The Atlantic just widened

T he high-price environment for fertilizers and other commodities, including natural gas, is having very different consequences globally.

T he high-price environment for fertilizers and other commodities, including natural gas, is having very different consequences globally.

A record rise in gas prices at the end of August triggered a spate of ammonia production curtailments across Europe. These included major shutdown announcements from CF Fertilisers UK, Grupa Azoty, Yara International and others.

The fertilizer price and supply chain shocks caused by the war in Ukraine have supercharged the debate about the shift to more sustainable and efficient crop nutrition – with farmers and governments urgently looking for different approaches to maximise crop productivity.

As we near the end of the third quarter of 2022, the attention of the nitrogen industry is focused on the coming northern hemisphere winter, and the prospects for higher natural gas prices as temperatures fall and power and heating demands rise. Vladimir Putin has been stoking these worries to try and force a climbdown from European countries over the sanctions that followed his invasion of Ukraine, with the flow of gas through the Nordstream 1 pipeline across the Baltic Sea gradually dwindling over the summer and finally stopping altogether at the end of August due to “technical issues” – an explanation somewhat undermined by the subsequent statement from spokesman Dmitry Peskov that gas would flow again once sanctions were eased. This is a familiar enough tactic; Russia has used gas stoppages to pressure Ukraine and Europe several times over the past two decades.

Market Insight courtesy of Argus Media

Copper leaching and smelting projects in Zambia and Zimbabwe continue to dominate acid production and consumption, with output expected to increase from the Kamoa-Kakula project.

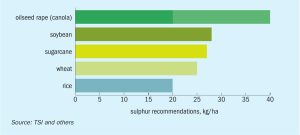

Sulphur is becoming an increasingly vital crop nutrient, due to a combination of lower sulphur deposition from the atmosphere, the increasing prevalence of high-analysis fertilizers and higher cropping intensity.

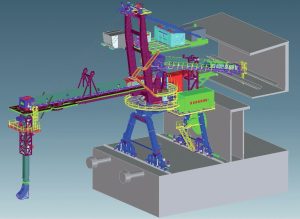

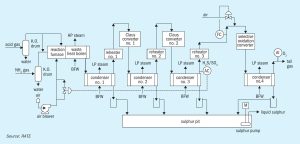

Condensate formation in sulphuric acid plants can cause severe corrosion problems leading to high maintenance and plant downtime. Santhosh S . of Metso Outotec discusses the importance of carrying out regular monitoring and maintaining accurate and detailed data about condensate to increase equipment life and avoid downtime. Different sources of condensate formation in the plant are discussed as well as the typical locations in the plant where the condensates end up.

Acid output is expected to increase as copper mining and smelting increases; the copper market is moving moves from deficit to surplus, with copper output expected to rise 5% in 2022 as demand increases for electric vehicles.

M. Rameshni and S. Santo of Rameshni & Associated Technology & Engineering (RATE USA) report on advanced catalysts for increasing the sulphur recovery efficiency of new and existing sulphur recovery units to meet stricter environmental regulations.