SulGas Mumbai 2024

We report on the key highlights of the annual SulGas® conference, organised by Three Ten Initiative Technologies LLP,, which took place in Mumbai, India, from January 31 to February 2, 2024.

We report on the key highlights of the annual SulGas® conference, organised by Three Ten Initiative Technologies LLP,, which took place in Mumbai, India, from January 31 to February 2, 2024.

In January, Kazakh uranium producer Kazatomprom warned of potential adjustments to its 2024 uranium production due to challenges with sulphuric acid availability and construction delays at new uranium mining operations. In a statement the company said that its projected uranium output for 2024 will be between 21,000 t/a and 22,500 t/d U3 O8 , around 20% lower than the amount it had been expecting to be able to mine. Kazatomprom’s uranium output was 21,100 t/a U3O8 in 2023, down 1% on 2022 figures, with output flat during 4Q 2023. While it said it had sufficient inventory in stock to cover contracted deliveries in 2024, there could be problems for 2025 deliveries.

The phosphate industry, the dominant consumer of sulphuric acid worldwide, has grown to its present size on the back of fertilizer consumption. And while this has seen considerable growth over the past decades, especially in countries like China, India and Brazil, it has generally been fairly steady and – subject to the annual vagaries of weather and the commodity cycle – relatively predictable. However, the world economy is now in the throes of a major transformation towards less carbon intensive generation and use of energy, and that is disrupting many markets, including that for phosphates.

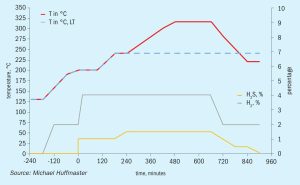

In the final part of this two-part article, Michael Huffmaster , Consultant, presents case study results using a discrete reactor model incorporating heat, mass transfer, and activation reaction kinetics to assess the impacts of these variables on in-bed temperature profile and activation effectiveness. Tailoring gas rate, composition, and temperature progression can achieve in-bed exotherms which improve CoMo catalyst activation effectiveness for low temperature tail gas units.

Falling volumes of sulphur from refining and sour gas could turn Europe into a sulphur importer.

Qatar construction services company UCC Holding has signed a memorandum of understanding with the Kazakh Ministry of Energy for a gas treatment plant at the Kashagan field with a capacity of 6 billion cubic meters as part of the Phase 2B expansion. The memorandum was signed by Minister of Energy Almassadam Satkaliyev and Mohamed Moutaz Al Khayyat, chairman of UCC Holding.

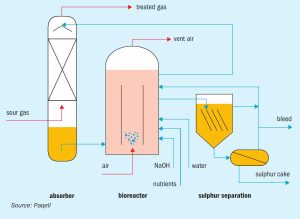

As environmental SO2 emission regulations become more stringent, tail gas treating options become limited. To potentially achieve lower opex and improved plot plan, utilising a biological desulphurisation process as an alternative to a conventional amine-based TGT unit is becoming of increased interest in the oil and gas industry. At the same time, demands for increased SRU capacity and reliability favour the use of medium and high-level oxygen enrichment.

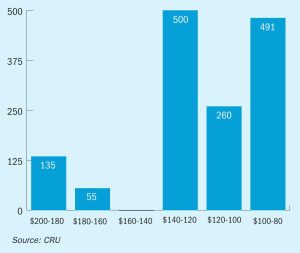

China’s drive to build new battery production capacity for electric vehicles and stationary storage is leading to a familiar problem for the Chinese economy; overcapacity.

Sulphur prices reached a low point in mid-February, with buyers looking to the tender from Muntajat as well as the return of Chinese buyers following the Lunar New Year holiday for the direction that the market would turn. CMOC’s 5 February tender for 40,000 tonnes of sulphur for early-April arrival was indicated awarded in the upper $90s/t c.fr on supply from the FSU, though details were not confirmed.

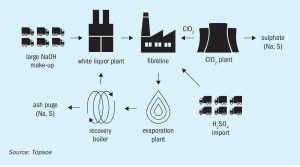

The implementation of WSA technology to recover sulphur as sulphuric acid from lean sulphurous off-gases offers significant environmental benefits. These include waste reduction, resource efficiency and reduced overall CO2 e footprint, while also producing profitable sulphuric acid. By embracing such practices, industries can ensure improved or better consumption and production patterns and foster a more sustainable and responsible future. J. Feddersen and S. S. Johansson of Topsoe illustrate these benefits using three distinct industrial applications where WSA technology provides a smarter way to treat sulphurous off-gases. It is not only waste stream management in the three cases, but also reduced transportation of chemicals, reduced opex and reduced CO2 e footprint.