Canadian sulphur

After many years of slow decline, Canadian sulphur exports have begun to rise slightly, but dwindling US markets are seeing a move towards more sulphur forming to expand export opportunities.

After many years of slow decline, Canadian sulphur exports have begun to rise slightly, but dwindling US markets are seeing a move towards more sulphur forming to expand export opportunities.

Construction work has begun on a new hydrocracking complex for the Assiut refinery in Egypt, in the central Nile valley, according to TechnipFMC plc, who won the $1 billion engineering, procurement, and construction (EPC) contract for the project. The contract involves construction of new processing units including a vacuum distillation unit, a diesel hydrocracking unit, a delayed coker unit, a distillate hydrotreating unit and a hydrogen production unit which will use TechnipFMC’s proprietary steam reforming technology.

The global pandemic and new wave of lockdowns in some regions continue to pose a level of uncertainty to oil demand and in turn sulphur recovery. There are positive signs in the macro economic picture on the back of the vaccine rollout but significant question marks remain.

Metal markets are used to ups and downs, and, as we discuss elsewhere in this issue, this year has seen more than most, mainly thanks to the virus that is still keeping us indoors – as I write this, the UK has just moved back into a second national ‘lockdown’. However, this year has seen the fortunes of one metal in particular simply rise and rise – nickel.

Brimstone STS Ltd. today announced a new partnership with Sulphur Recovery Engineering Inc (SRE). The two companies say that this collaboration will bring together decades of experience and the latest technology in support of the sulphur recovery and gas treating industry worldwide.

A look back at some of the major events of 2020 for the sulphur and sulphuric acid industries, as well as a look forward as to how 2021 might look.

Demand for oil in developed countries was already falling before the coronavirus outbreak, and consumption growth is slowing in the developing world. Peak oil demand may arrive in the next decade. Coupled with more reinjection of sour gas rather than sulphur extraction, could we be seeing falling elemental sulphur production in a decade or so?

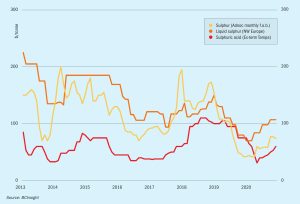

Although 2019 had been a volatile year for acid markets, with shutdowns disrupting supply, the coronavirus outbreak wrought even more havoc in 2020, across both supply and demand.

Sulphur reports on this year’s Sour Oil and Gas Advanced Technology (SOGAT) conference, which was run as a virtual event at the end of September 2020.

New approaches and novel processing schemes employing oxygen enrichment in sulphur recovery units have been developed and commercialised. In this feature Siirtec Nigi, Linde, Blasch, Fluor and RATE report on their latest developments.