Casale to convert Kakinada complex to green ammonia

AM Green has selected Casale as its technology partner for India’s largest under-development green ammonia complex in Kakinada, Andhra Pradesh.

AM Green has selected Casale as its technology partner for India’s largest under-development green ammonia complex in Kakinada, Andhra Pradesh.

Carbon Recycling International (CRI), which operates a geothermally powered green methanol plant at Svartsengi, 40km southwest of Reykjavik, had to evacuate its site in late November when a 3km fissure opened in the earth a few kilometres away and lava began spilling across adjacent land. Satellite photos of the area taken on November 24 show a large field of molten and cooled lava to the north, west, and south of Svartsengi, though the plant itself remained undamaged. CRI’s Iceland facility runs on CO2 , water, and renewable electricity from the Svartsengi geothermal power station. CRI says the low-carbon energy source allows it to produce 4,000 t/a of methanol with a greenhouse gas footprint just 10–20% that of conventional methanol.

India’s phosphate production is using increasing volumes of sulphuric acid, but new domestic smelter and sulphur burning acid capacity may mean reduced imports in future.

In spite of increasing environmental concerns over the use of coal as a feedstock, it continues to provide around one quarter of the world’s ammonia. But in a world that is decarbonising, is there still a future for coal-based capacity?

Global sulphur prices underwent increases in some key benchmark markets during October, but spot activity nevertheless remained muted, with demand subdued and availability tight. Market participants continue to closely track geopolitical developments.

SGS Sulphur Experts has appointed Patrick Beck as the new CEO. Beck brings over two decades of leadership experience in the oil and gas industry and what Sulphur Experts describe as “a wealth of strategic insight and operational excellence to the team, steering the company towards continued innovation and engineering excellence.”

Join us at the CRU Sulphur + Sulphuric Acid 2024 Conference and Exhibition in Barcelona, 4-6 November, for a global gathering of the sulphur and sulphuric acid community. Meet leading market and technology experts and producers, network, share knowledge, and learn about market trends and the latest developments in operations, process technology and equipment.

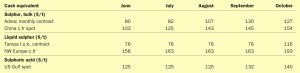

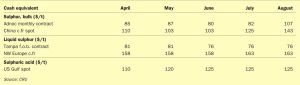

At the end of August, the Qatar Chemical and Petrochemical Marketing and Distribution Company (Muntajat) tendered for 35,000 tonnes of sulphur for September loading from Ras Laffan, with offer prices reported at or around $130s/t f.o.b., according to market sources. Bids were received at multiple levels, with market participants initially anticipating awards around the mid-$120s/t f.o.b. The tender result was higher than market expectations and would equate to delivered prices to key Asian markets at $150-155/t c.fr. But prices in China and Indonesia remained lower this week at around $140-145/t c.fr, with India at $145-150/t c.fr. Prices have increased steeply since Muntajat’s 25 June session, which was indicated awarded in the mid-$80s/t f.o.b.. and Muntajat posted its Qatar Sulphur Price (QSP) for September at $125/t f.o.b., up $19/t from $106/t f.o.b. in August. This represents the highest QSP since March 2023 at $133/t f.o.b., and reflects delivered levels to China nearing $150/t c.fr at current freight rates. Tight supply and strong downstream demand have pushed tender prices higher. Muntajat tenders were previously awarded at $92/t f.o.b. in April, up from $88/t in March and the low $80s/t f.o.b. in February.

This year will be the 40th Sulphur – now Sulphur + Sulphuric Acid – Conference to be held. From its beginnings in Canada to this year’s meeting at the Hyatt Regency hotel in Barcelona, much has changed, but its mission – to be an essential annual forum for the global sulphur and acid community – remains the same.