Sulphur 415 Nov-Dec 2024

30 November 2024

The merchant market for sulphuric acid

SULPHURIC ACID

The merchant market for sulphuric acid

Short term supply constraints are dominating acid markets at present, but increasing smelter production across Asia may lead to oversupply in the longer term.

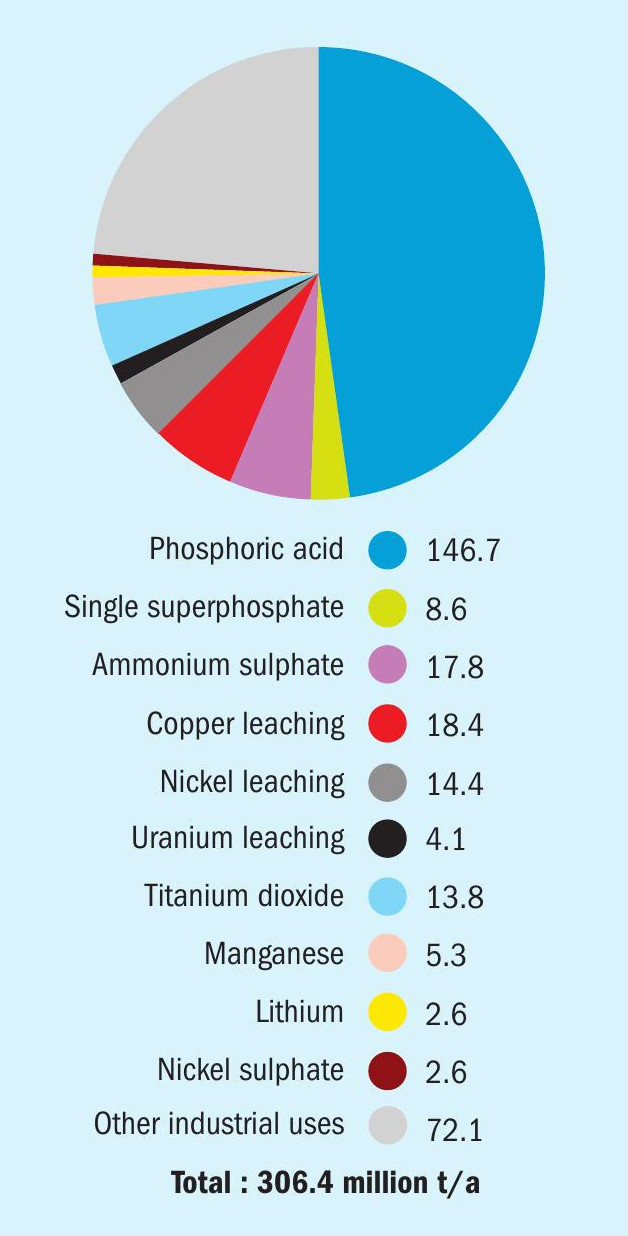

The merchant market for sulphuric acid remains a relatively small slice of the overall acid market. In 2024 it is estimated to be 22.3 million t/a out of a total acid consumption of 306 million t/a. As Figure 1 shows, fertilizer production remains the largest consumer of sulphuric acid globally, driven by phosphoric acid’s use in phosphate fertilizers. Morocco, China, and India are key players, with Morocco’s OCP (Office Cherifien des Phosphates) investing heavily in sulphuric acid production to support its phosphate industry. A recovery in global phosphate demand has accelerated sulphuric acid consumption, a trend expected to continue as agricultural demands for fertilizer intensify worldwide.

Batteries and metal processing

Demand for sulphuric acid is expanding in the battery and metal processing sectors, especially in the production of battery materials such as nickel and lithium, essential for electric vehicles (EVs) and energy storage. Indonesia, for example, is experiencing a surge in demand for sulphuric acid, supporting its nickel leaching projects. Additionally, increasing production of lithium-ion batteries across Asia, particularly in China, is bolstering sulphuric acid demand.

Industrial applications

Beyond fertilizers and batteries, sulphuric acid serves in various industrial applications, including petroleum refining and chemical synthesis. Industrial sectors in Asia, especially in China and India, are rapidly growing, thereby supporting consistent sulphuric acid demand over the coming years.

Supply dynamics

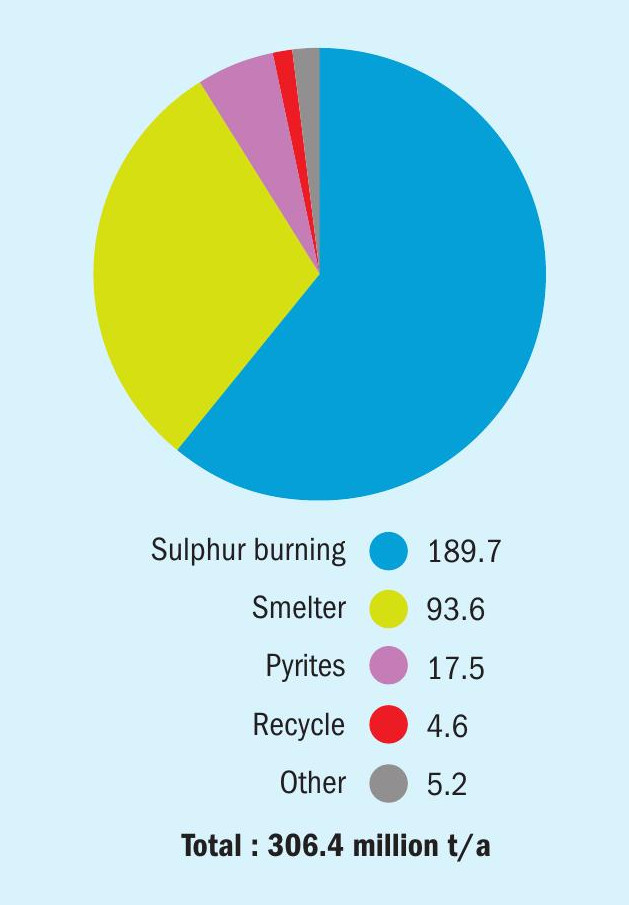

Figure 2 shows sulphuric acid supply by source. In spite of some residual pyrite roasting, mostly in China, the supply of sulphuric acid is essentially influenced by the availability of smelter by-product acid and output from sulphur-burning facilities. Smelter acid production has been constrained this year by the availability of copper concentrates, but acid from sulphur burning supplements the demand shortfall. Notable supply developments include:

Growth in smelter capacity

New smelter projects in Asia, primarily in China and Indonesia, are expected to significantly impact global supply. India’s Adani Mundra smelting plant and Indonesia’s Freeport smelting project in Gresik, expected to operate at full capacity by late 2024, will increase regional supply and reduce import dependence. While these expansions bring more supply, a key constraint remains copper concentrate availability. There is a projected copper concentrate deficit through 2025, which may limit sulphuric acid production from smelters.

Sulphur-burning capacity

Sulphur-burnt acid production, particularly in Morocco and China, is set to rise to meet fertilizer sector demands. Sulphur-burning facilities offer a reliable, though more costly, production method compared to smelter by-product acid. Morocco’s OCP complex at Jorf Lasfar, for example, is increasing its sulphur-burning capacity by 1.8 million t/a. As sulphur-burnt acid costs remain high, its competitive position is challenged when compared to the more economical smelter by-product acid, especially in regions with higher transportation costs, such as Europe and Brazil. However, the market is seeing increased supply integration with sulphur burning acid production being built at consuming sites in order to gain control over supply and costs. This is leading to a contraction in the merchant market overall and may contribute to lower prices next year.

Recycling and other sources

Recycling and pyrites provide minor contributions to the global sulphuric acid supply. However, pyrites-based output, particularly in China, is anticipated to decline, partly due to environmental restrictions. Recycling is a stable but limited supply source, with its impact concentrated in highly industrialised regions.

Regional market dynamics

Each region contributes uniquely to global demand and supply dynamics, with regional trends highlighting differences in sulphuric acid production methods, trade balances, and sector-specific demands:

Asia

China, the largest consumer and producer of sulphuric acid, is shifting towards meeting domestic demand with increased smelter acid production while reducing export volumes. With exporters changing to mostly smelter-based acid, this may limit China’s ability to react to changing acid prices.

There is an oversupply risk in Asia by 2025 as regional projects ramp up, with India and Indonesia also becoming significant producers. Indonesia’s sulphuric acid demand is closely tied to its nickel projects, which are essential for EV battery manufacturing. The country’s HPAL projects, like PT Lygend, are projected to add 11.4 million t/a of sulphuric acid production by 2028. China is forecast to add 3.7 million t/a of sulphur burning acid production over the same period, and increases in domestic operating rates may add another 3 million t/a of effective supply.

Europe

Europe’s sulphuric acid market has been relatively tight due to lower output from domestic smelters. Demand is stable, primarily for industrial and agricultural uses, while prices are high compared to Asian benchmarks due to transport costs. European supply challenges are compounded by smelter maintenance and limited expansion plans. Nevertheless, a recovery in smelter supply is expected to boost supply to 21 million t/a by 2027. Export volumes will decline slightly, from 3.2 million t/a to 2.7 million t/a by 2028.

Americas

North and South America exhibit slower demand growth. US sulphuric acid consumption remains stable, with modest growth tied to fertilizer and industrial use. By 2025, supply growth is anticipated due to the Southern States Chemical sulphur burner in Georgia and expanded production at Rio Tinto’s Garfield smelter.

Brazil and Chile are notable in South America. Chilean demand has been impacted by mine closures and reduced copper-based consumption, though a rebound is expected in 2025 as mining activity resumes. Brazil’s market outlook is mixed, with some growth in fertilizer production but slower industrial demand.

Africa

Morocco’s sulphuric acid demand is closely linked to OCP’s phosphate production expansion. Phosphate demand growth drives Morocco’s sulphuric acid consumption, making it a key market in Africa. Morocco’s imports surged in early 2024 as its domestic sulphur-burning facilities were expanded. There will be increased domestic production by 2025, potentially reducing the need for imports.

Australia

Australia faces unique supply challenges, with the closure of BHP’s Nickel West smelter at Kalgoorlie in 2024 significantly reducing sulphuric acid availability. This loss is expected to turn Australia into a net importer of sulphuric acid, with imports rising as regional sources are sought to meet industrial demand, especially for nickel processing.

Pricing trends and trade dynamics

Sulphuric acid prices reached higher levels in 2024, their highest levels for two years, influenced by supply tightness and increased transportation costs. Benchmark prices for sulphuric acid in regions such as Brazil, the U.S., and Europe have risen, with Brazilian prices climbing from $125/tonne in April to $149/tonne by August.

Freight costs have kept European prices at a premium relative to Asian f.o.b. markets. Despite increased freight costs in the Pacific, the Atlantic market maintains higher premiums due to tighter supply. However, a gradual price correction is expected, beginning in late 2024 or early 2025 as supply pressures ease. Increased smelter production capacity in Asia, specifically in India and Indonesia, is expected to contribute to market oversupply. By 2028, prices are likely to align more closely with sulphur-burnt acid production costs, leading to a balanced supply-demand dynamic.

China’s role as a sulphuric acid exporter is diminishing as domestic demand grows and export volumes are reduced. Meanwhile, India and Indonesia are increasing their exports, with the new smelting capacity targeting both domestic and international markets.

A reduction in annual import requirements is expected in Morocco in 2025, but major importers in India, Chile, SE Asia and the USA are all expected to maintain a stable import demand. A change in the structure of Chinese acid exporters, from predominantly sulphur-burnt acid to predominantly smelter acid, has shifted the market’s ability to respond to import demand weakness. Although moderated from recent highs, freight rates will continue to maintain larger (than historically typical) price gaps between South American delivered markets and East Asian origins into 2024/25.

Outlook

The sulphuric acid market outlook to 2028 presents both growth opportunities and risks:

- Oversupply: The expected growth in Asian smelter capacity may push the market toward oversupply by 2025. This would lead to increased competition among producers, especially those reliant on sulphur-burnt acid production, which is costlier than smelter by-product acid.

- Copper concentrate shortages: The availability of copper concentrates is a major concern. A deficit in copper concentrates is expected to limit smelter acid production, particularly in China, which could constrain supply and sustain price premiums in some regions.

- Sulphur price volatility: The cost of sulphur, the primary input for sulphur-burning acid, is projected to increase, adding to production costs. This volatility could affect pricing strategies, particularly for producers in regions heavily reliant on sulphur-burning processes.

- Regulatory and environmental factors: Environmental regulations, especially in Europe and China, may limit sulphuric acid production from pyrites and smelters, potentially constraining supply in regions with stringent environmental policies. Recycling initiatives may expand but are not expected to meet the total demand requirements.

- Battery metal demand: Growing demand for battery metals such as nickel and lithium will likely absorb some of the excess sulphuric acid production.