CRU Phosphates welcomes you to Warsaw!

CRU Events will convene the 2024 Phosphates International Conference & Exhibition in Warsaw at the Hilton Warsaw City Hotel, 26-28 February.

CRU Events will convene the 2024 Phosphates International Conference & Exhibition in Warsaw at the Hilton Warsaw City Hotel, 26-28 February.

Kevin De Bois of Prayon Technologies describes an innovative process for removing magnesium from phosphate rock. Increasingly, phosphoric acid producers are looking to consume low-grade phosphate rock as a feedstock due to the prohibitive costs of high-grade rock sources. This has potentially negative consequences as the presence of impurities such as magnesium can negatively affect both the phosphoric acid process and the quality of the acid produced.

Market Insight courtesy of Argus Media. Urea: Prices in general fell further in late October. Suppliers in most regions were forced to accept lower than expected net-backs due to low import demand and high producer inventories. India was the exception with IPL securing 1.7 million tonnes of urea at $400-404/t cfr under its 20th October tender.

Proman has signed a memorandum of understanding (MoU) with Mitsubishi Corp to collaborate on the development of a blue ammonia plant at Lake Charles, Louisiana. This new facility will aim to produce around 1.2 million t/a of low carbon ammonia, making it one of the largest of its kind in the world. The plant will incorporate carbon capture and sequestration technology. Proman says that this development aligns with the company’s commitment to sustainability and reducing greenhouse gas emissions. The proposed ammonia plant will be located at Proman’s existing site in Lake Charles, adjacent to its gas-to-methanol plant, which is also currently being developed.

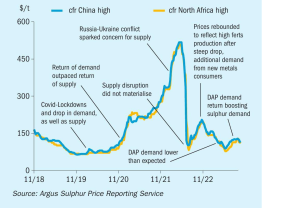

Volatility in sulphur prices has been reduced in the past year following the large price spike and subsequent drop in the summer of 2022. This price volatility has been due to various disrupted seasonal trends from the global pandemic, uneven recovery, geopolitical shifts and demand destruction for fertilizers.

One of the things that produced a lot of worried news headlines over the past couple of years is whether the energy transition is likely to lead to a shortage of sulphur as we switch away from fossil fuels on a large scale. As we’ve discussed in this magazine, those fears are overblown, certainly in the medium term future. Peter Harrison of CRU tackled the issue in his sulphur markets presentation at the recent Sulphur and Sulphuric Acid conference in New Orleans, and while he did admit to some reduction in sulphur supply from oil in the 2030s and increasing into the 2040s, increased sulphur recovered from sour gas is likely to more than make up for that at least until the 2040s. But one of the things that did strike me about his presentation is the extent to which the energy transition is indeed already changing the way that the sulphur market works, and will increasingly do so over the next few years.

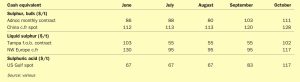

Market Intelligence Price Indications Table 1: Recent sulphur prices, major markets

A report on CRU’s annual Sulphur + Sulphuric Acid conference, held in New Orleans, USA, 6-8 November 2023.

Tecnimont, part of MAIRE’s Integrated E&C Solutions business unit, has signed a letter of award with ADNOC for the onshore processing plant of the Hail and Ghasha Development Project. The award was signed at ADIPEC, the world’s largest energy summit. The project aims to operate with net zero CO 2 emissions, in part due to the facility’s CO 2 carbon capture and recovery units, which will allow the capture and storage of CO 2 . The project will capture 1.5 million t/a of CO 2 , taking ADNOC’s committed carbon capture capacity to almost 4 million t/a. The company recently announced its decision to double its carbon capture capacity to 10 million t/a by 2030. The Hail and Ghasha CO 2 will be captured, transported onshore and stored underground, while low-carbon hydrogen will be produced to replace fuel gas and further reduce emissions, according to ADNOC. The project will also use power from nuclear power plants and renewable sources from the grid.

A softer trend in DAP prices, linked to lower operating rates in China and declining demand, is contributing to falling sulphur prices.