Price Trends

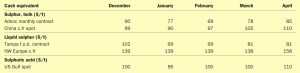

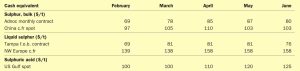

Sulphur prices in China are expected to recover with downstream demand anticipated to surge in the second half of the year and good affordability to support raw materials purchasing. Chinese nitrogen, phosphate, and potash prices have surged, driven by heightened demand for the summer corn application season. In particular, average 11-44 MAP prices jumped 16% from $390/t ex-works to $463/t in Hubei province. However, sulphur prices have taken a while to follow the trend on phosphate prices. Port prices have fluctuated in the range of $126-130/t c.fr since late March, and import prices fell from a high of $112/t c.fr to $100/t c.fr, capped by high port inventory and sufficient supply. Port inventories in China remain around 2.8 million tonnes, well above the 2022 average of 1.4 million tonnes and the 2023 average of 2.07 million tonnes. These elevated stock levels limited the upside for prices in China and provided buyers with options. At the start of July, Sinopec’s Puguang, the largest sulphur producer in China, increased its sulphur sales prices at Wanzhou port up $4/t RMB980/t, while its factory price at Dazhou was up RMB20/t at RMB950/t ex-works. These prices are considerably down from RMB1,600/t in December 2022 and RMB 2,945/t from mid-June 2022 and are the lowest since July 2023, but are still up from a low of RMB605-655/t at the end of August 2020.