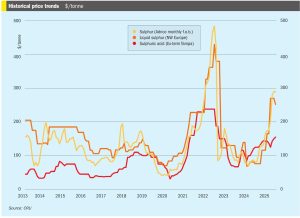

PT QMB New Energy Materials, a major Chinese-owned nickel smelter in Indonesia, is temporarily cutting production due to mounting waste management challenges, according to a 24 November report from local news source Sina, a move expected to temporarily impact regional sulphur demand. The facility, located in the Morowali Industrial Park, will reduce output for at least two weeks as its tailings ponds are nearing capacity while it awaits approval for a new facility. The shutdown may have implications for the sulphur market, as QMB is a major consumer.