Enhancing sulphuric acid production

In this case study, CS Combustion Solutions presents a comprehensive strategy for the capacity enhancement and optimisation of a sulphuric acid plant that was facing several operational challenges.

In this case study, CS Combustion Solutions presents a comprehensive strategy for the capacity enhancement and optimisation of a sulphuric acid plant that was facing several operational challenges.

Transporting sulphur as a dry bulk solid can lead to it breaking into small particles which create dust. Over the years, various forming processes have been developed to try and minimise dust formation and produce the strongest, most resilient formed sulphur particles.

SGS Sulphur Experts has appointed Patrick Beck as the new CEO. Beck brings over two decades of leadership experience in the oil and gas industry and what Sulphur Experts describe as “a wealth of strategic insight and operational excellence to the team, steering the company towards continued innovation and engineering excellence.”

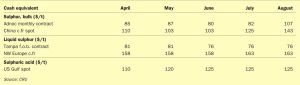

Muntajat announced its QSP for September at $125/t f.o.b., an increase of $19/t from its August price. This was following its tender earlier this week, which market sources indicated to have achieved at or around $130s/t f.o.b. Over the past two weeks, KPC in Kuwait closed two sales tenders, with both indicated awarded in the high $120s/t f.o.b. Middle East spot f.o.b. prices are at their highest level since March 2023 and have climbed 58% over the past two months.

One of the biggest areas for new sulphuric acid demand in the past few years has been in nickel processing plants, particularly in Indonesia. A decade ago, incoming president Joko Widodo took a strategic decision that the country needed to try and capture more of the value chain from its mining and mineral industry, which was focused at the time on exports of aluminium, copper and nickel ores and concentrates, mainly to China. Over the past 10 years, the export of raw ores has been progressively restricted and companies instead compelled to build downstream processing plants for the metals. With China the main recipient of Indonesian ores, much of the investment in metals processing in Indonesia has been via Chinese companies.

As more focus extends to a circular economy, there are industry wide discussions on whether future global sulphur demand will be challenged by the energy transition and decarbonisation. Hannes Storch, Collin Bartlett and Marcus Runkel of Metso discuss how the recycling of pyrite tailings could address some of these issues.

Refinery sour water strippers are an often overlooked resource of low GWP ammonia. Martin A. Taylor and Charles L. Kimtantas of Bechtel Energy Technologies and Solutions, Inc. (BETS) show the results of a study on reusing an existing SWS as one of the major systems in a SWSPlus unit for the recovery of ammonia for sale. Relative cost factors will compare a complete SWSPlus unit versus reusing an existing SWS.

Join us at the CRU Sulphur + Sulphuric Acid 2024 Conference and Exhibition in Barcelona, 4-6 November, for a global gathering of the sulphur and sulphuric acid community. Meet leading market and technology experts and producers, network, share knowledge, and learn about market trends and the latest developments in operations, process technology and equipment.

At the end of August, the Qatar Chemical and Petrochemical Marketing and Distribution Company (Muntajat) tendered for 35,000 tonnes of sulphur for September loading from Ras Laffan, with offer prices reported at or around $130s/t f.o.b., according to market sources. Bids were received at multiple levels, with market participants initially anticipating awards around the mid-$120s/t f.o.b. The tender result was higher than market expectations and would equate to delivered prices to key Asian markets at $150-155/t c.fr. But prices in China and Indonesia remained lower this week at around $140-145/t c.fr, with India at $145-150/t c.fr. Prices have increased steeply since Muntajat’s 25 June session, which was indicated awarded in the mid-$80s/t f.o.b.. and Muntajat posted its Qatar Sulphur Price (QSP) for September at $125/t f.o.b., up $19/t from $106/t f.o.b. in August. This represents the highest QSP since March 2023 at $133/t f.o.b., and reflects delivered levels to China nearing $150/t c.fr at current freight rates. Tight supply and strong downstream demand have pushed tender prices higher. Muntajat tenders were previously awarded at $92/t f.o.b. in April, up from $88/t in March and the low $80s/t f.o.b. in February.

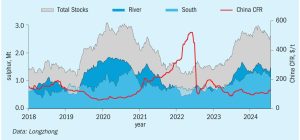

In the last two years there have been significant changes to the level and location of sulphur inventory, which has caused swings in short-term supply availability. Inventory plays a necessary role in balancing the sulphur market but exactly when, where, how, and why inventory enters the market can trigger a diverse range of price responses. In this insight article, CRU’s Peter Harrisson looks at how inventory change influences sulphur availability and pricing.