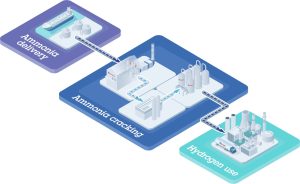

Cracking it back: Hydrogen from ammonia

Air Liquide is developing a new ammonia cracking technology based on its proven steam methane reforming (including SMRX™ ) technology, which introduces a heat exchange concept to cut energy use, lower environmental impact, and potentially eliminate steam export. Leveraging extensive SMR design expertise, a robust R&D programme, and an industrialscale NH3 cracking pilot plant, it aims to rapidly mature all technology blocks and deliver safe, reliable, and customisable lowcarbon hydrogen solutions to meet growing demand.