Sulphur 419 Jul-Aug 2025

16 July 2025

Market Outlook

Market Outlook

SULPHUR

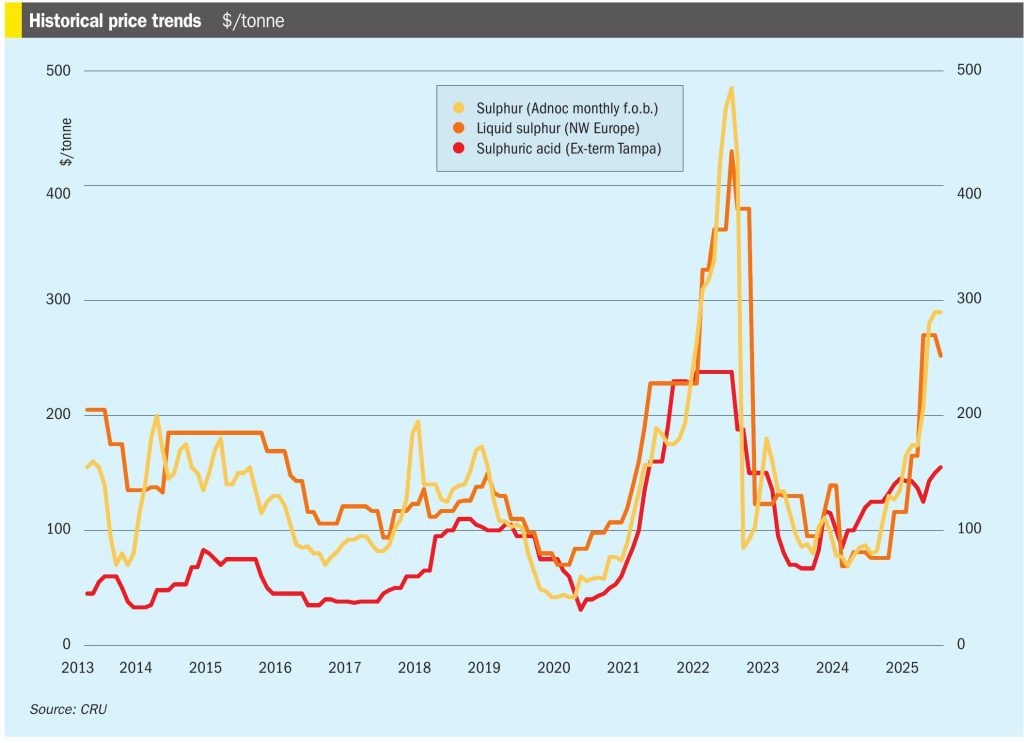

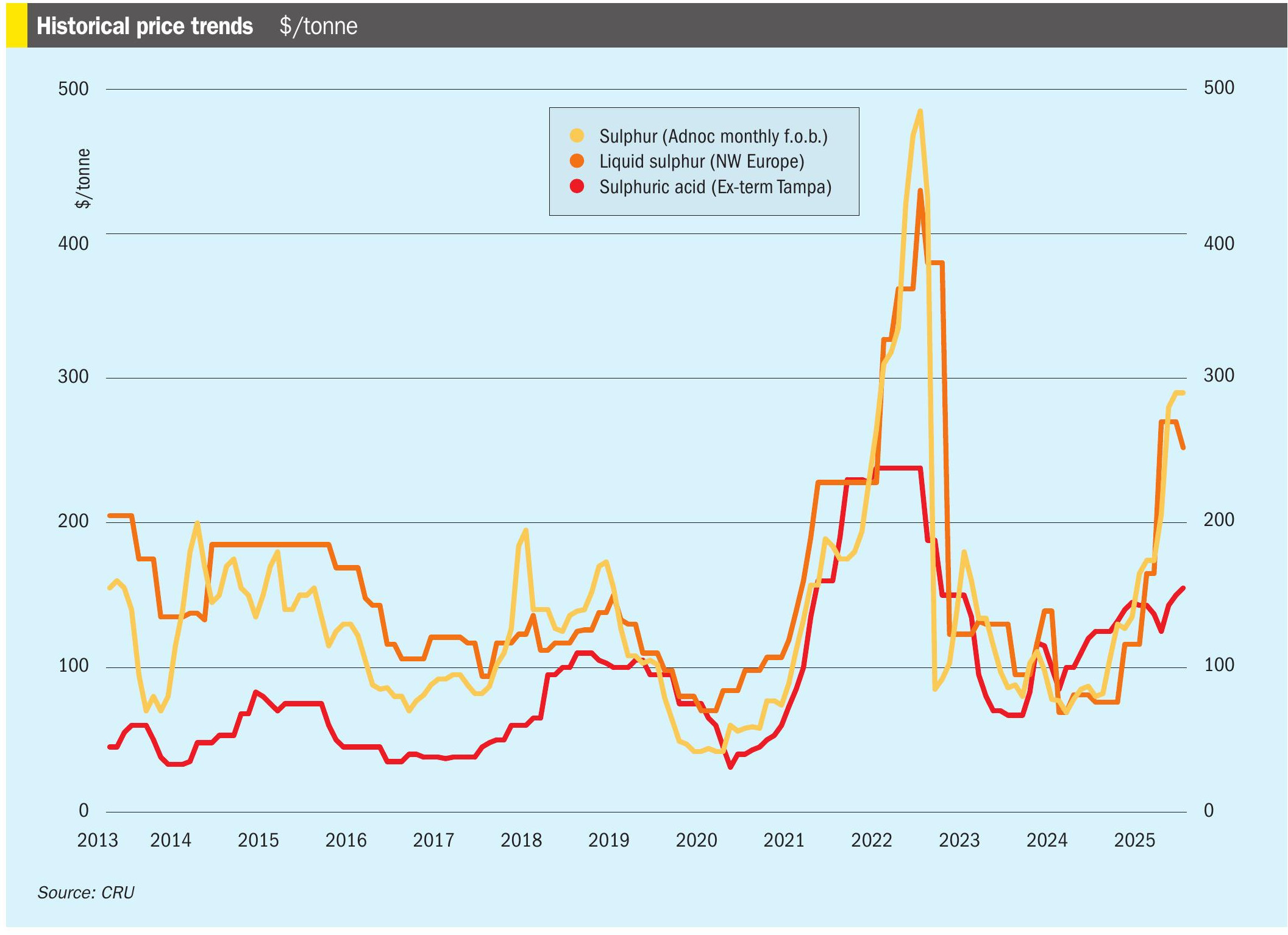

• Global sulphur prices are expected to experience decreases over the next few weeks. Buyers in Asia report that they are covered for contracted supply throughout July, and domestic prices in China are likely to decrease further, putting downward pressure on sulphur prices.

• Indian spot buying may only resume closer to August, targeting deliveries into September, when operational needs begin to align with tighter inventory cycles. Further corrections are anticipated as traders report minimal inquiries from Indian buyers, even as global sulphur prices continue to decrease.

• Early 2025 saw a short short-term mismatch of supply and demand which triggered the price surge. But this is expected to be short short-lived as inventory drawdown and demand seasonality are expected to cause the price to move lower in 2025 H2.

• However, over the past year and a half, demand growth in phosphates and market tightness has been masked by global stock drawdowns, but in the medium term the market deficit is expected to see price increases over the next year.

SULPHURIC ACID

• The global sulphuric acid market is expected to experience limited trading activity in the immediate term as availability tightens further. Still, global prices are likely to experience periods of stabilisation and slight increases in the coming weeks as demand sporadically enters the market to cover urgent requirements until availability improves further into Q3.

• Availability in Japan and South Korea remains tight, with producers currently quoting the earliest possible date to purchase material as September, according to industry sources.

• Key DAP/MAP spot price benchmarks have moved further upwards as a bullish tone continues to pervade the market due to tight availability. The lack of available spot cargoes means it remains very much a seller’s market despite exceptionally poor affordability.

• Growth in smelter and sulphur burner-based acid supply in Asia is expected to cut import requirements in the second half of 2025. Weaker traded demand will limit export opportunities from China.

• New demand in Chile and Peru will maintain the long-distance trade requirement in the Pacific, counteracting lower import demand in SE Asia.

• India’s Fertilisers and Chemicals Travancore Limited (FACT) issued a fresh tender for sulphuric acid import in early July, inviting bids for a cargo of 10,000-12,000 tonnes for delivery 25-30 July.

• Contracts for the supply of sulphuric acid in Europe for the third quarter of 2025 have registered increases in the range of €2-5/t, according to multiple market sources. This puts the 2025 Q3 contract prices at €160-188/t c.fr. up from the Q2 price which was €158-183/t c.fr. The price for Q1 was set at €155-180/t c.fr.