Sulphur 393 Mar-Apr 2021

31 March 2021

Market Outlook

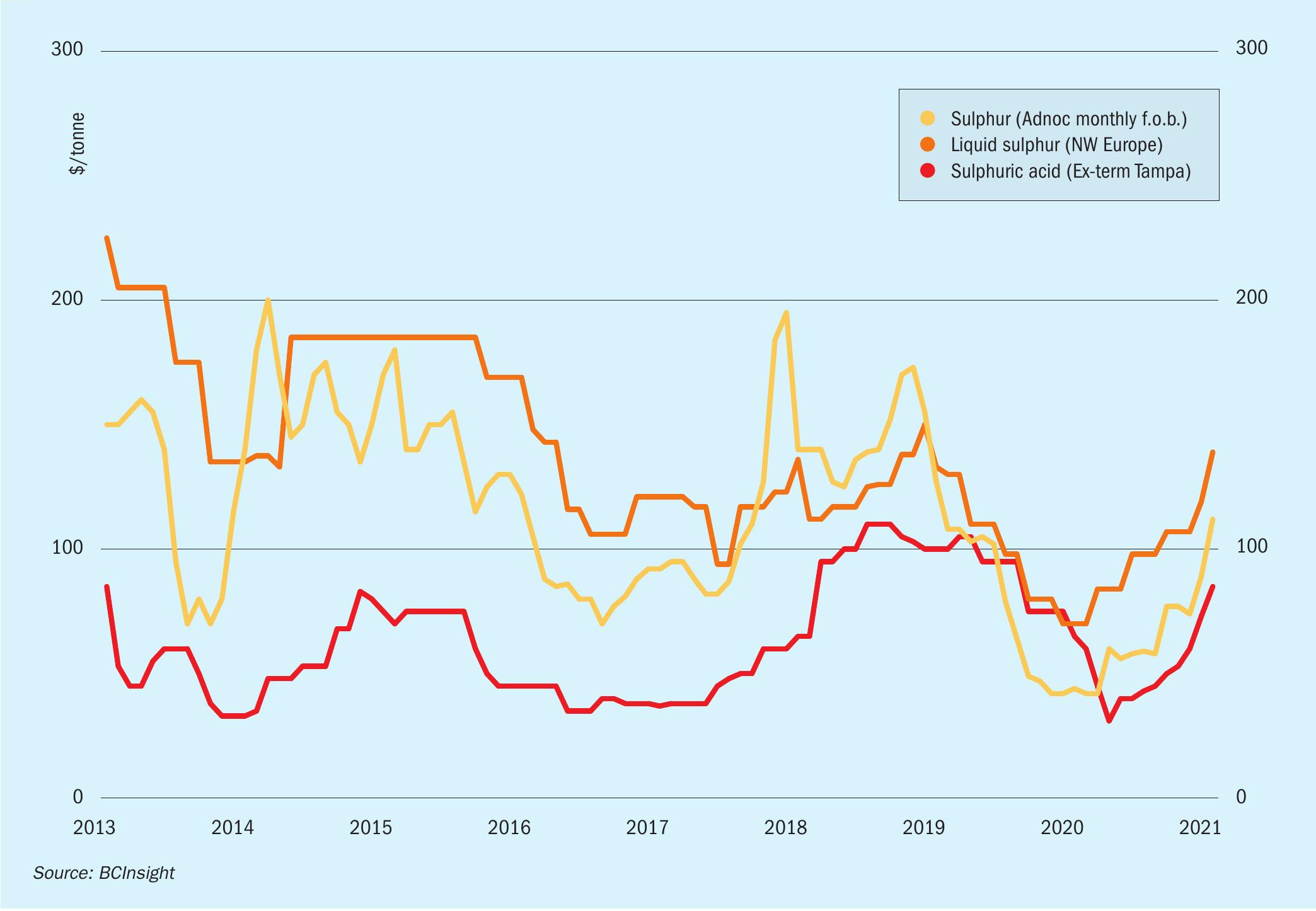

SULPHUR

- Restrictions and lockdowns across the globe have significantly reduced oil demand, impacting refinery run rates. This has aided in reducing sulphur liquidity, supporting the short term view.

- Speculative traders in China stepped in during Q4 2020, driving up prices ahead of the spring application season. China port inventories dropped in December, leading to a flurry of buying.

- Brazilian sulphur demand is expected to increase in the short term with rising phosphoric acid production. Sulphur imports are forecast to tick up by 0.3 million tonnes in 2021 in parallel to meet growing demand.

- Increasing phosphoric acid production at OCP’s/Morocco operations in 2021 is expected to raise sulphur import demand. Supply from the Middle East will likely increase as a result.

- Global sulphur demand recovery is forecast in 2021 following erosion in 2020 from Covid-19 related disruption. The processed phosphates sector is expected to see strong growth in particular.

- Two Middle East projects are expected to start ramping up in 2021 – Barzan in Qatar and the Clean Fuels Project in Kuwait. Combined these represent over 3.0 million t/a of sulphur at capacity. Covid-19 is influencing the short term outlook for supply and delaying project ramp up.

- Outlook: DAP prices are forecast to remain firm in the coming weeks with a tight balance expected, supporting sulphur demand and pricing. Pressure is likely in subsequent quarters but the tight sulphur supply side issues are likely to prevail.

SULPHURIC ACID

- The copper price run has continued through Q1, providing support to SX-EW copper mining operations. Argus expects to see copper-based acid demand rebounding in the short term, with growth forecast at 1.8 million t/a this year on 2020 levels to 19.5 million t/a.

- Excelsior Mining announced the sale of first copper cathode from the Gunnison Copper Project in Cochise County, Arizona at the end of January. Production at the project started in December 2020 and is set to continue ramping up to reach nameplate capacity rates later in 2021. Excelsior is procuring acid from the local market to cover demand. A sulphur burner may be built in the sixth year of operation.

- Industrial-based demand in India is expected to increase in 2021. Demand from the sector contracted last year as the pandemic shutdown many industrial sectors. A recovery is expected throughout 2021 and into 2022.

- Outlook: Acid prices are expected to be well above 2020 levels this year – in most cases more than doubling on average. Morocco is a bright spot for trade, with expectations of a strong year for imports once again. Prices will likely be less attractive in 2021 but phosphoric acid based demand is forecast to remain healthy. The macro picture is healthy with an effective vaccine roll out in hand in major regions with significant stimulus packages and Opec+ agreement compliance set to bolster 2021 GDP growth.