Recent developments in the ammonia market

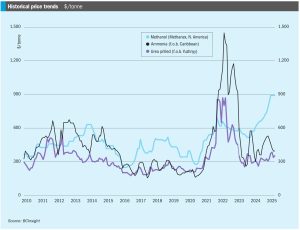

Increased merchant ammonia capacity over the next few years may lead to longer term price declines.

Increased merchant ammonia capacity over the next few years may lead to longer term price declines.

By combining oxygen-blown Lurgi™ autothermal reforming (ATR) technology with Cryocap™ H2 carbon capture technology, Air Liquide offers an innovative plant configuration to meet the need for a central production facility offering flexible product diversification with hydrogen and ammonia at a scale that satisfies extensive decarbonisation targets.

Price trends and the market outlook, 19th June 2025

President Donald Trump delayed his ‘liberation day” tariffs by three months on 9th April, while simultaneously ramping up levies on China.

Price trends and the market outlook, 10th April 2025

It is with great sadness that we report the death of Dr. Umberto Zardi, who passed away on March 17th 2025 at his home in Breganzona, Lugano, Switzerland. Dr Zardi was an innovator in the nitrogen industry and for many years the president and driving force behind Ammonia Casale, now simply Casale SA, becoming responsible for its revival and transformation into the global engineering and technology giant that it is today.

• Continuing oversupply means that ammonia prices should continue to come under pressure moving into 2H April, though it remains to be seen just how much further values in Asia can decline before producers begin to shutter output.

Spanish company Ignis has decided to pause work on the renewable energy generation projects it had planned in Chile’s Magallanes region. In a press statement, Ignis said that: “even though we firmly believe that this industry will develop and mature, the company is considering a longer time frame than initially planned and a reduction in the project to adapt it to this new reality.” The company was developing a wind farm to supply the green ammonia plant with hydrogen, but reportedly found the process of leasing the land area to build the turbines slower and more difficult than it had hoped.

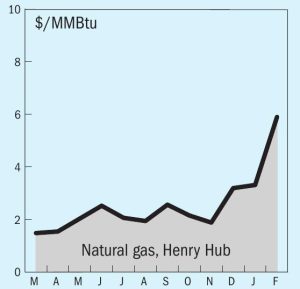

Achema says that it plans to “temporarily” suspend ammonia production at its site at Jonava from May 15th, due to the volatility of natural gas prices and competition from cheaper foreign imports. It currently plans to resume production in 3Q 2025. The facility has been operating at reduced capacity since 2021, and Lithuanian lawmakers have discussed converting the site to explosive grade ammonium nitrate production as part of a European rearmament programme.

In mid-April, Ammonia prices both east and west of Suez remained firmly oriented to the downside, with supply still heavily outweighing demand and suppliers scrambling to place excess tonnage. Bearish market sentiment was exemplified by a Trammo sale to OCP at $415/t c.fr Morocco, $20/t short of Tampa’s c.fr settlement for April and around $44/t down on February.