Nitrogen+Syngas 396 Jul-Aug 2025

15 July 2025

Recent developments in the ammonia market

AMMONIA

Recent developments in the ammonia market

Increased merchant ammonia capacity over the next few years may lead to longer term price declines.

Global production of ammonia increased by another 6 million t/a to 202 million t/a in 2024. Merchant supply, while only a small fraction of the total, nevertheless increased significantly by 1.1 million t/a to 17.7 million t/a, just under 9% of the total. It remains the case that most ammonia is consumed at the point of production, mainly in captive downstream urea, ammonium nitrate, nitric acid and ammonium phosphate production, as ammonia is more difficult and expensive to transport than most downstream products. Merchant ammonia demand therefore tends to be focused more on industrial uses such as caprolactam, acrylonitrile, adipic acid, and isocyanates, or for ammonium phosphate manufacture, which is centred on regions of phosphate mining like Florida, Morocco, Jordan etc. However, there are now an increasing number of low carbon merchant ammonia plants under development which may change this calculus.

India remains the largest importer of ammonia, at around 2.2 million t/a in 2024, with the US at 2.0 million t/a, Morocco at 1.7 million t/a and South Korea at 1.2 million t/a collectively representing 40% of all ammonia trade. India, the US and Morocco are all focused on domestic ammonium phosphate production, with South Korea mainly using imported ammonia for nitric acid for industrial uses.

Trinidad, Saudi Arabia and Indonesia were the largest exporters in 2024, at 3.5 million t/a, 2.4 million t/a and 1.8 million t/a respectively. Canada and the US exported 1.0 and 1.4 million t/a, and Algeria 1.3 million t/a. This means that the top six exporters represented two thirds of all ammonia exports. Russia dropped to seventh place due to sanctions at 978,000 t/a.

New capacity

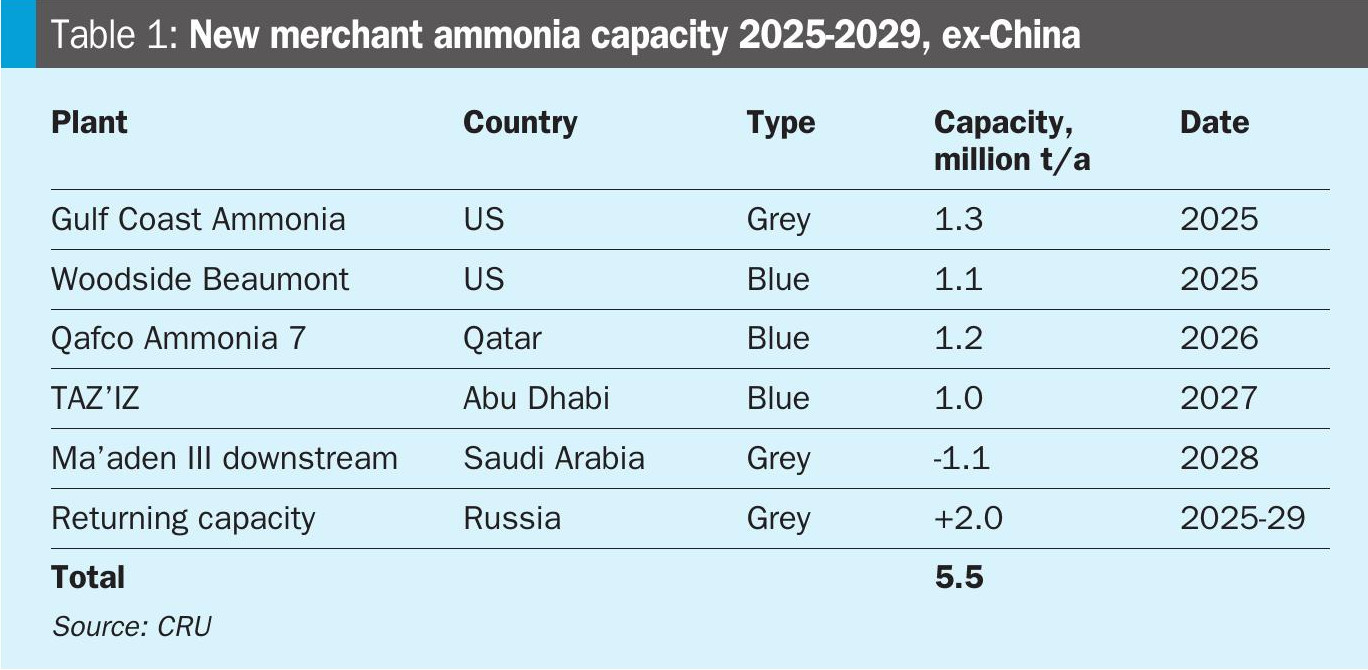

New merchant ammonia capacity is being commissioned, beginning this year with the Gulf Coast Ammonia project in the US, which has been pushed back from a target completion date in 2023 to 1H 2025. The Woodside Beaumont plant is now scheduled to come onstream in the second half of 2025. These two plants will add 1.3 million t/a and 1.1 million t/a to US ammonia capacity and 2.4 million t/a to merchant ammonia supply, which is expected to weigh on prices going into 2026. Additional supply will follow from

Qafco’s Ammonia 7 Project and Fertiglobe’s TA’ZIZ plant in 2026 and 2027, respectively, which will further add to availability and extend the period of depressed prices. Some relief may come in 2028 when the startup of the ammonium phosphate section of the Ma’aden III plant in Saudi Arabia will remove 1.1 million t/a of ammonia from the market, and by 2029 the market is expected to begin to rebalance and supply pressures ease, leading to a modest price recovery.

Supply – Russia

Togliattiazot’s transshipment terminal at Taman in the eastern Black Sea has been delayed and is now expected to start ammonia shipments this year. It will come at a similar time to the startup of the new ammonia transhipment terminal at Ust-Luga on the Baltic Sea. Ust-Luga has a planned capacity of 1 million t/a this year, with a potential expansion to 1.5 million t/a by 2026, offering a more efficient alternative to the current truck-based transport. It remains to be seen if Russian producers can deliver all of that ammonia to port. EuroChem’s 1 million t/a Kingisepp plant supplies ammonia to Ust-Luga, but it only managed to export around 600,000 tonnes from Ust-Luga in 2024. The second train at Kingisepp, scheduled for 2026, could boost output, but much of the ammonia will be used for urea production. Other plants that previously exported via Ust-Luga have shifted focus to downstream products, further limiting ammonia exports. There is also the potential for war-related disruption; Ukrainian drones attacked the port of Ust-Luga in January 2025 and could do so again.

EU tariffs on Russian fertilizers but excluding ammonia could help boost ammonia exports, but despite combined export capacity of 3 million t/a at Taman and Ust-Luga, Russian exports may rise to 1.0 million t/a in 2025 and as high as 2.6 million t/a by 2029, in line with increased ammonia production and improved utilisation rates, expected to reach 97%.

Trinidad

Trinidad, conversely, had been facing pressure on its ammonia exports as US demand contracts and US supply expands. Trinidad returned to its position as the largest exporter of ammonia in 2023 due to contractions in Russian exports, but domestic gas supply issues have hit production in recent years, reducing operating rates to below 75%. Trinidad’s exports of ammonia increased from 3.1 to 3.5 million t/a in 2024, but this is still down from 5.3 million t/a a few years earlier.

Low carbon capacity

With a surge in merchant capacity expected in the medium term, CRU has incorporated low carbon ammonia projects that have reached a final investment decision into our base case scenario, reflecting the expectation that new end markets such as power generation, hydrogen carriers, and marine fuel will not generate significant demand in the near term, forcing new blue ammonia capacity to compete with traditional grey ammonia markets. Blue ammonia volumes will attract interest from EU importers as the Carbon Border Adjustment Mechanism comes into force from 2026, with importers able to reduce costs by substituting imports of grey ammonia with low emissions ammonia. This will enable suppliers to attract premiums for low emissions ammonia.

Woodside’s Beaumont project and QAF-CO’s Ammonia 7 project are both based around carbon capture and sequestration to produce low emissions ammonia. Fertiglobe’s Taziz project, scheduled later for 2027, will produce lower carbon ammonia via other means. New supply from renewable-energy based ammonia projects, like NEOM in Saudi Arabia, are not reflected in this analysis due to the greater potential for it to service any new end-use demand that does eventuate.

Demand – Europe

High feedstock costs continue to force the closure of European ammonia capacity. Stringent emissions regulations such as the EU’s Emissions Trading Scheme, elevated energy prices, and growing global competition have weighed heavily on operating rates, with Western Europe’s plants expected to run at just 55% in 2025, well below historical levels. Recent closures include Yara’s closure of its Tertre ammonia plant in Belgium, which means that it will have to rely on imported supply to meet its downstream production needs. Yara also reportedly has plans to mothball its 300,000 t/a Hull plant in the UK, which exported around 214,000 t/a to its downstream operations in Europe in 2024. LAT Nitrogen is also halting ammonia production at its Grandpuits site in northern France due to rising production costs. The site has a capacity of around 440,000 t/a of ammonia and typically produces a surplus of approximately 130,000 t/a. As producing ammonia in Europe becomes less economical compared to importing, the region will increasingly rely on other sources where production costs are lower. This would result in a surge of import demand from less efficient plants or higher cost producers, leading to the upward revision of Europe’s imports.

To curb carbon leakage from imports, the EU has introduced the Carbon Border Adjustment Mechanism (CBAM). This aims to align imported goods with EU-produced ones by factoring in embedded emissions, applying the EU ETS carbon price, and considering carbon costs paid outside the bloc. From 2026 to 2033, CBAM obligations will gradually expand as free EU ETS allowances are phased out, though potential policy adjustments remain a possibility. CRU’s Emissions Analysis Tool estimates CBAM liabilities based on the weighted average emissions intensity of ammonia imports. The tax is projected at $67/t in 2026, rising to $130/t by 2029 due to increasing carbon prices and the gradual removal of free allowances.

Recovery in European ammonia production is restricted by sustained margin pressures and high feedstock costs, with TTF prices staying above historical norms. As such, ammonia production is expected to remain below historical levels, with margins staying negative for much of 2025. While CBAM’s introduction in 2026 will level the playing field on carbon costs, structural cost challenges will persist.

Morocco

Morocco’s ammonia imports are expected to increase as it continues to build new ammonium phosphate capacity. OCP had a record year for exports in 2024 and is expected to maintain this performance in 2025. However, the company has been prioritising TSP exports, particularly to India, which does not require ammonia input. Consequently, ammonia import growth is expected to be marginal in 2025 before gaining momentum as ammonia prices ease and phosphate demand recovers. CRU projects an increase in imports from 1.64 million t/a in 2025 to 1.84 million t/a in 2029 as DAP output rises from 2.33 million t/a in 2025 to 2.45 million t/a in 2029, and MAP production from 1.53 million t/a to 2.04 million t/a.

India

India’s ammonia imports are projected to rise to 2.3 million t/a in 2025 due to depleted DAP stocks, with steady growth to 2.6 million t/a by 2029, in line with DAP production reaching 2.2 million t/a. Meanwhile, India’s urea production is expected to decline to 30.3 million t/a in 2025 before a modest recovery to 31.5 million t/a by 2029. However, the gap between production and domestic consumption is projected to widen, reducing internal ammonia consumption.

China

In 2024, China produced a record 73.1 million t/a of ammonia, an 8.1% increase year-on-year. Over the next five years, 14.2 million t/a of new ammonia capacity is expected to be built, with 5.9 million t/a coming from 15 plants in 2025, 4.7 million t/a from ten plants in 2026, and 1.7 million t/a from three plants in 2027. Three additional plants with a combined 1.9 million t/a capacity are set to come online in 2028, with no new capacity expected in 2029. Most of the new capacity is based on bituminous coal and many closures involve anthracite or natural gas. During the same period, around 1.8 million t/a of ammonia capacity is expected to be closed, including 1.0 million t/a from anthracite-based plants and 0.8 million t/a from natural gas-based plants.

China’s self-sufficiency in non-fertilizer industries continues to increase. Acrylonitrile demand is now 100% self-sufficient, dimethyl formate 90%, and ammonium nitrate about 80%, reducing demand for merchant ammonia. Additionally, about one quarter (3.4 million t/a) of the new capacity from 2025-2029 will be integrated for non-urea use, further limiting merchant ammonia demand. This rapid capacity growth and increased self-sufficiency are expected to reduce China’s ammonia imports over the forecast period. Chinese ammonia imports may decline to 0.4 million t/a this year, and may be as low as 0.2 million t/a by 2029, driven by a worsening arbitrage between domestic prices and import cost. Chinese ammonia exports will also likely rise, reaching 165,000 t/a by 2029, making China in almost a net exporter. The growth in domestic supply, alongside tight export restrictions on urea, is expected to create an oversupply in the medium term. Additionally, China’s port ammonia storage capacity is set to reach 600,000 m3 by 2026, as new tanks under construction in Nanjing and Lianyungang will add 100,000 m3 .

Tariffs

US tariffs on Canadian ammonia, delayed from 4 February to 2 April 2025, could impose a 25% levy on exports, creating risks for both the Canadian nitrogen industry and US agriculture. Canada exports over 1 million t/a of ammonia to the US and relies heavily on this market, though it has experienced a 9.5% year-on-year decline in exports, indicating higher domestic consumption. This may mitigate the tariff’s impact if implemented. As a low-cost producer, Canada could absorb the tariff and maintain margins, despite limited alternative offtake options. However, given ammonia’s inelastic demand, any reduction in Canadian exports could push US fertilizer prices in the Northern Plains higher.

The European Union’s proposed tariffs on Russian and Belarusian fertilizers, aimed at boosting domestic production and reducing reliance on imports, are expected to increase fertilizer costs in Europe. While this measure may encourage more domestic fertilizer production, it will also drive higher ammonia demand. However, high natural gas prices will continue to make domestic ammonia production costly, leading to a rise in ammonia imports. The EU’s reliance on imports is projected to grow from 31% of ammonia demand in 2024 to 44% as imported ammonia remains the more cost-effective option. It’s also worth noting that while ammonia is excluded from these tariffs, the EU reinstated a 5.5% import duty on ammonia, including Russian imports, in June 2023 after a six-month suspension.

Trade

Overall, global ammonia imports are projected to grow steadily, reaching 21.4 million t/a by 2029, with European and Moroccan demand rising, while China’s imports are expected to decrease due to expanded domestic production. Russian and US ammonia exports are expected to increase, though competition will intensify with new capacity. US tariffs on Canadian ammonia could raise fertilizer costs, impacting both the Canadian nitrogen industry and US agriculture.

European imports are expected to grow steadily, increasing by 800,000 t/a in 2026 as weak margins from declining ammonia prices support higher import demand. In contrast, China’s ammonia imports are forecast to decline as domestic production capacity expands. Russian exports are set to grow, reaching 2.6 million t/a in 2029, but they are unlikely to completely return to pre-war levels. Meanwhile, US ammonia exports are expected to gain market share, driven by new capacity from the Gulf Coast Ammonia and Woodside Beaumont projects. This increase in supply will heighten market competition, particularly with improved availability from the Middle East. As a result, Trinidad’s export growth is forecast to see some declines. Europe’s demand for blue ammonia will grow with the implementation of CBAM, capturing some share from grey ammonia imports.

Pricing

Ammonia prices are expected to decline from 2025 due to the major capacity additions noted above, and the increase in exports from Russia. These will create a significant market surplus, keeping prices depressed through to 2028. European production continues to face challenges from high energy costs, which combined with falling ammonia prices will result in favourable importing conditions with the potential for further production curtailments and plant closures.

While strong supply from the US Gulf, North Africa, and the Middle East will limit sharp price increases, potential delays in capacity expansions, unplanned outages, and a more volatile energy market could provide upside pressure toward late 2026. Nonetheless, overall, prices are expected to remain on a downward trajectory. A recovery is not anticipated until 2029, when the market is expected to rebalance, and no significant new capacities are added.