Sulphur 421 Nov-Dec 2025

21 November 2025

Price Trends

Price Trends

SULPHUR

Sulphur prices advanced further in October, more than expected, supported by the supply towards the end of summer becoming restricted, with a number of non-mainstream sources facing logistical constraints. Russian supply was cut due to drone strikes at the Astrakhan and Orenburg gas plants in early September. Exports of sulphur from Russian ports fell from around 400,000 tonnes per month to 100,000 tonnes in October. Bullish pricing prevailed, with higher benchmark prices from China and Indonesia.

Indonesian prices reached $420-430/t c.fr at the start of November, with offers heard up to $440/t c.fr. Upward price momentum is likely to continue with a number of buyers lacking the import licenses needed to shift from sulphur to sulphuric acid, according to market participants. As such, demand is expected to tick along throughout November.

Although the phosphate export window has now closed, the bullish sentiment also remains present in China, with deals reaching as high as $420/t c.fr in the south. Additionally, a phosphate producer in southern China is said to have bought Canadian material at $408-410/t c.fr. Port spot prices are reported at rmb 3,350-3,360/t ($472-473/t), up $8/t compared with last week. This port price would indicate a delivered price of around $408/t c.fr. Sulphur port inventories in China decreased by 58,000 tonnes to around 2.299 million tonnes as of 29 October 2025. Stocks at Yangtze River ports rose by 34,000 tonnes to 1.036 million tonnes, while Dafeng port inventories declined by 30,000 tonnes to around 250,000 tonnes.

In the Middle East, the Qatar Sulphur Price (QSP) was set $76/t above October levels, but other monthly contracts by KPC and ADNOC were yet to be released as of the time of writing. Still, the market has not seen benchmark prices at these levels since July 2022 at $428/t c.fr. This, along with higher Asian deals, pushed prices in the Middle East to $400-410/t f.o.b. The new QSP reflects delivered levels to China in the high $410s/t c.fr, and follows the QatarEnergy tender, which is understood to have been awarded at around $412/t f.o.b. to another producer in the region.

The Brazilian market also saw an uptick in prices to $390-395t c.fr, based on higher global levels. The price was indicated as higher in line with higher prices at origin locations, with previous levels no longer considered viable by market sources. The market has seen limited activity after a single bid was presented in a CMOC tender at a level around $410-412/t c.fr. The tender was scrapped, and it is understood that negotiations post-tender also failed, according to market participants. Since then, offers into the market have been heard at around $410-420/t c.fr, but no transactions are understood to have taken place at these levels. The Brazilian market has most recently looked at Canadian material due to the risk of trade tariffs between Brazil and the US. Still, competition for Canadian material has increased with enquiries now reported from Brazil, India, China and Indonesia, according to industry participants.

In the Mediterranean, tight availability alongside persistent demand supported price increases in both f.o.b. and c.fr bases. The price is bullish and further increases are expected on any new business. Mediterranean sulphur prices were assessed up at $380-400/t f.o.b. and $410-425/t c.fr at the start of November.

In Africa, the main Tanzanian port of Dar Es Salaam was reported as closed, with operations halted until at least 31 October. The disruption comes after civil unrest was reported following the general elections held in the country on 29 October. Operations are also being affected by a government-imposed internet blackout, according to industry sources. Dar Es Salaam is the largest port in the country and is considered essential for trade not only by Tanzania but also functioning as an entry point to a number of landlocked neighbouring countries. Sulphur imports into the port are estimated at around 1.2 million t/a, but the country has most recently been building stock at the port, estimated at around 200,000 tonnes.

SULPHURIC ACID

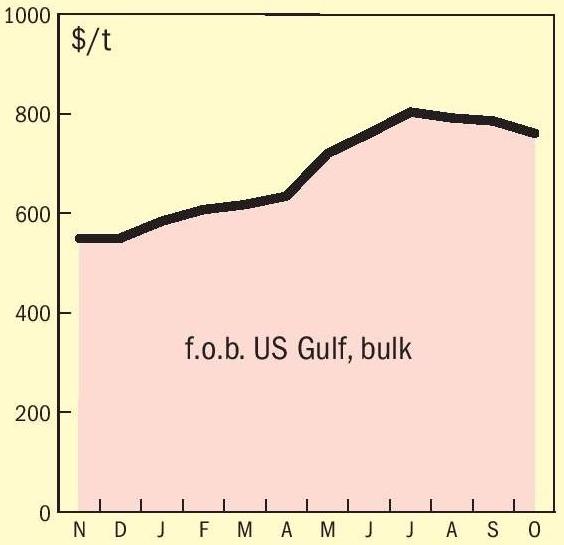

Global sulphuric acid prices have seen steady declines from the peak of July this year, with the return of smelter supply from maintenance, combined with weak demand. October saw a shift to a more bullish sulphuric acid market, driven primarily by a higher sulphur price environment (see above) combined with supply constraints due to limited Indonesian production. Demand also gained momentum. As a result, multiple sulphuric acid benchmarks climbed towards the end of the month, reflecting sustained bullish momentum driven by tighter availability, stronger sulphur pricing, and firmer December-loading indications.

Spot prices for sulphuric acid into the US Gulf were assessed at $125-140/t c.fr, with market sources indicating a number of transactions in the $130-140/t c.fr range. Sentiment is broadly bullish, supported by tightening supply in Europe and elevated sulphur prices.

The Chinese acid export market surged 103% year on year in January-September, with smelter material filling international gaps amid renewed demand from Saudi Arabia and Chile. In October, sulphuric acid spot prices moved to $95-105/t f.o.b., the highest since July 2022. Offers as high as $120/t f.o.b. were reported, though these have not been confirmed. Producers have reportedly recently raised spot offers to around $110/t f.o.b. Again, the market tone is bullish, with strength in sulphur prices supporting higher acid values. In Japan and South Korea, export prices moved up to $80-95/t f.o.b. despite limited liquidity, tracking higher levels in China and reflecting where cargoes would likely clear if moved.

India’s acid market is trending up as sulphur-driven burner economics raise the floor. Trades at $137-145/t c.fr have reset benchmarks. Offers for 20,000 tonnes cluster at $140-150/t, while pricing for smaller lots is higher due to scarcity and freight. Near term, the bias is higher towards $150/t c.fr, with downside capped unless sulphur softens or Chinese availability improves. Paradeep Phosphates Limited (PPL) bought 20,000 tonnes from a trader at $137/t c.fr for equal discharge at Paradip and Mangalore, though several sources indicate the parcel will fully discharge at Paradip. The cargo, reportedly of Far East origin, likely Japan or South Korea, is due late November to early December. Separately, a 10,000 tonne parcel was sold to Mangalore Chemicals at $140-145/t c.fr for December loading, reportedly sourced from China via Torbert; the trader involvement remains unconfirmed. Local traders suggest PPL secured both parcels below prevailing indications. Fertilisers and Chemicals Travancore Limited (FACT) has closed a tender for two parcels of 10,000-14,000 tonnes each for discharge at Cochin. Three bidders participated – Hindalco, Hexagon, and Libra Alkalischemie Private Limited, a new entrant to India’s acid supply chain. Market participants expect offers to reflect the firmer environment, likely $140–150/t c.fr. India’s October acid imports were about 221,100 tonnes, up 38% year on year, according to Interocean vessel tracking, underscoring India’s continued reliance on seaborne supply. Early November arrivals total roughly 48,000 tonnes, keeping inflows steady ahead of the Rabi season.

In October, the northwestern European f.o.b. level edged higher but still remained $37/t down from the peak seen in mid-June at $135/t f.o.b. Availability in the region has started to tighten up despite muted Moroccan demand, with December shipments now reported at $90-95/t f.o.b. Fresh spot interest is now centred on December and January loadings. For secondhalf December into early January, indications have been pegged as high as $100/t f.o.b., with near-term CFc.frR ideas around $105/t. Reported December loadings were $90–100/t f.o.b. Near-term sentiment is bullish, with tight spot supply supporting further gains.

Brazilian spot prices were steady, unchanged for a month amid limited market liquidity. In South America, attention centred on Chile, where initial ideas for annual contract negotiations were heard, with early indications in the $160s/t c.fr. That backdrop, together with firmer global f.o.b. levels, helped nudge Chilean spot indications to $150-160/t c.fr despite a lack of concluded sales. Prices are likely to keep trending higher in the region.

In Chile, the market has been quiet, with prices holding around $153/t c.fr for three consecutive weeks, and significant activity is unlikely to resume until Q2. Even so, a more bullish global backdrop should lend support despite limited demand. Average prices are forecast to firm from $152/t c.fr in October to a peak of $163/t c.fr in February, before drifting back to roughly $152/t c.fr by October 2026.

END OF MONTH SPOT PRICES

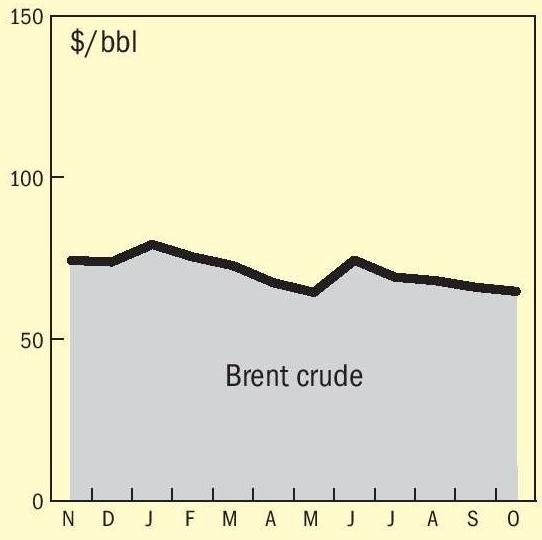

oil

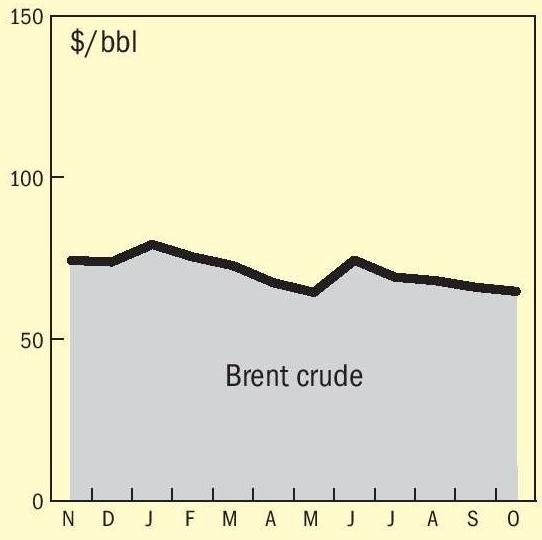

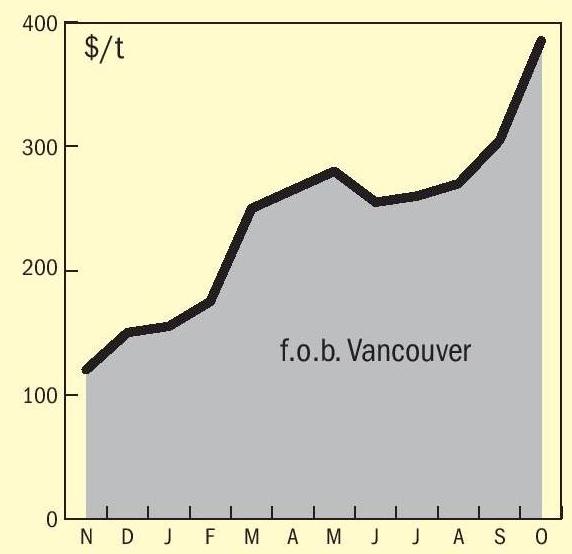

sulphur

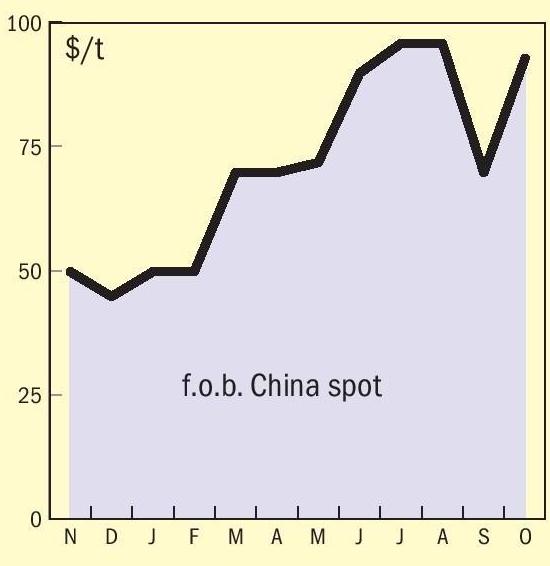

sulphuric acid

diammonium phosphate

Price Indications