Nitrogen+Syngas

10 February 2025

Round up day one CRU Nitrogen+Syngas ExpoConference

10th February, 2025 – sessions as reported by Richard Hands from Barcelona

CRU’s 38th Nitrogen+Syngas 2025 Expoconference has begun in Barcelona with three strands covering business development, technical innovations and practical operator training, the latter comprising case studies for analysing hazards associated with green ammonia production.

Heading up the business development session, Marti Leppälä, Secretary General of PensionsEurope, gave an investor’s eye view of the climate for investment in sustainable technologies. While acknowledging the uncertain climate, particularly as regards the new government in the USA, Marti argued that a “net zero ambition is no longer optional but increasingly mandatory, especially in Europe.” The US pension funds of course dominate the sector, with up to 65% of assets held, but even so, 35% of all global investments are into sustainable projects, and much more will need to be invested to reach 2050 targets. While Marti touched on the forest of EU regulations and reporting requirements, recent EU reports appear to belatedly acknowledge that the continent’s welfare model is unsustainable without increased competitiveness, and there is a new focus on innovation and digital transformation, and reducing some of the onerous green reporting commitments.

Key takeaways from the subsequent investment panel discussion, chaired by CRU’s Head of Fertilizers Chris Lawson, and including representatives from ING, Rabobank and Société Generale, as well as the Oxford Institute for Energy Studies and Germany’s Nitric Acid Climate Action Group, were:

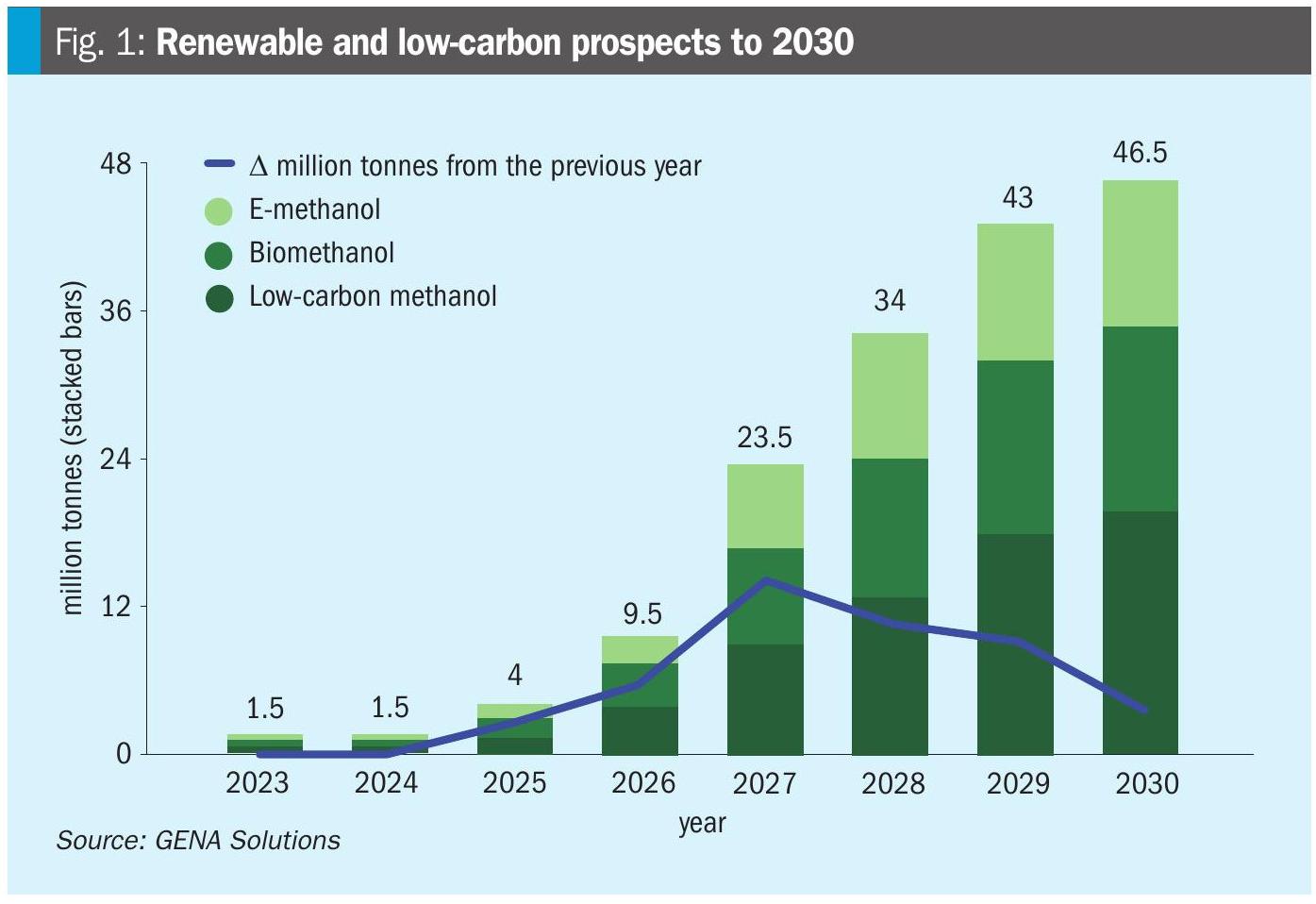

But where will this supply come from? An optimistic answer came from Bernd Haveresch, KBR’s Chief Technical Advisor for Business Development, Clean Ammonia and Hydrogen. Europe’s current ammonia capacity is around 20 million t/a, but demand for 2040 is forecast to be as high as 47 million t/a, with demand rising rapidly in the 2030s for clean ammonia and hydrogen to feed energy and industrial sectors, and towards the end of that period strong demand as a bunker fuel, representing perhaps 50% of maritime consumption by that time. Current low carbon ammonia projects worldwide that have reached a final investment decision total perhaps only 5 million t/a, leading to a gap of up to 20 million t/a, perhaps more if more grey ammonia capacity closes in Europe. KBR puts production cost at anything from $440/t for blue ammonia in the US ($330/t with IRA incentives) to $670/t for blue ammonia in Europe and $700/t for green ammonia in Chile. The recent announcement by H2Global and Fertiglobe for delivered low carbon ammonia from Egypt to Rotterdam at $1,000/t leaves plenty of headroom for investors.

The main conference programme began on Monday afternoon with the commercial sessions, introduced by Lisa Connock, Nitrogen+Syngas magazine’s Publisher, who remarked that it had been a year now since the magazines were brought back into the CRU fold, and showcasing their new website.

Nina Fahy of Rabobank noted that investment into clean energy projects had dipped in 2024, presumably due to political uncertainty. Nevertheless, the US IRA has generated $00 billion of new spending in the US on green projects. Going forward, she said, there needs to be a balance of risks between producers and consumers, which may require a role for government.

Charlie Stephen, CRU senior analyst for fertilizer costs and emissions, presented the nitrogen market outlook. The EU has pivoted from Russian gas to LNG, a move made easier by large new incremental supplies from the US. High gas prices and falling ammonia prices will make 2025 a difficult year for European producers, who may have to switch to ammonia imports, but gas prices will ease over the decade as more LNG comes onstream, and European producers may be assisted by new tariffs on Russian fertilizers, especially after 2028-29 when they may push Russian product out of the market.

There was much discussion of the EU Carbon Border Adjustment Mechanism, including a paper on its economics by Halima Abu Ali of CRU. January 1st 2026 is the first time that EU importers will have to pay a capped carbon price of around $50/t ammonia (on an average grey ammonia energy basis), but this will rise to as high as $350/tonne of ammonia by 2034. By 2029, it should have reached a break even point where EU low carbon producers will be advantaged, especially for downstream nitrate production, which has better margins than urea.

Nevertheless, CRU’s Chris Lawson and Charlie Stephen gave delegates “a dose of realism” on the market potential for low carbon ammonia and hydrogen. Carbon capture and storage requires a carbon price of $150/t to incentivise in Europe, ranging up to $400/t for ammonia as a transportation fuel and $500 to make green hydrogen gas grid injection worthwhile. Enabling policy frameworks are at risk due to the new US administration, and possible opt-outs and delays for the CBAM. Policies to support the development of market demand will be required. Nevertheless, if we are now in the ‘trough’ of the Gartner ‘hype cycle’, at least that means that the only way is up.