Nitrogen+Syngas 396 Jul-Aug 2025

15 July 2025

Market Outlook

Market Outlook

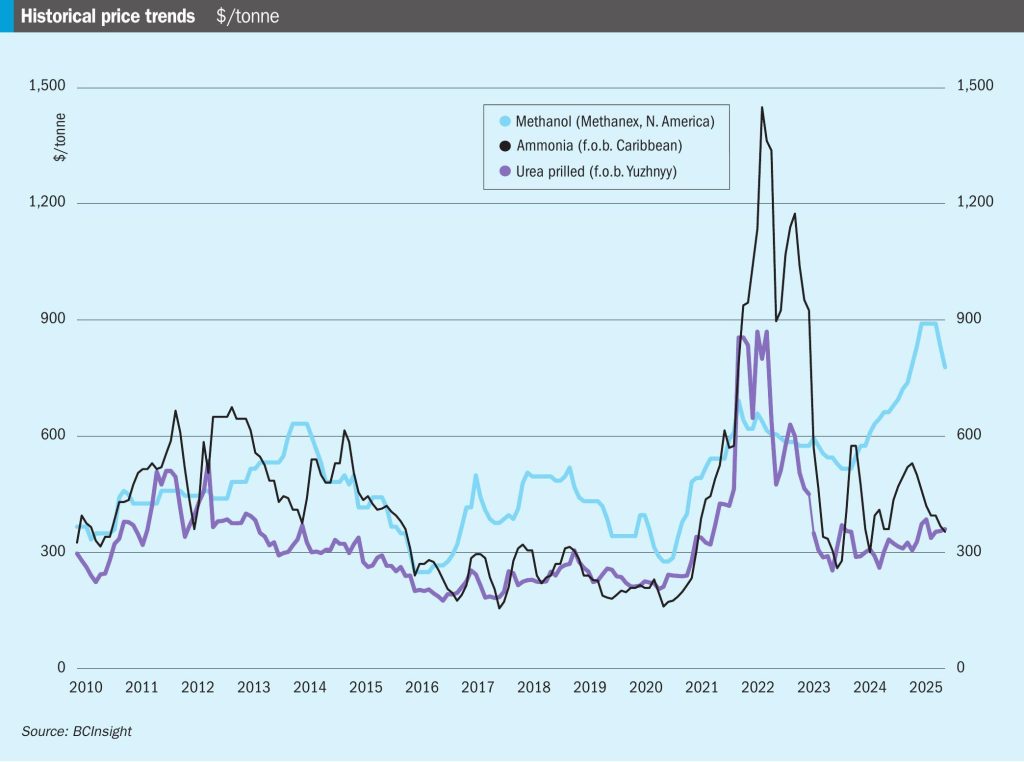

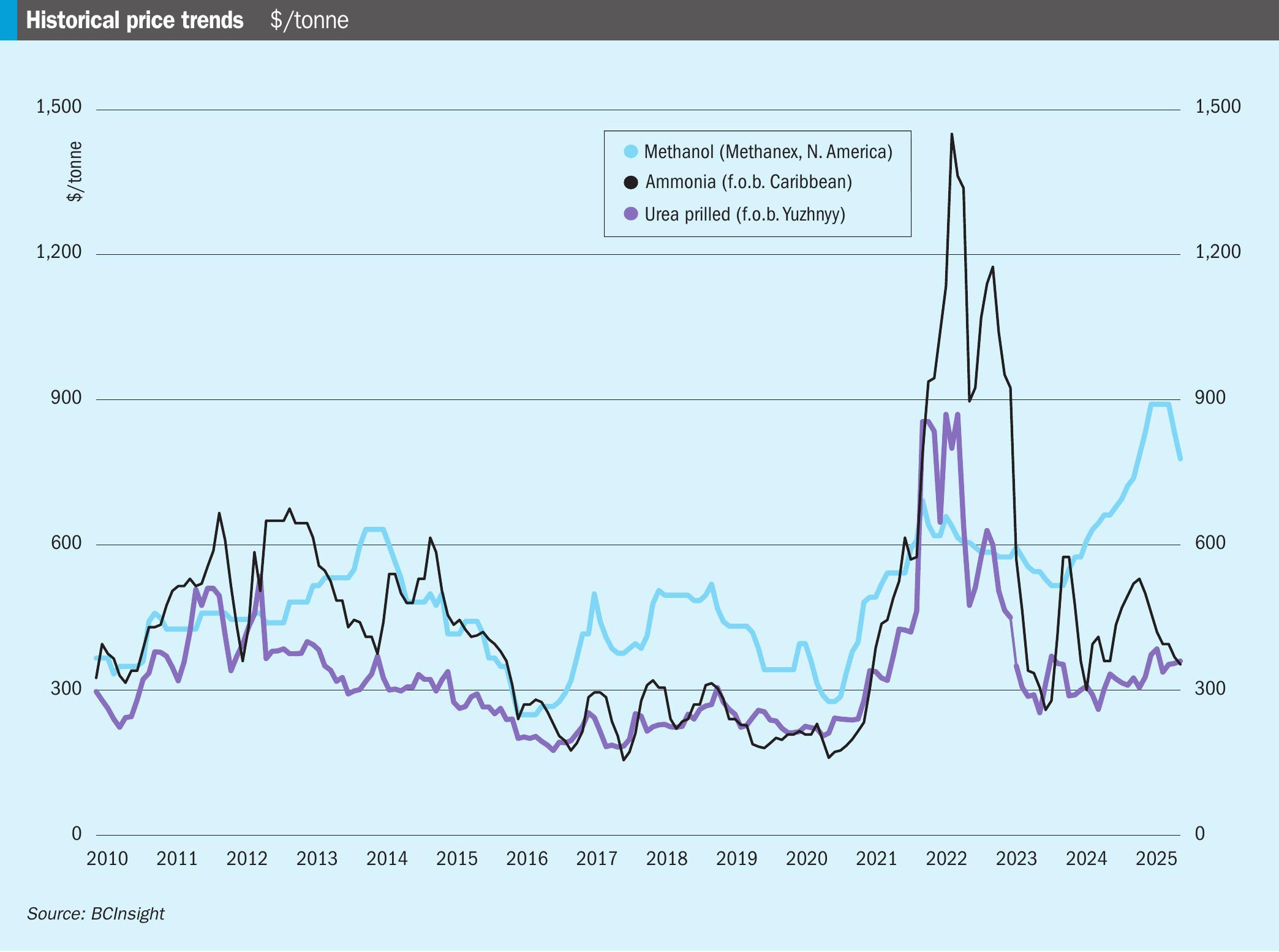

AMMONIA

• The short term outlook appears balanced for the most part, although more bullish participants seem to be holding sway over market sentiment.

• Imminent tariffs on imports of Russian fertilizers into the EU may trigger an uptick in downstream capacity utilisation across the continent.

• US gas storage has been higher than expected from slightly warmer weather – this has led to a slight reduction in prices over the summer.

• European premiums for lower carbon ammonia are likely to emerge from the start of 2026 due to the creeping implementation of the Carbon Border Adjustment Mechanism.

UREA

• The short term outlook for urea is firm, though there is the potential for disruption from a low tender for India.

• North African prices may correct as European interest fades.

• The ongoing strikes by Israel on Iran may herald a broader and more serious conflict in the Middle East with the potential to severely disrupt vital energy and fertilizer trade.

• The US introducing tariffs and then flip flopping on its implementation raise market uncertainty and curbed fertilizer imports.

• Clarity on Chinese urea exports emerged in early May via a ‘quota allocation’ system for urea exports, with a total of 2 million tonnes of exports allowed between May-Sept 2025. While exports to India remain banned, they are likely to find home in South Korea, Sri Lanka, Philippines, and Mexico, and many in the industry expect the market to ‘find a way’ to access India, with prices likely to fall until restrictions are reimposed in October.

• f.o.b. values of $370-375/t are proving competitive in west coast Latin America.

METHANOL

• China continues to dictate the overall global methanol market. Chinese thermal coal prices have fallen by 10% since January and supply remains healthy for now, with a weaker demand outlook.

• Crude oil prices have risen on market uncertainty and low inventories but additional OPEC+ production will limit the upside to prices.

• Chinese MTO demand sets the methanol price cap, with overcapacity in Chinese olefin markets contributing to headwinds in that direction, although it remains to be seen whether the current conflict between Israel and Iran will affect Iranian methanol shipments to China; Iran represents more than half of Chinese methanol imports.

• Shortages of new supply projects outside of China will likely lead to higher prices to drive reinvestment in the longer term.