Price trends

Alistair Wallace, Head of Fertilizer Research, Argus Media, assesses price trends and the market outlook for nitrogen.

Alistair Wallace, Head of Fertilizer Research, Argus Media, assesses price trends and the market outlook for nitrogen.

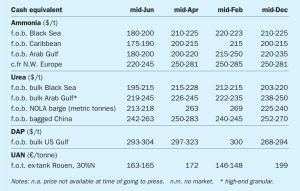

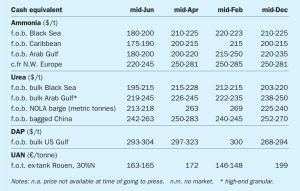

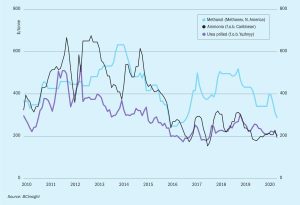

Merchant ammonia capacity, only a relatively small 10% of overall ammonia demand, has been expanding in recent years and was already in surplus even before the current Covid crisis, but longer term a shortage of new projects may tighten the market again.

Prices remain at low levels, in part because of oversupply due to new plant start-ups. However, there has also been a contraction in demand, especially for technical ammonia – industrial markets for ammonia in China and East Asia have been badly affected.

Market Insight courtesy of Argus Media

Demand from horticulture has seen the use of water-soluble phosphates rise globally to almost one million tonnes annually. We assess the market and its growth prospects, identify leading producers and highlight recent product innovations.

Sulphur is becoming an increasingly important crop nutrient – due to a combination of lower sulphur emissions, the increasing prevalence of high-analysis fertilizers and higher cropping intensity.

Following the publication of the 2020 nitrogen project listing by our sister magazine Nitrogen+Syngas, we profile a selection of leading nitrogen projects and their process licensors. Australia, Egypt, India, Nigeria and Russia have been key countries for new project developments.

Tecnimont SpA has signed an EPC contract worth approximately e200 million with Gemlik Gübre Sanayii Anonim Sirketi for the construction of a new urea and urea ammonium nitrate (UAN) solutions plant at Gemlik, 125 km south of Istanbul. The plant will have a capacity of 1,640 t/d of granular urea and 500 t/d of UAN, and will be based on Stamicarbon urea technology, a fully owned subsidiary of the Maire Tecnimont group. The scope of work includes engineering, supply of all equipment and materials and construction and erection works. Project completion is planned within about three years of the contract beginning.

The impact of coronavirus on both supply and demand continues to provide considerable uncertainty to the market. Industrial demand seems to have been worst affected, and fertilizer related demand has largely kept up, although shutdowns in India’s ammonium phosphate sector have also affected demand. Spring is traditionally the strongest time for fertilizer demand, and this has helped support prices at least in the short term.

Southeast Asia has been a major site for new syngas projects in recent years as countries such as Indonesia, Malaysia and Brunei continue to monetise their natural gas resources.