People

A summary of recent company appointments.

A summary of recent company appointments.

BASF Corporation has appointed Heather Remley as its new president and chief executive officer, effective April 1, 2025. She takes the helm of the North American arm of BASF SE, one of the world’s largest chemical companies. Remley has a background in global leadership and operations. Most recently, she was president of BASF’s global engineering services division in Ludwigshafen, Germany. Before that, she led the company’s North American petrochemicals business as senior vice president in Houston. Since joining BASF in 2016, she has held key positions across the US, China, and Germany.

We compare and contrast the 2024 financial performance of selected major fertilizer producers following the publication of fourth quarter results.

Yara Clean Ammonia has signed a time-charter contract with Nippon Yusen Kabushiki Kaisha (NYK) for an ammonia-fuelled medium gas carrier, to be delivered in November 2026. Medium gas carriers are the most popular type of vessel for international shipping of ammonia, and Yara and NYK have been studying the possibilities of running them off ammonia fuel since 2021. Yara Clean Ammonia operates the largest global ammonia network with 15 ships and has, through Yara, access to 18 ammonia terminals and multiple ammonia production and consumption sites across the world. Yara says that use of an AFMGC will contribute to reducing GHG emissions from marine transportation and developing an ammonia supply chain by providing a more environment-friendly means of ammonia transport as demand grows for ammonia use in the power sector, for marine fuel, and the like.

Yara says that it plans to wind down production of phosphate fertilizers and sulphuric acid at two sites in Brazil; Cubatão and Paulínia. The sites are expected to cease production by 3Q 2025, as part of what Yara describes as a strategy to concentrate on more sustainable operations focused on its main activity: the production of nitrogen fertilizers. At Cubatão, the suspension will affect unit 3 and the phosphate plants of unit 2, while units 1 and 2, responsible for the production of nitrogen, in addition to the mixer (unit 5), will continue to operate normally. Yara reported a net loss of $290 million in 4Q 2024, down $536 million from the $246 million profit it made in 4Q 2023. Revenues are down 11% for the year, leading Yara to announce a cost reduction and investment program of $150 million, with the aim of optimising its operations and focusing on strategic areas to ensure long-term sustainability. At the same time, the company has begun renewable ammonia production at Cubatão.

While there is still a considerable push for use of biomass waste as a lower carbon feedstock for chemical production via gasification to syngas, biological processes such as fermentation are increasingly gaining traction as an alternative.

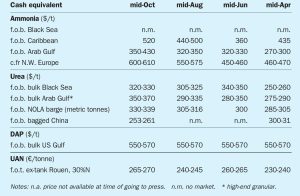

In October, ammonia benchmarks were more or less stable across the board. West of Suez, supply from Algeria was constrained by an ongoing turnaround at one of domestic player Sorfert’s production units. Still, demand from NW Europe remained quiet, although CF was set to receive a 15,000 tonne spot cargo from Hexagon some time in November, reportedly sourced somewhere in the region of $530/t f.o.b. Turkey. While regional supply appeared tight, steadily improving output from Trinidad and the US Gulf could alleviate recent pressures, with many players of the opinion that Yara and Mosaic could agree a $560/t c.fr rollover for November at Tampa as a result.

An ammonium nitrate industry geared around producing explosives for the mining sector is now being joined by a major urea project and a number of renewables-based products for export of green ammonia.

QatarEnergy has announced its decision to build a new, world-scale urea production complex that will more than double Qatar’s urea production. The project is aiming to construct three ammonia production lines which will supply four new world-scale urea production trains in Mesaieed Industrial City. Total capacity for the new complex is projected to be 6.4 million t/a, more than doubling Qatar’s annual urea production from about 6 million tons per annum currently to 12.4 million tons per annum. Production from the project’s first new urea train is expected before the end of this decade.

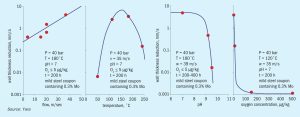

In recent years, extensive and severe internal attack has been observed of carbon steel equipment and lines in aqua ammonia service at several Yara manufacturing sites across the globe. In all cases, the damage has a distinct flow-accelerated corrosion (FAC) signature which challenges the current understanding of FAC. All features typically observed for this kind of damage mechanism, that seem to be specific to the NH3 recovery section of ammonia plant, are reported. Upgrading the material of construction for this unit, will solve this failure mode, but a leak would potentially generate health and safety problem for the release of ammonia.