Market Outlook

Prices will remain stable-to-soft across the board, though benchmarks could remain slightly more supported in the short-term than previously thought, with more significant declines likely in Q2-Q3.

Prices will remain stable-to-soft across the board, though benchmarks could remain slightly more supported in the short-term than previously thought, with more significant declines likely in Q2-Q3.

Methanol continues to be a front runner among alternative fuels for the shipping industry. However, concerns remain over the availability and cost of green and blue methanol.

NextChem Tech, has signed a contract with Paul Wurth SA, a subsidiary of SMS group, and Norsk e-Fuel AS for a licensing and engineering design package relating to its NX CPO (catalytic partial oxidation) technology, which will be used in an industrial scale plant producing sustainable aviation fuel (SAF) from green hydrogen and biogenic CO2 in Mosjøen, Norway. NextChem’s NX CPO technology produces synthesis gas via a very fast controlled partial oxidation reaction. When applied to synthetic fuel production, it can improve carbon efficiency recovery yield. The first plant developed by Norsk e-Fuel will have a production capacity of 40,000 t/a of green fuel and will enter operation after 2026. Based on the initial design, two additional facilities with a capacity of around 80 000 t/a each are planned to be built by 2030. The fuels will current aviation emissions.

TOYO explores green methanol synthesis technology and the challenges in utilising renewable energy sources and introduces its g-Methanol® technology.

As the production of renewable methanol continues to scale up, it will provide a long term, carbon-neutral energy solution to different transport sectors. However, the optimum design parameters for green methanol plants are substantially different to natural gas-based methanol plants and pose new challenges to the methanol loop designer. Johnson Matthey discusses the challenges and presents the benefits of the tube cooled converter for e-methanol production.

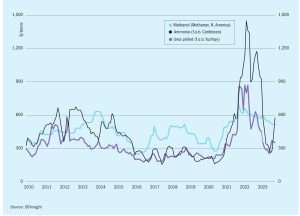

Ammonia prices are expected to remain soft moving through January into February, with little in the way of price support from both a supply and demand perspective. January’s Tampa settlement was $100/t down on December at $525/t CFR.

Maire Group subsidiary MyRechemical has been awarded a feasibility study for the integration of its proprietary waste-tosyngas technology in a large-scale conversion plant that would transform solid municipal waste into 120,000 t/a of sustainable aviation fuel (SAF). MyRechemical would provide the gasification unit to transform solid waste streams into synthesis gas, which would then be converted into low carbon ethanol and then to SAF.

We are very pleased to be able to tell you that, as of this issue, Nitrogen+Syngas magazine has a new publisher. Or rather, an old publisher, as the magazine is now once again part of the CRU Group.

Jiangsu Sailboat Petrochemical has started up a CO2 -to-methanol plant at the Shenghong Petrochemical Industrial Park. The plant was developed in conjunction with Iceland’s Carbon Recycling International (CRI), with the plant brought to life in under two years from the initial contract signing. The methanol plant uses CRI’s proprietary emissions-to-liquids (ETL) technology, transforming waste carbon dioxide and hydrogen gases into sustainable, commercial-grade methanol. According to CRI, uses 150,000 t/a of carbon dioxide sourced from waste streams at the large petrochemical complex as feedstock, significantly reducing emissions that would have otherwise been released into the atmosphere. The plant has the capacity to produce 100,000 t/a of sustainable methanol, used primarily to supply Jiangsu’s methanol to olefins facility to produce chemical derivatives, including sustainable plastics and EVA coatings for solar panels. This is expected to reduce the reliance on fossil-based methanol to drive more sustainable value chains and carbon footprint reduction initiatives across various sectors, such as industrial manufacturing and renewable energy.

Tampa ammonia contract prices increased dramatically during September, from $395/tonne c.fr to $575/ tonne c.fr. The main culprit was plant outages and reduced production at several plants in the region. The tight supply situation was exacerbated by a delay to the restart of Ma’aden’s 1.1 million t/a ammonia plant in Saudi Arabia.