Sulphur 422 Jan-Feb 2026

28 January 2026

Acid demand for battery production

BATTERY TECHNOLOGY

Acid demand for battery production

The switch towards battery technologies like lithium iron phosphate (LFP) is leading to major growth in demand for sulphur and sulphuric acid.

Sulphuric acid is the key to battery production. Cathode materials need sulphuric acid to make cobalt, manganese, aluminium and nickel sulphates, which form the active material that are the foundation of these battery technologies. Soluble sulphates allow precise control over deposition to form cathode active materials (CAM) during nickel cobalt aluminium (NCA) or nickel manganese cobalt (NMC) cathode processing. Sulphuric acid is also used for the purification of graphite to 99.95% for battery use, and in, recycling, both hydrometallurgical and pyrometallurgical processes use sulphuric acid to recover metals from black mass and convert them back into sulphates for reprocessing into new cathodes. Lithium sulphur batteries offer further potential use for sulphur.

Battery markets

Progressive electrification of power trains is leading to a huge increase in demand for these materials. Global battery demand is projected to double between 2025 and 2029, from 2,000 GWh to nearly 4,000 GWh. While electric vehicle demand has softened recently outside China due to policy rollbacks in both Europe and the United States, and there are high inventories that will require a drawdown, there has been strong growth in the battery energy storage system (BESS) sector. Growth of energy storage is primarily being driven by the economics of power storage, arbitrage, and grid balancing needs.

The majority of BESS demand will be at the utility-scale to support deployment of renewable energy, but there will be rising demand for standalone battery installations, and residential and commercial and industrial (C&I) storage. Despite isolated policy disruptions in several regions, CRU’s outlook remains bullish, under the assumption that it still makes sense to build out solar and BESS, especially in regions with supportive solar profiles; solar and BESS costs and prices will stay low; and by and large, global policies remain supportive to BESS build-out. New demand hotspots are emerging across the world, notably Europe and the ‘global south’, where there is a surging number of PV and BESS mandates, funding, and large-scale project announcements.

Energy storage also remains at the core of China’s power transition plans. In November alone, 45 new provincial battery storage policies were unveiled across China to aid the pricing of electricity from renewable and battery energy storage, with over half of them coming from 12 provinces.

Electric vehicles

The shift to battery electric vehicles is forecast to accelerate, driven by more affordable vehicles due to declining battery costs, stronger competition, and tighter emission targets. However, the pace of change outside China is now at risk as policy support suffers attrition, and legacy automakers are push for more time to adapt.

In Europe, despite a dilution of emissions standards this year, BEV demand has remained strong, driven by high-volume model launches and intensified competition. Plug-in hybrid electric vehicle (PHEV) sales have also increased, supported by stronger model offerings and heightened competition from Chinese brands, which are leveraging their PHEV portfolios. These are subject to lower import duties than BEVs. Further changes to future emission standards in 2030 and 2035 have been announced, providing upside for other powertrain types, such as PHEVs. To boost BEV sales, several countries have introduced new incentives. Italy and France recently launched favourable incentives to support BEV uptake, while Germany plans to roll out a subsidy scheme from 2026. In the UK, a BEV grant is available, and over 25% of BEVs sold currently qualify. Some automakers excluded from the scheme have responded with price cuts. However, despite these positives, manufacturers have ongoing concerns about the region’s competitiveness, and about whether future emissions targets are realistic without further support – especially given the headwinds facing the industry. As a result, the European Commission has responded with an Automotive Package, which proposes a range of measures to support European manufacturers and soften future emissions standards. A central proposal is to relax the 2035 mandate for a 100% tailpipe emissions reduction (versus 2021 levels), replacing it with a 90% target. The remaining 10% could be covered through compensatory mechanisms, such as the use of green steel or renewable fuels, allowing some non-BEV powertrains to remain in the mix. Even so, CRU’s view is that BEVs will still become the dominant powertrain.

In the US, policy rollbacks will slow BEV adoption. Tariffs, the removal of IRA consumer tax credits, the rescission of California’s Clean Air Act, and the elimination of emissions-standard fines will reduce demand for BEVs, with some OEMs falling back on their ICE and hybrid portfolios. There could be further cutbacks to emission policy, with the US administration taking steps to water down the emission standards. These policy changes are set to reduce BEV demand, as OEMs will face less regulatory pressure to prioritise BEV offerings and lean more on their ICE and hybrid portfolios. Pure-play BEV makers will be disproportionately affected, not only by weaker demand but also by the loss of revenue from selling emissions credits to OEMs struggling to meet targets.

However, the Chinese market remains robust, supported by strong consumer sentiment, attractive promotions, and both local and national incentives. These include the ongoing trade-in policy and the NEV purchase tax subsidy, which will decrease from 10% to 5% in 2026. Competitive pressures are expected to persist, ultimately leading to further consolidation. BEV demand has strengthened as product improvements, faster charging technology, and an expanding charging network ease range anxiety. BEV exports continued to strengthen as Chinese automakers expand their EV footprint abroad. PHEV exports also grew, aided by new model launches in Europe and lower import duties than BEVs.

Changing technology

Active support for battery technologies continues in China, and elsewhere, lithium iron phosphate technology is maturing quickly and still expanding outside China, including high compaction density 4th and 5th generation routes. This supports cheaper cells for BESS and many battery electric vehicle (BEV) segments. Given its superior cycle life, LFP is now the dominant chemistry in BESS, but there is a niche for sodium-ion technologies in future. In China, LFP is expanding its presence in all vehicle segments due to advancements in fast charging and energy density.

Fastercharging LFP, and semisolid and solid-state chemistries with increased lithium per kWh, as well as changes in anode/cathode routes will shift future lithium and precursor demand profiles. The first mass-produced electric vehicle with a semi-solid battery technology was launched last year by Chinese automaker SAIC, using lithium manganate (LMO), which has surpassed the performance and cost of lithium-iron-phosphate (LFP). All-solid-state batteries (ASSBs) are often touted as the “holy grail” technology as they promise rapid charging speeds, super-long EV ranges and high safety all in one. However, developers have yet to overcome challenges in ASSB cycle life (how many times a battery can be charged/discharged before its capacity plummets). The poor cycle life arises from solid-solid interfaces breaking apart during use with no liquid to fill the gaps, resulting in lost capacity. Producers have turned to using high-pressure clamps to maintain interface contact, but this adds too much weight and volume to warrant adoption.

Semi-solid batteries (SSBs) are a compromise technology that could render ASSBs redundant. SSBs are similar to ASSBs but retain some liquid content. The added weight is a trade-off, but it substantially increases the cycle life and improves performance on current liquid electrolyte cells. SAIC’s semi-solid pack will contain cells from startup Qingtao Energy and include the use of a manganese-based chemistry, with very few other details. The SAIC-Qingtao joint venture has published three patents relating to semi-solid battery technologies, focused on halide solid-electrolytes combined with a polymer gel or liquid electrolyte.

These SSBs change the anode from graphite and silicon-containing graphite to lithium metal. Lithium metal can store more charge per gram than graphite – 3,860 mAh/g vs. 372 mAh/g respectively – while enabling faster charging cells. This transition will increase the amount of lithium contained per cell and therefore raise overall lithium demand, shifting processing and feedstock needs toward production routes for lithium metal and its precursor compounds. Semi-solid batteries are expected to account for 25% of total battery-grade lithium demand by 2033.

The lack of an LFP supply chain outside China is the main barrier to more profound growth in those markets, but this will expand sufficiently in the long term. Based on the lead time for new projects outside China and for battery development and certification, CRU expects an acceleration in LxFP’s market share in EVs from 2027. Meanwhile, nickel-based chemistries are driven by markets that remain heavily invested in the NMC-based supply chain. NMC will not disappear entirely, but its market share and advantage is being eroded by improvements in LFP. Manufacturers are also reverting from super-high-nickel to medium-nickel high-voltage variants.

Lithium

Significant supply growth is anticipated across all major regions, particularly in 2026. China will lead the growth, adding over 100,000 t/a of lithium carbonate equivalent capacity this year. It will become the largest producer of lithium, surpassing Australia for the first time. Elsewhere, African supply keeps coming, supported by Chinese investment, with countries including Mali and Nigeria rapidly increasing output. Supply in Argentina, Australia and Chile will add a combined 450,000 t/a LCE by 2030, while secondary supply from recycling continues to accelerate, anticipated to account for 9% of total supply by 2030, up from 5% in 2025.

The US is moving into lithium extraction on a large scale. The Thacker Pass project in northern Nevada, being developed by Lithium Americas, will be the largest single-unit lithium operation in the US in more than 30 years. The project has a phase 1 capacity of 40,000 t/a of lithium carbonate, which is sufficient for 800,000 EVs or one-third of Texas’s 2023 stationary storage additions. Sulphur consumption will be 250,000 t/a of liquid sulphur, burned on-site to produce sulphuric acid for clay leaching; the clay is potassium-based and highly basic and hence requires significant volumes of acid. The acid extracts magnesium, and potassium ions; excess acid is neutralised post-leach, producing magnesium sulphate as a neutral by-product, with no acid mine drainage. Heat recovery from the acid production will generate around 50 MW of electricity to power the plant. Longer term, the site could expand up to 160,000 t/a of lithium carbonate, multiplying sulphur demand by five. Each phase is a “cookie-cutter” design interlaced on the same facility. CRU expects US lithium extraction to be consuming 950,000 t/a of sulphuric acid by 2030.

Nickel and cobalt

Nickel processing has been one of the largest growth areas for sulphuric acid consumption. Nickel HPAL (high-pressure acid leach) operations consume 12-18 tonnes of acid per tonne of refined nickel, similar to lithium clays and rare earths, and sulphuric acid represents 19% of all-in operating costs – the single most expensive input. Indonesian sulphur imports surged from zero in 2018 to 4.8 million t/a in 2025, and are projected to grow to an estimated 8 million t/a by 2030. Indonesian nickel operations remain profitable even at $450/tonne sulphur and $15,000/tonne nickel, thanks to low labour, energy, and environmental compliance costs. Evolving Indonesian regulations could be a supply risk, however. A recent directive aimed at boosting downstream processing will require nickel intermediate producers (including HPAL) to commit to higher-value products to obtain a business license. Over the next five years, Indonesia is expected to increase its total sulphuric acid production from 13.5 million t/a in 2025 to 27.2 million t/a in 2030. Supply will be a mix of sulphur-burnt acid (80% share by 2030) and smelter acid (13%), with some additional pyrite roasting capacity.

On the cobalt side, the DRC remains the key player. After a US-backed DRC-Rwanda peace deal, a US-DRC strategic partnership, and a Gécamines-Mercuria JV (backed by the US Development Finance Corporation) have been signed which will give the US priority access to DRC projects and offtake. At present however DRC export quotas have tightened the cobalt market. Some relief could come from Indonesian cobalt exports. Indonesian low cost projects will drive almost all non-DRC mined cobalt growth to 2030, adding 15-20,000 t/a of cobalt in both 2027 and 2028. By 2029, Indonesian MHP production could top 100,000 t/a of cobalt. However, policy and regulatory risks are rising. Low nickel prices are prompting Jakarta to tighten supply, mandate higher-value products, require annual RKAB approvals and scrutinise tailings management, putting most planned HPAL capacity at risk, if not advanced before 2029.

Rare earths

Like nickel production, rare earth element (REE) extraction uses 12–18 tonnes of acid per tonne of separated oxide. If all North American REE demand for EVs and wind turbines were produced domestically, it would consume 200,000–300,000 tonnes of acid by 2035. The US sees domestic onshoring as a geopolitical imperative, since China currently controls around 70% of rare earth processing, although US sulphuric acid availability could be a bottleneck.

Phosphates

While most phosphate demand is for fertilizer, high purity phosphates are in increasing demand for lithium iron phosphate demand. The vast majority of LxFP CAM is manufactured via the creation of an FP (iron phosphate) precursor. The main production routes for FP utilise either purified phosphoric acid or technical grade mono-ammonium phosphate. CRU assesses the LxFP demand share in China will peak just shy of 80% in 2025, and projects its share of CAM demand outside China to grow substantially, displacing mostly nickel-based chemistries. Consequently, LxFP’s global demand share of the battery market is expected to continue to grow to around 67% by the early 2030s. The additional phosphate that will be required will consume a further 4 million t/a of sulphuric acid over the period 2025-2029.

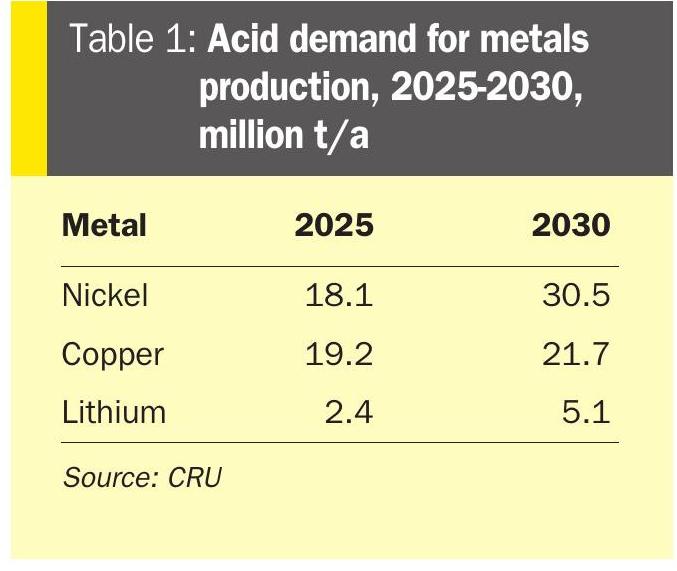

Metals to the fore

Increased demand for battery metals is leading to a major boost to sulphuric acid demand, as shown in Table 1. This year, it is expected that metals-based demand growth will actually exceed phosphate based demand growth for the first time, and over the next few years they will be roughly on par. The energy transition cannot happen without sulphuric acid. From lithium clays in Nevada to nickel laterites in Indonesia, from NMC cathodes in China to copper foil in every battery on Earth, acid is the invisible enabler, and we are looking towards a future where metals demand may rival fertilizers. The question is no longer whether battery metals will drive acid demand – it is whether the world can build enough capacity, fast enough, to keep pace.