Nitrogen+Syngas 397 Sep-Oct 2025

16 September 2025

Demand for nitric acid

NITRIC ACID

Demand for nitric acid

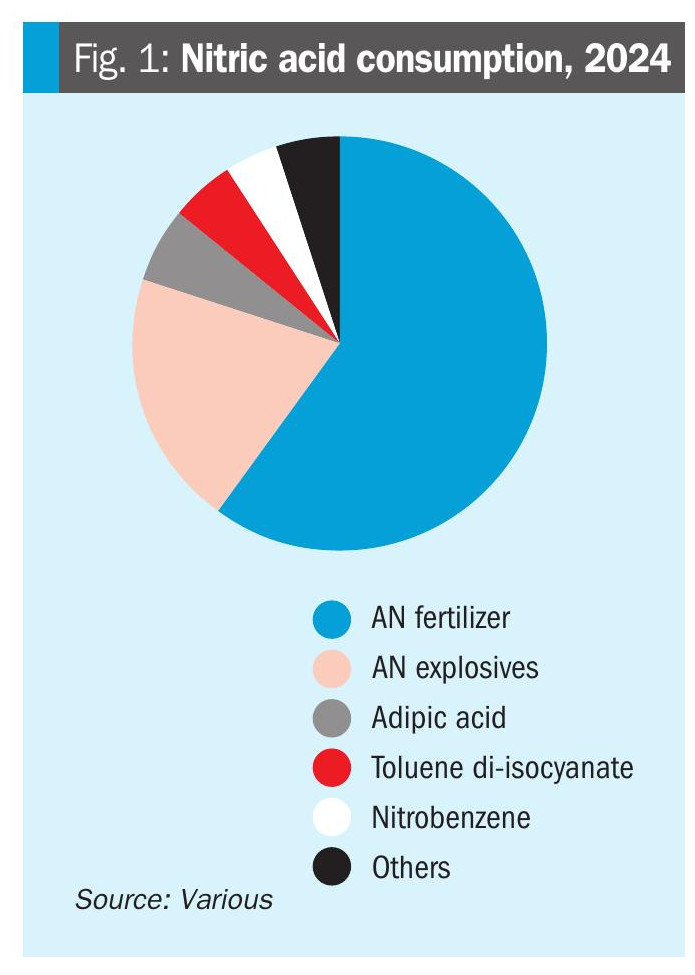

Nitric acid demand continues to be dominated by fertilizer uses via various nitrate and NPK fertilizers, but industrial chemical production, metallurgical uses and explosives production are continuing to contribute to growth, especially in Asia.

Nitric acid is the second most used industrial acid after sulphuric acid. Based on 100% nitric acid, total tonnage was about 80 million t/a in 2024. The route almost exclusively used for nitric acid production is the Ostwald process, developed early in the 20th century by German chemist Wilhelm Ostwald. Ammonia gas is mixed with air and passed over a platinum-rhodium catalyst gauze at high temperatures (around 850°C). This oxidises the ammonia into nitric oxide (NO). The nitric oxide gas is then cooled and further oxidised with excess air to form nitrogen dioxide (NO2). The nitrogen dioxide gas is then passed through absorption towers where it reacts with water to form a solution of nitric acid.

Nitric acid production represents about 10% of all ammonia demand globally.

Uses

In terms of end uses, nitric acid is predominantly used for the production of ammonium nitrate and its various derivatives, including urea ammonium nitrate (UAN) and calcium ammonium nitrate (CAN), as well as other specialty fertilizers and mixtures such as NPK fertilizers (Figure 1). Outside of its fertilizer use, ammonium nitrate is also widely used in the explosives industry as a component of ammonium nitrate-fuel oil (ANFO), a mixture that is the most common industrial blasting explosive, used in mining and quarrying, and representing around 90% of the commercial explosives market. However, while around 80% of nitric acid is used in AN manufacture, the remainder mainly goes to a number of industrial processes, with the three largest by end use being:

• Nitrobenzene production, for use in dyestuffs;

• Toluene di-isocyanate (TDI), used in polyurethane manufacture, and;

• Adipic acid, used in nylon and other polyamide manufacture.

There is also a substantial quantity used in metal extraction and treatment, especially ferrous metal etching and cleaning and the passivation of steel, as well as the reprocessing of uranium.

Various grades of nitric acid are produced. So-called “weak” nitric acid, which has a nitric acid concentration of around 45-65%, is mainly used for fertilizer and ammonium nitrate production. Concentrated (or “fuming”) nitric acid, at around 96-98% HNO3, is used for the chemical and metallurgical uses mentioned above. ‘Highly pure’ nitric acid with parts per billion concentrations of metals or other contaminants is used in the semiconductor industry for cleaning and etching of silicon wafers.

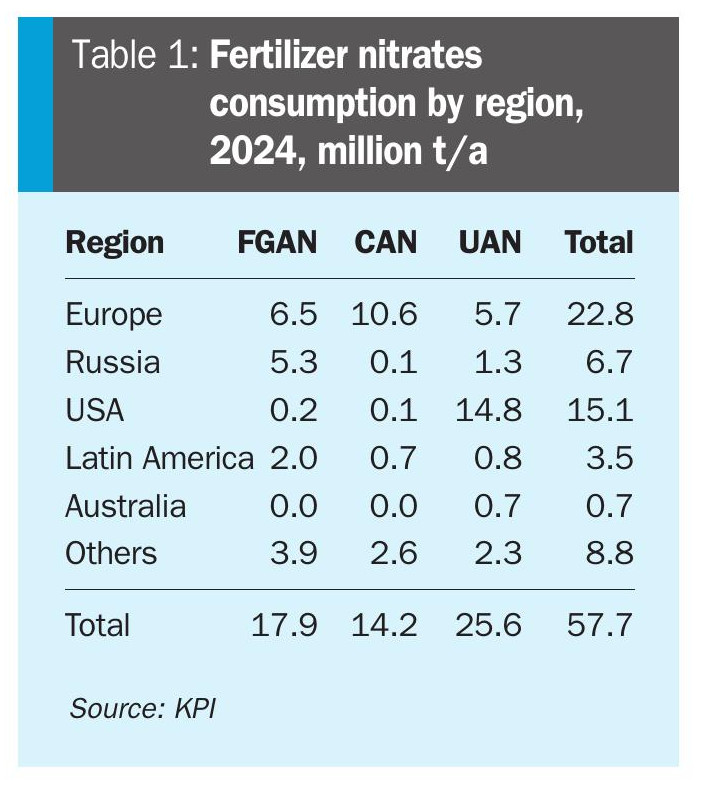

Because nitric acid production is almost always integrated into downstream production, on a geographical basis capacity tends to concentrated wherever AN is manufactured, primarily in Europe and Eurasia and North America, as well as, increasingly, in China. European/Eurasian capacity is mainly for AN and CAN fertilizer production, and around 85% of fertilizer grade AN capacity and 75% of CAN capacity is based in Europe and the CIS. North American is capacity mainly for UAN and AN explosives production, and about 55% of all UAN capacity is in North America and the Caribbean. Industrial/technical/explosive grade AN capacity is more widely spread, according to the requirements of domestic mining industries. About 25% is based in China. As well as this TAN capacity, Chinese nitric acid capacity is mainly focused towards chemical and metallurgical uses. Highly pure nitric acid capacity is concentrated in South Korea and Taiwan, China.

Demand projections

In terms of end-use markets, ammonium nitrate fertilizer use peaked in about 2012, at 22.8 million t/a, and saw a slow decline to 19.2 million t/a in 2021, then a fall to 16.9 million t/a in 2023. CAN use likewise dropped from 15.3 million t/a in 2021 to 13.0 million t/a in 2022. The invasion of Ukraine and consequent sanctions on Russia, one of the major exporters of AN and CAN fertilizers, has been the main reason for this, with European consumption falling particularly. However, these figures are seeing something of a turnaround as market conditions favour AN in Europe, and consumption of AN and CAN is expected to return to 2020 levels by 2028. Increased consumption in, e.g. Brazil is also boosting demand. Ammonium nitrate is preferred as a fertilizer in regions with short growing seasons, as the nitrate is present in a form readily available to the plant, unlike urea, which must hydrolyse to nitrate in the soil before it can be taken up. UAN consumption also took a dip in 2022, from 26.5 million t/a to 22.7 million t/a, but is expected to reach 27.7 million t/a by 2028, mainly due to increased consumption in Europe (especially France) and the US.

The commercial explosives market, meanwhile, is based mainly based around mining and quarrying. Three industries have traditionally dominated demand for mining explosives; coal mining, iron ore mining, and copper mining, collectively using more than two thirds of all explosives. Of these three, coal mining has remained essentially static over the past decade, and TAN use for coal mining is falling. However, this is more than offset by increased consumption for iron ore mining, with Australia, Brazil, China and India the leading producers, and copper mining, mainly in Chile, Peru, China and Congo. Overall, demand for TAN is expected to rise from 16.9 million t/a in 2024 to 17.6 million t/a in 2028.

Industrial chemical markets are a much faster growing segment for nitric acid, with average annual growth rates for TDI, nitrobenzene and adipic acid ranging from 3.5% to 4.9%, and it is a similar story for some of the metal treatment segments. However, collectively they only represent 20% of nitric demand, and so growth in these segments only brings the overall growth rate for nitric acid demand to just over 2% year on year.

Nitrous oxide

The nitric acid industry is under increasing pressure to reduce its emissions of nitrous oxide, N2O. It is estimated that around 5 kg of nitrous oxide are produced for every tonne of nitric acid, which has turned nitric acid production into the single largest industrial process source of nitrous oxide. Because of N2O’s high global warming potential; around 270-300 times that of CO2, even the emission of relatively lower quantities can have a significant impact on man-made climate change.

Because of this, installation of N2O abatement technologies has been strongly encouraged via the Kyoto Protocol, and has become mandatory in some jurisdictions, including the European Union. So-called ‘tertiary’ NOx removal systems are increasingly popular, treating final ‘end of pipe’ emissions, as they are an easier retrofit to existing plants. Iron zeolite catalysts have proven effective at decomposing N2O to N2 and O2, and form the basis of thyssenkrupp’s EnviNOx® process, which has achieved N2O removal rates of 98-99%, with overall NOx emissions being reduced to as low as 1 ppmv. BASF’s DeNOx process uses a vanadium oxide catalyst instead for similar effect. In early September 2025, thyssenkrupp Uhde announced that it had just successfully delivered and commissioned an EnviNOx unit for Covestro’s Baytown, Texas, facility as part of Covestro’s Nitric Acid Unit Climate Initiative (NAUCI), equating to an annual abatement of approximately 154,000 t/a of CO2 equivalent. Meanwhile the European Union is revising its ‘best available techniques’ (BAT) and lowering guidance figures for permissible N2O emission levels as part of its Large Volume Inorganic Chemicals (LVIC) directive.

However, of the estimated 580 nitric acid plants operating globally, around half are believed to still have no N2O abatement technology in place, mostly in countries without the appropriate emissions control legislation in place. To try and combat this, the German Environment Ministry’s Nitric Acid Climate Action Group (NACAG) has been partnering with governments and nitric acid producers in these countries and providing financial support to install abatement technology. In its most recent report (2024) it cites having signed up 10 operating companies which are actively engaged in N2O reduction strategies, with an impact of 2.6 million t/a of CO2 equivalent reduction.

The US Environmental Protection Agency says that it believes that the nitric acid and adipic acid industries could remove 80% of their emissions of CO2 equivalent gases by 2030, or around 116 million t/a of CO2e, with a 65% reduction in emissions achievable at break-even prices below $20/t.

Low carbon nitric acid

As with all industries nitric acid is also facing pressure to lower the carbon intensity of its production as well as emissions. This is a particular focus for the European industry, which represents around one quarter of nitric acid production and use. Nitrogen fertilizer prices could rise over the next decade as a result of EU targets on ammonia producers, with significant implications for fertilizer affordability. The cost of fertilizer grade ammonium nitrate (FGAN), which is driven by the cost of ammonia, could rise to as much as ~$1,500/tonne N in real terms in 2030 if produced with green ammonia in line with EU policy obligations. The same product was selling for as low as ~$800/t N in 2020 when produced with conventional grey ammonia. If using the lowest cost form of imported green ammonia from the USA, the cost of FGAN would be roughly half, at ~$800 /t N in 2030. A similar cost would also be achieved using blue ammonia from the USA.

At the same time, high natural gas prices have impacted upon European producers, and the combined burden of tightening NOx standards, carbon pricing and offshore low carbon ammonia production will push marginal producers in Europe to refit their plants or face closure.