Sulphur 401 Jul-Aug 2022

31 July 2022

Sulphuric Acid News Roundup

CHILE

Strike at Codelco briefly halts copper production

At the end of June a three day strike among workers at Chilean state mining company Codelco paralysed copper output at the world’s largest copper producer. The strike was in protest at the threatened closure of the Ventanas smelter, which was the site of an alleged leak of sulphur dioxide on June 6th. Chile’s environmental regulator subsequently provisional measures for both Codelco and power company AES Chile after numerous people in the nearby towns of Quintero and Puchuncavi in central Chile, including hundreds of high school students and staff, showed signs of sulphur dioxide poisoning. The measures include the installation of a new temperature sensor to measure potential thermal inversions. Both companies have denied responsibility for the leak; Codelco says that its air quality stations recorded normal levels of SO2 during the time of the incident.

President Gabriel Boric said that Ventanas had become “an embarrassment” and the board of state-owned Codelco ordered the smelter shut down after the incident and said that it would move towards permanent closure of operations at the site. Ventanas has had a troubled history, with numerous SO2 leaks over the course of several years, including on in August 2021. The Quintero-Puchuncaví Bay, 160 km northwest of Santiago on the Chilean coast, is home to numerous industrial facilities including oil and chemical plants, and has been described by environmental activists as an “environmental sacrifice zone”. However, in response to the announcement Codelco workers belonging to the Federation of Copper Workers Union began a strike at Ventanas and six copper mining facilities, describing the closure as “arbitrary” and blocking access to the sites by setting fire to tires, demanding that the government makes the required investment to bring the smelter up to higher environmental standards. Codelco moved to an agreement with the union to invest the required $54 million to reduce SO2 emissions at the site after the government agreed to reinvest 30% of the company’s profits from 2021-2024 back into its projects, with an aim to reduce borrowing requirements, freeing up cash.

Chile produces 8% of the world’s copper, which represents up to 15% of GDP. The National Mining Company (Enami) has proposed building a new $1 billion smelter at Paipote in the Atacama region to replace output at Ventanas.

DEMOCRATIC REPUBLIC OF CONGO

Earthworks construction begins at Kamoa copper smelter

Ivanhoe Mines says that construction of earthworks has begun at the site of its new 500,000 t/a direct-to-blister flash smelter at the Kamoa-Kakula copper mining complex. The smelter will be large enough to process most of the copper concentrate forecast to be produced by Kamoa-Kakula’s Phase 1, Phase 2 and Phase 3 concentrators, and will be built adjacent to the Phase 1 and 2 concentrator plants using technology supplied by Metso Outotec. In late 2021, Kamoa Copper awarded engineering company China Nerin Engineering the basic engineering contract for the planned smelter.

Once in operation, the smelter is expected to enable Kamoa-Kakula to reduce its cash costs per pound of copper produced by about 10% to 20%, due to significantly reduced transportation costs, as well as more favourable tax treatment, and the recovery and sale of sulphuric acid as a by-product revenue stream. There is strong demand for sulphuric acid in the DRC for copper leaching operations and copper mines in the region currently import significant volumes of sulphur used in sulphur-burning acid plants to produce sulphuric acid for the treatment of oxide copper ores. The DRC also imports sulphuric acid, primarily from Zambia.

The Phase 3 expansion of Kamoa-Kakula will make the mine the third largest copper producer globally, increasing yearly copper production capacity to about 600,000 t/a by 4Q 2024. Phase 3 will consist of two new underground mines known as Kamoa 1 and Kamoa 2, as well as the initial development at Kakula West. A new 5 million t/a concentrator plant will be established adjacent to the two new mines at Kamoa, taking total processing capacity to more than 14 million t/a. Going forward, the existing Phase 1 and 2 concentrators will be debottlenecked and operate at a combined throughput of 9.2 million t/a by 2Q 2023, which is expected to increase Kamoa-Kakula’s copper production to more than 450,000 t/a.

Kakula is projected to be the world’s highest grade major copper mine, with an initial mining rate of 3.8 million t/a at an estimated average feed grade of more than 6.0% copper over the first five years of operations, and 5.9% copper over the initial 10 years of operations. The Kamoa-Kakula Copper Project is a joint venture between Ivanhoe Mines (39.6%), Zijin Mining Group (39.6%), Crystal River Global Limited (0.8%) and the Government of the Democratic Republic of Congo (20%).

INDIA

Vedanta to sell Tuticorin smelter

Vedanta Ltd has put its 400,000 t/a Sterlite Copper smelter and refining complex at Tuticorin up for sale. The site includes the primary and secondary smelter complex, sulphuric acid plant, copper refinery, continuous copper rod plant, phosphoric acid plant, effluent treatment plant, 160 MW captive power plant, reverse osmosis units, oxygen generation unit and a residential complex with amenities. However, the request for expressions of interest comes while the company is still bogged down in a legal case in the Indian Supreme Court over the Madras High Court’s decision to order the closure of the site for environmental violations, even though this was subsequently overturned by an environmental tribunal. The smelter has been closed since 2018 as legal cases progress through various courts.

Prior to its closure, the Sterlite smelter produced around 40% of India’s copper requirements. Parent company Vedanta has also proposed setting up a 500,000 t/a copper smelter in a coastal location to help meet India’s growing demand for copper.

AFRICA

Outotec to deliver electrowinning technology

Metso Outotec says that it has been awarded a contract for the delivery of advanced electrowinning equipment to a copper cathode production plant at an unspecified location in Africa. The value of the contract was put at e11 million. Metso Outotec’s scope of delivery includes the supply of basic engineering and equipment for the copper electrowinning plant expansion.

UNITED STATES

Process to sequester CO2 while producing sulphuric acid

Travertine Technologies, a new technology start-up based on research from the University of California at Berkeley, says that it has received $3 million in seed financing from the Grantham Environmental Trust and Clean Energy Ventures to enable the company to commercialise its novel process to capture and permanently sequester ambient carbon dioxide while producing sulphuric acid. The company says that the financing will allow it to scale up its team in Colorado and accelerate its pathway to pilot-scale technology implementation in 2023.

Travertine’s electrochemical process processes waste sulphates such as phosphogypsum, a by-product of phosphate production, and mineralises CO2 from the air as a carbonate precipitate while co-producing sulphuric acid, as well as ‘green’ hydrogen with potential use in renewable energy and oxygen. The carbonate permanently stores carbon in the solid phase, according to the company. For every tonne of sulphuric acid produced, around 500 kg of CO2 is saved and sequestered.

Ground broken on secondary smelter

German-based Aurubis AG has broken ground on the United States’ first large secondary smelter for multi-metal recycling at Augusta, Georgia. Total investment is estimated at $320 million, and the plant is expected to be fully operational by mid2024. Once fully on-line, Aurubis Richmond will have the capacity to process about 90,000 t/a of complex recycling materials including printed circuit boards, copper cables, and other materials containing metals.

“We have doubled down on our commitments to use our technology and experience to become a forerunner for recycling valuable materials containing copper, nickel, tin, and other industrial and precious metals locally in the US,” said Roland Harings, CEO of Aurubis AG. “The US currently produces about 6 million tons of recycling materials that contain valuable metals. We want to take advantage of this great potential and help ensure that these materials get reused. They are critical input materials for many industries in the US”, said Roland Harings.

Itafos begins production of hydrofluorosilicic acid at Conda

Itafos says that it has begun production and sales of hydrofluorosilicic acid (HFSA) at its Conda site in Idaho. The company says that extraction and commercialization of HFSA is an organic growth opportunity to monetise the fluoride contained in Conda’s ore. Conda has capacity of approximately 550,000 t/a of monoammonium phosphate (MAP), superphosphoric acid, merchant grade phosphoric acid and ammonium polyphosphate. The site’s existing phosphoric acid evaporation process was modified so as to have the capacity to extract up to 30,000 st/a of HFSA as part of Conda’s scheduled plant turnaround during 2022. Following completion of the modifications and turnaround, Conda returned to full production capacity and began production of HFSA. Conda has also completed its first commercial delivery of the new product under a long-term offtake agreement.

“We are pleased to have safely and successfully completed our HFSA plant at Conda and look forward to supplying the North American market for many years to come. Our team did an incredible job to bring this initiative from concept to production in 18 months,” said G. David Delaney, CEO of Itafos.

Elessent increases catalyst prices

Elessent Clean Technologies has announced an additional global price increase of $0.60/litre for its MECS® sulphuric acid catalyst products, effective immediately. Thecompany says that additional surcharges may apply for freight, near term delivery and specialty product grades.

JORDAN

JPMC signs offtake agreement with Coromandel Fertiliser

Jordan Phosphate Mines Company (JPMC) has signed an agreement to supply India’s Coromandel Fertiliser Company with 100,000 tonnes of phosphoric acid up to the end of December. The agreement was signed in the UAE by JPMC CEO Abdulwahab Rawad and Coromandel’s managing director in the presence of JPMC Chairman Muhammad Thnaibat. Thnaibat said that the agreement added to JPMC’s record of agreements with a number of international companies, enhancing its competitiveness and global presence. He added that the agreement also lays the groundwork for a long-term partnership with Coromandel by supplying it with phosphoric acid produced by the Indo-Jordan Chemicals Company, which is fully owned by the JPMC. JPMC will also sign an agreement with Coromandel to supply it with Jordanian raw phosphate and DAP fertilizer until the fourth quarter of 2022 and in 2023.

JPMC has also signed a memorandum of understanding with the Munir Sukhtian Trading Group to establish a purified phosphoric acid plant at the port city of Aqaba, to produce 20,000 t/a of technical grade acid for the food industry. JMPC’s Chairman, Mohammad Thneibat, said that the ageement would have a “positive and significant” impact on Jordan’s food industry sector.

FINLAND

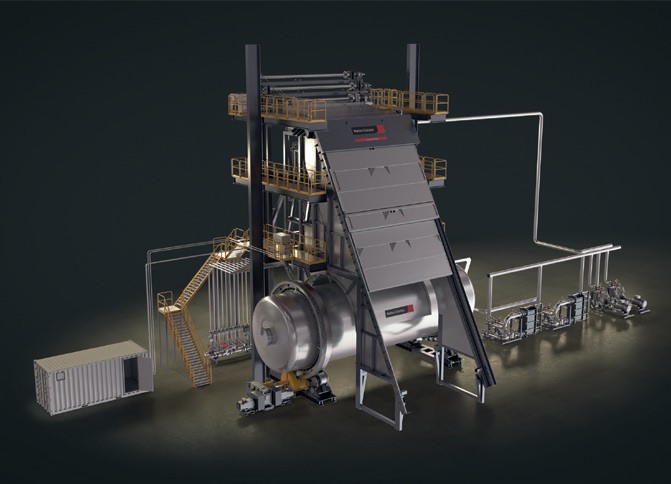

Modular converter hood for gas capture in smelting plants

Metso Outotec has launched a modular converter hood system for horizontal converter vessels used in the smelting process. The new system, which is suitable for both greenfield and brownfield installations, has a sulphur dioxide capability of 99%, minimising the environmental impact of the smelter. The company says that the modular design enables quick on-site assembly, minimising plant downtime. It also offers improved safety in the converter aisle; controlled ingress air flow for improved process gas quality; prolonged equipment lifetime due to the advanced water-cooling system; reliable operation with low maintenance needs; and expert service and support during commissioning as well as training for operators and management.

AUSTRALIA

Contract awarded for rare earths project

Australian Strategic Materials Ltd (ASM) has awarded Hyundai Engineering the contract to provide engineering, procurement and construction definition work for the Dubbo mining and processing project. Dubbo is a potential long-term resource of rare earths, zirconium, niobium, and hafnium located in New South Wales. At full capacity, the Dubbo plant will be capable of processing 1 million t/a of crushed ore via sulphuric acid leach and solvent extraction recovery. Mining will take place in a single open pit, then transported to the processing facility. Sulphuric acid used for leaching will be produced on-site using a sulphur burning acid plant that also generates electricity and steam for the process plant. A small amount of waste rock will be extracted and transported to a small waste rock emplacement (WRE) to the southwest of the open cut. The liquid and solid residues from the processing plant will be transported and stored in liquid residue storage facilities, solid residue storage facilities and salt encapsulation cells.

The contract includes a capital cost estimate), an operating cost estimate, a detailed project schedule, major project plans, and early-stage engineering documentation. Completion will allow Hyundai to produce an open book cost estimate for the project which will form the basis of an EPC offer to deliver the Dubbo project. Completion time is 14 months.

SOUTH AFRICA

Rare earths extraction from phosphoric acid production

Rainbow Rare Earths says that it has entered into a memorandum of understanding with an unspecified chemicals group based in South Africa to investigate the opportunity of extracting rare earth elements from a nitrophosphate process stream at its phosphoric acid production plant near Johannesburg. Under the terms of the MoU, Rainbow will conduct a rare earths extraction pilot study with the group, which will involve initial grade test work on processing stream material. This will be followed by a technical programme to confirm a flowsheet using Rainbow’s knowledge and intellectual property gained from work carried out to date at the company’s Phalaborwa Rare Earths Project in South Africa, including the licenced K-Technologies, Inc. separation technology.

The feedstock for the phosphoric acid plant originates from the same ore originally mined by Foskor that generated the two gypsum stacks at Phalaborwa. Rainbow says it has already completed preliminary sampling of the processing stream, with initial results indicating a total rare earth oxide grade of 0.81%, with a 27% weighting to high-value neodymium and praseodymium, alongside economic levels of terbium and dysprosium, similar to Phalaborwa. Direct costs associated with the pilot study conducted by Rainbow using its exclusive IP and technology will be financed by the chemicals group. Subject to a successful outcome, the parties intend to negotiate terms for a potential joint venture agreement to extract value from the rare earths present in the phosphoric acid processing stream.

Rainbow Rare Earths CEO, George Bennett, commented: “This project allows us to partner with a global chemicals business and demonstrates the significance and broader application of our IP and technology at another project in South Africa. This is a very exciting opportunity for Rainbow to release additional value from a nitro phosphate processing stream by efficiently producing separated rare earths, which are currently untapped within the phosphoric acid production process. As at our Phalaborwa Project, the rare earths in this stream are contained within an acid solution in a ‘cracked form’, which will allow us to apply the rare earths separation technology, thereby facilitating a simple process with significantly fewer extraction and separation steps than a traditional rare earth mining project. Through our processing projects, which have fundamentally different risk profiles to traditional rare earth mining projects, we see enormous potential to facilitate near-term access to sources of critical permanent magnet rare earths, which are required to decarbonise energy systems in an environmentally responsible way.”