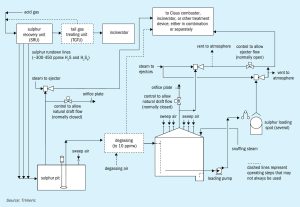

Undegassed molten sulphur can contain several hundred ppmw H2 S. If the headspace in the storage tank is stagnant, the H2 S can accumulate in the vapour space above undegassed liquid sulphur to dangerous levels. Sweeping and blanketing systems are commonly applied to manage the explosion risk in the headspace of molten sulphur storage tanks. D. J. Sachde , C. M. Beitler , K. E. McIntush , and K. S. Fisher of Trimeric Corporation review these approaches, outlining the benefits and limitations, design considerations, and industry experience/guidance for each approach. Calculation methods for natural draft flow of sweep air are also presented.