Fertilizer International 530 Jan-Feb 2026

23 January 2026

The year ahead – new geopolitical rules

2026 MARKET OUTLOOK

The year ahead – new geopolitical rules

We look ahead at fertilizer industry prospects for the next 12 months, including the key economic and agricultural drivers likely to shape the market during 2026.

Tariff shock dims lacklustre growth

The International Monetary Fund (IMF) expects world economic growth to remain relatively stable at 3.2 percent in 2025 and 3.1 percent in 2026.

The economic impacts of US tariffs have been smaller than previously anticipated – so far – according to the Fund’s latest World Economic Outlook report published in October1.

“The good news is that the growth downgrade [from US tariffs] is at the modest end of the range. The reasons are clear. The United States negotiated trade deals with various countries and provided multiple exemptions. Most countries refrained from retaliation, keeping instead the trading system largely open. The private sector also proved agile, front-loading imports and speedily re-routing supply chains,” said Pierre-Olivier Gourinchas, the IMF’s economic counsellor and director of research.

Gourinchas caveated this by adding that it would be “premature and incorrect” to conclude that the US tariffs introduced in April 2025 are not affecting global growth:

• Premature – because effective US tariff rates remain high and trade tensions continue to flare up with no guarantees yet on lasting trade agreements. Tariff costs, which so far have mainly fallen on US importers, may still be passed onto US consumers through higher retail prices. International trade may also reroute permanently, leading to global efficiency losses.

• Incorrect – because counteracting economic forces are simultaneously at play. In the US, for example, economic activity is being supported by loose financial conditions, the softening of the dollar in the first half of 2025 and an AI-driven investment boom. Elsewhere, China is weathering higher tariffs with a weaker exchange rate and redirected exports to Asia and Europe, while Germany’s fiscal expansion is lifting Eurozone growth.

Looking ahead, Gourinchas says the US tariff shock is dimming already lacklustre growth prospects.

“We expect a slowdown in the second half of this year [2025], with only a partial recovery in 2026, and, compared to last October’s projections, inflation is expected to be persistently higher. Even in the United States, growth is weaker and inflation higher than we projected last year – hallmarks of a negative supply shock,” Gourinchas said.

Consequently, the global economic outlook remains fragile with risks tilted to the downside. In particular, the IMF highlights the risk of higher tariffs emerging due to renewed and unresolved trade tensions. This, together with supply chain disruptions, could lower global output by 0.3% in 2026, concludes the Fund.

The IMF names “four simmering downside risks” to the world economy as especially worrying:

• The AI surge – promise or peril?

• China’s structural struggles – particularly the financial risks from its shaky property sector

• Mounting fiscal pressures – facing some governments in major advanced economies.

• Imperilled institutional credibility – with central banks under political pressure to ease monetary policy to support the economy, a move which always backfires, says the IMF, because it endangers price stability and/or increases debt servicing costs.

WHAT DRIVES FERTILIZER DEMAND?

Fertilizer demand is influenced by the complex interplay of many factors – some of which are harder to predict than others. In the short-term, the main drivers of demand include:

• The macroeconomic environment, interest rates, currency exchange rates and farm economics

• Crop prices and fertilizer-to-crop price ratios

• Crop mix, growing areas and crop yields Soil nutrient levels and nutrient replenishment

• Policy, regulation and fertilizer subsidies

• Sustainability, nutrient management and nutrient recycling

Many of these factors vary from country-to-country and region-to-region. Adding to the complexity, these primary drivers are in turn influenced by a host of secondary considerations.

Macroeconomic conditions, by triggering slowdowns or expansions in global, regional and national growth, control overall economic demand and affect the health of agricultural markets. Farm economics and attendant issues such as working capital, interest rates, credit availability and barter ratios have a more direct impact on the cost of doing business and the ability of farmers to purchase fertilizers.

Crop prices and fertilizer-to-crop price ratios act as key controls on crop nutrient demand as they play a critical role in determining farm buying power and (alongside exchange rates) fertilizer affordability. Crop prices in turn are driven by the harvest size annually, stock levels and demand for agricultural commodities. Fertilizer industry analysts pay particularly close attention to the prices of cereals, oilseeds, cotton, sugar and palm oil, the main fertilizer-consuming crop types globally.

The biofuels market is also an important driver of fertilizer demand due to large-scale cultivation of maize and sugarcane for ethanol and oilseed rape (canola) for biodiesel (Fertilizer International 474, p22). Crop failures due to extreme weather events such as El Niño (Fertilizer International 475, p38) and La Niña can also affect fertilizer demand in the short-term.

Ag commodities – pawns on a geopolitical chessboard.

Global agricultural has entered a new phase where geopolitics – alongside traditional market drivers – will dictate trade flows, prices and production decisions, according to Rabobank’s Agri Commodity Outlook 2026 published in November2 .

Trade wars, by reshaping long-standing patterns of production and export through tariffs and subsidies, are leading to a fragmented, policy-driven global food system, the report concludes.

Increasingly, the world is becoming divided between two spheres of influence – the United States and China – with agricultural commodity exports becoming “pawns on a geopolitical chessboard”, Rabobank reports.

“Agriculture is no longer playing by supply-and-demand rules, it’s also playing by geopolitical ones,” said Carlos Mera, Rabobank’s head of agri commodity markets research. “We are only at the beginning of the middle game.”

A trade conflict that began with tariffs has now evolved into a global subsidy race. Governments across the world – from the US and Brazil to Indonesia, Argentina, and Russia – have intensified agricultural support through direct payments, minimum price guarantees, and biofuel mandates, the report suggests.

“This widespread protection has muted the reaction of farmers to low prices and will likely sustain high total planted areas, keeping global grain and oilseed prices subdued for 2026,” says Rabobank.

In the US, soybean plantings have fallen to their lowest level in six years – as US farmers anticipated export barriers with its dominant soybean buyer China – while corn has expanded to its largest area since the 1930s. The consequent rise in US corn stocks by the end of the 2025/26 season will depress volatility and keep corn prices low, the report predicts.

“Increasingly, the world is becoming divided between two spheres of influence – the United States and China – with agricultural commodity exports becoming pawns on a geopolitical chessboard.”

Tariffs and trade barriers are also leading to widening price gaps between agricultural producing regions.

“Before the Trump-Xi agreement, Brazil’s soy export prices benefited from strong Chinese demand, while US prices were heavily depressed. US and Brazil soybean prices have come closer together since the announcement of the agreement but, given that we still see a lot of trade barriers ahead, more price differences are likely,” Mera said. “We expect these geographic price differentials to persist or increase in 2026.”

The unintended consequences of the tariff war are still being corrected, the report notes. US authorities, for example, are reviewing tariffs on products the country does not produce – such as coffee and cocoa – which could ease costs for US consumers and restore trade flows from producing nations.

Rabobank highlighted three other ag commodities trends for 2026:

Wheat. While prices are expected to be capped by cheap corn, these could be lifted by adverse weather or renewed geopolitical tensions. The 2025/26 season is set to deliver the first global wheat surplus in six years, with output up by 25 million tonnes. Lower prices in 2025 (USc 533/ bu average) will, however, most likely trigger area gly, the ecoming tween reductions next season, resulting in a projected 4 million tonnes deficit in 2026/27.

Coffee. After record-high arabica and robusta prices in 2025, Rabobank expects supply and demand to balance in 2025/26 and then be followed by the first significant global surplus in five years in 2026/27 – estimated at 7-10 million bags. After some short-term volatility, coffee prices are expected to stabilise at between $2.5-3.5/lb by the end of 2026.

Cocoa: Prices nearly halved in 2025, amid a rebound in production and weak demand. Rabobank forecasts a 328,000 tonne cocoa surplus for 2025/26 building to a potential 403,000 tonne surplus in 2026/27. With cocoa production shifting from Côte d’Ivoire and Ghana toward Latin America and Indonesia, overproduction and price volatility risks will increase in future.

The only certainty for ag commodities is uncertainty, concludes Carlos Mera, with geopolitical fragmentation redefining global agriculture.

“We foresee continued trade disruptions, fluctuating regional prices, heavy government intervention, and a high probability of unexpected events. Farmers, traders, and policymakers alike must prepare for a world where trade is disrupted and the unexpected is now the baseline,” Mera said.

Fertilizer demand growth slows

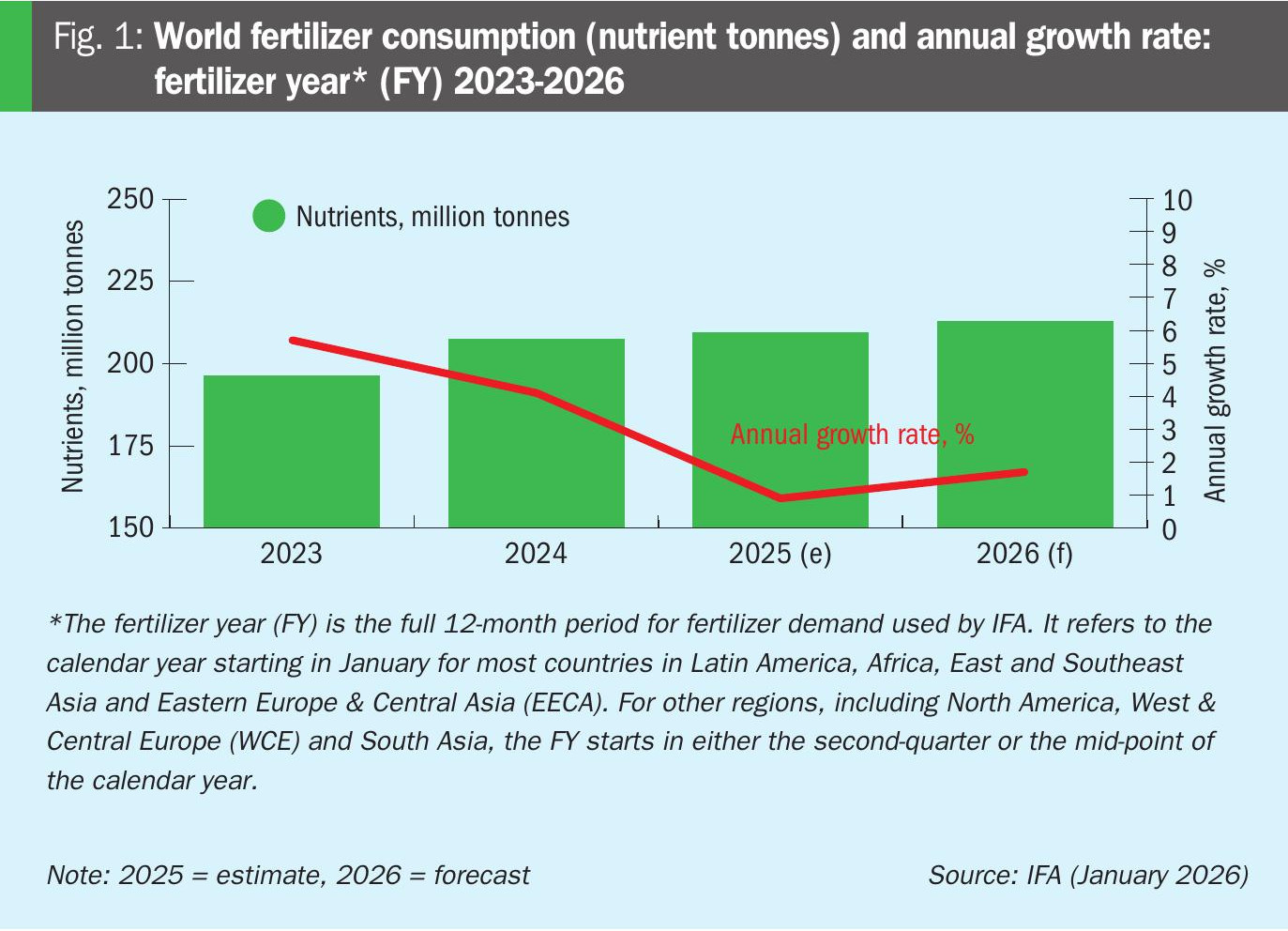

Globally, the International Fertilizer Association (IFA) is forecasting a sharp slowdown in fertilizer consumption growth in its latest Short-Term Fertilizer Outlook3 . This is expected to increase by just 0.9% year-on-year (y-o-y) to 209.5 million tonnes nutrients (N + K2 O + P2 O5 ) for the fertilizer year 2025 (FY2025). That compares to y-o-y consumption growth of 4.1% in FY2024 and 5.7% in FY2023 (Figure 1).

Lower crop prices and reduced fertilizer affordability affected fertilizer use last year, according to the Association. These factors have acted in concert with high interest rates, import duties, currency depreciation and unfavourable weather to depress demand3 .

The consumption pattern for individual nutrients is mixed:

• Nitrogen fertilizer use is set to grow relatively strongly in FY2025 – rising by 2.0 million nutrient tonnes to 119.8 million tonnes N – driven by strong national support programmes in Asia.

• Meanwhile, a small decrease in phosphate fertilizer use is expected in FY2025 – down by 0.4 million nutrient tonnes to 48.5 million tonnes P2O5 – linked to consumption declines in North America, East Asia and Oceania.

• While potash fertilizer use overall is expected to grow in FY2025 – up by 0.3 million nutrient tonnes to 41.2 million tonnes K2O – increases in Latin American and South Asian consumption are partly offset by declines in North America and the palm oil producing countries of East Asia (Malaysia and Indonesia).

After slowing in FY2025, IFA expects global fertilizer demand growth to rebound by 1.7% this year (FY2026), with consumption set to increase in most regions across the globe – except for North America and Oceania. Uncertainties still abound, however, and the following year-on-year changes in regional consumption in FY2026 are subject to a number of caveats:

• Eastern Europe & Central Asia: +4% demand growth. Assumes higher application rates in Russia and a better agricultural outlook in Ukraine.

• Africa: +4% demand growth. Assumes optimism prevails and governments provide support.

• West Asia: +3% demand growth.

• South Asia: +3% demand growth. Assumes normal rainfall and continued government subsidy support.

• Latin America: +3% demand growth. Assumes higher crop prices and improved fertilizer affordability.

• East Asia: +1 demand growth. Assumes more affordable fertilizers and continued government support.

• Western & Central Europe: +1% demand growth. While phosphate fertilizer use is expected to recover, the forecast is subject to many uncertainties, including the EU’s introduction of CBAM, the carbon border adjustment mechanism (Fertilizer International 526, p14).

• North America: a -1% demand contraction is expected linked US economic uncertainties.

• Oceania: a -4% demand contraction is forecast on the expectation of drought.

Summing up, IFA’s says that, while geopolitics and trade remain wildcards, fertilizer demand fundamentals are robust and confidence in economic growth is strong.

“Farmers, traders, and policymakers alike must prepare for a world where trade is disrupted and the unexpected is now the baseline.”

Urea and potash output at record highs

IFA’s preliminary estimates of 2025 global production and trade for the main fertilizer commodities – versus 2024 – are as follows3 :

• Urea production (+2%) and trade (+4%) increased to record levels of 204 million tonnes and 56 million tonnes, respectively, led by China’s rebound and international re-entry.

• Monoammonium phosphate and diammonium phosphate (DAP/MAP) production is reported to be back on track (+1% to 67.7 million tonnes), while trade remained sluggish (+1% to 39.4 million tonnes).

• Muriate of potash (MOP) production globally (+1% to 77.1 million tonnes) saw its second consecutive year of record-breaking output, while trade also grew strongly (+5% to 63 million tonnes).

IFA is currently forecasting the following fertilizer production capacity additions over the two years 2025-20263 :

• A 7.8 million tonne increase (+4%) in nitrogen capacity (ammonia) from 195 million tonnes to 203 million tonnes N – driven by new capacity in China and low-cost projects in the US and Russia. This includes the start-up of a large-scale (1.2 million tonnes per annum) ‘blue’ ammonia project in Qatar.

• After a very quiet year for phosphate capacity (phosphoric acid) in 2025, with few global changes to report, the installation of new capacity is expected to rebound by 2.6 million tonnes (4%) this year, mainly located in Africa and China, taking total global capacity to 65.7 million tonnes P2 O5 .

• After a lull in 2024, potash expansion projects (Russia, Laos, Canada, Jordan, Spain), together with two new projects (Laos and Belarus), will see global potash capacity expand by 3.8 million tonnes to 68.1 million tonnes K2 O over the two years 2025-2026.

Summing up

The key takeaways from IFA’s latest Short-Term Fertilizer Outlook3 are:

• After two strong years, fertilizer demand growth is expected to slow in FY2025 before rebounding in FY2026.

• Nitrogen fertilizer use will lead on growth over this two-year period, followed by potash and then phosphate.

• Regionally, Asia and Latin America are expected to drive fertilizer consumption globally in 2025-2026, with economic uncertainties affecting demand elsewhere.

• A steady pace of investment in fertilizer supply capacity is expected during 2025-2026, with this then accelerating from 2027.

• While many factors are shaping global fertilizer supply – from geopolitics to policy and regulation – market fundamentals are expected to remain the ultimate drivers of fertilizer output.

“Asia and Latin America are expected to drive fertilizer consumption globally in 2025-2026, with economic uncertainties affecting demand elsewhere.”

CRU in its top fertilizer calls for 2026 predicts:

• European affordability pressures will lead to lower fertilizer import duties and CBAM carve outs.

• China NP exports to slow on a shift back to DAP/MAP – while global importers continue to evolve towards a more diverse product mix.

• Phosphate investment builds momentum – with capital from less traditional sources for projects in riskier jurisdictions.

• Indian urea and DAP imports to remain high as domestic production faces limitations.

• China urea exports will start earlier and be more substantial – CRU forecasts almost 6 million tonnes.

• Potash projects internationally will face further delays and capital overruns – while Russia continues to explore further projects and expansions.

• Sulphur prices to remain above historical norms in the first half of 2026 – but the year’s second half will see price relief as supply tightness eases.

• European nitrogen majors to invest in US ammonia capacity and offtakes – pivoting away from their existing high emissions sources.

• China’s ‘anti-involution’ policy will not result in fertilizer capacity consolidation – but it may lead to looser urea export restrictions.

References