Nitrogen+Syngas 395 May-Jun 2025

3 May 2025

Market Outlook

Market Outlook

AMMONIA

• Continuing oversupply means that ammonia prices should continue to come under pressure moving into 2H April, though it remains to be seen just how much further values in Asia can decline before producers begin to shutter output.

• Conversely, questions remain as to how much of an upside impact US 10% tariffs will have on imports of Trinidadian ammonia for the next Tampa settlement.

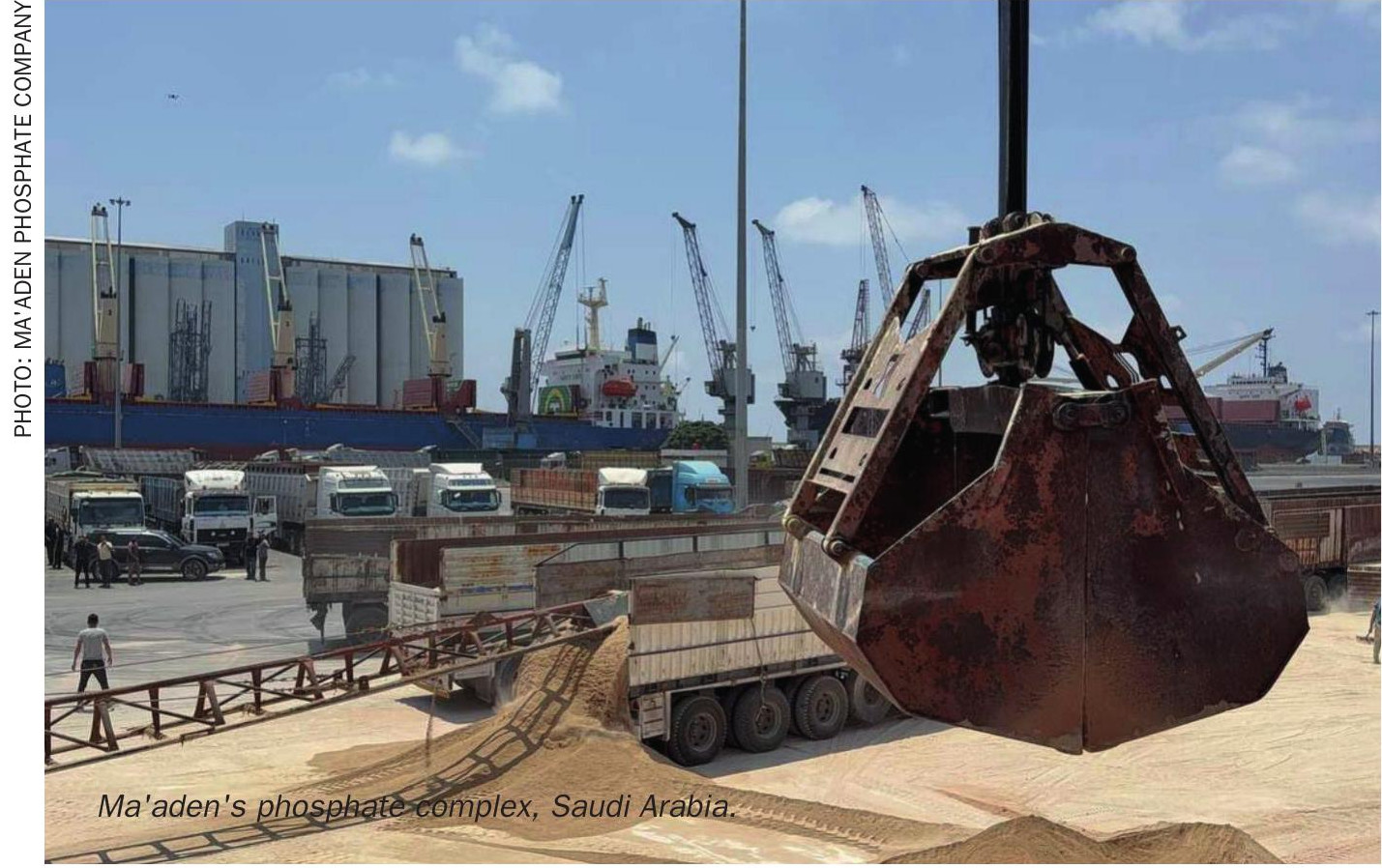

• The seven week Ma’aden turnaround announced for May-June should also help to put a floor under ammonia prices out of the Arab Gulf.

• The netback to the Caribbean will be adjusted down $43.50/t this week to $351.50/t FOB, taking into account the 10% US tariff on imports from Trinidad. Mosaic and Yara are understood not to have agreed a way forward yet for the Tampa contract in May and the Caribbean export price is calculated on Tampa at $435/t CFR less the 10% tariff and assuming a $40/t freight.

UREA

• The meltdown in global financial markets unleashed by the US last week showed few signs of abating. Even as President Trump paused his “reciprocal tariffs” for 90 days, and cut them all back to 10%, he ramped up the pressure on China. All fertilizer producers that export urea to the US will now face a baseline 10% rate, excluding Canada, Mexico and Russia.

• Amid the turmoil, India held its first urea tender for nearly two months and had secured less than a third of its stated aim of 1.5 million t/a at the time of writing. The very short term could therefore see urea prices stabilise, as India may well have to tender again. Not all benchmarks may increase, however, as fading interest in Europe could take its toll on Algeria and Egypt.

METHANOL

• Methanex, the world’s largest producer and supplier of methanol, maintained its Asian contract price (ACP) for April 2025 unchanged at $420/t, with China $20/t lower at $400/t.

• There are concerns that US tariffs on China, the major importer of methanol, may lead to slower demand growth in industrial sectors. Chinese MTO demand also appears to be falling, with lower operating rates and delays to new capacity. The tariffs may also lead to lower methanol demand in the US as spending slows.

• Falling oil prices due to concerns about recession will also likely play on methanol markets, bringing prices lower. This, taken together with some new capacity in Iran and the US, means that the outlook for the short to medium term is for lower prices for both Atlantic and Pacific methanol.