FI Sentiment Survey Results February 2025

Click here to access the February 2025 FI sentiment survey results.

Click here to access the February 2025 FI sentiment survey results.

CRU recently relaunched its Fertilizer International and BCInsight Platform. This relaunch coincided with the Fertilizer Latino Americano (FLA) conference in Rio de Janeiro, where we issued our inaugural sentiment survey for delegates. This insight presents and analyses the survey results, which point towards an optimistic tone for 2025 markets in Brazil and beyond. Prices are […]

Ammonia markets saw a slow start to 2025, with further transparency needed on both sides of the Suez to determine the extent to which prices are expected to fall through January amid healthy supply and only limited pockets of demand.

Prices in most markets should register declines through January, though the extent to which benchmarks will ease is yet unclear. Chinese suppliers have seen significant price declines in recent weeks.

While there is still a considerable push for use of biomass waste as a lower carbon feedstock for chemical production via gasification to syngas, biological processes such as fermentation are increasingly gaining traction as an alternative.

Nitrogen+Syngas went to press just a few days before Donald Trump’s swearing-in as the next president of the United States. While it is sometimes difficult to sort the truth from the hyperbole in his public pronouncements, nevertheless, if taken at face value, they would seem to indicate that we may be in for a turbulent four years in commodity markets in particular. While he is an avowed military non-interventionist, on the economic policy side he has emerged as a firm believer in the power of tariffs to alter markets in the favour of the US, and has promised 20% tariffs on all goods entering the US, potentially rising to 25% for Canada and Mexico, and 60% for his particular bugbear, China, sparking a scramble for wholesalers to stock up in the last few weeks of the Biden presidency. Trump previously raised tariffs on Chinese goods entering the US to 20% during his first term, and the Biden administration made no attempt to reverse this, and even added some additional ones, for example 20% on Russian and Moroccan phosphate imports.

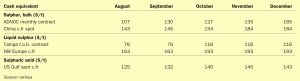

Global sulphur prices were mostly assessed flat in mid-January, with only slight changes for China, Indonesia and India, while the first quarter contracts for the Middle East, North Africa and Tampa increased from the previous quarter. Overall, the number of transactions taking place globally has declined as subdued demand has limited trading activity in most delivered markets. The current sulphur price environment has been shaped by the combination of rising Chinese demand and higher Middle East f.o.b. prices in the second half of last year. As a result, some consumer markets such as Indonesia and India have been subject to upward pressure in order to remain attractive destinations. But demand remained lacklustre across delivered markets, leaving prices relatively stable.

Sulphur prices may remain stable before decreasing on muted demand and transactions may increase in frequency contributing to price decreases in the first half of 2025.

As a tumultuous 2024 draws to a close, CRU’s fertilizer team to make a few predictions for the year ahead.

Market snapshot, 2nd January 2025