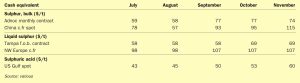

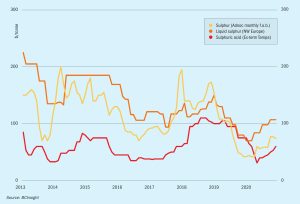

Price Trends

Meena Chauhan, Head of Sulphur and Sulphuric Acid Research, Argus Media, assesses price trends and the market outlook for sulphur.

Meena Chauhan, Head of Sulphur and Sulphuric Acid Research, Argus Media, assesses price trends and the market outlook for sulphur.

Ron Olson of The Sulphur Institute considers sulphur’s important role in plant health.

Norilsk Nickel has finally closed down its nickel smelting operation at Nikel in Russia’s Murmansk region; the company’s oldest still operating production facility. The shutdown is part of the company’s environmental programme, which aims to significantly reduce its environmental impact at all production sites. The Nikel closure will eliminate SO2 emissions in the cross-border area with Norway, which had become a major bone of contention with the Norwegian government. Norilsk aims to reduce SO2 emissions at Kola by 50% by the end of 2020 and 85% by the end of 2021, and is modernising its production in Monchegorsk, including the construction of new state-of-the-art facilities.

Continuing rationalisation in China’s phosphate industry has been reducing demand for sulphur and sulphuric acid at the same time that the country is producing more of both.

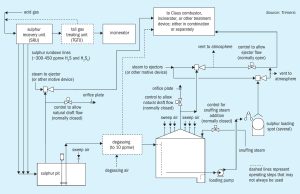

Fires are known to occur in sulphur storage pits and tanks somewhat frequently due to the presence of both flammable material and air, so methods for preventing and extinguishing these fires are critical. D. J. Sachde, K. E. McIntush, C. M. Beitler, and D. L. Mamrosh of Trimeric Corporation review fire suppression methods used in the industry including snuffing/sealing steam, rapid sealing, water mist, and inert gas blanketing. Protective tank design features to reduce the likelihood of a sulphur fire are also reviewed. Benefits and limitations, design considerations, and recommended guidance for suppression and preventative measures are discussed.

The turning of a new calendar year is a predictable waypoint in our lives. That is why it has always traditionally been a time for reflection on the past and looking to the future. Therefore, given how 2020 had turned out, perhaps there was an inevitable hope that the turning of the New Year and the start of 2021 might see an improvement in things in general, and of course the trajectory of the pandemic in particular, especially now that several vaccines have been approved for use in record time, and a massive programme of vaccination has begun across the world.

After many years of slow decline, Canadian sulphur exports have begun to rise slightly, but dwindling US markets are seeing a move towards more sulphur forming to expand export opportunities.

The global pandemic and new wave of lockdowns in some regions continue to pose a level of uncertainty to oil demand and in turn sulphur recovery. There are positive signs in the macro economic picture on the back of the vaccine rollout but significant question marks remain.

Metal markets are used to ups and downs, and, as we discuss elsewhere in this issue, this year has seen more than most, mainly thanks to the virus that is still keeping us indoors – as I write this, the UK has just moved back into a second national ‘lockdown’. However, this year has seen the fortunes of one metal in particular simply rise and rise – nickel.

A look back at some of the major events of 2020 for the sulphur and sulphuric acid industries, as well as a look forward as to how 2021 might look.