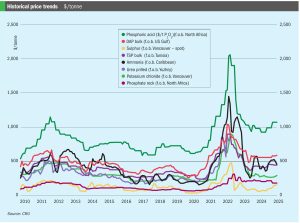

Developments in phosphate markets

Tight supply limits availability as China maintains export restrictions.

Tight supply limits availability as China maintains export restrictions.

Global sulphur benchmarks rallied at the end of February, underpinned by strong demand in Indonesia and stock drawdowns in China as fresh European sanctions on Russia targeted the port of Ust-Luga. Chinese buyers paid up to $225t/t c.fr for a cargo, with unconfirmed rumours of business at even higher levels. However, delivered prices still lag domestic port spot prices in China, which are now assessed at a delivered-price equivalent of around $242/t c.fr. China’s delivered sulphur price jumped significantly as port inventories declined, and new arrivals were limited. Only two new cargoes were reported in the last week of February, one from a mainstream source into southern China at $205/t c.fr, and the second at $225/t c.fr by a phosphate producer for the Yangtze River. The sulphur port spot transaction price is reported at around 2,0402,050 yuan/t FCA ($281-283/t), with the low-end up $26/t and high-end up $25/t compared with previous settlements. That port price indicates delivered values at around $242/t c.fr, which is $17/t higher than the import price on the Yangtze. Phosphate producers need to purchase more sulphur to meet the increased buying activity in northeastern market and the improving spring application season demand in northern China. Still, market sales availability is limited, as most port tonnes are held by traders instead of end-users, while traders are selling limited quantities now to push prices higher. Chinese total port inventory dropped to 1.89 million tonnes by 26 February 2025. The quantity at Yangtze river ports declined 59,000 tonnes to 633,000 tonnes, while Dafeng port inventory decreased 20,000 tonnes to 450,000 tonnes.

The past few weeks have seen sulphur prices spiking after a steady rise since 3Q 2024. At time of writing, delivered prices to a variety of locations were around $280/t c.fr, their highest level since mid-2022 when the price of commodities of all kinds jumped in the wake of the Russian invasion of Ukraine and subsequent sanctions. Steady buying from Indonesia and China, the two largest importers of sulphur, appears to have supported the market, in China’s case mainly for phosphate production as well as a variety of industrial processes, and in Indonesia’s case to feed the high pressure acid leach (HPAL) plants that are producing nickel for the battery and stainless steel industries. Although Chinese buying has dropped off slightly since Lunar New Year, and demand has also slackened in India, Indonesia’s appetite continues unabated, having tripled its nickel production since the start of the decade to become the world’s largest producer, representing 60% of global supply in 2024.

Building on the success of its previous conferences, SulGas Mumbai 2025 brought together 154 sulphur and gas treating stakeholders, representing 68 companies for its 7th technical forum in the Indian subcontinent. We report on some of the key topics on the agenda.

Price trends and market outlook, 20th February 2025

We profile North America's phosphate and potash industries – focusing in on Florida and Saskatchewan, those two centres of P&K excellence.

Fertilizer International presents a global round-up of phosphate rock, phosphoric acid and finished phosphates projects.

Ammonia markets saw a slow start to 2025, with further transparency needed on both sides of the Suez to determine the extent to which prices are expected to fall through January amid healthy supply and only limited pockets of demand.

Prices in most markets should register declines through January, though the extent to which benchmarks will ease is yet unclear. Chinese suppliers have seen significant price declines in recent weeks.

The 38th Nitrogen+Syngas Expoconference will take place in Barcelona, Spain, from 10-12 February 2025. Join us at this industry leading event featuring the most comprehensive agenda to date.