Sulphur 421 Nov-Dec 2025

21 November 2025

Market Outlook

Market Outlook

SULPHUR

• Russia is set to impose a temporary ban on sulphur exports, covering liquid, granulated, and lump material, to ensure domestic supply. The measure will be in effect until 31 December 2025. CRU expects Russia to return to the export market in 2026 Q1. On the other hand, exports from Iranian ports are set to come back not only for Iranian production but also for Turkmenistan.

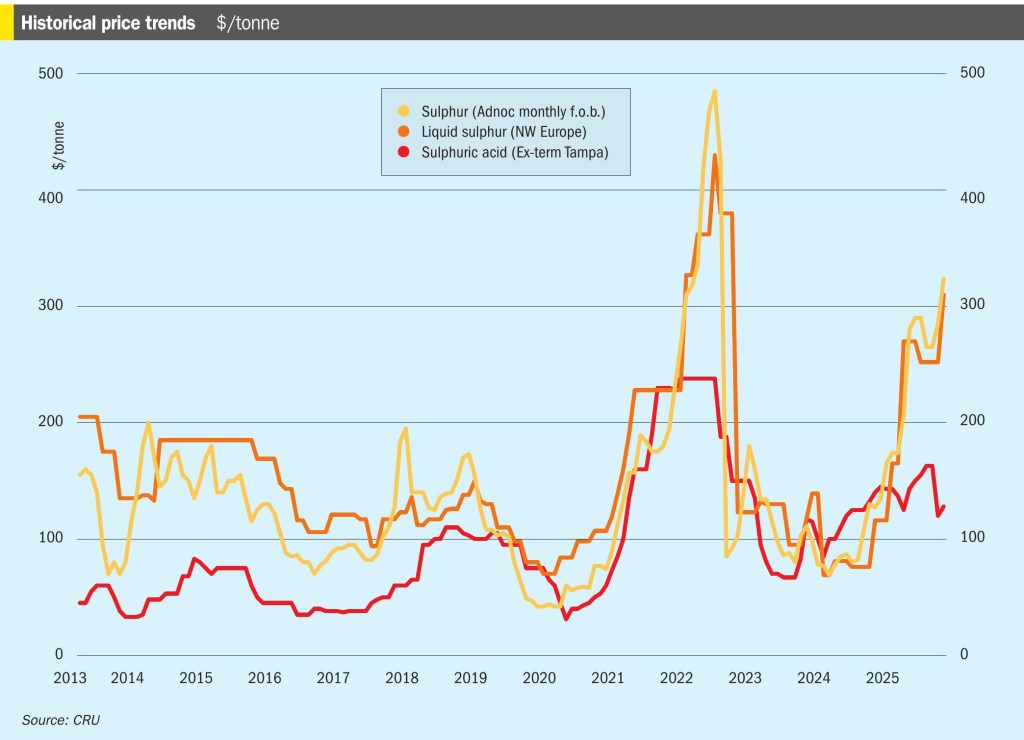

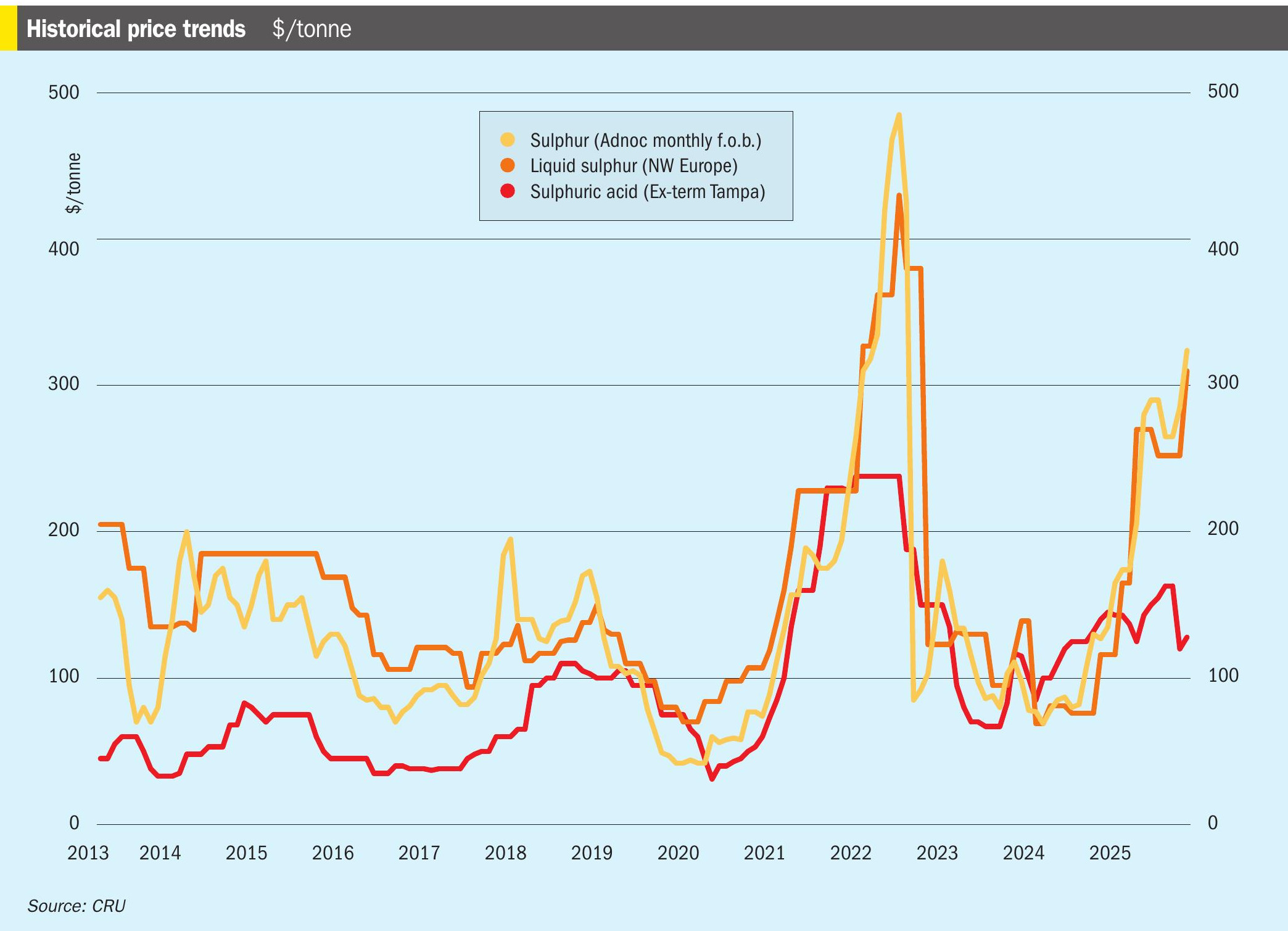

• Sulphur spot prices in the Middle are set to peak at $430/t f.o.b. in December-January before steadily declining to a low of $268/t f.o.b. in October 2026.

• Average Canadian prices moved to $385/t f.o.b., supported by the latest Asian transactions. Prices are set to trend similarly to other key markets, peaking at a forecast price of $420/t f.o.b. in January 2026 before falling to a low of $262/t f.o.b. in October 2026.

• Demand in Asia has been a highlight, with Indonesia particularly active. In the Chinese phosphate sector, sulphur has become chronically unaffordable, with the share of phosphate price already at around 84%, poised to surpass the 2022 peak of 92%. This implies crisis-level cost pressure for consumers. Prices are set to rise until January and then decline through 2026. Unlike 2022, normalisation is less likely to come quickly from the supply side; near-term adjustment will need to come from demand rationing or substitution.

• European sulphur prices are expected to peak in January before correcting lower thereafter. With northern hemisphere winter exports typically subdued, demand will need to soften to pull prices down. The 2026 Q1 decline will be driven largely by increased Russian and Iranian supply and slower Chinese consumption after the New Year holiday.

SULPHURIC ACID

• NW Europe prices are likely to continue higher to an average peak of $92/t f.o.b. in January, then trend lower through the year to a low near $72/t f.o.b. by October 2026. Morocco will likely step back into the market in 2026 Q1 for cargoes, which should help support the European FOB level.

• Chinese demand is likely to be even stronger from Saudi Arabia and from Indonesia in 2026. Higher sulphur prices have encouraged a shift from sulphur burning to importing acid, with Indonesia already taking Chinese cargoes. The price divergence between sulphur and sulphuric acid is incentivising increased acid imports, particularly in Indonesia and India. This should more rapidly absorb any surplus in the market.

• Acid premiums have compressed sharply, with India and China briefly in negative territory, weakening sulphur burner economics. In the near term, firm sulphur prices and constrained Asian smelter availability should keep imports elevated and support sulphuric acid prices into early 2026.

• Overall, prices are expected to rebound in November-December and remain supported through much of Q1, aided by limited Asian smelter availability due to seasonal maintenance and a likely pickup in Chilean procurement