Nitrogen+Syngas 395 May-Jun 2025

3 May 2025

Price Trends

Price Trends

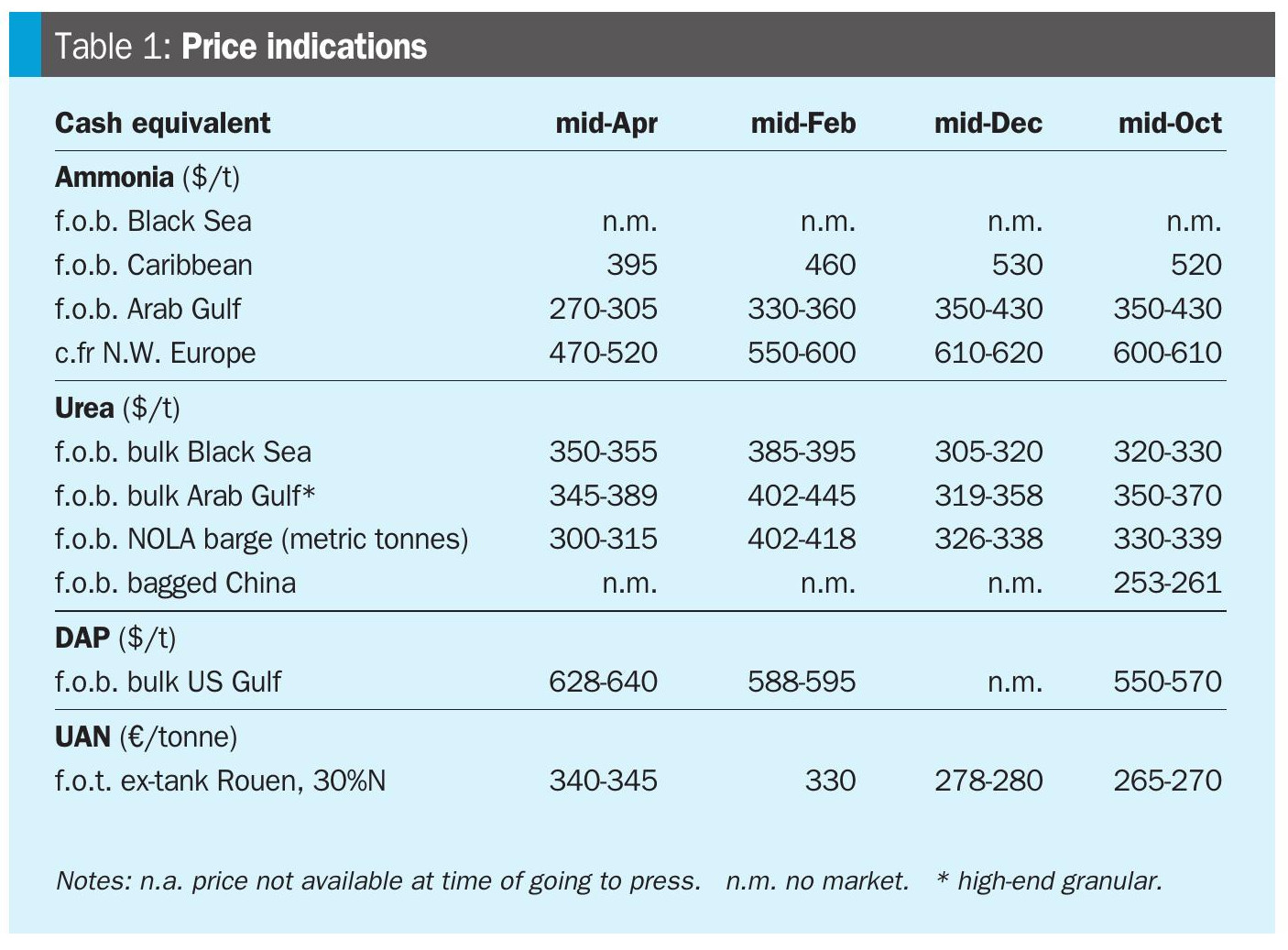

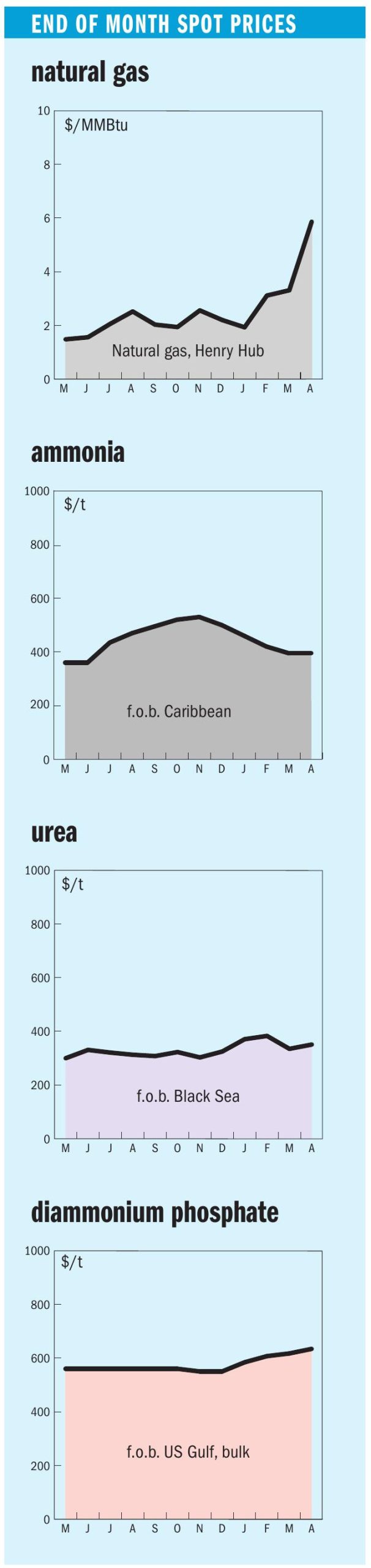

In mid-April, Ammonia prices both east and west of Suez remained firmly oriented to the downside, with supply still heavily outweighing demand and suppliers scrambling to place excess tonnage. Bearish market sentiment was exemplified by a Trammo sale to OCP at $415/t c.fr Morocco, $20/t short of Tampa’s c.fr settlement for April and around $44/t down on February.

Across the Atlantic, exports continue from the US Gulf, where prices are now suggested below $400/t f.o.b. and possibly as low as $350/t, amid healthy availability from regional suppliers. Suggestions that the 1.3 million t/a Gulf Coast Ammonia facility in Texas, which loaded its first export cargo in March, is facing further production hiccups, are yet to be confirmed.

East of Suez, Ma’aden announced that it would be taking its 1.1 million t/a No.1 unit offline for seven weeks as of early May, likely removing around 120,000 tonnes of output from the market, though observers see the curtailment as having little impact on Middle East fundamentals. In Iran, PPC tendered for and sold around 23,000 tonnes of material in the $250s/t f.o.b. range, to be split between Turkey and India. Import demand from the latter remains lacklustre. Mitsui is shipping a Kaltim cargo from Indonesia to the Americas, demonstrating the ongoing length seen in Southeast Asia and poor demand from nearby markets. Industrial appetite from the Far East remains limited, with contract prices in South Korea and Taiwan, China steadily slipping closer towards the $300/t c.fr mark.

In urea markets, India is still believed to be in need of 1.5 million tonnes of urea, and with spot interest emerging from Australia, suppliers see this as an opportunity to gain ground. It remains unclear if IPL will secure anywhere close to the tonnage it required with just short of 400,000 tonnes so far accepted from the initial low bids and counters. The Middle East saw a net-back of $370-380/t f.o.b. for the Indian tender with the east coast counter offering a much higher return than the west. When Australian interest emerged for end April/ May, an opportunity arose to push the spot price back towards the $390/t f.o.b. secured earlier by Sabic. Fertiglobe is the supplier said to be behind the latest sale to Australia which traded at $387-389/t.

European prices have risen in France and Italy although the latter appears to have quite a line up of ships heading its way. With the market running way behind however and Yara failing as yet to fire up its Ferrara plant, the tonnes could be quickly absorbed and prices maintained. Algeria looked set to see the US market cut off with the very high duty of 32% set last week in the Trump Tariffs. However the tariff debacle continues and this has now been pushed back to 10%. NOLA prices unsurprisingly have been volatile as the tariffs come and go. As high as $425/st has been secured for 1H April but further forward prices slipped below $400/st. Upriver barges could command quite a premium with a two week delay in securing transport to move loaded barges out of NOLA.