Sulphur 400 May-Jun 2022

31 May 2022

Market Outlook

Market Outlook

SULPHUR

- The ongoing conflict in Russia-Ukraine remains a key focus for the market in the months ahead. It is unclear whether buyers that are currently doing so will permanently choose non-Russian sulphur sources, but trade flow changes are expected to persist through the rest of 2022.

- Two-tier pricing will be a feature of the market with Russian sulphur expected to be priced at a heavy discount to other exportable supply in the outlook. Demand for sulphur from North America and the Middle East will continue to support the run-up in pricing for at least the next few months.

- The re-entrance of China to the fertilizer export market underpins the view for a price correction in both the DAP and sulphur markets. High raw material costs for processed phosphates producers will keep prices at elevated levels on the 2021 average.

- The progress of the Covid-19 outbreak in China is a risk to the sulphur market with new capacity expected to add considerable supply in the second half of the year. The reduction of crude runs may hamper short term output in some provinces but Chinese sulphur supply is forecast to rise to 9mn t for the first time in 2022.

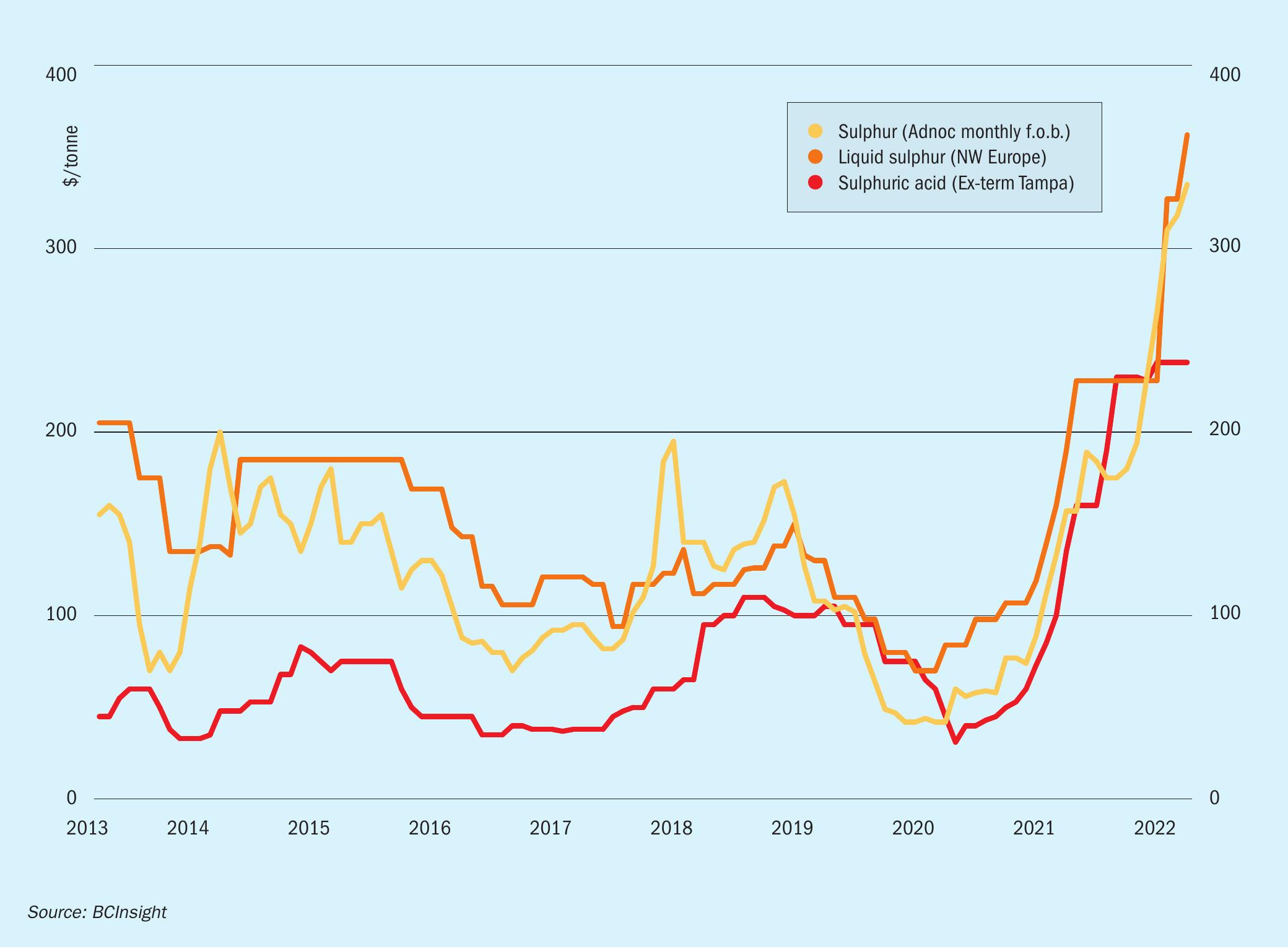

- Outlook: Global sulphur prices are likely to see further increases in the short term through the month of May but a price correction is forecast in the latter part of the year. The last time prices were at these levels was in 2008 which was followed by a crash in pricing. Strong demand and support from high product prices in end user markets is expected to limit the extent of the downturn in sulphur in 2022.

SULPHURIC ACID

- Freight rates have been on the rise. The Asia-Chile freight increased in April to a range of $115-130/t for a 20,000t vessel. This is supporting the view for firmer prices for acid.

- Chile’s state copper mining agency, Cochilco has increase its copper price forecasts for 2022-23 amid a perceived scarcity of supply caused by the Russia-Ukraine conflict. Russia makes up about 4% of global refined copper. Higher copper prices are a supportive factor for acid consumption rates at mines and supports pricing.

- Moroccan acid imports totalled 199,000t in January 2022, up by 54% on a year earlier. Imports for the year are expected at 1.3 million t/a in 2022, down on 1.7 million t/a imported in 2021.

- Outlook: There is strong support for sulphuric acid prices in the short term with buying activity in major markets increasing. Second half demand for spot is expected to test prices further against a backdrop of tight supply. The spate of turnarounds in Europe as well as potential demand destruction remain key influences on the balance.