Sulphur 397 Nov-Dec 2021

30 November 2021

Price Trends

MARKET INSIGHT

Meena Chauhan, Head of Sulphur and Sulphuric Acid Research, Argus Media, assesses price trends and the market outlook for sulphur.

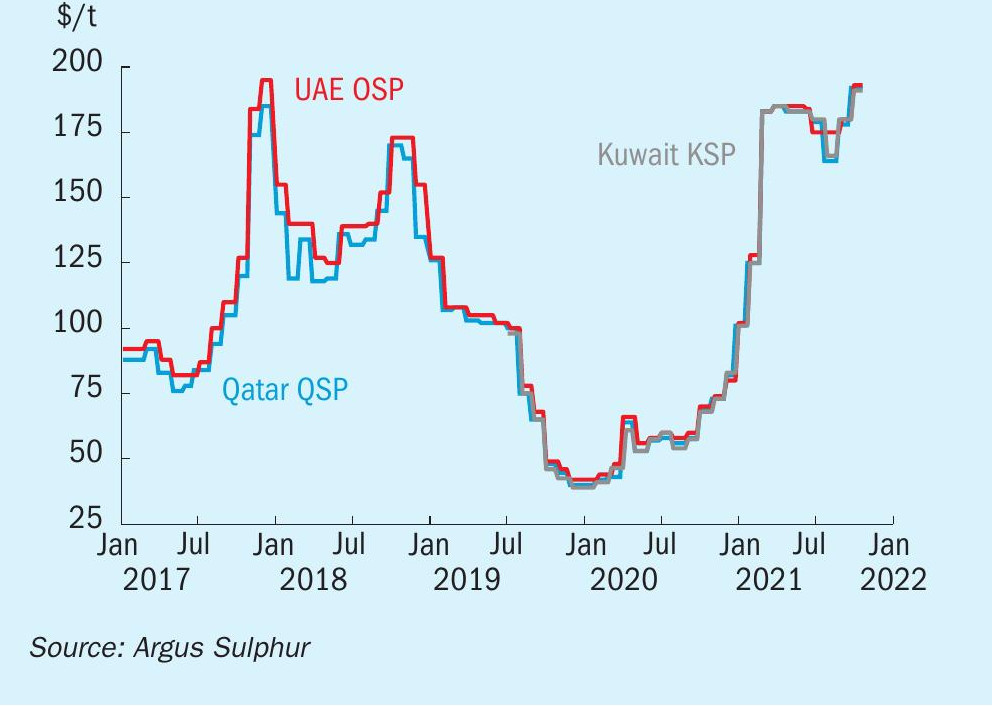

SULPHUR

The more stable and slightly softer tone to the global sulphur market has given way to firmness. There has been considerable uncertainty in the market in recent months, with new capacity yet to come online in the Middle East and restrictions on Chinese processed phosphates exports lacking clarity. DAP prices have rallied through October meanwhile, providing strong support to sulphur markets and pricing. The Middle East sulphur benchmark breached the $200/t f.o.b. mark in October and was assessed by Argus at $223-230/t f.o.b. on 28th October, with the expectation of further firming in the short term.

Restrictions on Chinese exports had been expected, with discussions taking place in recent months. Exports of phosphates, largely DAP and MAP, will be restricted as producers have made agreements with China’s top economic planning agency the NDRC to curb exports. Some Chinese port authorities halted fresh deliveries and since 15th October fertilizer export inspections also commenced. The restrictions are expected to remain in place until June 2022. This has led to supply concerns in the DAP market and the short term market balance moving to deficit or tighter in the forecast.

Port inventories in China continued to fall in October before steadying at around 1.51.6 million tonnes. The likelihood of stocks being replenished was limited until import prices see a correction. Domestic prices for sulphur in the country softened through October. The government is enforcing restrictions on energy consumption and energy intensity across a range of industries in a drive to curb emissions. The move comes on the back of China’s pledge to achieve carbon neutrality by 2060 and puts in question the expected increase in oil-based sulphur production in the second half of 2021. In the longer term, increased integration and forecast expansions in the Chinese refining sector means China’s reliance on sulphur imports is expected to decline. But the clamp down on energy use and focus on emissions reductions may impact the rise of new capacity and production.

Middle East producers increased official selling prices into the low $190s/t f.o.b. at the start of October, up by around $11-14/t on September. The increases at the time reflected strong buying activity from China and India with product availability deemed to be stable. Strong demand has been driving the tightness and led to spot prices firming beyond posted prices at the start of the month. 4Q contracts for Middle East supply concluded at $180/t f.o.b., with higher volume buyers in north Africa securing slightly lower settlements at $175-180/t f.o.b.

Opec+ continues to ease its crude production restraints in line with its previously agreed plan. The group confirmed at the start of October that it will stick to the planned increase of 400,000 bbl/d in November. Meanwhile, crude prices have continued to rise, despite the increase in output because of strong oil product demand. Increased travel on the back of continued Covid-19 restrictions being relaxed has contributed to this uptick.

Long delayed new sulphur capacity in the Middle East has yet to emerge but appears to be more promising for 2022. Kuwait’s new 615,000 bbl/d Al Zour refinery entered into the commissioning stage. The first of three trains is expected to begin operations in February with the remaining two operational during the second half of 2022. Sulphur capacity at the refinery is 600,000 t/a. Meanwhile the Clean Fuels Project was reported as being operational.

Over in Brazil, sulphur prices were assessed at $245-246/t c.fr at the end of October, firming by over $100/t since the start of 2021. The phosphate market is heavily reliant on imports and supply concerns emerged following the news of Chinese export restrictions. Sulphur demand from domestic phosphate producers is expected to be strong to meet production rates.

In India, sulphur prices have also been rising as demand from phosphate producers remains strong while the country struggles with high DAP import process. Further support to the sulphur market is expected as the government is encouraging replenishment of sulphur stocks to supply increased domestic fertilizer production in the aftermath of the Chinese export clampdown. Highers prices in India continue to support the outlook for Middle East netbacks. Indian prices were assessed at $277/t c.fr on average at the end of October. Delhi has approved a new fertilizer subsidy boost, offering temporary comfort to some trading companies. DAP import prices have rallied to levels far above the breakeven point of the DAP subsidy set back in mid-May. But with DAP prices expected to continue to climb in the weeks ahead, it is unlikely to provide relief for long. Domestic producers will continue to achieve the most favourable DAP margins, which will continue to support sulphur demand.

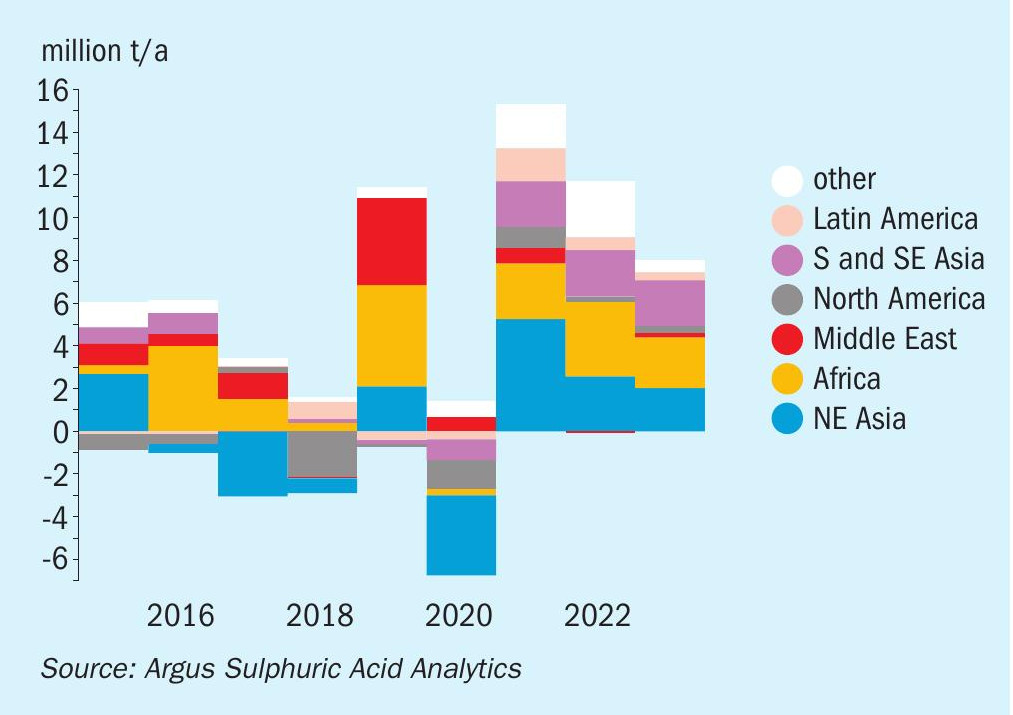

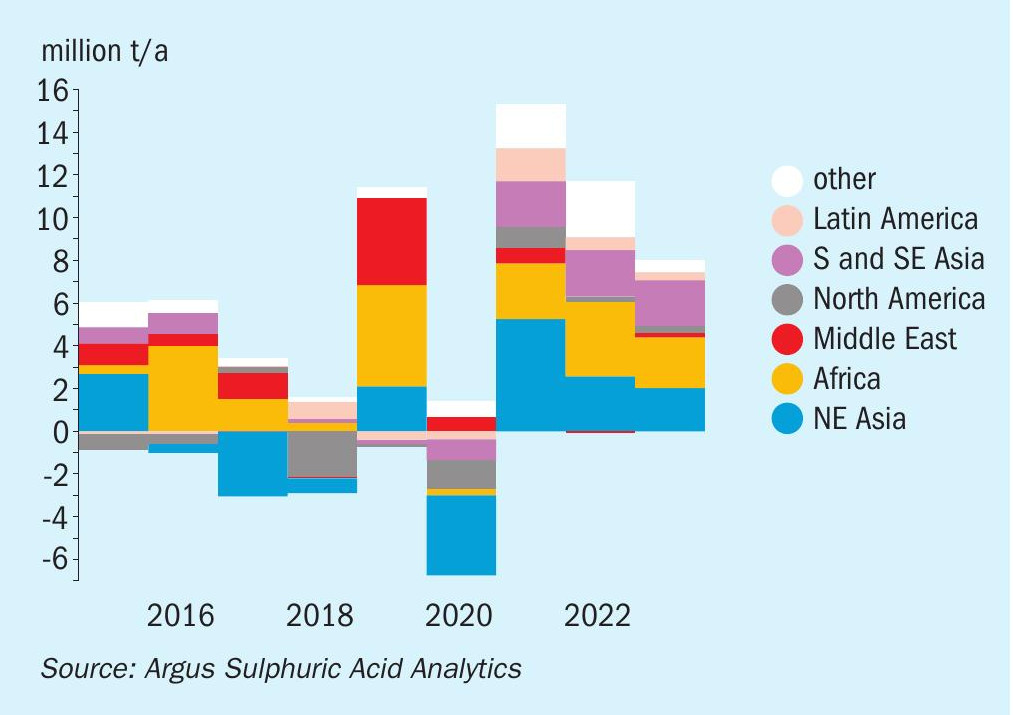

SULPHURIC ACID

The firm trend in the global sulphuric acid market has not abated. Prices have continued to firm through to the end of October, with no signs of slowing. Tight supply coupled with strong demand has kept the market supported. Northwest European export prices were assessed at $200-220/t f.o.b. at the end of October, slightly below highs of $230/t f.o.b. earlier in the month. The European market was deemed to be in a critical state, as key suppliers curtailed production. Nyrstar announced it would be curtailing supply at three of its plants by up to 50% added concerns over security of supply for buyers in other regions. Prayon declared force majeure at its sulphur burner in Belgium in October. Strong import demand following the closure of Inovyn’s sulphuric acid plant at Runcorn is further exacerbating the market situation. The expectation is for further price increases before the end of the year. The tight balance is also pointing to a likely firm view for the early months in 2022. The shift in DAP and sulphur price direction in light of the new restrictions on Chinese DAP exports is also supporting the acid price outlook.

Chile spot prices have been a key market discussion, particularly as we approach negotiations for 2022 annual contracts. Prices firmed at the end of October to $250-260/t c.fr with traders pointing to higher freight rates. Spot business is expected to be slower with the focus turning to those price discussions but demand from the copper sector remains robust. There were indications from one buyer that a cargo had been secured for Q1 2022 at close to $250/t c.fr. Planned maintenance at Anglo American’s Collahuasi mine impacted copper production in Q3 2021, according to the company’s production results. Copper production was down 6pm on the quarter, but up 1% year to date. The Tia Maria project in Peru appears to be facing further obstacles despite having necessary permits. The social and political environment has put the potential start up of the project in question following years of delays and opposition. If the project were to progress, it would lead to a significant increase in domestic consumption of acid produced from local smelters. This would impact export availability to main market Chile.

Over in Brazil, prices were stable in the second half of October after firming to $255-260/t c.fr. November appeared to be covered at the time of writing but there was potential for a cargo for December. Itafos announced on 20 October that it had made the decision to restart its sulphuric acid plant at Arraias. The recommissioning of the plant is expected to be completed over a 4 month timeframe in order to commence sulphuric acid sale in the first quarter of 2022. Acid demand in Brazil has been high, with supply extremely tight through parts of the year. This has led to domestic prices in the market firming. The Itafos plant has the capacity to produce 220,000 t/a acid. The plant had been idled since the fourth quarter of 2019, alongside the associated integrated phosphate fertilizer business. The associated plants will remain idled.

In Japan, planned smelter turnarounds during 4Q are expected to lead to lower sulphuric acid production compared with a year earlier. In South Korea, Namhae Chemicals was undergoing a month of planned maintenance at both of its 800,000 t/a plants until November. Prices out of South Korea/Japan have been much lower than the NW European benchmark. At the end of October, the northeast Asian high end of the price was $70/t below the European export price. Expectations are stable in the outlook for export availability and capacity, with no closures or expansions currently planned in the forecast.

Sulphuric acid production in Namibia will be impacted by a water leak in the off-gas system at Dundee Precious Metals’ Tsumeb smelter. The company has revised its production guidance down for 2021, with potential additional maintenance required at the plant. Tsumeb produced 249,000 t of acid in 2020. Supply from the smelter is primarily for the local market, with the balance exported to neighbouring countries in the region.

In the US, negotiations are underway for 2022 contracts. Prices were at $245255/t c.fr at the end of October for spot volumes. The market is expected to remain tight through 1H 2022 with strong demand from various sectors. Imports are expected to increase next year.

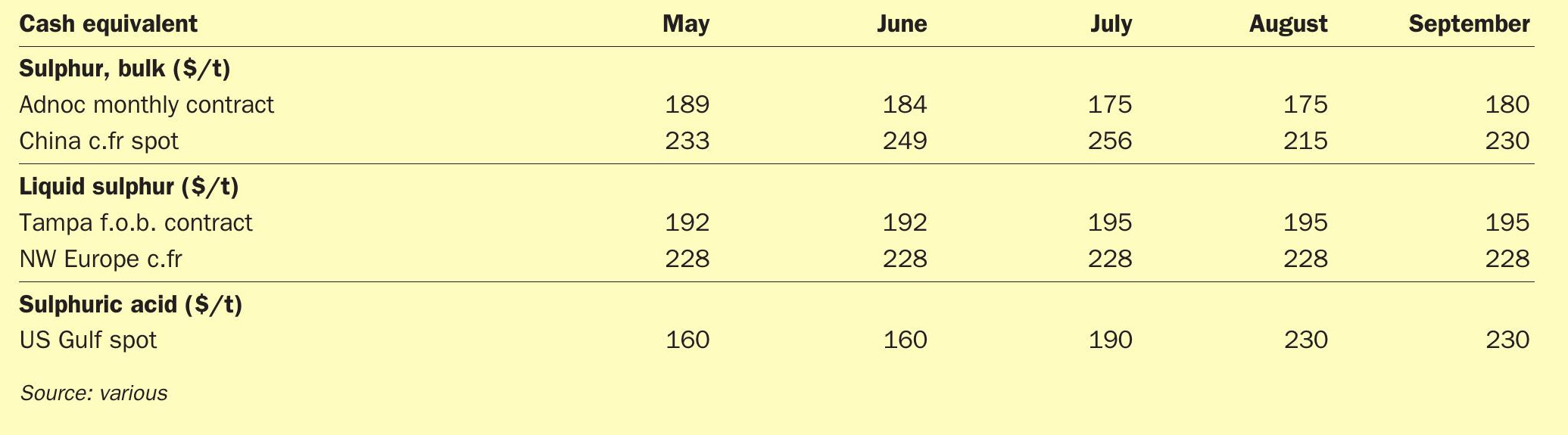

PRICE INDICATIONS