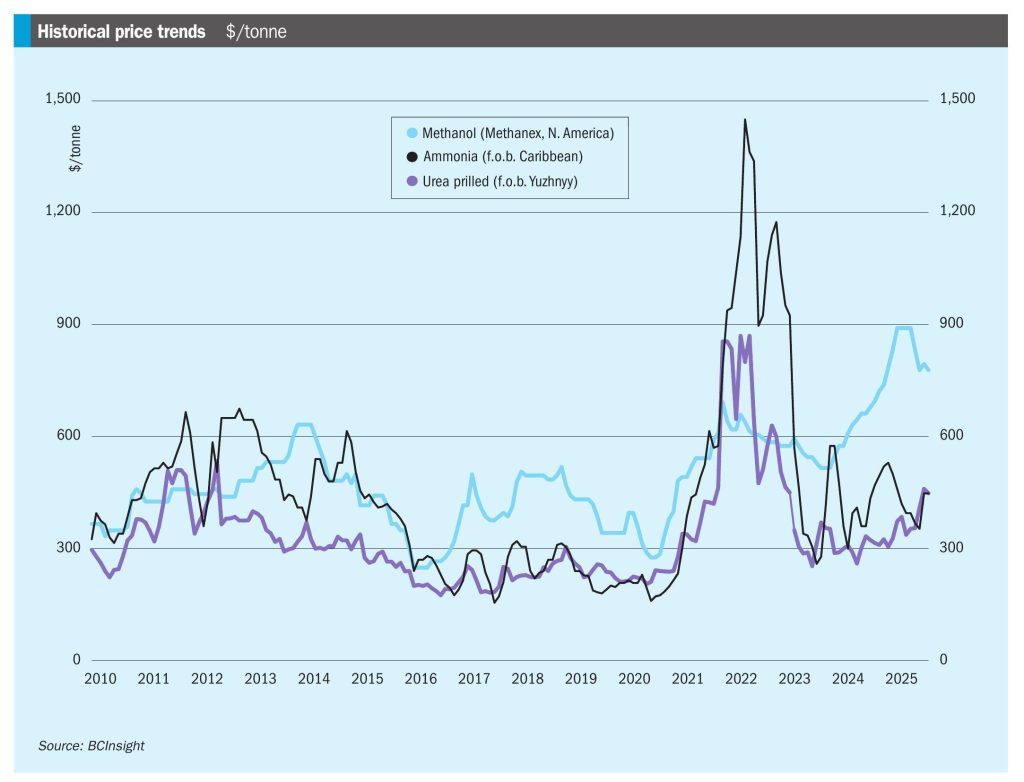

AMMONIA

• Ammonia prices look well insulated against any declines over the immediate term, though the upside may be more limited in some regions than others.

• In Trinidad, market players are awaiting clarity from the island’s Natural Gas Company (NGC) on when long-awaited feedstock constraints will come into effect. Trinidadian f.o.b. prices should gain ground in September, with the Tampa c.fr settlement expected to increase further on the $487/t cfr agreed for August.

• Ma’aden’s 1.1 million t/a MPC unit has suffered an unplanned outage which could see the plant remain offline for up to two to three months. The outage could see around 150,000-200,000 tonnes worth of ammonia production lost. The company had been expecting to export 150,000 tonnes of ammonia in September.

UREA

• With China releasing additional quotas, global prices are expected to soften despite the huge volume India needs to secure. However, there is confusion over Chinese availability for India.

• China released the third round of urea export allocations on 20th August, at 700,000 tonnes, bringing the total export allocation figure to around 4.2 million tonnes, but it remains uncertain what volume, if any, from the allocation will be allowed to be exported to India. It appears that only a previously approved 300,000 t may be exported by nine distributors, while the export ban to India remains in place for all other suppliers.

• Indian demand is nevertheless still expected to bring prices higher in the longer term.

• There is growing concern that urea imports into Brazil will fall short of previous years as buyers focus on the cheaper priced AS from China.

METHANOL

• Methanol prices have spiked in India due to US sanctions being imposed against six Indian companies which are accused of buying Iranian methanol. The move has cut Indian buying of Iranian methanol and led to a sharp price increase domestically in India, which is likely to continue for some months. Iranian exports continue to run at high levels, reaching 700,000 tonnes in August, in spite of the temporary shutdown of the Bushehr plant.

• Conversely, Chinese prices have fallen due to concerns about oversupply. Port stocks have reached 1 million t/a with storage space reported to be limited. MTO demand has been steady, but economic news remains mixed, and future demand is uncertain. European methanol prices reached two year lows in early August before rebounding slightly. Lower demand has led to an excess of supply.