Fertilizer International 530 Jan-Feb 2026

23 January 2026

Dry bulk market to weaken in 2026?

BULK FREIGHT OUTLOOK

Dry bulk market to weaken in 2026?

BIMCO, the leading international shipping association, expects the global supply/demand balance for dry bulk freight to loosen slightly in 2026 – albeit from a high baseline. This may lead to weaker freight rates over the next 12 months, explains Filipe Gouveia, BIMCO’s shipping analysis manager, especially for the ship sizes used to transport fertilizers.

The dry bulk carrier Ultra Regina. PHOTO: CANPOTEX

2025 defied expectations

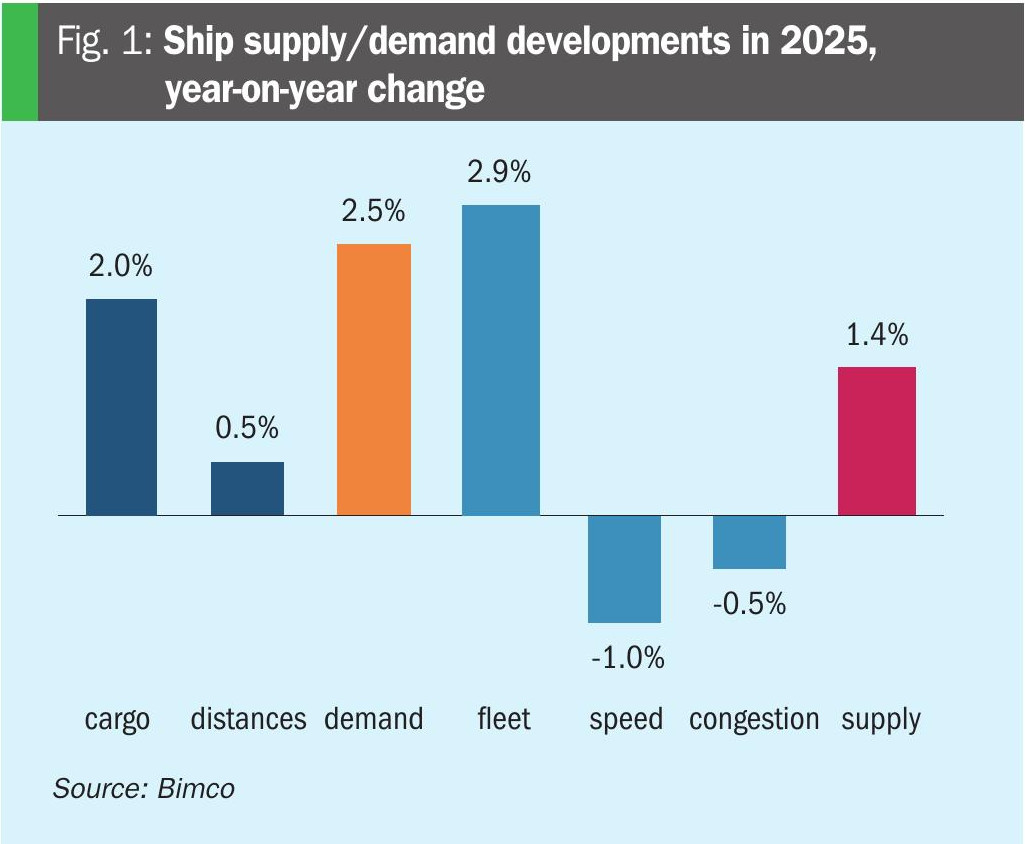

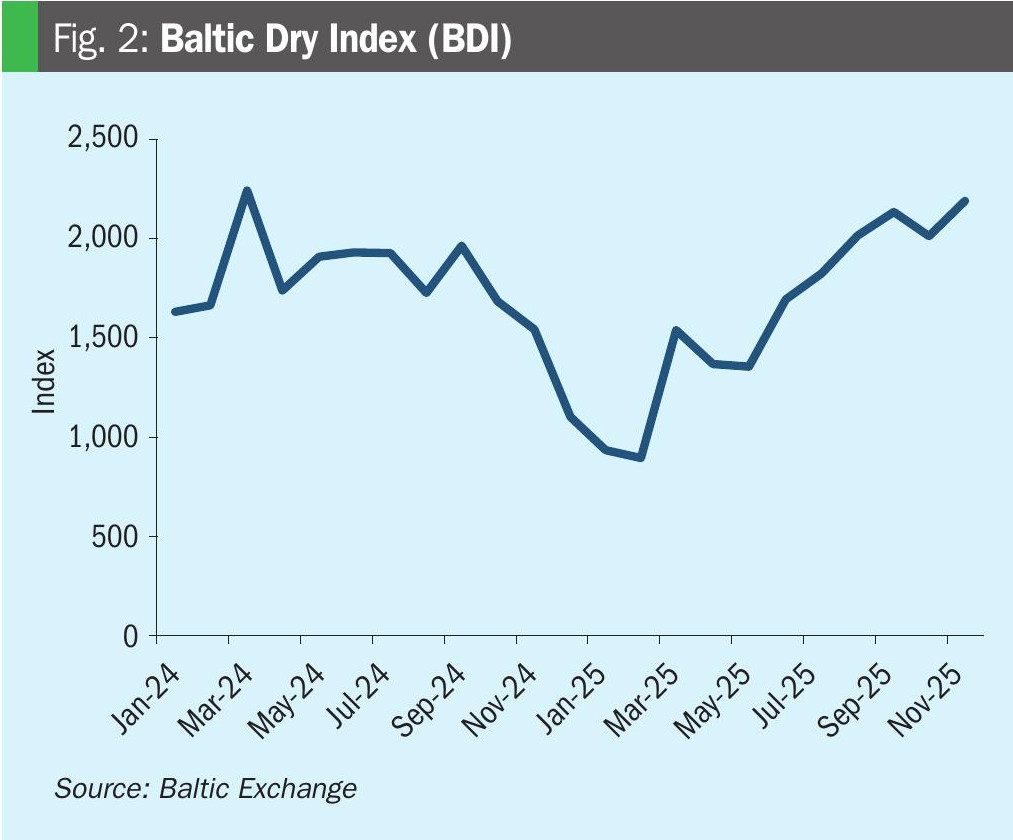

The dry bulk supply/demand balance tightened in 2025, with an estimated 2.5% rise in ship demand for the year outpacing 1.4% growth in ship supply (Figure 1). The Baltic Dry Index (BDI), meanwhile, fell 30% year-on-year (y-o-y) during the first half of 2025, but rose 15% y-o-y between July and November (Figure 2). After a weak start, dry bulk demand eventually firmed up in 2025 across the three largest dry bulk commodities: iron ore, coal and grains (Figure 3).

Average sailing distances lengthened by an estimated 0.5% in 2025, driven up by stronger iron ore and minor bulk shipments. Longer sailing distances, in turn, boosted ship demand – since ships take longer to finish each trip – with more ships needed to transport the same amount of cargo.

Cargo demand growth slowed y-o-y to 2% in 2025 (down from 2.7% in 2024), as weaker economic conditions combined with commodity-specific developments. Changes in US trade policy dampened overall economic activity and directly affected coal, grains and steel shipments. The global economy did, however, fare better than expected, due to the scale-back in US tariffs and several trade agreements agreed by the Trump administration, including one with China.

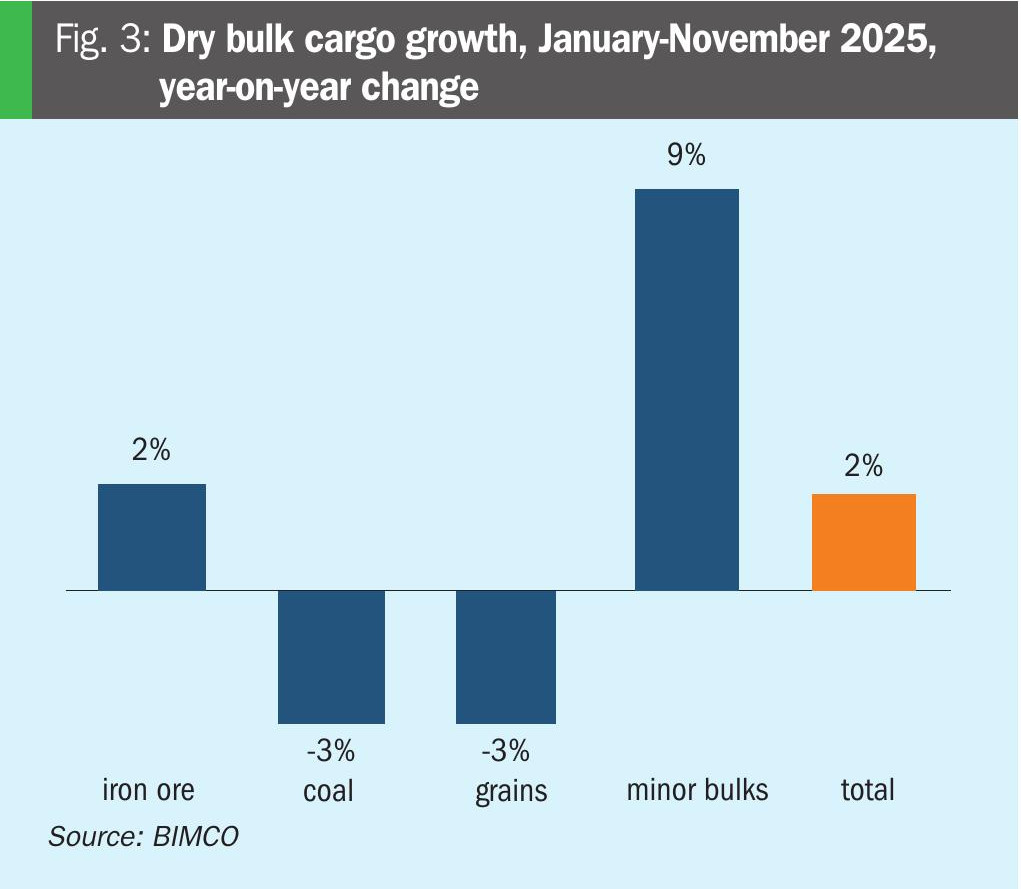

Minor bulk cargoes were a key demand driver last year, growing 9% y-o-y between January and November 2025 (Figure 3). Shipments of ores and concentrates grew particularly strongly, surging by 16% over this period. These commodities play a key role in the energy transition with growth supported by strong demand in China – driven by the rapid expansion of the country’s renewable electricity capacity, electric vehicle production and aluminium output.

Iron ore shipments grew by 2% y-o-y in 2025 (Figure 3), growing most strongly towards the end of the year, as China built up inventories. Iron ore is used to produce virgin steel with China – the world’s largest steel producer – accounting for 54% of global production.

Between January and November 2025, coal and grain shipments fell by 3%, compared to the same period the previous year (Figure 3). Coal import demand fell amid weaker steel production, greater renewable electricity generation in India and China, and higher domestic coal supply in China. Grain shipments, meanwhile, fell due to lower wheat shipments as trade out of the Black Sea weakened.

On the ship supply side, the dry bulk fleet is estimated to have grown 2.9% in 2025, driven by high deliveries of panamax ships (Figure 1). Ship recycling remained low compared to historical levels but was still up 33% y-o-y between January and December 2025. Overall, ship supply is estimated to have grown 1.4% in 2025 (Figure 1), 1.5 percentage points below expected fleet growth (2.9%). This was due to a decrease in fleet productivity as sailing speeds fell and congestion increased.

“Bulk freight rates could weaken over the next 12 months, according to BIMCO, especially for the ship sizes used to transport fertilizers”

Poor outlook for iron ore and coal shipments

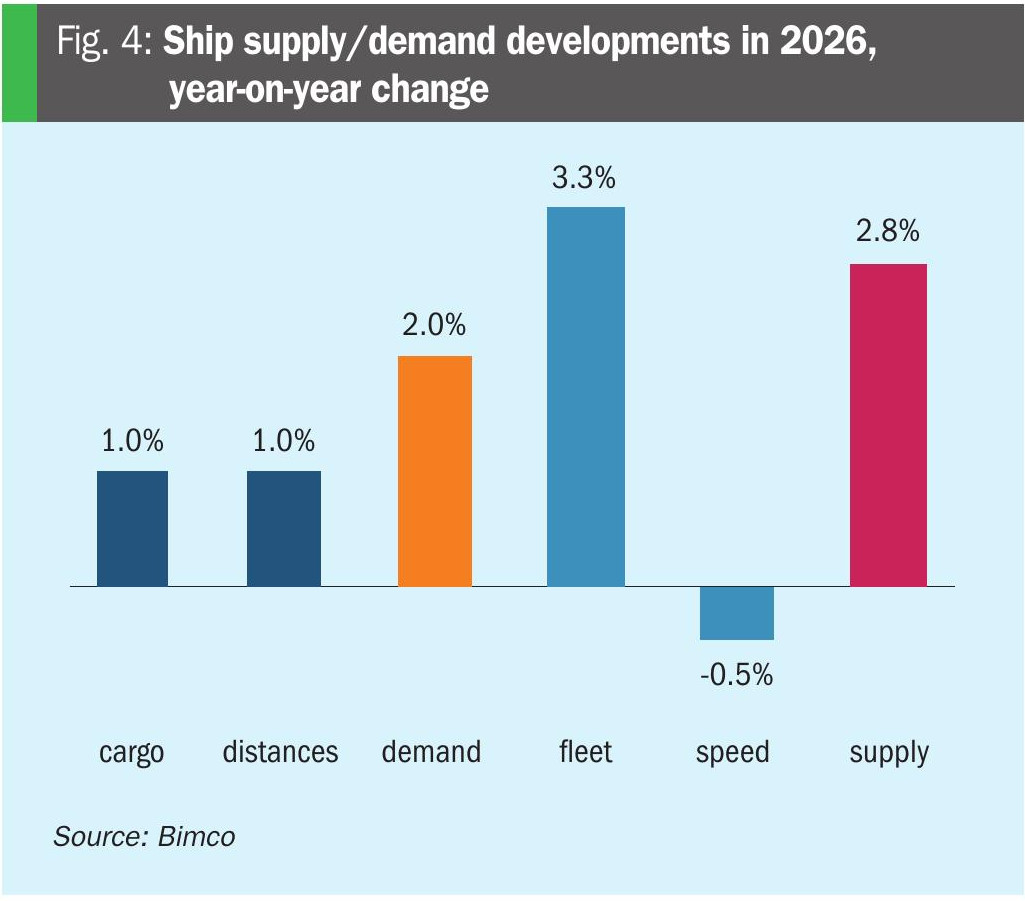

BIMCO expects the dry bulk market to weaken slightly in 2026, albeit from a high baseline, a development that could lead to lower freight rates. Ship demand is forecast to grow 1.5-2.5% y-o-y in 2026, outpaced by the expected 2.8% growth in ship supply (Figure 4).

Supply growth is expected to be slowest for capesize ships, a segment which is also expected to benefit from longer sailing distances. Conversely, the panamax and supramax fleets are expected to grow the fastest, with a consequent negative impact on the freights rates for both these segments.

BIMCO expects the 1.5-2.5% growth in ship demand forecast for 2026 to be divided 50:50 between higher cargo demand and longer sailing distances. The rise in sailing distances is linked to an expectation of more iron ore and bauxite shipments from the South Atlantic to East Asia, combined with a decline in coal shipments, these typically being associated with below average sailing distances.

A downturn in economic conditions could also negatively affect dry bulk cargo demand this year. The global economy is forecast to grow 3.1% in 2026, according to the International Monetary Fund, its slowest growth rate since 2020. In China, economic growth is expected to slow to 4.2%, with the country’s lingering real estate crisis, manufacturing overcapacity and weak domestic demand all exerting a negative effect.

Growth in iron ore shipments of just 1% or less is expected in 2026, as Chinese steel demand is forecast to weaken further. China’s property sector crisis and the resulting drop in construction activity will continue to affect steel demand, while the demand for steel from manufacturing and for infrastructure could also slow. Consequently, we expect any growth in demand for iron ore imports this year to be driven by lower iron ore export prices. A price fall would boost the competitiveness of iron ore exports, versus China’s domestic iron ore supply.

BIMCO expects coal shipments to fall by 1-2% fall in 2026, due to higher renewable electricity generation and a timid steel demand outlook. The International Energy Agency is forecasting a doubling in global renewable energy capacity between 2025 and 2030. China is leading this rapid expansion in renewables with its capacity nearly tripling by 2030. Despite the poor demand outlook, a slowdown in domestic coal mining in India and China could boost trade and keep coal shipments from falling further.

Grain shipments look set to rise by 4-5% in 2026 amid ample supply. The projected growth in soybean shipments, for example, is supported by a large harvest in Brazil and a resumption in Chinese purchasing of US cargoes. The outlook for maize and wheat shipments also appears positive, due to a large exportable surplus from the northern hemisphere harvests and a stable outlook for southern hemisphere harvests in early 2026.

Growth in minor bulk cargo shipments this year, at between 2.5-3.5%, is expected to be down on 2025 because of weaker economic conditions. A slowdown in bauxite shipments is expected during the year as China is nearing its government-mandated aluminium production cap. A rise in trade barriers for Chinese steel exports could also contribute to lower growth for steel shipments.

The dry bulk fleet is expected to grow by 3.3% this year (Figure 4) – its fastest rate since 2022 – supported by a 17% y-o-y increase in ship deliveries. The panamax and supramax segments are expected to grow the fastest, accounting for 35% and 27%, respectively, of ship capacity delivered in 2026.

The loosening of the supply/demand balance this year could result in a decrease in ship sailing speeds of up to 1% – with attendant cost savings due to lower fuel consumption – as well as a slight increase in ship recycling. While weaker freight rates could encourage the recycling of older and less competitive ships, BIMCO still expects ship recycling to remain below historical levels.

Fertilizer shipments growth to slow in 2026?

Fertilizer bulk shipments rose by 10% y-o-y between January and November 2025, driven by strong demand and supported by competitive nitrogen and potash prices. In addition, China’s relaxation of fertilizer export restrictions led to a 42% y-o-y increase in its shipments.

Global fertilizer shipments are expected to keep growing in 2026 but at a slower pace due to lower agricultural demand. The International Fertilizer Association is forecasting annual global fertilizer demand growth of just 1-2% between 2025 and 2029, versus growth rates of 4.5% and 4.4%, respectively, in 2023 and 2024 (fertilizer year basis).

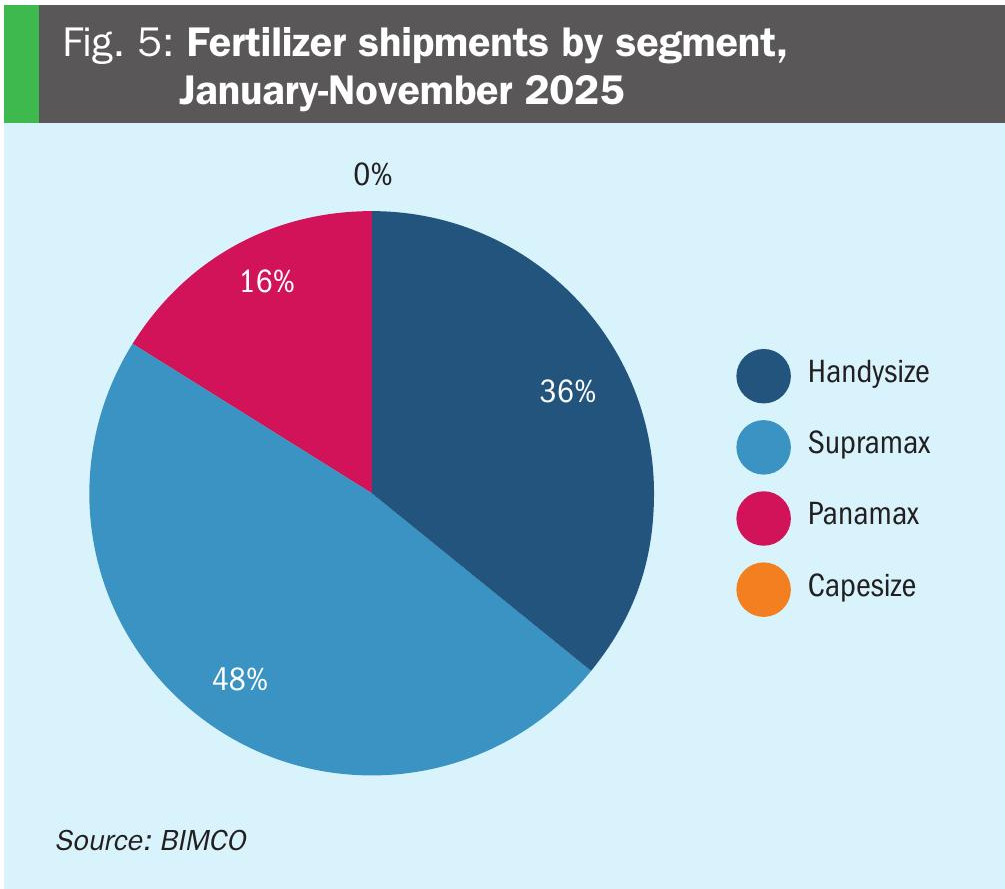

Fertilizer cargoes account for 4% of dry bulk cargo and are primarily shipped by smaller vessels below capesize class. Between January and November 2025, for example, 48% of fertilizer cargoes were transported by supramax ships, 36% by handysize ships and the rest mainly by panamax ships (Figure 5).

Over this period, handysize ships were more commonly used for shipments out of Morocco or the East Mediterranean, transporting cargoes for shorter distances on average. Panamax ships, in contrast, were more frequently used to transport Chinese, Omani and Jordanian cargoes.

Freight rates for segments smaller than capesize may weaken in 2026. Fleet growth is expected to be highest for the panamax and supramax segments, which could pressure rates, while an expected drop in coal shipments would negatively impact demand for these segments.

Weaker demand if ships return to the Red Sea

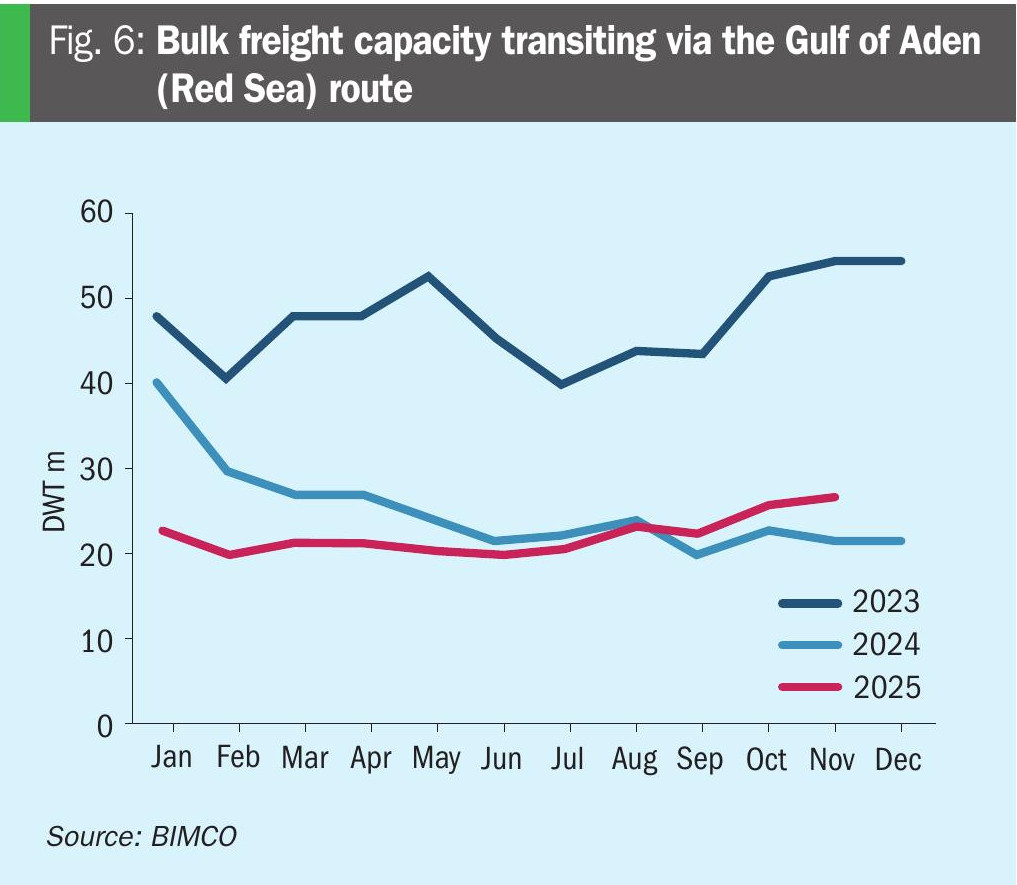

Our forecast for 2026 assumes that ships travelling west of Suez will continue sailing around the Cape of Good Hope instead of via the Red Sea route. Bulk carriers began avoiding the Red Sea in January 2024 and, since then, vessel capacity transiting via the Gulf of Aden has averaged around half of 2023 levels.

This rerouting has boosted sailing distances and led to higher ship demand, especially for the supramax and panamax segments. We estimate that a full return of bulk ships to the Red Sea would be equivalent to a 2% drop in dry bulk demand as sailing distances shorten.

The likelihood of a return of shipping to the Red Sea route increased during the fourth quarter of 2025 with the Gaza ceasefire. This was followed by an announcement by the Houthis in Yemen that they would stop attacks on ships if the ceasefire held.

Much uncertainty remains, however, over when ships will fully return to the Red Sea. While a slight increase in Red Sea transits was observed in November 2025, with a 6% rise in ship capacity transiting the Gulf of Aden compared to October 2025, these transits remained 51% below their November 2023 levels (Figure 6).

Author’s note

The 2026 forecast in this article is based on BIMCO’s October 2025 Dry Bulk Shipping Market Overview & Outlook report. Updates to this report are released quarterly in January, April, July and October.