Fertilizer International 528 Sep-Oct 2025

15 September 2025

Market Insight

Market Insight

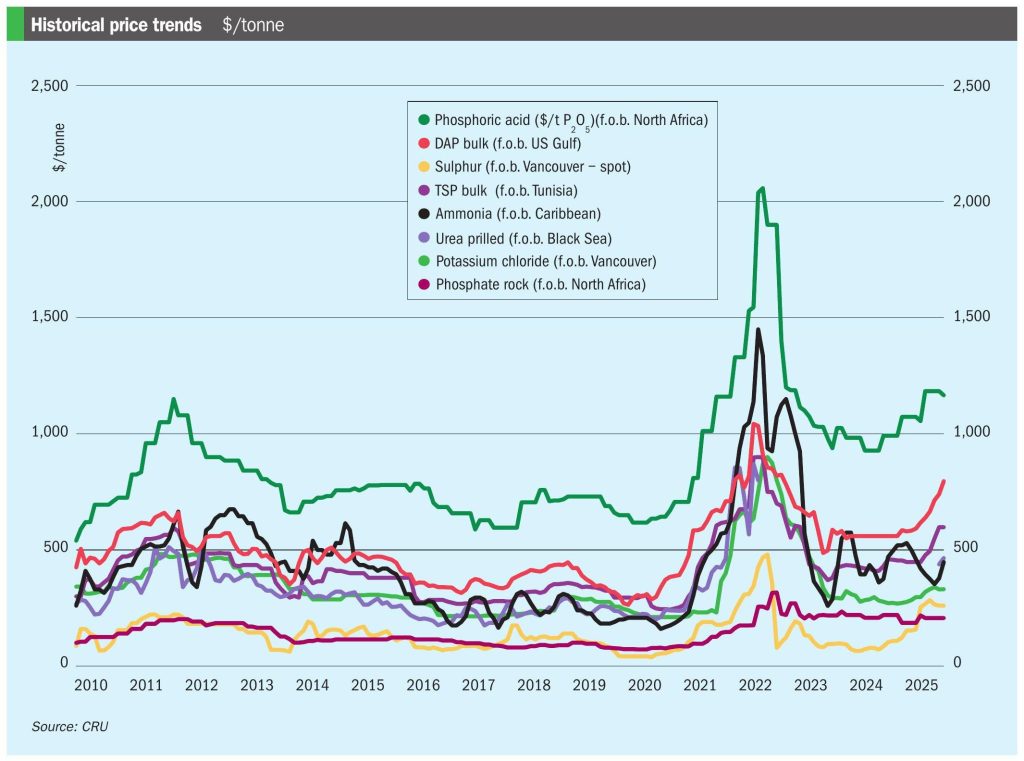

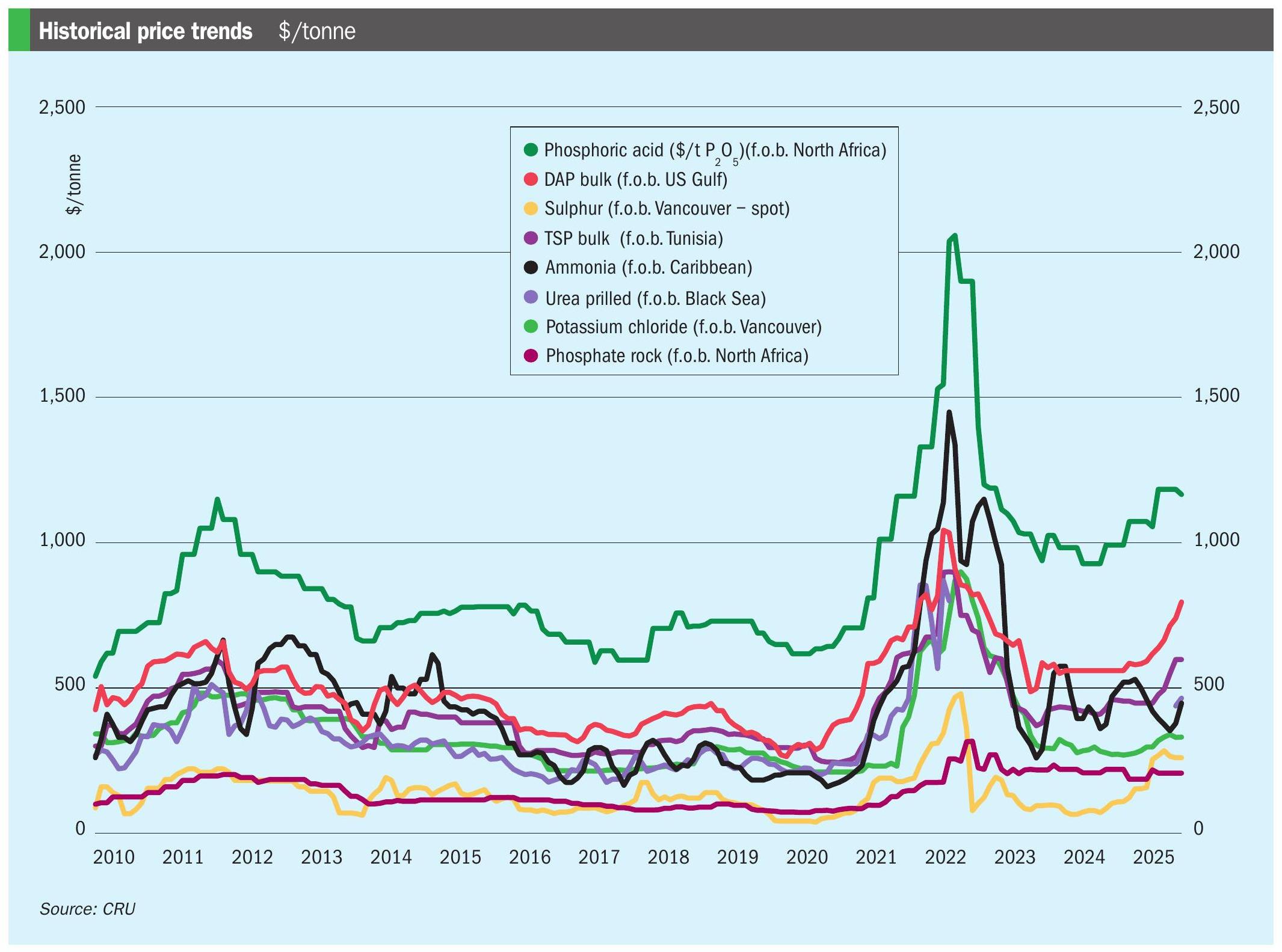

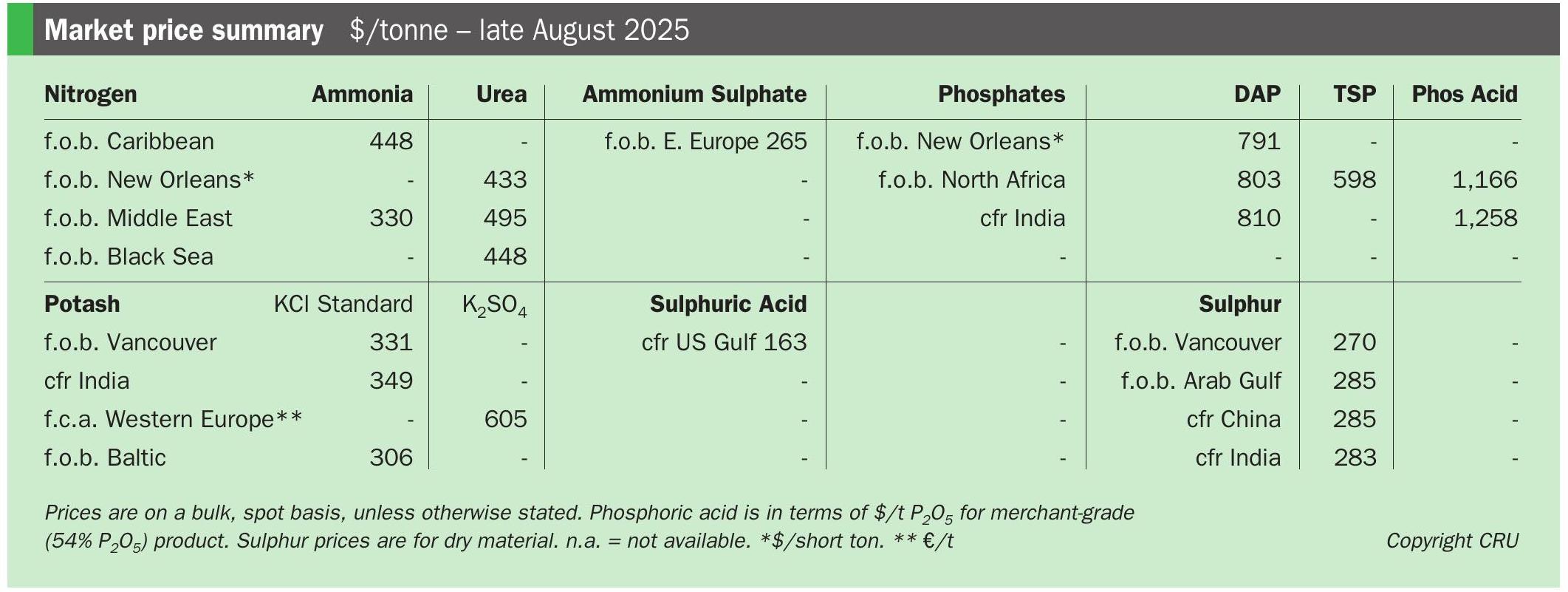

PRICE TRENDS

Market snapshot, 21st August 2025

Urea slides on news China will supply India. Market sentiment reversed on yet-to-be confirmed news that additional shipments from China to India are to be allowed – with the prospect of this happening triggering a price correction. Market players see prices sliding below $500/t cfr in the next National Fertilizer Limited (NFL) India tender. That compares to $530/t cfr west coast paid by Indian Potash Limited (IPL) earlier in August.

Not all producers, however, are ready to accept the urea market slide. Pupuk Indonesia scrapped a 45,000 tonnes granular tender for September shipment after refusing to accept no-one would pay the $503/t f.o.b. asked. Iran has also struggled to secure the $435/t f.o.b. it was hoping for, with a consequent build up of 300,000 tonnes of inventory being reported.

Brazil, meanwhile, has seen piecemeal purchasing at $480-495/t cfr. Volumes are thin, as are offers, with traders pursuing better netbacks in India for September cargoes. There are growing concerns that Brazil’s 2025 urea imports will fall well short of previous years, as buyers shift instead to plentiful and cheaper priced Chinese ammonium sulphate (AS).

Ammonia prices steady. Prices on both sides of Suez remain steady, except for a few upticks in some regions. All eyes are now on the next Tampa settlement, this being seen as an indicator of emerging upside pressures in coming weeks.

Market participants are currently expecting a moderate increase in the September Tampa price, with at least a 5% premium on the $487/t cfr fixed by Yara and Mosaic for August. Mosaic has been increasingly active on the spot and contract markets in recent weeks and the ammonia import line-up into Florida is strong at present. Export wise, ammonia shipments out of the US Gulf are also robust, with multiple cargoes departing or set to load from Texas and Louisiana.

East of Suez, ammonia exports continue to flow out of the Middle East at a steady rate, with no plant issues or turnarounds heard. Ma’aden said it will export 150,000 tonnes in September. Half of that total has been earmarked for delivery to India, where prices were largely stable.

Phosphate sentiment softens. DAP and MAP globally have experienced a period of relative stability in recent weeks, compared with the previous steep increases seen in 2025. While news of expanded export quotas from China has softened sentiment slightly, global availability remains tight overall, adding support to prices despite poor affordability.

Between 0.7-1 million tonnes of DAP/ MAP have been allocated in China’s latest export quota released on 20th August, according to sources. This total is said to comprise 550,000-600,000 tonnes of DAP and 100,000-150,000 tonnes of MAP, although other sources have indicated that DAP alone amounted to 700,000 tonnes out of a total allocation of one million tonnes.

A relative lack of supply from China has been the key reason for tight global availability. China exported 2.18 million tonnes of DAP/MAP in January-July this year, a 32% decrease from the same period in 2024.

Key DAP import market India, meanwhile, has remained steady at $810/t cfr, as fresh deals were awaited, while downwards pressure persisted in key MAP import market Brazil. DAP prices in Pakistan also climbed on a 60,000 tonne sale by Ma’aden.

Potash prices slip in Brazil and US. Granular potash prices have fallen modestly in Brazil and the US, while remaining stable elsewhere. The Brazilian MOP benchmark dropped to $355-360/t cfr, its lowest level since early May. Prices in the region peaked at $370/t cfr in July and then held at $360-370/t cfr for the next four weeks. Now, with the soybean season closed, prices have begun to decline on weak demand. In the US, potash activity has largely paused, with the market showing signs of softening – particularly in New Orleans, where prices have slipped to $335-340/st f.o.b.

In India, potash imports have surged, with 355,000 tonnes arriving by 20th August, marking a significant increase compared with last year. Demand, however, remains slow, and stock building at ports has seen inventories doubling to 142,000 tonnes in just two weeks.

In China, domestic potash prices have risen, despite weak demand and rising NPK stocks, with port prices averaging RMB3,240/t ($451/t) fca.

Bullish sulphur market. The Middle East sulphur spot price was assessed at $280-290/t f.o.b., up by $20/t in a week. The increase in regional pricing follows a rise in Asian demand, with firm offers currently at around $300/t cfr. While yet to be confirmed, the final award price for the latest QatarEnergy tender could be above $290/t f.o.b., according to sources.

China’s sulphur port prices also surged to RMB 2,520-2,540/t fca ($351-354/t), supported by demand from Indonesian tenders, relatively high phosphate operating rates and limited availability. This range indicates a delivery price of $301-304/t cfr.

Delivered prices into Indonesia were assessed up at $286-290/t cfr. The country’s January-June sulphur imports have increased by 74% year-on-year reaching 2.59 million tonnes. Seaborne sulphur export prices from Canada also rose to $265-275/t f.o.b. on Asian demand, although little activity was reported.

OUTLOOK

Urea price direction uncertain. Strong urea demand in India was expected to trigger price escalation. Market sentiment has, however, reversed recently on yet-to-be confirmed news that additional shipments from China to India are now to be allowed. A move by China to export to India could see Middle East and Russian prices take a downturn. Affordability is also exerting downside pressure with Brazil, Europe and US showing negative margins against current price levels.

Ammonia to climb into fourth quarter. Ammonia prices look set to rise through to the end of year, before finally easing heading into 2026. The tightening in supply west of Suez has seen prices gain further ground through July and triggered a $70/t hike in the August Tampa settlement. The start of exports from new capacity in the US Gulf could, however, see the market correct downwards. Similarly, the favouring of domestic production in northwest Europe could see import appetite – and therefore cfr values – retreat.

Phosphate near their ceiling. A price ceiling may now be in sight as buyer resistance to high prices grows across the globe. Still, some further upside is possible over the coming weeks, before third quarter declines set in as supply improves. Supply tightness is, however, likely to limit any price downside. Conversely, prices may trend lower if supply, particularly from China, is stronger than expected.

Potash prices poised to fall. After months of gains, global spot potash prices have been revised slightly lower, reflecting the seasonal slowdown following contract settlements in India and China. Weak underlying demand has prompted a more bearish outlook, with prices now forecast to decline over the next 12 months. Prices could drop more sharply than expected, if demand weakens further and/or crop price declines negatively affect affordability.

Sulphur declines moderate. Sulphur price declines are expected to be less steep than previously forecast, with recent activity in Asia supporting price levels for longer. In the short term, global sulphur prices are expected to stabilise before loosening, as buyers resist the price environment and muted demand continues in most regions until later in the third quarter. Middle East prices are projected to decline from August through November, followed by a modest recovery in December and January.