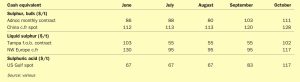

Price Indications

Market Intelligence Price Indications Table 1: Recent sulphur prices, major markets

Market Intelligence Price Indications Table 1: Recent sulphur prices, major markets

One of the things that produced a lot of worried news headlines over the past couple of years is whether the energy transition is likely to lead to a shortage of sulphur as we switch away from fossil fuels on a large scale. As we’ve discussed in this magazine, those fears are overblown, certainly in the medium term future. Peter Harrison of CRU tackled the issue in his sulphur markets presentation at the recent Sulphur and Sulphuric Acid conference in New Orleans, and while he did admit to some reduction in sulphur supply from oil in the 2030s and increasing into the 2040s, increased sulphur recovered from sour gas is likely to more than make up for that at least until the 2040s. But one of the things that did strike me about his presentation is the extent to which the energy transition is indeed already changing the way that the sulphur market works, and will increasingly do so over the next few years.

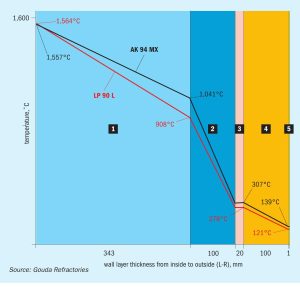

Gouda Refractories continues to upgrade its refractory solutions for the sulphur recovery industry as well as developing new superior products for installations operating at higher temperatures due to oxygen enrichment.

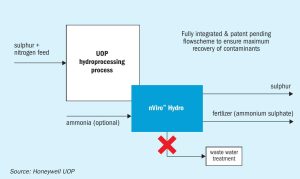

Honeywell UOP’s nViro Hydro process provides an alternative solution to conventional hydroprocessing waste treatment. Benefits include creating a new revenue stream and reduced capital outlays, operating expenses and water use.

First Quantum Minerals Ltd. has contracted with MECS, Inc. (MECS), a subsidiary of Elessent Clean Technologies, for the Kansanshi smelter expansion at the Kansanshi mine at Solwezi. MECS’ scope of work will include a redesign of the existing sulphur-burning sulphuric acid plant into a copper smelter off-gas recovery sulphuric acid plant. This transition to a copper smelter off-gas recovery acid plant will enable First Quantum to reduce emissions from the existing copper smelter, increase production at the mine, and supply more copper to the global market, which will enable the adoption of greener technologies. MECS’ design for First Quantum incorporates proprietary technologies such as MECS® catalyst for low emissions and high conversion, Brink® mist eliminators, ZeCor® alloy towers and pump tank and UniFlo® acid distributor technology for operational reliability and efficiency.

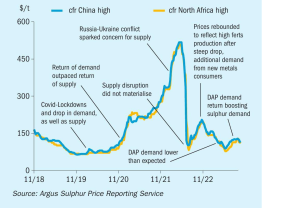

Volatility in sulphur prices has been reduced in the past year following the large price spike and subsequent drop in the summer of 2022. This price volatility has been due to various disrupted seasonal trends from the global pandemic, uneven recovery, geopolitical shifts and demand destruction for fertilizers.

While the world’s attention has been grabbed by the terrible situation in the Middle East, the Russian-Ukrainian conflict continues to drag on. Of particular concern in recent months has been the deal to allow export of grain from Odessa, which lapsed in July 2023, a year after it first began. The deal had allowed 33 million tonnes of grain to be exported, around 60% of it to the developing world. However, Russia had always insisted that continuing with the deal was contingent on (a) a resumption of Russian ammonia exports via Odessa and (b) removing SWIFT payment restrictions on the Rosselkhozbank agricultural bank, allowing easier export of fertilizer. Fertilizers remain exempt from sanctions on Russia, but the difficulty in securing payment, the closure of the ammonia pipeline to the Black Sea, and high maritime insurance rates for traversing the Black Sea have made exports much more difficult. And although Ukraine continues to export grain, now mostly via rail to ports like Ismail and Reni on the River Danube, Russia has done its best to disrupt this, striking ports and warehouses and laying mines in shipping lanes. Around 300,000 tonnes of grain has been destroyed, according to Ukraine, as well as up to three ships hit by mines and one possibly by a missile on November 8th. Furthermore, bottlenecks in rail transit and port capacity and the difficulty in getting ships to the ports mean that actual volumes of grain exported are considerably reduced, with only around 700,000 tonnes exported via the Danube Ports from August to the start of November.

Argus in collaboration with CRU will convene the 2024 Fertilizer Latino Americano conference at the Hilton Downtown Miami, Miami, Florida, 5-7 February 2024.

Bruce Bodine will become the new CEO of The Mosaic Company from the 1st January 2024. He was unanimously elected by the company’s board of directors at the end of August. His appointment followed the announcement that the current CEO Joc O’Rourke will retire next year. Mr Bodine was also elected company president in August and appointed as a member of Mosaic’s board with immediate effect. He was previously the company’s SVP -North America.

Market Insight courtesy of Argus Media. Urea: Prices in general fell further in late October. Suppliers in most regions were forced to accept lower than expected net-backs due to low import demand and high producer inventories. India was the exception with IPL securing 1.7 million tonnes of urea at $400-404/t cfr under its 20th October tender.