Smarter fertilizer handling

From ship to storage, Bruks Siwertell aims to ensure safe, reliable, high-capacity fertilizer transfers.

From ship to storage, Bruks Siwertell aims to ensure safe, reliable, high-capacity fertilizer transfers.

CSV Midstream Solutions says that it has successfully completed commissioning and commenced operations at its Albright gas plant in northern Alberta, tapping into the Montney shale gas field. The new 150 million scf/d sour gas plant with associated sulphur recovery represents the first of its kind to be built in Alberta in more than a generation.

First gas from Abu Dhabi’s 1.5 billion cfd Ghasha sour gas concession will be reached in early 2026, according to project partner PTTEP. The gas will come from the first phase 340 million cfd Dalma development. The Ghasha project is being developed by ADNOC (70%), Eni (10%), Thailand’s PTTEP (10%) and Russia’s Lukoil (10%). The outlook, published in PTTEP’s Q3 results, is a more cautious assessment than that provided by Eni in its own Q3 results. Eni said it was optimistic that the development would start up by the end of 2025.

India’s Megha Engineering and Infrastructures Limited (MEIL) has won a $225.5 million contract from the Kuwait Oil Company (KOC) for setting up a new gas sweetening and sulphur recovery facility at West Kuwait oilfields. The project, to be developed on a build-own-operate basis with a buyback option for KOC, includes design, construction, operation and maintenance. It will be completed in two years, followed by a five-year operation and maintenance phase.

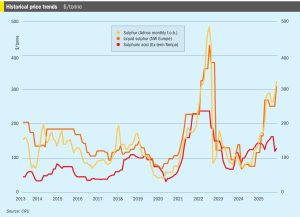

Prices in sulphur markets have been climbing rapidly for several weeks now due to short supply, reaching their highest levels for early two and a half years, since July 2022. A major cause has been widening Ukrainian drone and missile strikes against Russian oil and gas facilities. In particular, drone strikes in September on the Astrakhan and Orenburg natural gas plants led to Russian sulphur exports being cut drastically, first from around 400,000 tonnes per month to only 100,000 tonnes in October, and then to zero from the 1st of November, as Russia implemented a ban on exports of sulphur used in fertilizer production which was projected to last at least until December 31st. “This decision will stabilise shipments of raw materials to the domestic market to maintain current mineral fertilizer production volumes and ensure the country’s food security,” the government’s press service reported. The restriction applies to the export of liquid, granulated, and lump sulphur. It remains to be seen whether exports of Kazakh material from Ust Luga will be affected, but some Kazakh sulphur is now being sold via Iran.

While north Africa’s sulphur demand is dominated by its phosphate industry, south of the Sahara it is copper, cobalt and uranium mining, leaching and smelting that hold sway over acid production and demand.

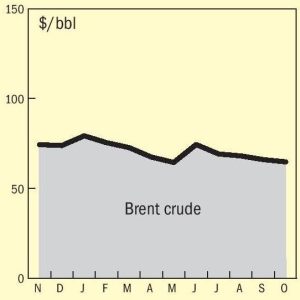

Sulphur prices advanced further in October, more than expected, supported by the supply towards the end of summer becoming restricted, with a number of non-mainstream sources facing logistical constraints.

IPCO’s Rotoform technology has become a popular solidification solution – delivering efficiency, quality & sustainability benefits.

• Russia is set to impose a temporary ban on sulphur exports, covering liquid, granulated, and lump material, to ensure domestic supply. The measure will be in effect until 31 December 2025. CRU expects Russia to return to the export market in 2026 Q1. On the other hand, exports from Iranian ports are set to come back not only for Iranian production but also for Turkmenistan.

A UK–based energy watchdog, the Impact Investigators Platform (IIP), has dismissed allegations that the Dangote Petroleum Refinery imported substandard gasoline into Nigeria, describing the claims as “technically inaccurate, commercially implausible, and unsupported by verifiable evidence.” The IIP said its independent assessment of shipping data, customs declarations, and refinery process documentation found no indication that the refinery imported or sold Premium Motor Spirit (PMS) with sulphur levels above Nigeria’s approved limit of 50 parts per million (ppm). The investigation followed media reports alleging that a vessel had delivered high-sulphur gasoline to the Dangote Refinery under the guise of locally refined products. However, the IIP clarified that the cargo in question was an intermediate feedstock , a raw material used for refining and not finished gasoline meant for retail.