Market Insight

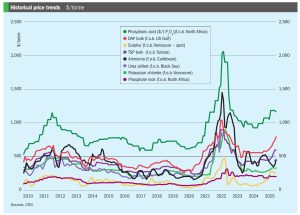

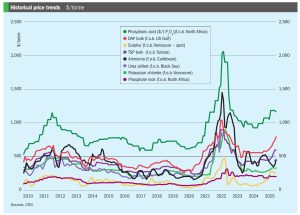

Price trends and market outlook, 23rd October 2025

Price trends and market outlook, 23rd October 2025

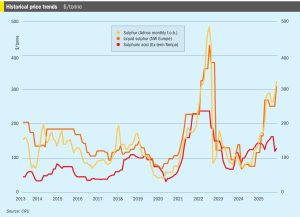

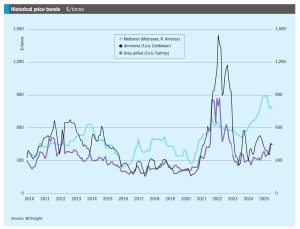

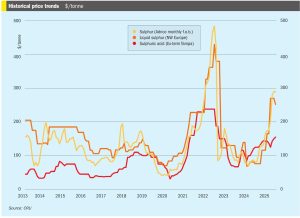

Sulphur prices advanced further in October, more than expected, supported by the supply towards the end of summer becoming restricted, with a number of non-mainstream sources facing logistical constraints.

• Russia is set to impose a temporary ban on sulphur exports, covering liquid, granulated, and lump material, to ensure domestic supply. The measure will be in effect until 31 December 2025. CRU expects Russia to return to the export market in 2026 Q1. On the other hand, exports from Iranian ports are set to come back not only for Iranian production but also for Turkmenistan.

l The market looks very tight through the end of the year, though some expect supply to improve in Q4. Prices are unlikely to ease in the coming weeks. l Woodside’s Beaumont New Ammonia Project is now 97% complete, and the producer expects production from the first train in late 2025. There is no information from Gulf Coast Ammonia on when to expect commercial production. l There was an absence of fresh confirmed business into northwest Europe. Still, producers with ammonia capacity in the region are expected to be maximising output given the favourable economics at current spot natural-gas prices at the Dutch TTF.

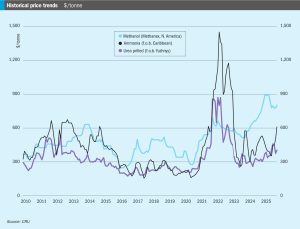

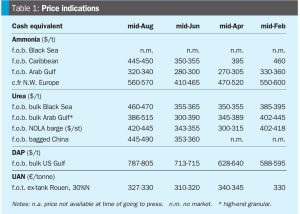

By the end of October the ammonia market was facing an acute shortage of spot tonnage, reflected in a $60/t jump in the Tampa price for November. The benchmark Tampa price increased for the sixth straight month to its highest since February 2023 as the global ammonia supply crunch deepened. The surge at Tampa was said to be driven by good demand in the US for direct application combined with a lack of supply. Contributing factors included Nutrien shutting down its nitrogen production in Trinidad, potentially removing around 85,000 tonnes/month from the market. So far, there is no suggestion that other producers in Trinidad will follow suit, and they may even benefit from a boost natural-gas supply given the Nutrien outage, although it is unclear whether the spare gas will be directed to ammonia as opposed to other demand sources.

The global sulphur market registered price increases during August as a result of demand in Asia and North Africa, while supply has tightened due to limited supply from the FSU and Saudi Arabia, as well as logistical constraints in both Iranian ports and railway capacity to Black Sea ports.

• Ammonia prices look well insulated against any declines over the immediate term, though the upside may be more limited in some regions than others.

Ammonia prices in both hemispheres had levelled out by the end of August, with the exception of a few marginal upticks in some regions on the basis of the latest supply-demand dynamics. All eyes are now on September’s Tampa settlement, which should spell out the extent of the upside pressure set to emerge over the coming weeks.

Price trends and market outlook, 21st August 2025

• Global sulphur prices are expected to experience decreases over the next few weeks. Buyers in Asia report that they are covered for contracted supply throughout July, and domestic prices in China are likely to decrease further, putting downward pressure on sulphur prices.