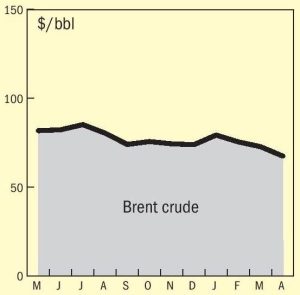

Price Trends

Sulphur markets have been on a tear over the past few months, driven by strong demand in Asia, with buyers primarily sourcing from the Middle East and Canada through late 2024 and into the early months of 2025. Steady buying from Indonesia and China, the two largest importers of sulphur, appears to have supported the market, in China’s case mainly for phosphate production as well as a variety of industrial processes, and in Indonesia’s case to feed the high pressure acid leach (HPAL) plants that are producing nickel for the battery and stainless steel industries. Prices saw a notable rally following the Chinese Lunar New Year celebrations. Nevertheless, this momentum finally began to shift as April began ago as the pace of price increases in Asia started to slow. As the spring fertilizer application season in China draws to a close, domestic prices began to drop, reaching the equivalent of a delivered price of around $272/t c.fr. As well as the narrowing window for spring application of phosphates, the decline was also driven by weakening demand amid uncertainty over tariffs and export restrictions. In southern China, phosphate producers continue to purchase import cargoes. A major phosphate producer in southwest China has been reported as having bought mainstream material at a price of $303/t c.fr, according to local market sources. Total sulphur port inventories in China had declined by 22,000 tonnes to 1.86 million tonnes by 16 April 2025. The volume at Yangtze River ports increased to 825,000 tonnes, while the port inventory at Dafeng decreased to 400,000 tonnes.