Market Outlook

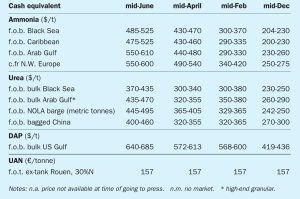

The first half of 2021 has been characterised by tight supply in the ammonia market, exacerbated by plant outages in Europe, Trinidad, Saudi Arabia and Indonesia. At the same time, higher spot demand has fuelled significant price increases in both the eastern and western hemispheres. Low inventories and reduced export availability in the Far East forced Indian phosphate producers and industrial consumers of ammonia to source product from other locations.