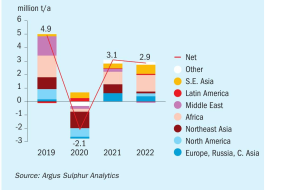

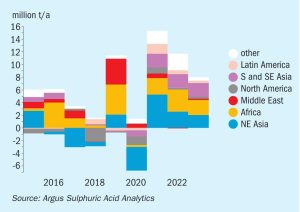

The impact of US duties on phosphate markets

Import duties on phosphates from Morocco and Russia imposed by the US government in 2021 have compounded a lack of availability of phosphate fertilizer caused by Chinese export restrictions and led to higher prices for US farmers. Are there knock-on effects possible for sulphuric acid demand?