Sulphur 396 Sept-Oct 2021

30 September 2021

Market Outlook

SULPHUR

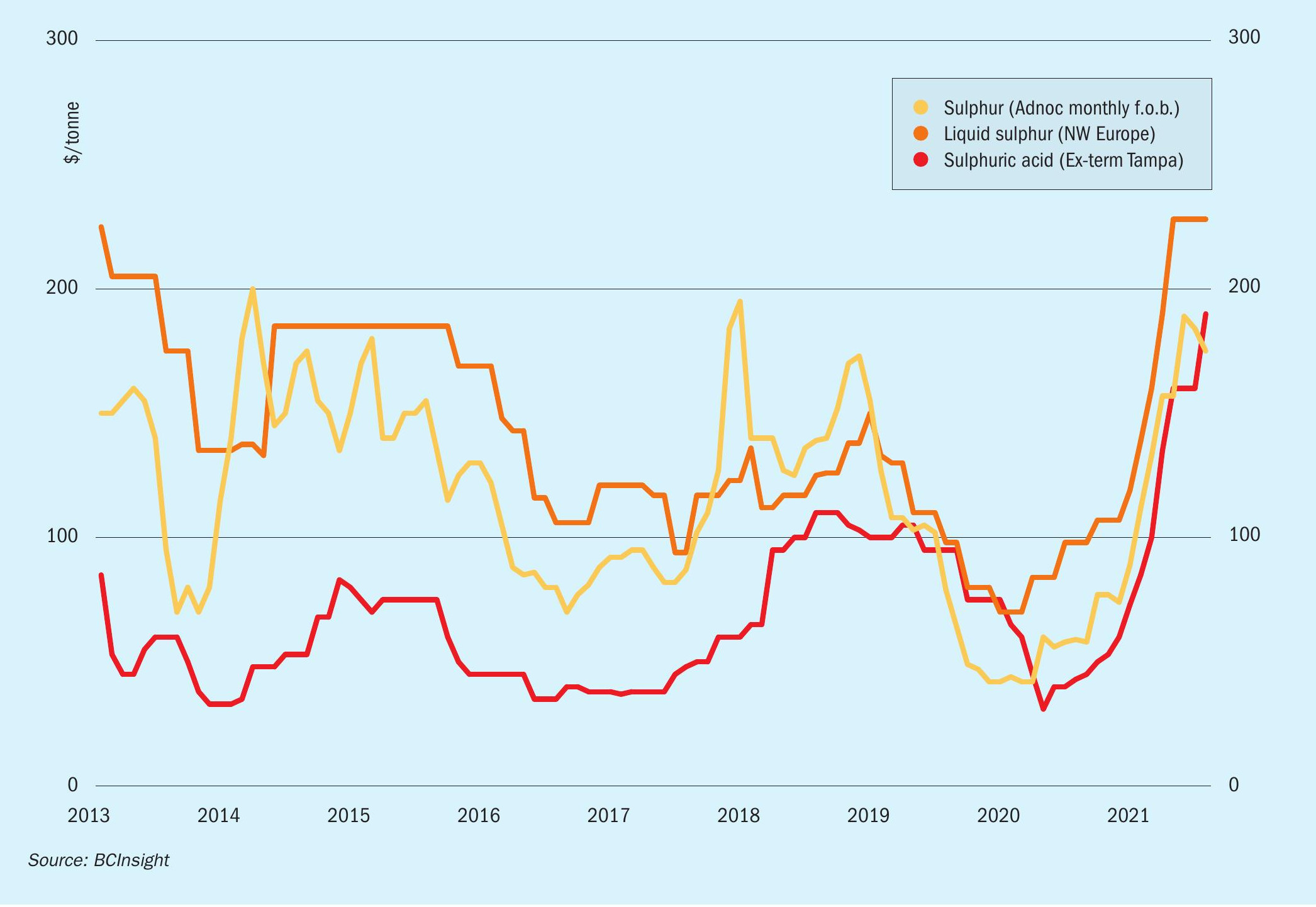

- The processed phosphates market view is supporting sulphur demand. The average DAP price for Morocco f.o.b. is forecast to rise significantly on 2020 levels. As the leading end use for sulphur consumption and trade, this has implications for pricing. The expected downward correction in DAP in 2022 will likely lead to a parallel decline in sulphur, at a time when supply is expected to improve in the oil and gas sector, adding further pressure for prices to ease.

- Large scale capacity additions have been delayed in the Middle East but remain a bearish factor for the short to mid term view. Kuwait and Qatar have projects with combined capacity exceeding 3 million t/a. Elsewhere, Saudi Arabia is also expected to ramp up sulphur supply from its gas and new refinery projects.

- US export duties on Moroccan phosphates products have not impacted OCP/Morocco and the producer has shifted any lost sales to Latin American markets where netbacks have been high, limiting any production losses and keeping sulphur demand firm.

- Outlook: Prices are expected in the fourth quarter on the back of improving supply following the OPEC+ announcement as well as increased fuel oil demand as the impact of the global pandemic starts continues to wane. Freight rates appeared to steady in mid-August, but nonetheless remained elevated.

SULPHURIC ACID

- Copper prices eased in August on the back of mixed inflation signals and a stronger US dollar. Nickel prices picked up pace in June and July, largely supported by Chinese battery and electric vehicle demand. EV sales hit new highs in July and will continue to drive demand across copper and nickel. These investments in metals projects support the view for sulphuric acid consumption. Nickel and copper-based acid demand combined is forecast to rise by over 3 million t/a in 2021 on 2020 levels.

- Global sulphuric acid demand is forecast to grow by over 15 million t/a in 2021, after a steep drop last year owing to the global pandemic. This is supportive for acid trade and pricing.

- Phase 1 start-up of the Udokan copper project is expected in the second half of 2022. Construction at the mine has been continuing with work underway on the concentrator and leaching site. An official announcement is still pending on whether acid demand will be met captive capacity from a sulphur burner or procured in the market. Argus expects the more likely scenario would be a sulphur burner.

- Outlook: Global acid prices are expected to remain firm in the coming months, marketing a continuation of the disconnect with elemental sulphur market pricing. The tightness in the acid market has not abated with the 2021 balanced expected to remain in deficit. A downward correction may emerge next year, based on the assumption balance returns but there is a risk to this moving to deficit once again as turnarounds and outages emerge. Average NW European acid prices are forecast at $127/t f.o.b. for the year.