Sulphur 421 Nov-Dec 2025

21 November 2025

Recent developments in sulphuric acid markets

SULPHURIC ACID

Recent developments in sulphuric acid markets

Smelter outages and tight concentrate markets ease an oversupplied market.

This year is set to be a transitional year for the global sulphuric acid market, with local supply additions set to increase overall availability, but ongoing smelter outages and tight concentrate markets somewhat muting the scale and timing of any price declines.

Supply

The near-term supply increase through 2025 is expected to be led by additional sulphur-burning capacity, notably in Morocco, India, and Indonesia, and by new or restarted smelter capacity (e.g., Adani’s smelter in India, Amman Mineral and expanded Freeport capacity in Indonesia). However, smelter supply growth is currently constrained by the availability of copper concentrate: persistent concentrate shortages are forcing smelters to run at lower utilisation rates, and therefore are likely to limit smelter acid output in some regions, especially China. This concentrates market tightness could persist into 2026, necessitating further smelter cuts or project delays. Pyrite-roaster contributions (e.g., Merdeka AIM in Indonesia) add incremental volumes of acid, as noted in our article elsewhere in this issue on the pyrite sector, but the dominant growth contributor in 2025 remains sulphur-burning expansion.

There has been a fundamental structural change in China’s export mix: exports are shifting away from sulphur-burnt acid toward smelter-derived acid. Whereas sulphur-burnt supply accounted for over 75% of China’s exports in 2018, it is expected to be roughly one-third by 2025. This shift makes the market’s response to import declines more complex; smelter acid behaves differently from sulphur-burnt acid because smelter output depends on concentrate availability and smelter operating rates; when concentrate flows tighten, smelter acid can fall back quickly. Nevertheless, China’s domestic market has remained supportive, with domestic prices rising strongly in 2025 and narrowing the incentive for exporters to offload volumes. As a result, China is positioned to increase market share in traded acid through 2025, particularly where smelter volumes can step into gaps left by outages elsewhere.

Looking to the medium term, by 2029, the market trajectory is toward greater overall supply abundance, with the sulphur-burnt sector still central in regions like Indonesia and Morocco, while smelter-derived acid recovers where concentrate availability allows.

Demand

Overall global demand is forecast to grow from about 306 million t/a in 2024 to roughly 355 million t/a by 2029, driven primarily by a recovery in phosphate fertilizer demand, particularly in Morocco, and a rapid expansion in metals-related demand – notably nickel for battery feedstocks – concentrated in Indonesia. Phosphate-based demand remains the single largest enduse and the primary driver of long-term acid demand growth. Recovery in phosphoric acid production (for DAP and other fertilizers), including higher operating rates in Morocco and rebounding US phosphate activity, is central to a medium-term demand recovery.

Metals-based consumption is forecast to grow rapidly, with nickel-related demand (nickel sulphate/Li-ion battery feedstocks) experiencing the fastest percentage gains, particularly in Indonesia, where massive nickel-leaching projects are ramping up. By 2029 nickel-related demand share is forecast to rise materially from 2024 levels. Other incremental demand sources include ammonium sulphate, uranium, titanium dioxide, manganese, and emerging lithium-linked acid consumption tied to battery supply chains. Demand growth is geographically concentrated: Indonesia leads metals-based increases, Morocco drives phosphate demand, and China shows mixed trends with some sectors (ammonium sulphate) growing while phosphate declines slightly this year due to export allocation policy changes.

Regional highlights

- China: Domestic prices surged in 2025 to their highest levels since 2022, supporting exports even as domestic smelter availability improved. China is expected to ramp up smelter acid supply in 2025 and increase exports by nearly 1 million t/a, though phosphate-policy adjustments via export quotas are creating downward pressure on local phosphate-based demand. The shift from sulphur-burnt to smelter-based exports makes China both a stabiliser (able to fill demand gaps) and a potential source of oversupply if domestic markets do not absorb volumes.

- Indonesia: The single largest geographic change in the outlook is that Indonesia’s total acid production and consumption will grow rapidly through 2029, driven by new nickel-leaching operations and sulphur-burner projects. Smelter commissions (e.g., Amman Mineral, Freeport expansions) and pyrite-based roasters (e.g., Merdeka AIM) substantially raise local supply, which reduces import dependence from 2025 onward. Nevertheless, Indonesia’s own nickel-driven demand rises substantially, possibly consuming much of the new smelter output domestically.

- Morocco: A material increase in on-site sulphur-burning capacity (at OCP’s Jorf Lasfar and related sites) is set to sharply reduce import reliance; imports are forecast to decline towards about 1.2 million t/a in 2025. Moroccan phosphate demand recovery in 2024– 25 underpins higher domestic sulphur-burnt production.

- Chile and Peru: Unplanned smelter outages in Chile (e.g., Altonorte, Potrerillos) in 2025 have raised import requirements substantially in 2025 Q2 and Q3. Consequently, China and other exporters are expected to supply larger long-distance cargoes into the Pacific. Peru’s domestic demand will rise from projects such as Tia Maria (if commissioned as expected), reducing Peruvian exportability by 2028–29.

- India: Local smelter capacity (notably Adani) and new sulphur burners (e.g.,Paradeep Phosphates Limited, plus other projects) will increase domestic supply, but early-stage start-up delays could maintain elevated import needs in 2025. Over time, increased local production should reduce India’s dependence on seaborne acid.

- United States: Demand rebounds in 2025 after a weak 2024, driven by phosphate and, later on in the outlook, from lithium projects. The US will continue to structurally rely on imports of around 3 million t/a, because sulphur-burner capacity additions are lagging consumption growth. Tariff dynamics and project timelines (e.g., new burners) shape near-term import patterns.

- Europe: Smelter acid production has been influenced by maintenance and outages but is projected to recover from 2026 as recent maintenance pressures ease and some new capacity comes online. However, exports from Europe are falling as a greater share of production is absorbed domestically.

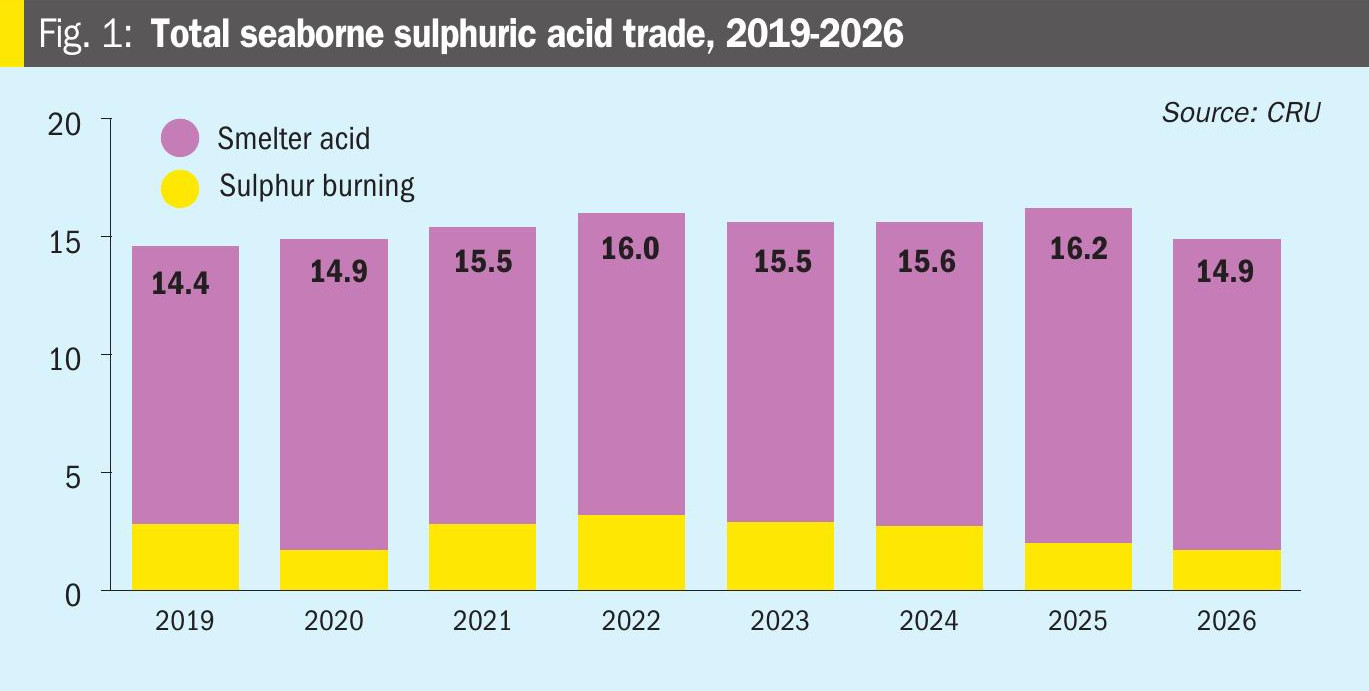

Seaborne trade

Traded acid flows are projected to remain elevated in 2025 as import needs rise in specific markets such as Chile, Saudi Arabia, and Peru, while import demand falls in places where sulphur-burner capacity is added (for example Morocco, India, and Indonesia) and where domestic integration increases. Global seaborne acid trade was relatively stable in 2024 at 15.6 million t/a, and is forecast to rise to 16.2 million t/a in 2025 as import needs grow where smelter supply is weak. The makeup of seaborne exports is evolving: smelter acid accounted for 83% of traded acid in 2024 with sulphur-burnt supply contributing the remainder. By 2025 the share is shifting but sulphur-burnt costs will still heavily influence price-setting. Export volumes from Europe, Japan/South Korea, and other traditional suppliers are expected to decline in 2025 by a combined drop of about 800,000 t/a, while China’s exports are forecast to grow by nearly 1.0 million t/a as it fills gaps in supply, particularly to Chile and Saudi Arabia. Despite growth in producer-side integration (more burners and smelters), long-distance supply, especially Pacific trade flows, remains important due to new demand additions in Chile and Peru.

Prices

Prices have been at elevated levels following supply tightening in Europe and East Asia; the premium of acid cost over the equivalent volume of sulphur rose sharply in 2024 and stayed high into 2025. However, it is expected that acid prices will soften in the second half of 2025 and into 2026 as smelter supply recovers and newly commissioned sulphur burner capacity begins to displace some imports. That said, the price decline is expected to be more muted than earlier anticipated because unplanned smelter outages (notably in Chile, the Philippines, and Namibia) have removed material volumes from the market and because strong domestic pricing in China will offer a floor under international spot levels. The acid-to-sulphur margin and the acid share of downstream product prices (e.g., DAP, copper, nickel) are key affordability metrics: DAP affordability currently looks favourable due to a surge in DAP prices, while metal-sector affordability has weakened as copper and nickel prices rise and acid costs remain firm.

Conclusion

The market is entering a phase where structural supply additions – mainly sulphur-burners and some smelter start-ups – increase overall capacity, but the full price impact is likely to be dampened by smelter outages and ongoing copper concentrate constraints. Traded acid volumes will remain significant through 2025 as China steps in to supply shortfalls and as new importers (notably Saudi Arabia and Chile) raise demand. By 2026–2029, CRU foresees a return toward a more balanced market with slower price trajectories, provided copper concentrate availability improves and planned burner capacities come online as scheduled. Market participants should therefore plan for volatility through 2025 and early 2026 while monitoring concentrate flows, smelter operational status, and sulphur feedstock pricing closely.